How To Business the “S&P 500 Pattern Following Technique” – R Weblog

On this article, we will be able to have a look at the long-term indicator buying and selling “S&P 500 Pattern Following” technique. We will be able to learn how it really works, how it’s utilized in buying and selling, and what indicator indicators it’s in line with. We will be able to additionally checklist its benefits and drawbacks.

How the S&P 500 Pattern Following technique works

This long-term technique implies buying and selling the S&P 500 (US 500) inventory index within the path of the present marketplace fashion. Notice that this index is most certainly the best-known and most well liked inventory index on this planet. It comprises the shares of the five hundred biggest corporations traded on america inventory marketplace and serves as a barometer of the state of america inventory marketplace.

Famend traders and asset managers Meb Faber and Paul Tudor Jones are the creators and popularisers of the S&P 500 Pattern Following technique. They introduced a relatively easy and on the similar time efficient trend-following buying and selling machine for the S&P 500 Index, which is in line with the indicators of the 200-day shifting reasonable.

The S&P 500 ceaselessly presentations a gradual uptrend all over sessions of a emerging inventory marketplace. The indicator must lend a hand to spot the start of the following long-term fashion and provides traders a sign to shop for to benefit from the index expansion.

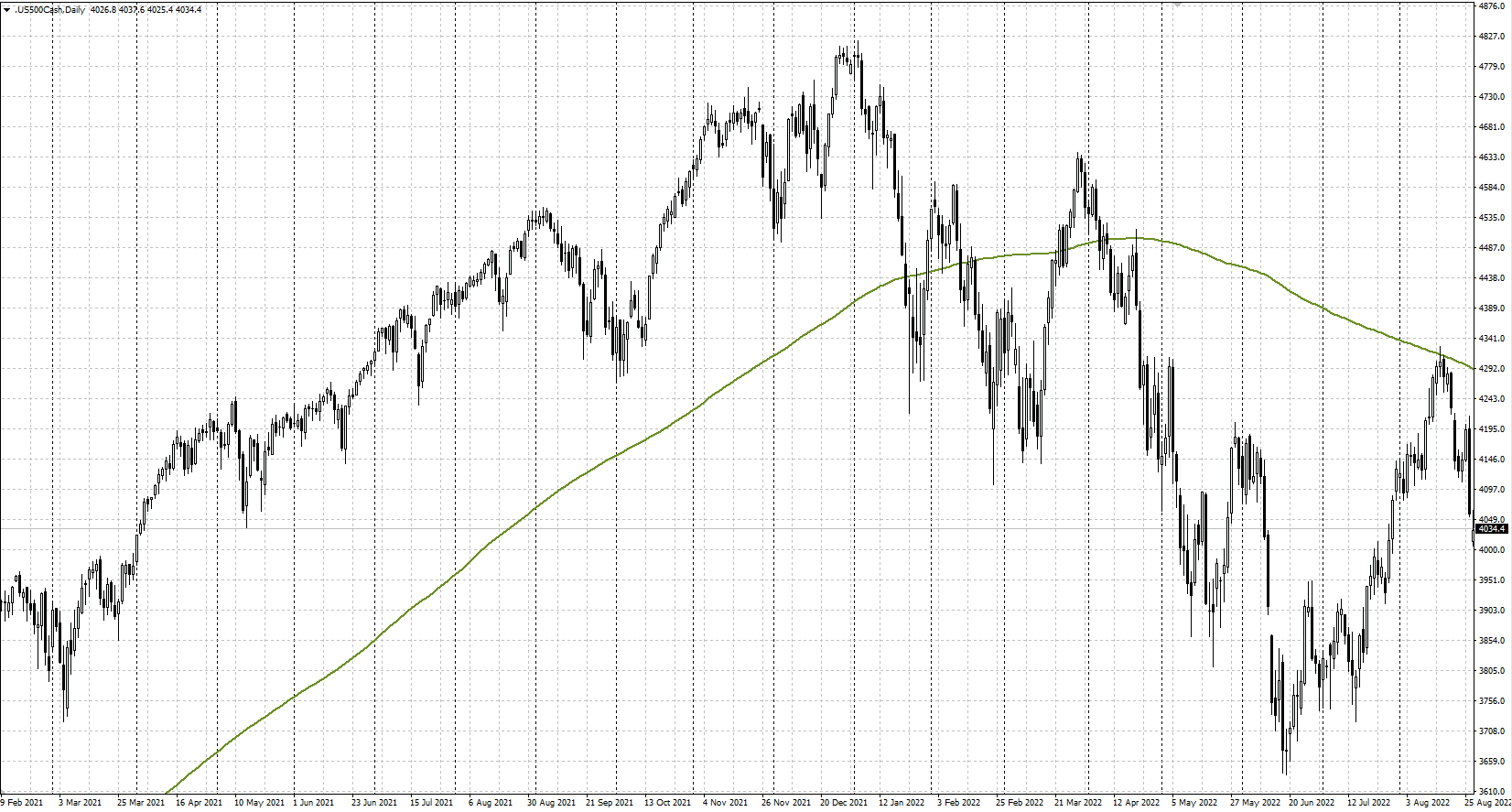

To explain the tactic merely: when the S&P 500 is above the 200-day shifting reasonable, the fashion is upward, and this is a excellent time to shop for the index; when it’s beneath the indicator line, the fashion adjustments, shifting downward, and all positions will have to be closed.

The best way to set up the Transferring Reasonable indicator

The Transferring Reasonable (MA) has lengthy established itself as a easy and efficient software for fashion research. The indicator is incorporated in most current buying and selling terminals the place it’s displayed without delay at the value chart.

