How To business the GBP/JPY Technique The use of the Bollinger Bands – R Weblog

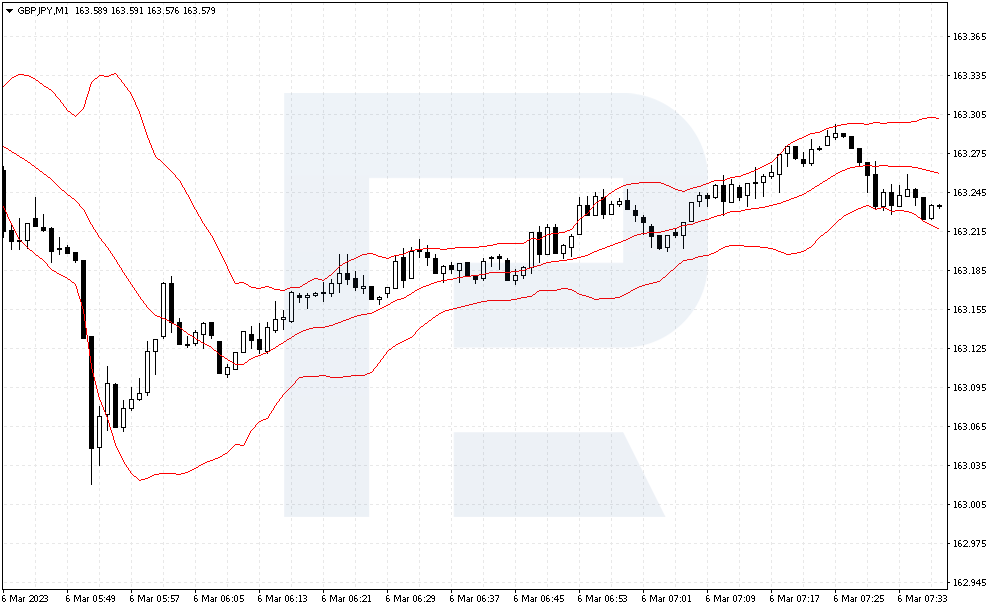

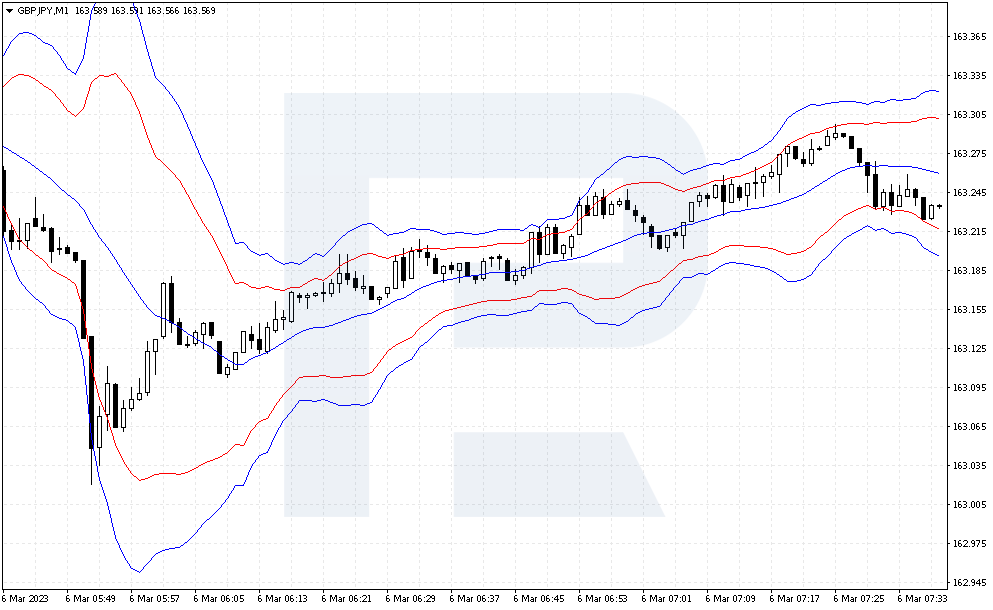

These days we will be able to have a look at a momentary buying and selling technique in accordance with the Bollinger Bands indicator with other timeframes. It’s designed to paintings with the foreign money pair GBP/JPY at the M1 chart.

GBP/JPY is a extremely risky tool, and the technical indicator will point out instants when the associated fee diverges considerably from its moderate fluctuation and there’s a prime chance of a transfer in the other way.

