Gold Research: Will There Be a Reversal or Will the Correction Persist? – R Weblog

Lately we will be able to have a look at the present state of affairs at the gold worth chart (XAU/USD). We can assess the buying and selling possibilities of this asset with the assistance of technical research, basic elements, and indicator alerts.

Technical research of the gold chart

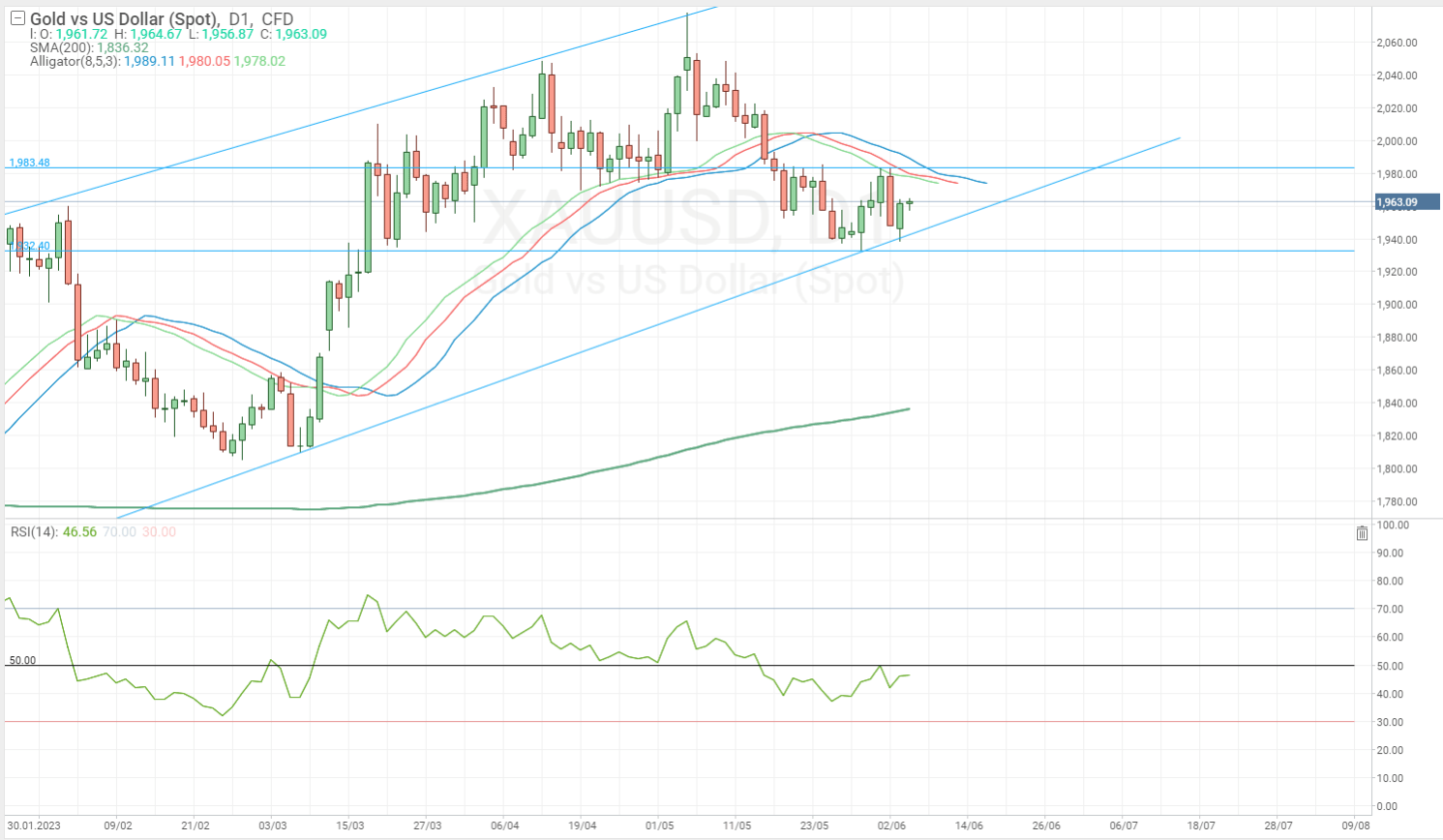

Let’s have a look at the day-to-day chart to analyse the medium-term outlook for the dear steel worth. On the time of writing, the XAU/USD quotes have been close to the 1,960 USD stage.