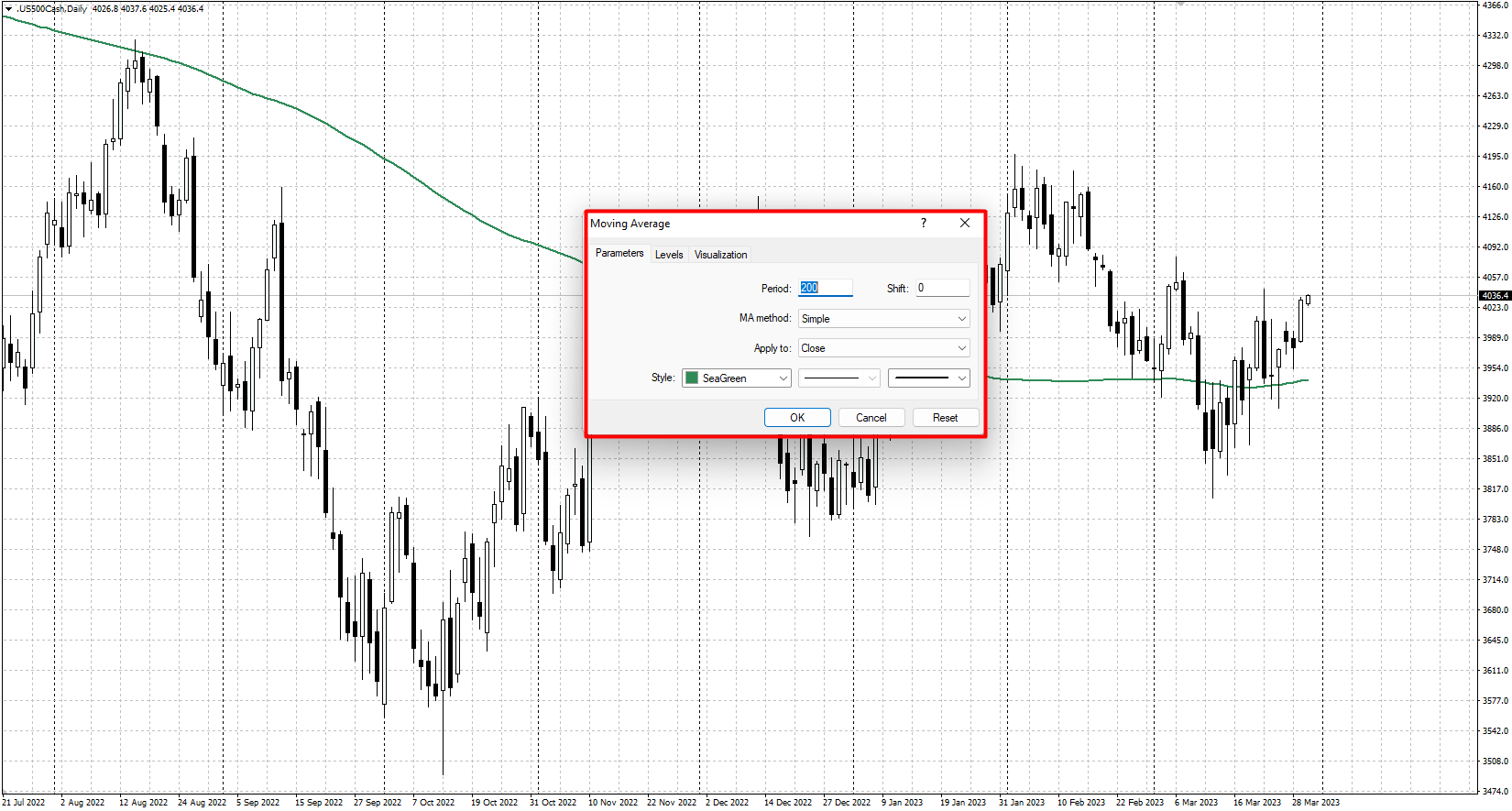

To set the Transferring Reasonable in the preferred MetaTrader 4 and MetaTrader 5 buying and selling platforms, apply those steps:

- Open the terminal and log in in your account.

- Make a selection the S&P 500 from the checklist of to be had monetary tools and upload it to the chart.

- From the primary menu, click on on Insert, then on Signs, then on Pattern, and choose Transferring Reasonable.

- Make a selection the duration 200, the road color and width, and the MA: Easy, and click on OK to use the settings and shut the indicator settings window.

Consequently, a 200-day shifting reasonable will seem at the value chart, which will probably be used to spot the present fashion and seek for buying and selling indicators consistent with the tactic.

The best way to use the tactic in buying and selling

The S&P 500 trend-following technique trades in a single path best – to shop for the asset. Its buying and selling theory is modest:

- When the final value of the index crosses the 200-day Transferring Reasonable from backside to most sensible, this means the start of an upward fashion and offers a sign to shop for

- When the final value of the index crosses the 200-day shifting reasonable from most sensible to backside, this indicators the top of the uptrend and the want to shut purchase positions

A purchase sign for the tactic

- The S&P 500 begins emerging and expectantly crosses upwards during the 200-day shifting reasonable. The day by day candlestick closes greater than midway or totally above the shifting reasonable

- On the opening of the following buying and selling day, a industry is made to shop for the asset

- Prevent Loss and Take Benefit don’t seem to be set, a place is mounted (benefit or loss) when the fee reverses and closes beneath the Transferring Reasonable with self assurance

Purchasing instance of “S&P 500 Pattern Following” technique

