Greenback Anchors Yen Close to 150 Forward of BoJ

- Fresh information indicated an important building up in US shopper spending in September.

- Markets are pricing a 19% likelihood of a charge hike in December.

- The Financial institution of Japan began its two-day financial coverage assembly on Monday.

The USD/JPY outlook for Monday hinted at a modestly bullish pattern, with the greenback status sturdy and maintaining the yen close to the 150 mark. In the meantime, all eyes have been at the Financial institution of Japan’s coverage announcement.

-If you have an interest in computerized foreign currency trading, take a look at our detailed guide-

The greenback index held secure as traders assessed the results of sturdy US financial information at the Federal Reserve’s rate of interest outlook. Significantly, contemporary information indicated an important building up in US shopper spending in September. It units a favorable trajectory for spending within the fourth quarter.

Markets be expecting the Federal Reserve to take care of present rates of interest later this week. Alternatively, the markets are pricing in a 19% likelihood of a charge hike in December.

The Financial institution of Japan began its two-day financial coverage assembly on Monday. It marks the beginning of per week that comes with rate of interest choices from america Federal Reserve and the Financial institution of England. Moreover, there are a number of PMI stories, Eurozone inflation figures, and US nonfarm payrolls to believe.

Carol Kong, a forex strategist on the Commonwealth Financial institution of Australia, famous, “It’s undeniably a packed week. Alternatively, the BOJ assembly is probably the most intriguing one, particularly with the rising hypothesis about attainable coverage changes.”

With the new upsurge in international rates of interest, there’s mounting force at the Financial institution of Japan to switch its bond yield keep an eye on. As such, there are rumors that the dovish central financial institution would possibly carry its present yield cap throughout this week’s assembly.

USD/JPY key occasions as of late

Buyers don’t seem to be anticipating necessary stories from america or Japan as of late. Due to this fact, there’s a likelihood the pair will transfer sideways.

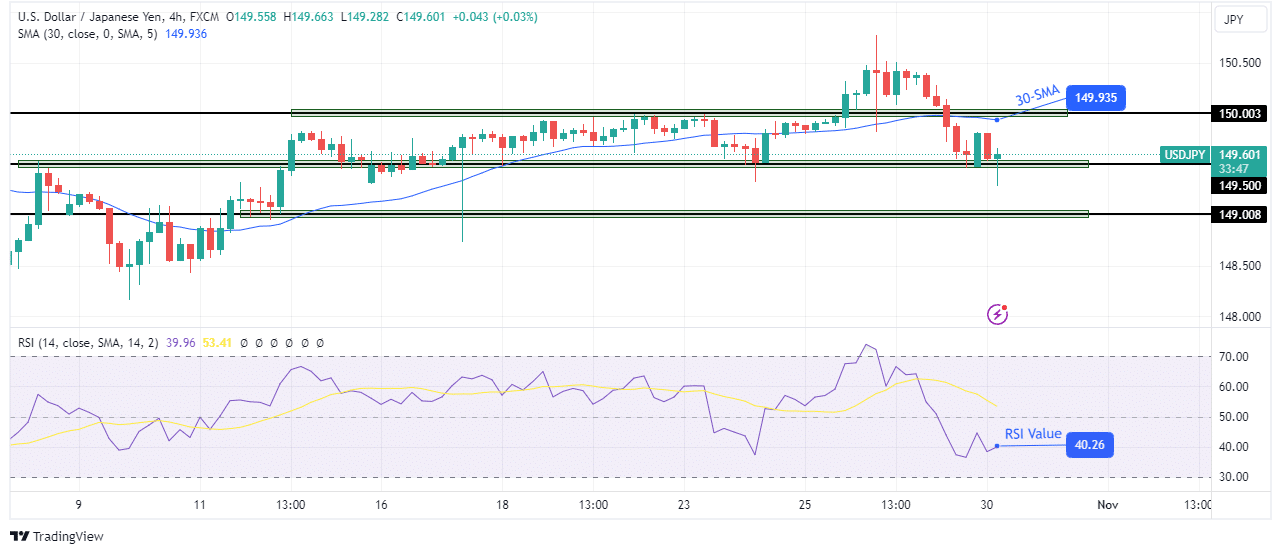

USD/JPY technical outlook: Bears problem the uptrend beneath 150.00.

The USD/JPY value has damaged beneath the 150.00 key degree and the 30-SMA as sentiment shifts to bearish. In a similar fashion, the RSI has damaged beneath the important thing 50 degree, setting apart bullish from bearish momentum.

If you have an interest in assured stop-loss foreign exchange agents, take a look at our detailed guide-

Alternatively, bears face the problem of a cast give a boost to degree at 149.50. An preliminary try to take over failed when the cost paused at 149.50 and failed to wreck beneath. However, this time, bears are appearing more potent momentum, as observed within the RSI. Due to this fact, the cost will most probably wreck beneath 149.50 to retest the 149.00 give a boost to degree.

Having a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll be able to find the money for to take the prime chance of dropping your cash.