Learn how to business GBP/JPY with the Bollinger Bands technique

We will be able to display you learn how to use Bollinger Bands alerts with 3 other deviation values. We will be able to have a look at the placement opening and talk about the Forestall Loss and Take Benefit regulations in step with the method.

Bollinger Bands in short

Bollinger Bands is designed as a development indicator, and it may display no longer most effective the course of the present development but additionally estimate volatility. It has 3 traces: a easy shifting moderate with a duration of 20 is situated within the heart, whilst two different traces are situated above and underneath, estimating most and minimal values. The extraordinary traces act as a floating make stronger and resistance ranges.

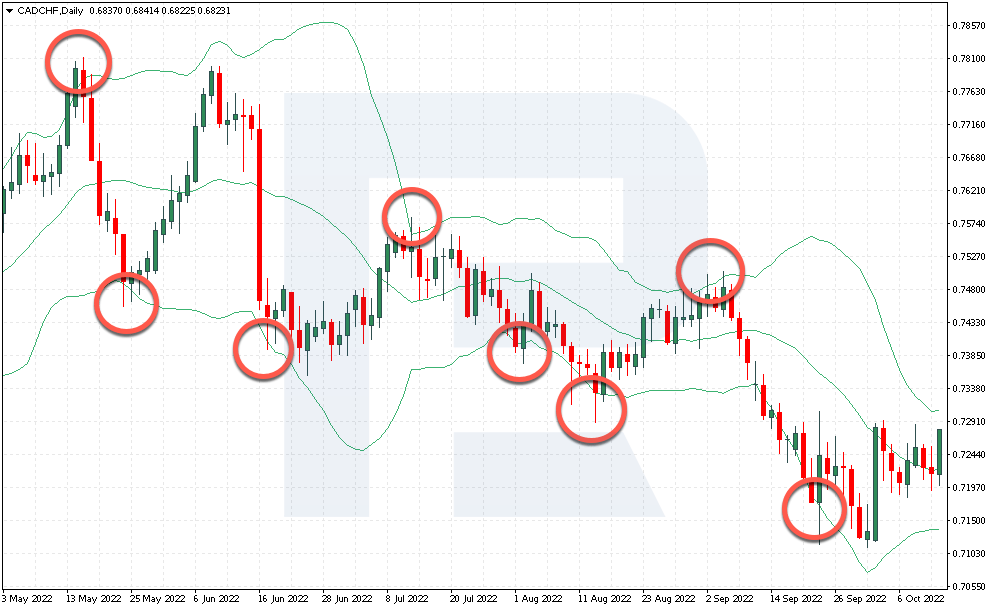

In line with the creator of Bollinger Bands, costs spend 95% of the time within the space between the bands of the indicator. Due to this fact, any value transfer out of this hall will also be observed as a reversal risk and an forthcoming go back of costs to moderate values.

The behaviour of Bollinger Bands all the way through robust marketplace traits could also be fascinating. Most of the time, in an uptrend, an investor needs to shop for on the lowest value. On this case, one will have to be expecting the associated fee to check the decrease boundary of the indicator. In a downtrend, the investor needs to promote on the most value. On this case, the associated fee is anticipated to check the higher boundary of the indicator.

Learn how to arrange Bollinger Bands

Upload the Bollinger Bands indicator to the chart. To set the drawing duration and color of traces, double left-click at the indicator within the chart or right-click as soon as and choose “Houses” within the menu that looks. Then trade the color of the traces and the deviation price within the opened settings window.

- Bollinger Bands with deviation 2 – choose the crimson color of the traces. Excessive traces of the indicator characterise the closest make stronger and resistance ranges. In line with the creator of the indicator, the associated fee very hardly ever strikes past those traces

- Bollinger Bands with deviation 3 – make a selection the blue color of the traces. In line with the creator of the indicator, value strikes past those traces are even rarer

- Bollinger Bands with deviation 4 – make a selection the fairway color of the traces. In line with the creator of the indicator, the associated fee will succeed in those traces as hardly ever as conceivable, most effective at moments of top volatility available in the market

