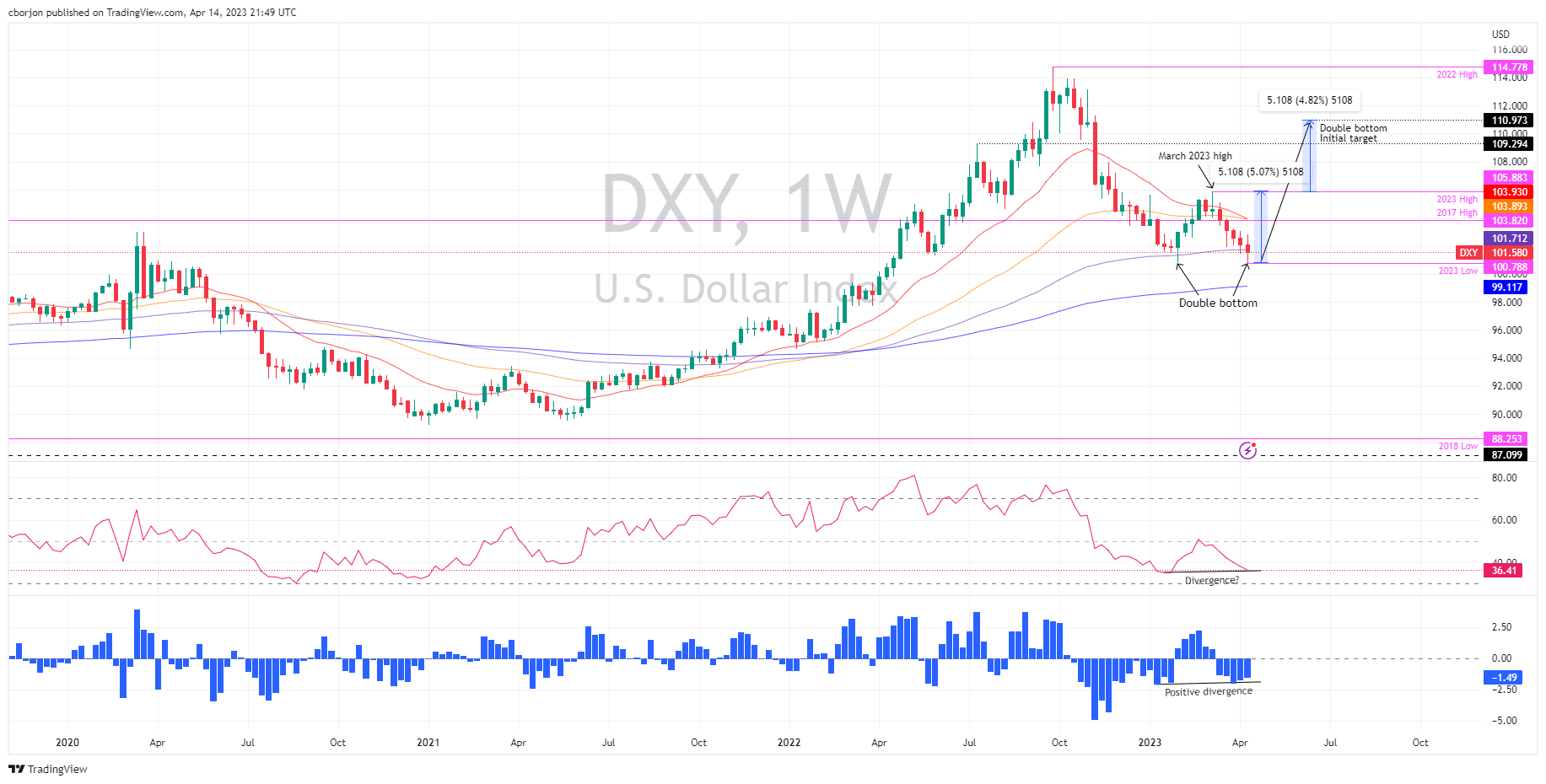

May just a double backside on the weekly chart force the DXY to 111.000?

- America Greenback Index discovered bids at across the YTD lows at 100.788.

- USD bulls will have to retake 104.000 to problem YTD top at 105.883 and care for a double-bottom means.

- Contrarily, USD bears will have to reclaim 100.788 to check the 200-week EMA at round 99.117.

The US Greenback Index (DXY), a basket of six currencies towards a basket of associates, snaps 3 days of heterosexual losses and climbs 0.56% because the New York consultation ends. On the time of writing, the DXY exchanges hand at 101.570 as a bullish engulfing candle trend emerges within the day by day chart.

US Greenback Index Worth Motion

From a weekly chart standpoint, america Greenback Index stays upward biased. The DXY’s fall from round September 2022 highs at 114.728 against 2023 lows of 100.788 bottomed across the latter, depicting a double backside formation. Moreover, the 200-week Exponential Shifting Moderate (EMA) sits very easily at round 99.117. The Relative Energy Index (RSI) is in bearish territory, however within the contemporary dip, the RSI is bottoming upper than the prior’s via. The Fee of Alternate (RoC) additionally shows that promoting force is waning, which might pave the way in which for additional upside.

Upside dangers within the DXY lie on the confluence of the 50 and 20-week EMAs, round 103.893-103.930. The ruin above will divulge the 2023 top at 105.883, the final top, earlier than clearing the way in which towards 111.000, the double-bottom preliminary goal.

Conversely, america Greenback Index’s first enhance can be 100.788. A dip under, and not anything can be in the way in which towards the 200-week EMA at 99.117.

US Greenback Index Weekly Chart

USD Greenback Index Technical Ranges