- On 27 Would possibly 2020, the index quotations confirmed an building up, and the day by day candlestick closed above the 200-day Transferring Reasonable with self assurance. On tomorrow, a purchase place might be opened at $3047.50 at the beginning of the buying and selling consultation

- Within the following month, the quotations returned to the Transferring Reasonable line however did not consolidate beneath it

- The index confirmed a gradual uptrend all through 2021 and best started a powerful downward correction in January 2022

- On 21 January 2022, the day by day candlestick closed beneath the 200-day Transferring Reasonable and the location needed to be mounted at $4422.40 on the opening of the following buying and selling day

Benefits and drawbacks of the tactic

Benefits:

- The method works smartly all over a sustained uptrend, permitting you to learn on sturdy and extended actions of the S&P 500 index

- The possible benefit will also be repeatedly more than the possible loss

Disadvantages:

- Offers unprofitable indicators: when there is not any transparent fashion out there, there’s a vast sideways motion

- The 200-day shifting reasonable indicators would possibly not be capable of stay alongside of the fee motion, so a big portion of income will also be misplaced on sharp marketplace reversals downwards

- Characterized via a small collection of trades and top capital necessities, this technique is extra aimed toward massive long-term traders and is probably not of pastime to buyers

Conclusion

The S&P 500 Pattern Following Technique is a straightforward long-term buying and selling machine in line with indicators from the 200-day shifting reasonable. It really works smartly all over a powerful fashion when the inventory marketplace and the S&P 500 index are emerging ceaselessly. This buying and selling method is geared extra in opposition to long-term traders and can most certainly now not paintings for buyers. The method must be examined on ancient knowledge ahead of use.