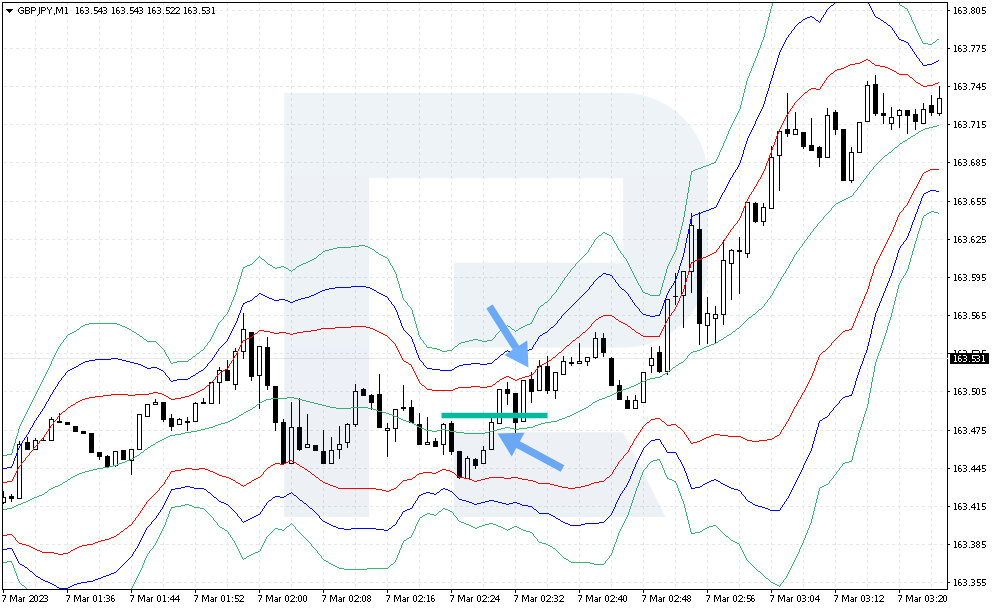

How to shop for GBP/JPY the usage of the Bollinger Bands technique

- At the M1 chart, the associated fee is checking out the decrease crimson indicator line or is situated between the crimson and blue decrease traces

- A Forestall Loss will also be set 2 issues underneath the low of the former candlestick on which you might be purchasing

- Take Benefit will also be set 15 issues above the marketplace access level. An alternative choice for atmosphere Take Benefit: you’ll be able to use the Bollinger Bands indicator traces to decide the objectives for the sign. As an example, the primary goal is the center inexperienced line of the indicator, and the second one is the higher crimson line

