Is Complex Micro Units (AMD) inventory about to leap at the again of the semiconductor growth? [Video]

Complex Micro Units, Inc (AMD) is a US multinational semiconductor corporate that gives high-performance computing platforms for cloud, edge, and finish units. Its merchandise come with CPUs, GPUs, FPGAs, and Adaptive SoCs, which can be utilized in quite a lot of units, together with private computer systems, gaming consoles, and servers. AMD confronted demanding situations prior to now however regained a few of its marketplace percentage because of the good fortune of its Ryzen processors. The corporate has expanded into new markets and plans to go into the high-performance computing marketplace. AMD is indexed on NASDAQ and is an element of NASDAQ 100 and S&P 500 Knowledge Era.

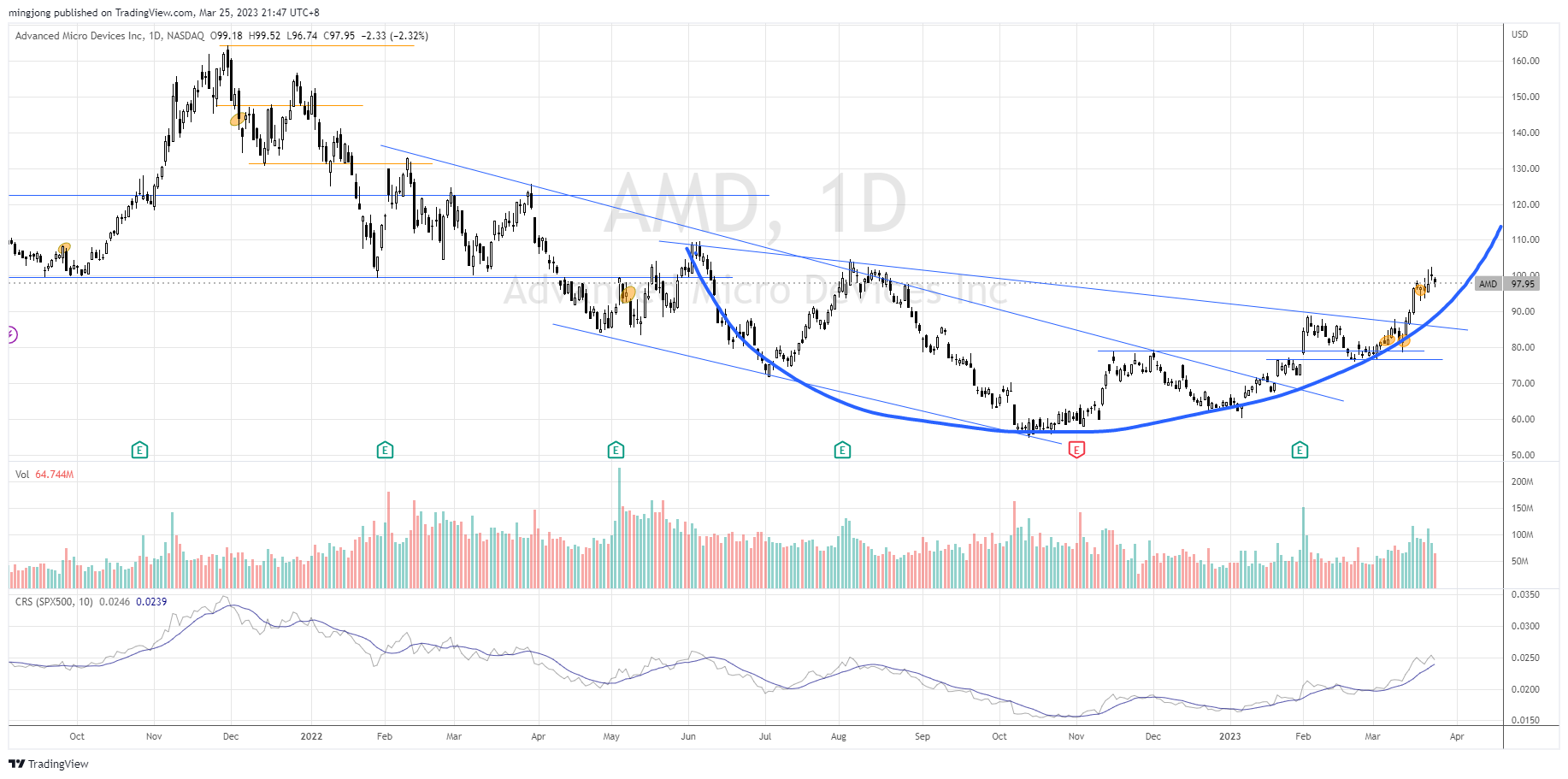

Pivot Wyckoff Trade Of Persona To Bullish Pattern

In overdue Nov 2021, AMD reached an all-time excessive of $164.46 however retraced due to this fact from that time. The cost was once not able to rebound and as an alternative entered a Wyckoff distribution segment. It broke the $122.50 axis and retested the help of $100 on 22 Jan 2022. The next weeks noticed the cost vary certain and the rise in quantity with incapacity to rally up suggests extra weak point forward. This was once showed when the cost broke the $100 help in a Wyckoff closing level of provide (LPSY) model.

There was once a spike in quantity on 4 Might, however no apply thru to the up facet which resulted in a redistribution. The Wyckoff signal of weak point (SOW) took the cost all the way down to round $54.60 on 13 Oct. The quantity was once excessive however no additional down transfer urged it was once preventing quantity. The check of the marketing climax in Dec 2022 contained decrease quantity with a better low adopted by means of a better excessive rally that broke out from the downtrend line. This signaled a very powerful idea, a Wyckoff alternate of personality, which switched the prejudice from downtrend into no less than a buying and selling vary if now not a reversal.

The 12 months 2023 started with an impressive SOS rally the place AMD broke above the $79 resistance with incomes effects as catalyst on 1 Feb. There was once a spike in quantity however the shallow pullback examined the resistance-turned-support at $76-$79 with low quantity hinted at provide absorption. It’s now checking out the long run resistance of $100.

Bias

Bullish. In line with the Wyckoff approach, AMD has simply damaged out from the non permanent Wyckoff accumulation segment and again up (BU). It’s now in segment E to problem the $100 axis, which might shape a bigger accumulation construction. The closing 3 days are appearing rejection tails with localized build up in quantity. Nonetheless, the bullish value construction remains to be intact and can most probably see extra rally as much as check quick goals of $110 and $122.50 due to this fact as supported by means of the rounding backside trend tweeted underneath.

If the cost breaks underneath $89, it’s going to most probably retest the help zone between $79 and $76.60.

AMD was once mentioned intimately in my weekly reside team training on 7 Mar 2023 prior to the marketplace opened. Regardless of the failure state of affairs confirmed up as mentioned on this newest video (refer underneath), the traits of the FOMC bar was once now not as bearish as expected. This may provide a buying and selling alternative for AMD to journey on its sturdy bullish momentum.