Most sensible 5 Associate Offers for the Finish of 2022 – R Weblog

These days, we will be able to communicate in regards to the firms whose shares their associates actively invested in right through the remaining two weeks of 2022. The highest 5 offers integrated purchases of the securities of Lucid Staff Inc., Dave & Buster’s Leisure Inc., Chargepoint Holdings Inc., STAAR Surgical Corporate, and Mediaco Protecting Inc.

1. Lucid Staff – 915 million USD

The biggest deal relating to budget invested was once the acquisition of US electrical automobile producer Lucid Staff Inc. (NASDAQ: LCID) stocks. Ayar 3rd Funding Co., which owns greater than 10% of Lucid Staff, purchased USD 914.9 million price of the carmaker’s stocks on 22 December 2022.

In step with Shape 13F filed via Ayar 3rd Funding, the fund bought nearly 86 million stocks at USD 10.67 in step with unit. On the time of writing, Lucid Staff was once buying and selling 40% under this price.

2. Dave & Buster’s Leisure – 39 million USD

Hill Trail Capital Companions LP, affiliated with Dave & Buster’s Leisure Inc. (NASDAQ: PLAY), obtained 1.1 million stocks in america leisure and eating place chain for USD 39.2 million from 21 to 30 December 2022.

Hill Trail Capital Companions’ reasonable acquire worth for Dave & Buster’s Leisure securities was once USD 34.31. On the time of writing, the corporate’s stocks had been valued at 38.6 USD.

Hill Trail Capital Companions’ stake in Dave & Buster’s Leisure now exceeds 10%. As a reminder, the fund began purchasing up the securities of this eating place and leisure trade in October 2022.

3. Chargepoint Holdings – 12 million USD

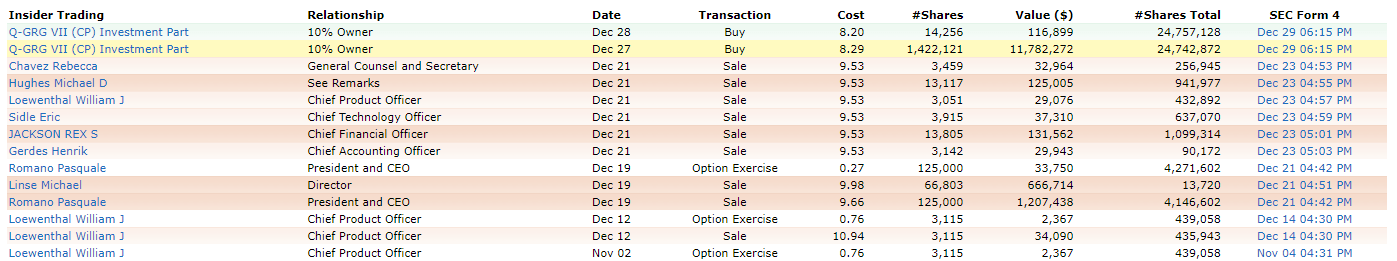

Q-GRG VII (CP) Funding Companions LLC purchased 1.4 million securities of Chargepoint Holdings Inc. (NYSE: CHPT) for USD 11.8 million on 27 and 28 December. The common acquire worth was once USD 8.28 in step with unit, and the worth of the securities was once USD 9 on the time of writing.

Chargepoint Holdings is a US corporate that develops infrastructure for electrical automobiles. It specialises in {hardware} and tool for charging stations.

It’s price stating that previous to this deal, Q-GRG VII (CP) Funding Companions had a stake in Chargepoint Holdings of greater than 10%. Apparently, people related to Chargepoint Holdings most popular to promote their stocks within the corporate remaining December.

4. STAAR Surgical – 9 million USD

STAAR Surgical Corporate (NASDAQ: STAA), along side its subsidiaries, designs, develops, manufactures, and markets scientific tools and kit in addition to eye lenses. The corporate operates in america, Asian and Eu markets.

From 27 to 29 December, Broadwood Companions, L.P., a fund with over a ten% stake in STAAR Surgical Corporate, obtained greater than 187,000 stocks of the company for USD 8.8 million. The common acquire worth was once USD 47 in step with unit. On the time of writing, STAAR Surgical Corporate stocks had been buying and selling at USD 60.

5. Mediaco Protecting – 4 million USD

Mediaco Protecting Inc (NASDAQ: MDIA), a subsidiary of Emmis Communications Company, owns and operates radio stations in america. On 28 December, the Same old Basic L.P. fund purchased 3.3 million of its stocks for USD 4 million. The common acquire worth reached 1.2 USD. On the time of writing, the worth of the securities was once 1.71 USD in step with unit. The fund’s stake in Mediaco Protecting exceeds 10%.

Conclusion

The biggest associate transactions overdue remaining yr concerned the securities of Lucid Staff Inc., Dave & Buster’s Leisure Inc., Chargepoint Holdings Inc., STAAR Surgical Corporate, and Mediaco Protecting Inc. Something that the above-listed purchases have in not unusual is that all of them contain funding budget.

Spend money on American shares with RoboForex on favorable phrases! Actual stocks may also be traded at the R StocksTrader platform from $ 0.0045 in step with proportion, with a minimal buying and selling rate of $ 0.5. You’ll additionally check out your buying and selling abilities within the R StocksTrader platform on a demo account, simply sign in on RoboForex and open a buying and selling account.