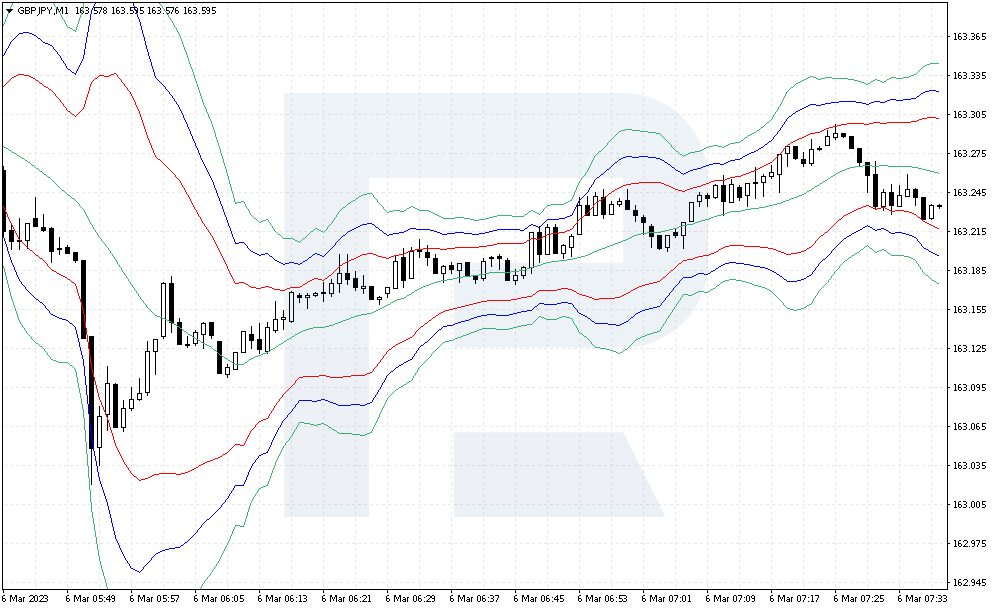

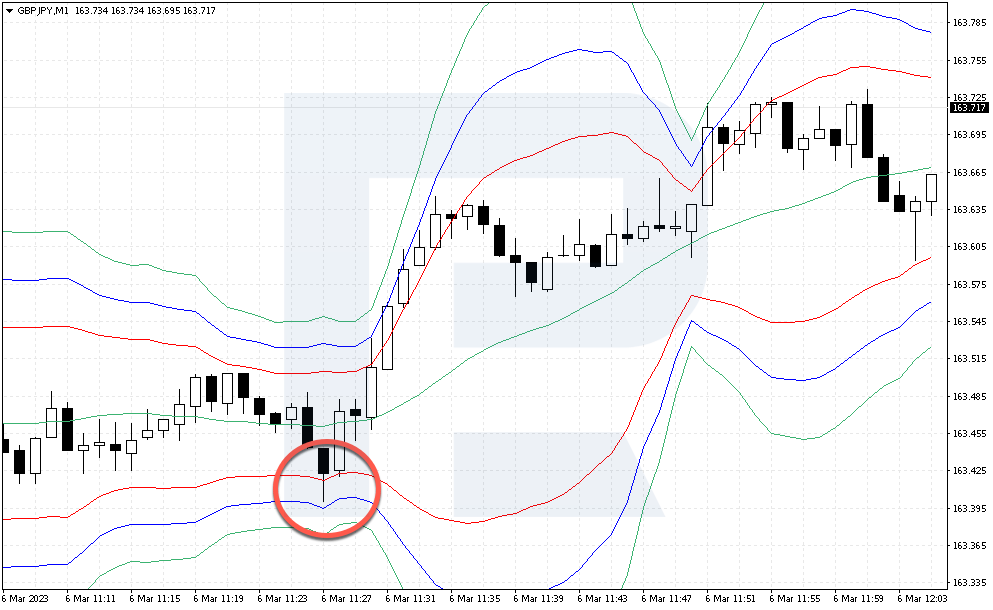

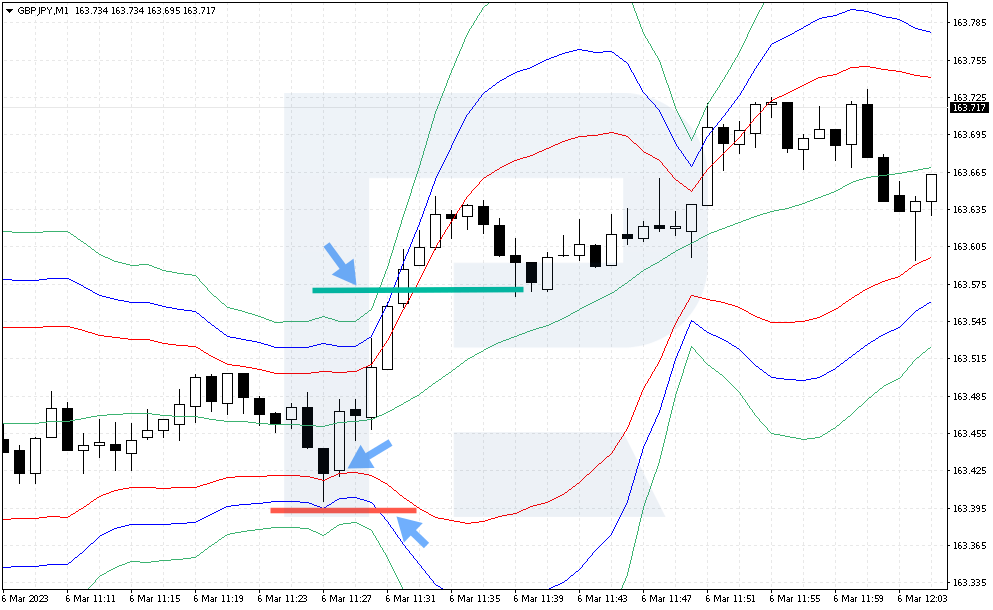

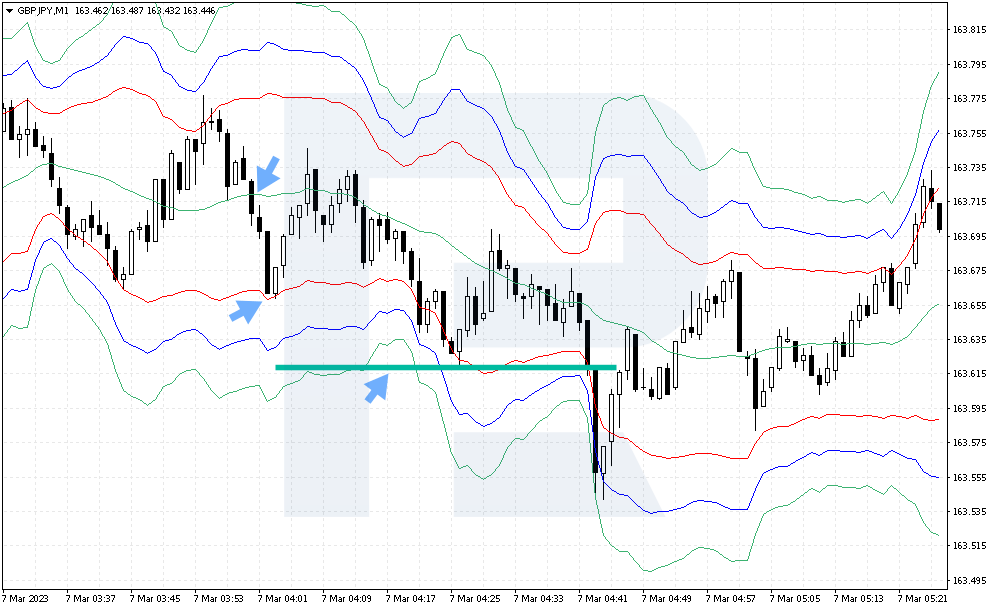

Instance of shopping for GBP/JPY the usage of the method

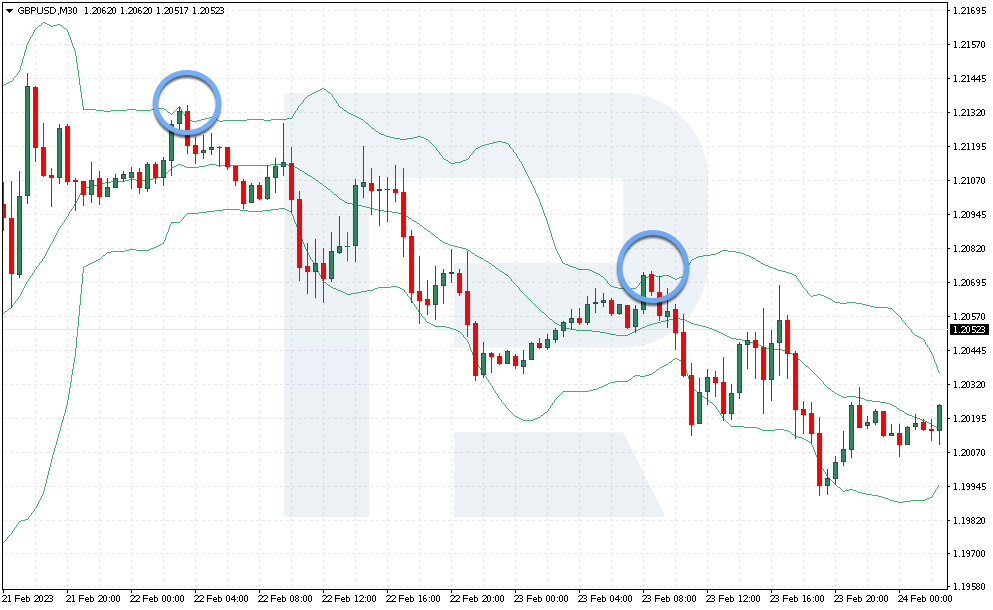

On 6 February 2023, the GBP/JPY foreign money pair chart confirmed a correction in a slender vary. The cost then broke in the course of the decrease crimson line, which used to be a sign to open an extended place. It used to be conceivable to shop for on the opening of a brand new candlestick.

The purchase order used to be opened at the cost of 163.42. Forestall Loss used to be positioned at 163.38, underneath the former candlestick’s low via 2 issues, and the danger reached 4 issues. Take Benefit used to be set 15 issues above the access level, at 163.57. The cost reached this goal inside of 4 mins.

