IPO of Beamr Imaging: In-Call for Video Compression Generation – R Weblog

This text is ready Israeli era corporate Beamr Imaging Ltd., which plans to move public and checklist at the NASDAQ trade on 28 February. The ticker image of its shares is BMK. The company develops answers for video encoding, optimisation, and interpreting.

Lately we can communicate in regards to the issuer’s trade fashion, the outlook for its addressable marketplace, its primary competition, the corporate’s monetary scenario, its strengths and weaknesses, and the main points of the IPO.

Beamr Imaging in short

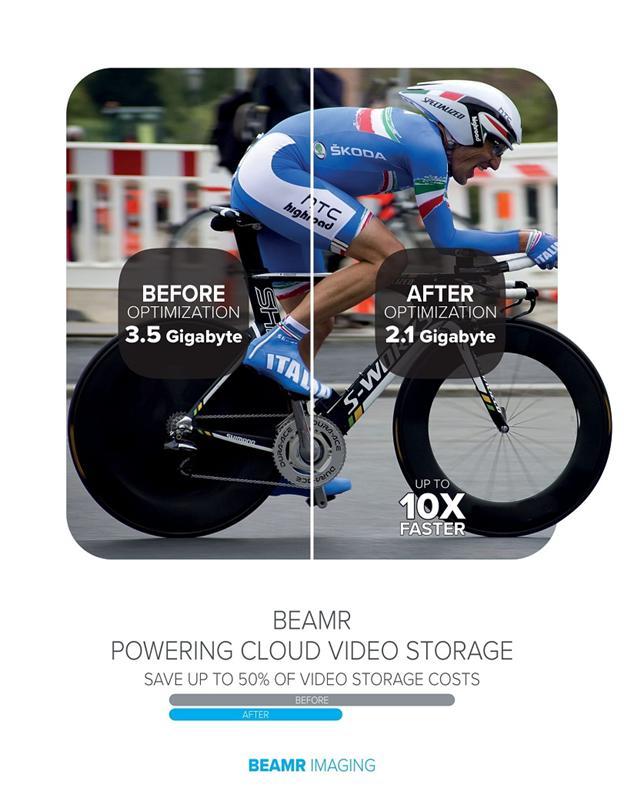

Beamr Imaging Ltd. specialises within the building of applied sciences that may considerably cut back the amount of video and symbol information whilst keeping up the extent of high quality. This optimisation permits sooner and extra environment friendly knowledge importing, sharing, and are living streaming.

The corporate used to be based in 2009 in Israel and is headquartered in Herzliya. The company’s CEO since inception is Sharon Carmel, who prior to now held a identical place and used to be a founder at BeInSync and Emblaze.

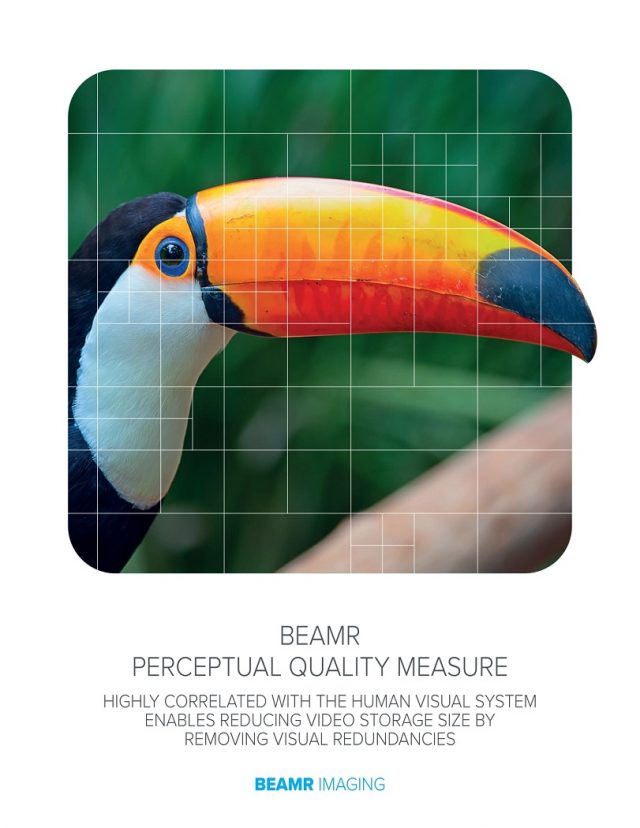

Beamr’s video encoding and interpreting era used to be awarded an Emmy in 2021. The corporate holds 51 patents, together with for Beamr High quality Measure algorithms, which permit environment friendly compression of multimedia information.

