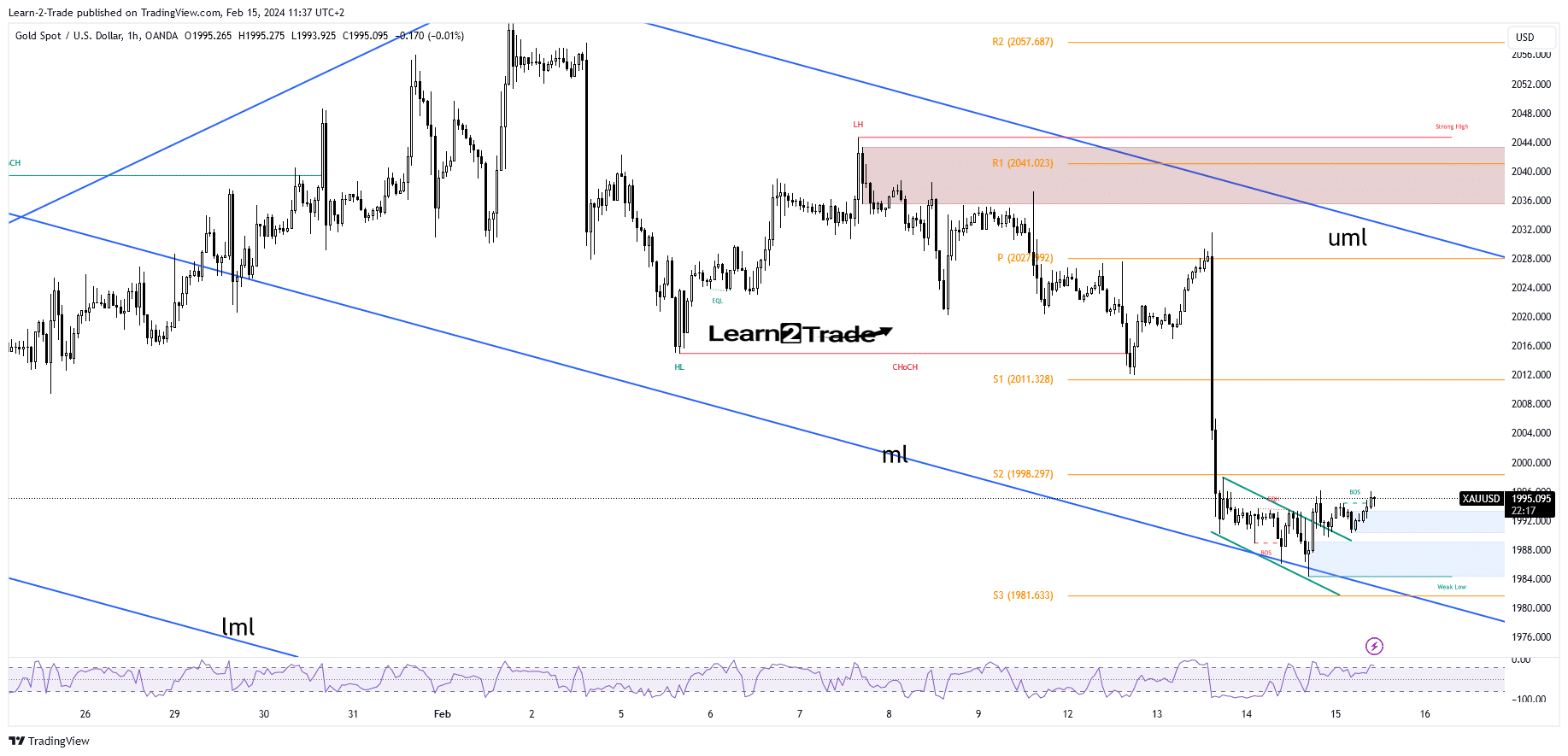

Gold Worth Targets to Regain $2,000, Eyes on US Retail Gross sales

- XAU/USD turns out made up our minds to rebound and get better after registering false breakdowns underneath the median line.

- The USA information will have to transfer the associated fee these days.

- The S1 is observed as a possible upside goal.

The gold value became to the upside and is buying and selling at 1996 on the time of writing. The weakening buck helped the XAU/USD patrons to take it upper within the quick time period.

–Are you to be informed extra about foreign exchange choices buying and selling? Take a look at our detailed guide-

After an important drop, the yellow steel may attempt to rebound and get better. Gold costs slumped after the US reported upper inflation than anticipated in January.

The day prior to this, the UK Client Worth Index reported just a 4.0% enlargement as opposed to the 4.1% enlargement estimated, whilst the Core CPI registered a 5.1% enlargement, much less in comparison to the 5.2% enlargement forecasted.

The Australian information reported deficient figures these days, whilst the United Kingdom introduced combined financial figures. Later, the USA information will have to be decisive.

Retail Gross sales are anticipated to record a nil.2% drop, Core Retail Gross sales would possibly announce a nil.2% enlargement, the Empire State Production Index may well be reported at -13.7 issues, whilst Unemployment Claims may leap from 218K to 219K.

Moreover, the Philly Fed Production Index, Commercial Manufacturing, Capability Usage Charge, and Industry Inventories information can be launched. Deficient financial figures will have to weaken the USD and would possibly drive the XAU/USD to check in a bigger rebound.

Gold Worth Technical Research: Leg Upper

From the technical viewpoint, the XAU/USD discovered reinforce at the descending pitchfork’s median line (ml). This represents a dynamic impediment: the false breakdowns introduced exhausted dealers. The primary upside impediment is represented via the weekly S2 of 1998.

-If you have an interest in understanding about scalping foreign exchange agents, then learn our pointers to get started-

Taking away this resistance and making a brand new upper top turns on additional enlargement against the S1 (2011). If the DXY develops a bigger drop, the cost of gold may means the higher median line (uml). Nonetheless, it’s untimely to discuss any such greater rebound.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll be able to manage to pay for to take the top chance of shedding your cash.