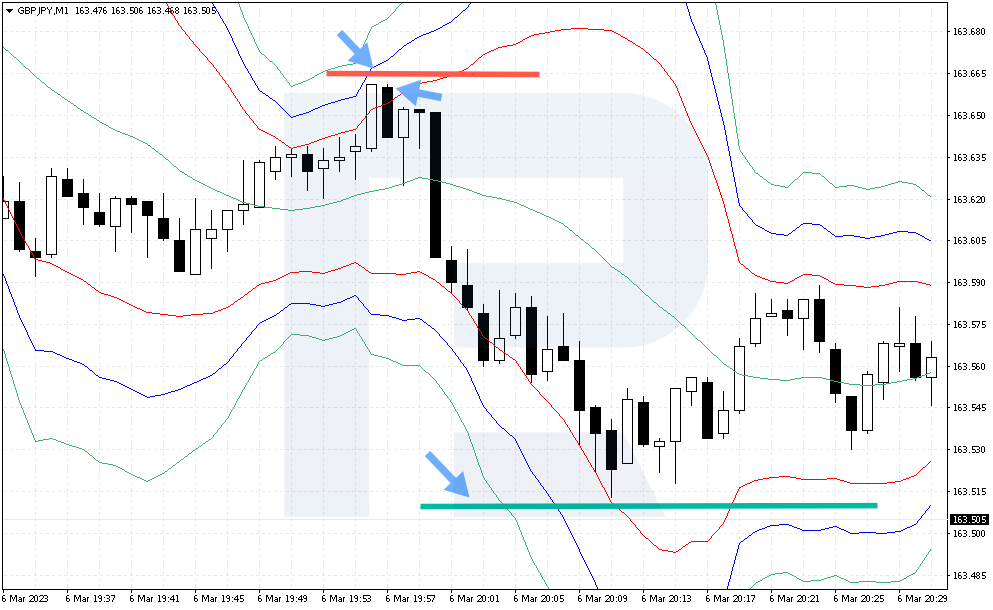

- At the M1 chart, the associated fee is checking out the higher crimson line of the indicator or is situated between the higher crimson or blue traces

- A Forestall Loss will also be set 2 issues above the prime of the former candlestick on which the sale is opened

- Take Benefit will also be set 15 issues underneath the marketplace access level. Yet one more variant of Take Benefit: we use indicator traces to decide the objectives for the sign. As an example, the primary goal is the center inexperienced line of the indicator, and the second one is the ground crimson line