What makes this era distinctive is that it considers the peculiarities of human visible belief of graphic data. The optimised video and symbol parameters agree to the ITU BT.500 world usual.

Beamr Imaging is lately operating on patent registrations for 3 extra answers:

- Beamr JPEGmini is a picture compression tool

- The Beamr Silicon IP block is a video encoding and compression software

- Beamr 4 and Beamr 5 are video encoders and decoders

As well as, Beamr Imaging plans to enforce a cloud provider with built-in graphics compression era. This may occasionally make it more straightforward and sooner for customers to get entry to the corporate’s turnkey answers. Its consumers come with primary media content material manufacturers and vendors reminiscent of Netflix Inc. (NASDAQ: NFLX), Paramount International (NASDAQ: PARA), Wowza Media Programs LLC, Microsoft Company (NASDAQ: MSFT), VMware Inc. (NYSE: VMW), Vimeo Inc. (NASDAQ: VMEO), and Citrix Programs Inc.

On the finish of 2021, those firms accounted for 62% of Beamr Imaging’s overall gross sales. The issuer decreased this percentage to 58% between January and June 2022 to extend the diversification of its buyer base. As we will be able to see, the company has numerous paintings to do on this house.

As of 31 December 2021, the volume of funding raised through Beamr Imaging Ltd. reached USD 30.2 million. The principle traders are Verizon Ventures LLC, Disruptive Applied sciences L.P., Innovation Endeavors L.P., and Marker LP.

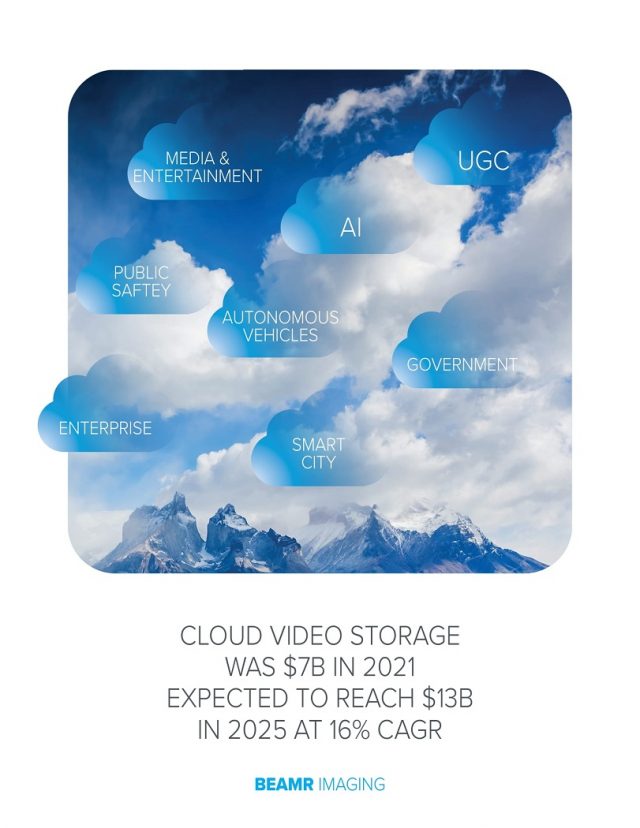

Potentialities for the Beamr Imaging addressable marketplace

Consistent with Fortune Trade Insights, the worldwide cloud video garage marketplace used to be valued at USD 7.3 billion in 2021. It’s anticipated to succeed in USD 20.9 billion through 2028. The projected compound annual enlargement price (CAGR) from 2022 to 2028 is 16%.

Consistent with a Datamation document, the worldwide knowledge optimisation marketplace is valued at USD 3 billion in 2020. It’s anticipated to succeed in USD 4.5 billion through 2026. The projected compound annual enlargement price (CAGR) from 2020 to 2026 is 5.2%.

Major competition:

- Seagate Generation LLC

- Apple Inc.

- Alphabet Inc.

- Ateme S.A.

