Gold Worth Soars to $1,960 Forward of CB Shopper Self assurance

- The disadvantage power stays excessive, so this might be just a transient rebound.

- America knowledge might be decisive later these days.

- After its sturdy drop, a rebound was once herbal.

The gold value rallied within the remaining hours, buying and selling at $1,957 on the time of writing. The dear steel has been neatly above the day by day low of $1,932. The steel has erased the day gone by’s losses.

–Are you to be informed extra about ETF agents? Take a look at our detailed guide-

Then again, the disadvantage power nonetheless persists. The XAU/USD edges upper because the Buck Index slipped these days after achieving 104.53. DXY’s correction must weaken the USD. That’s why Gold grew to become to the upside.

Basically, Switzerland’s GDP rose via 0.3%, beating the 0.1% expansion estimated, whilst Spanish Flash CPI reported a three.2% expansion as opposed to the three.6% expansion predicted.

Nonetheless, a very powerful match of the day is represented via the USA CB Shopper Self assurance, which might drop from 101.3 issues to 99.1 issues.

Deficient US knowledge must weaken the buck and might carry the XAU/USD. As well as, the HPI and the S&P/CS Composite-20 HPI signs shall be launched as neatly.

The next day to come, the United States JOLTS Task Openings, Canadian GDP, German Prelim CPI, Australian CPI, and the RBA Gov Lowe Speaks constitute high-impact occasions. Those may in reality shake the markets.

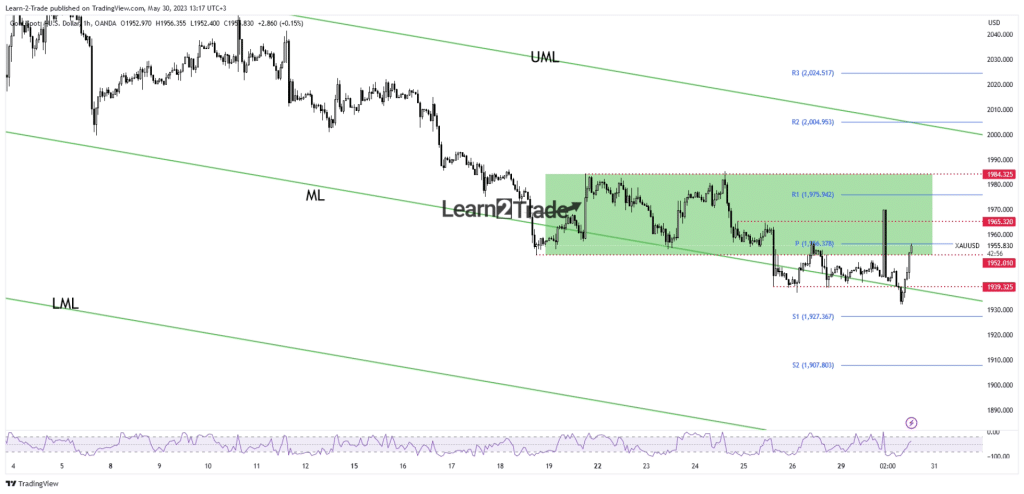

Gold value technical research: Rebounding to the previous vary

From the technical perspective, the XAU/USD dropped as soon as once more under the median line (ML). Then again, it has failed to stick there. The yellow steel has registered a brand new false breakdown under $1,939, and now it demanding situations the $1,952 and the weekly pivot level of $1,956.

–Are you to be informed extra about Thailand foreign exchange agents? Take a look at our detailed guide-

Failing to stick under the median line (ML) introduced exhausted dealers. After its sturdy drawback motion, the yellow steel tries to recuperate. The $1,965 and $1,984 constitute upside stumbling blocks as neatly. Nonetheless, speaking a couple of greater rebound is untimely as the promoting power stays sturdy within the quick time period.

Gold may retest the near-term resistance ranges sooner than turning to the disadvantage. Brief rebounds may convey new quick alternatives.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll be able to manage to pay for to take the excessive chance of shedding your cash.