Gold Value Suffering to Rebound, Eyes on US Inflation

- XAU/USD turns out made up our minds to go back upper so long as it remains above the decrease median line.

- The United States inflation information will have to convey sharp actions the next day.

- Just a new decrease low invalidates a bigger expansion.

The gold worth is buying and selling within the inexperienced at $2,034 on the time of writing. The steel turns out made up our minds to hit new highs as the United States buck became problem. The buck’s sell-off will have to assist the XAU/USD to return again upper and to erase one of the vital newest drops.

–Are you curious about finding out extra about MT5 agents? Take a look at our detailed guide-

The day gone by, the United States Business Steadiness and RCM/TIPP Financial Optimism got here in higher than anticipated, whilst the Canadian Business Steadiness and Construction Lets in signs reported deficient information.

As of late, the Australian CPI reported 4.3% expansion, much less in comparison to the 4.4% expansion estimated and a long way under the 4.9% expansion within the earlier reporting length. Later, the BOE Gov Bailey Speaks, and the United States Ultimate Wholesale Inventories may just convey some motion.

Nonetheless, the investors are looking forward to the United States inflation information. The Shopper Value Index, CPI y/y, and the Core CPI information will likely be launched the next day.

Upper inflation may just punish the cost of gold and raise the USD within the brief time period. Moreover, the United States PPI, Core PPI, the United Kingdom GPD, and the Chinese language inflation figures may just transfer the velocity on Friday.

Gold Value Technical Research: Bullish Momentum

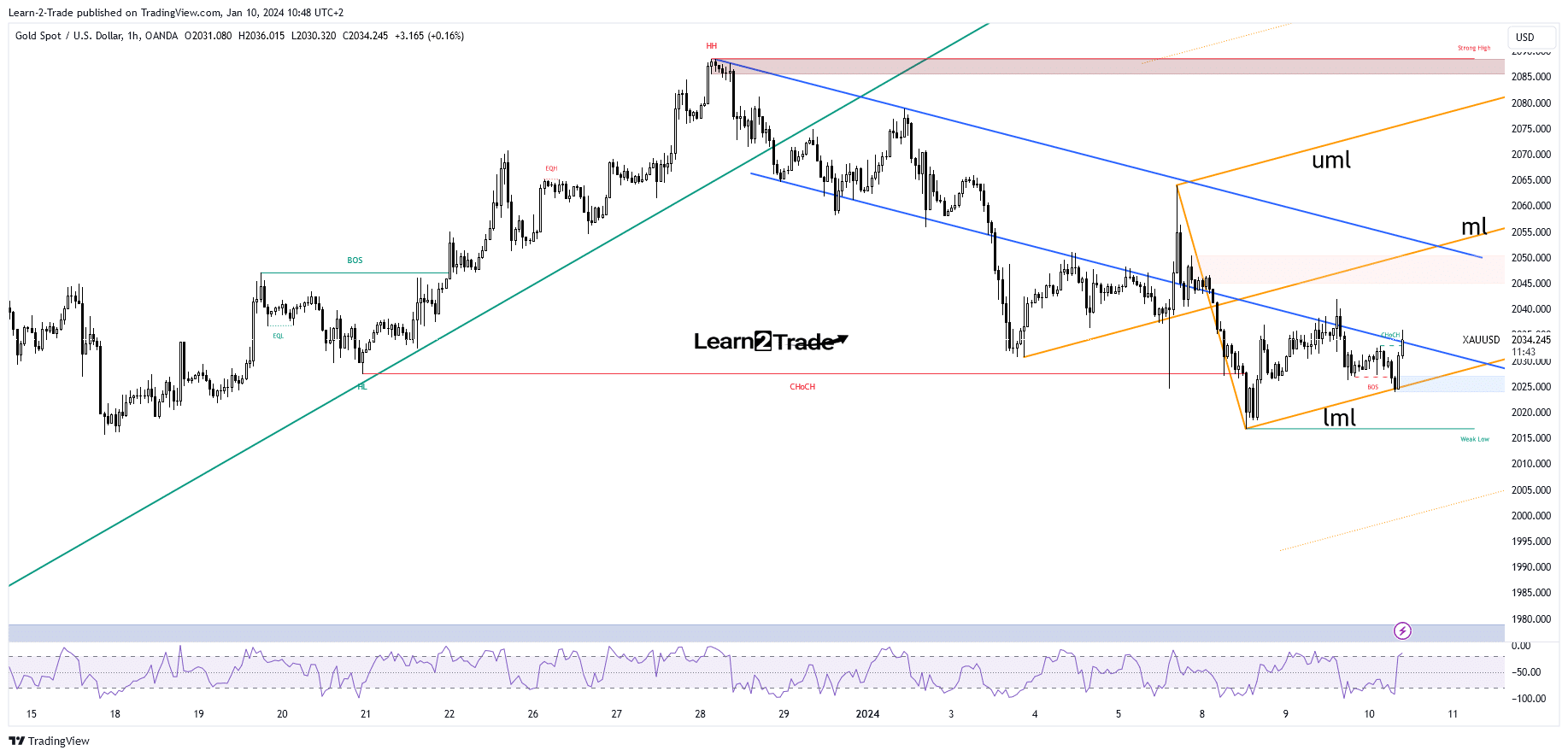

Technically, the yellow steel demanding situations the previous channel’s problem line. The associated fee has discovered sturdy enhance at the decrease median line (LML) of the ascending pitchfork, and now it is attempting to leap upper once more. Its failure to take out the decrease median line (LML) published dealers’ exhaustion and that the corrective section may well be over.

–Are you curious about finding out extra about foreign exchange indicators telegram teams? Take a look at our detailed guide-

The downtrend line, $2,050, and the median line (ml) of the ascending pitchfork constitute attainable upside objectives. XAU/USD may just broaden a broader rebound so long as it remains above the decrease median line (LML).

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll be able to come up with the money for to take the prime possibility of dropping your cash