- MainConcept GmbH

- Ittiam Programs Non-public Restricted

Beamr Imaging’s monetary efficiency

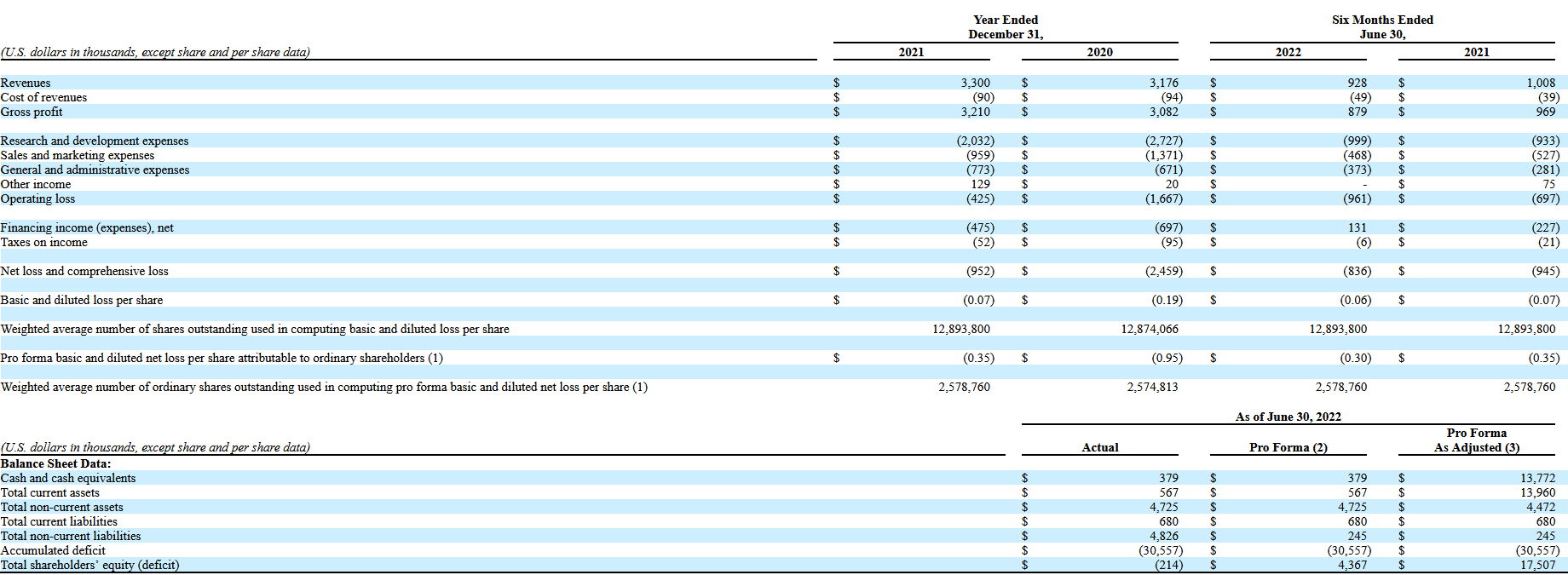

Beamr Imaging Ltd. generated revenues of USD 3.3 million for 2021, an building up of three.9% over the end result for 2020. For the primary part of 2022, the determine lowered through 7.9% to USD 0.93 million. From July 2021 to June 2022 inclusive, earnings reached 3.1 million USD.

The issuer’s web loss for 2021 used to be USD 0.95 million, down 61.3% from the end result for 2020. For the primary part of 2022, the determine lowered through 11.53% to USD 0.83 million.

As of 31 December 2021, the online money drift used to be certain and reached USD 0.57 million. Right through the similar length, the corporate had USD 1 million in accounts, with overall liabilities achieving USD 6.2 million.

Beamr Imaging’s strengths and weaknesses

Strengths:

- A promising addressable marketplace

- A standard buyer base

- Certified control

- A sought-after era advanced in-house

- Lowering the online loss

- Cooperation with famend firms

Weaknesses:

- Fierce festival

- No web benefit

- A lower in earnings

- An building up in working prices

- Low stage of industrial diversification

What we all know in regards to the Beamr Imaging IPO

ThinkEquity LLC would be the underwriter for Beamr Imaging Ltd.’s IPO. The issuer plans to promote 3 million strange shares on the introduced reasonable value of five USD according to unit. The gross proceeds from the sale of the shares will quantity to fifteen million USD, except the sale of choices through the underwriter. The corporate’s marketplace capitalisation might succeed in USD 68.5 million.

It’s most probably that the issuer’s P/S a couple of (capitalisation/revenues) will succeed in 22.1. This kind of P/S worth might be regarded as over the top for a consultant of this sector. Alternatively, enlargement within the lock-up length is imaginable in case of beneficial marketplace prerequisites.

Spend money on American shares with RoboForex on favorable phrases! Actual stocks can also be traded at the R StocksTrader platform from $ 0.0045 according to percentage, with a minimal buying and selling price of $ 0.5. You’ll additionally take a look at your buying and selling abilities within the R StocksTrader platform on a demo account, simply sign up on RoboForex and open a buying and selling account.