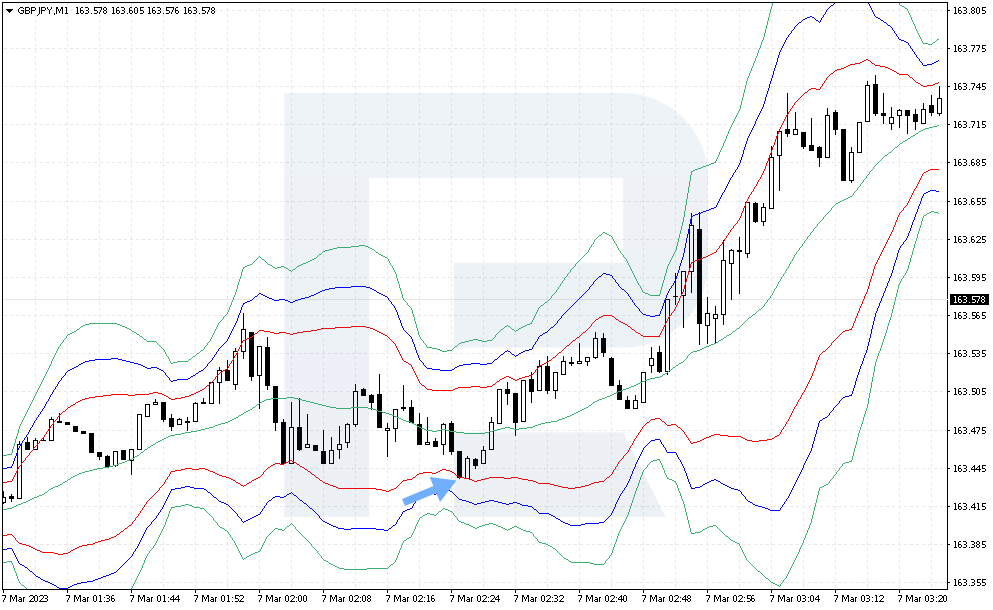

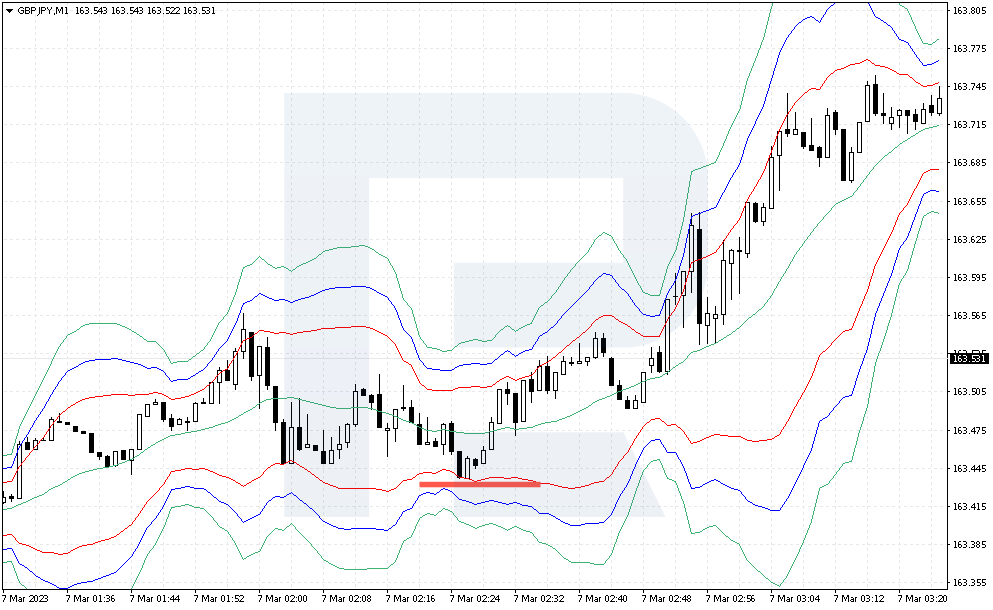

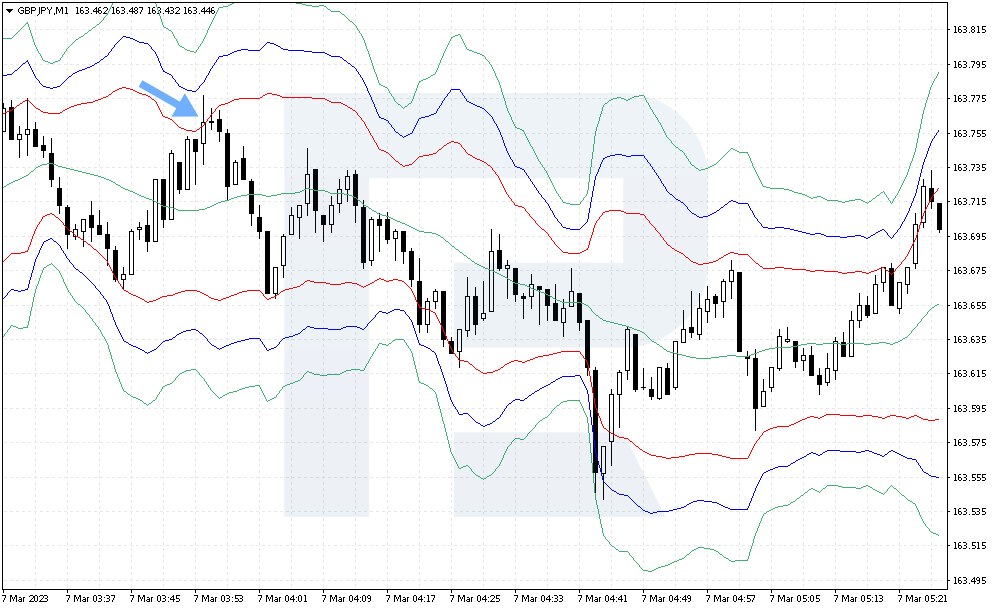

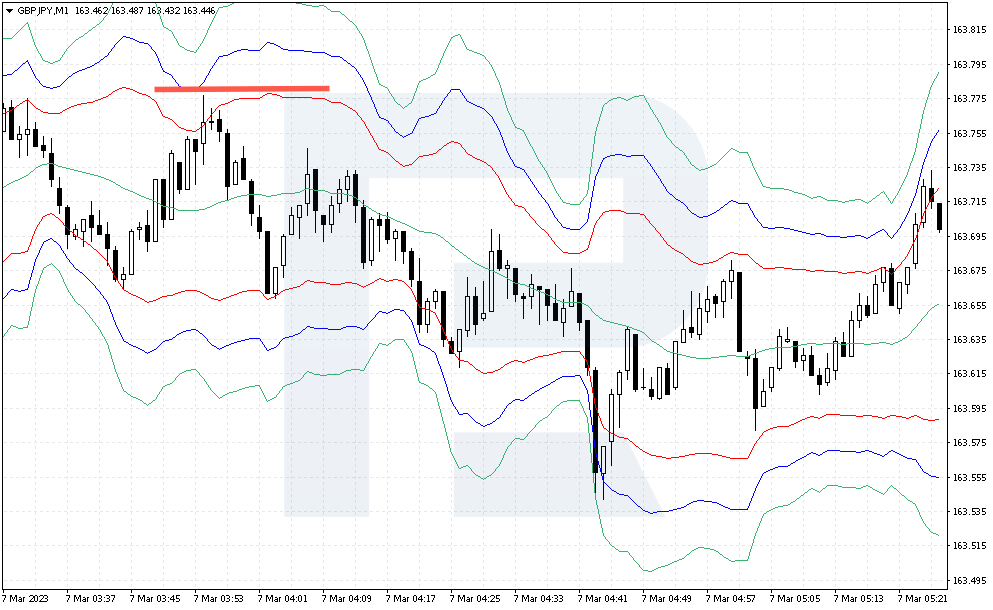

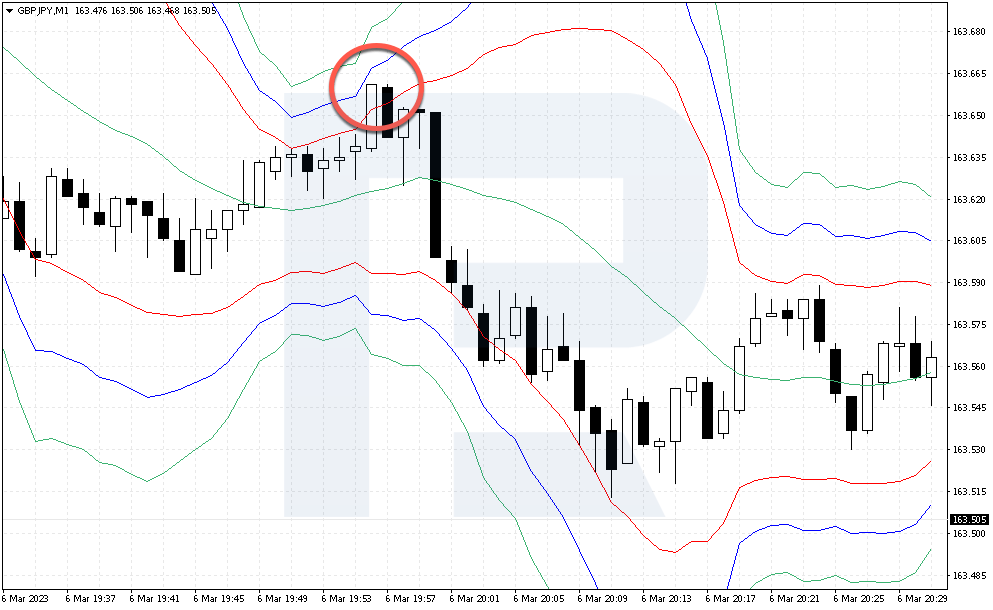

Instance of promoting GBP/JPY via technique

On 6 February 2023, after the expansion recorded at the GBP/JPY foreign money pair chart, the associated fee broke in the course of the higher crimson line. This used to be a sign to open a quick place. It used to be conceivable to promote on the opening of a brand new candlestick.

The promote business used to be opened at the cost of 163.66. Forestall Loss used to be set 2 issues above the former candlestick’s most, on the degree of 163.68, the danger reached 2 issues. Take Benefit used to be set 15 issues underneath the access level at 163.51. The cost approached this goal in 14 mins, however then it reversed upwards.

Conclusion

A scalping technique in accordance with the Bollinger Bands indicator for the GBP/JPY foreign money pair is a straightforward variant of buying and selling at the M1 chart with transparent regulations. The dealer makes a speciality of excessive deviations of the associated fee from the common values and opens offers most effective at those ranges. The method has thought-out tactics of atmosphere Forestall Loss and Take Benefit, which will also be modified rather to extend the extent of efficiency.

One downside of this manner is that it does no longer paintings against the present development, however merely from the degrees at the indicator. It could be price bearing in mind including a Transferring Moderate to decide the course of the fad, and most effective paintings against the primary development.