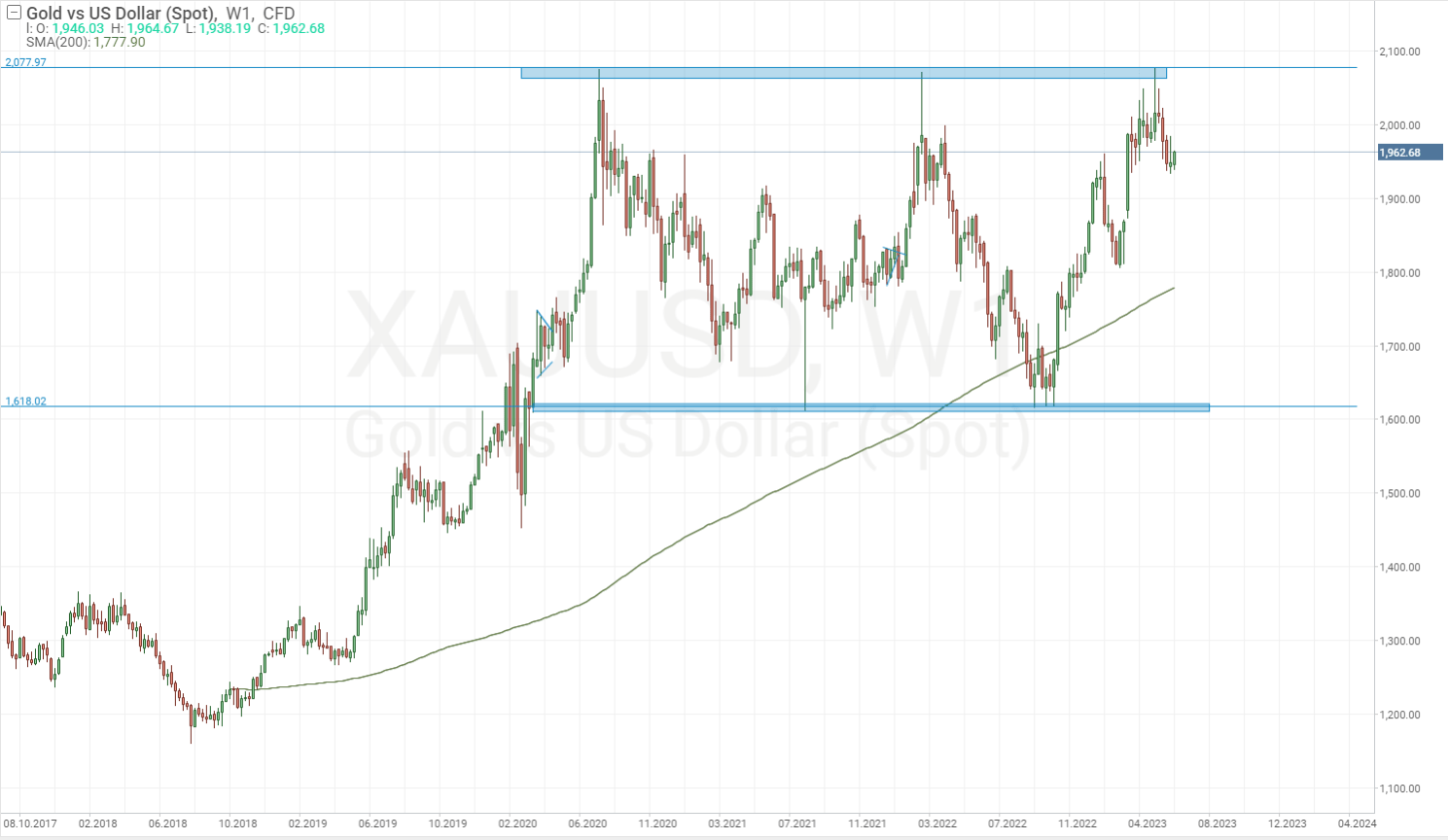

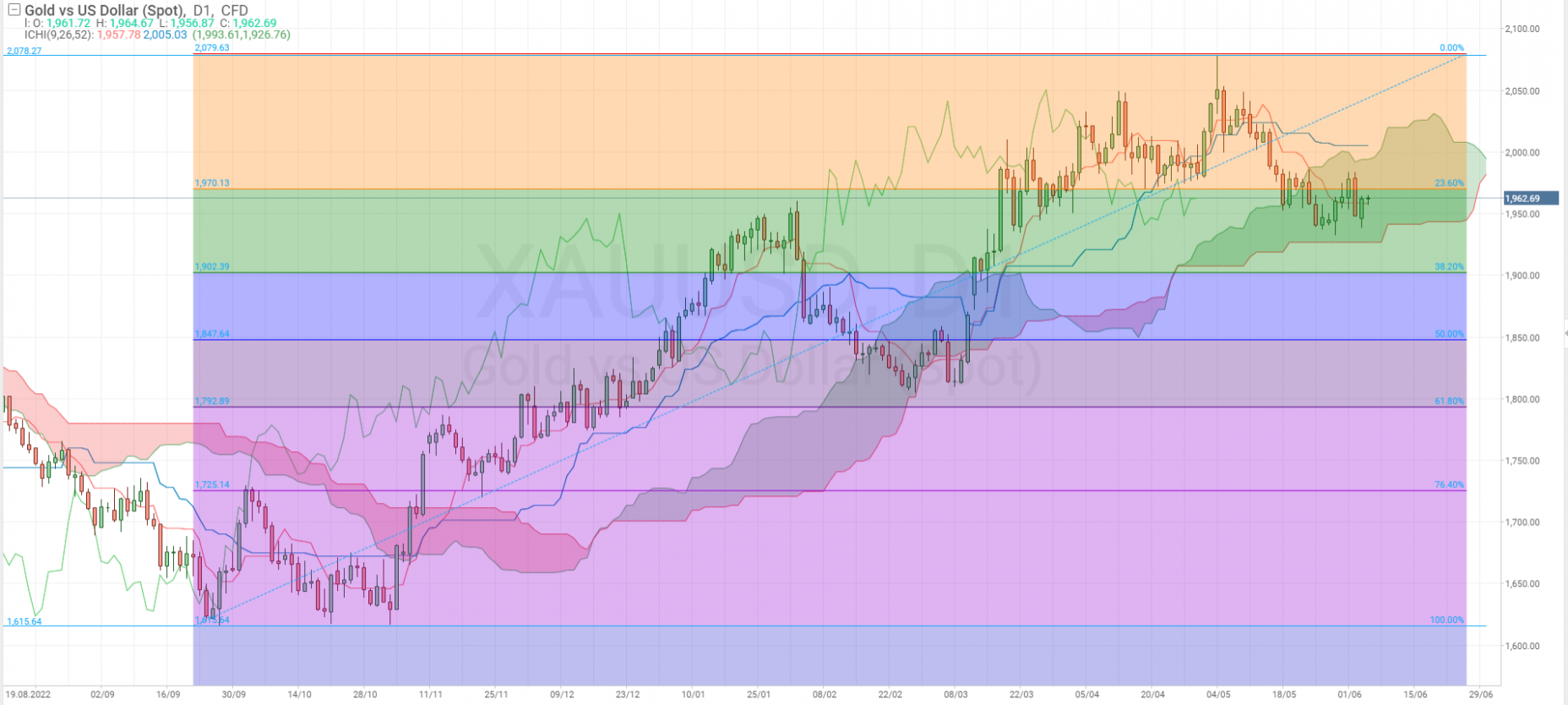

At the weekly chart, the fee has been in a large sideways vary since April 2020, with the decrease boundary at 1,611-1,615 USD and the higher one at 2,070-2,078 USD. In Would possibly 2023, the higher boundary used to be examined for the 3rd time, which used to be adopted through a pullback downwards. If the bulls acquire their forces, opposite the asset’s worth upwards, and the fourth checking out of this house happens, a breakout of the higher boundary will likely be much more likely with additional enlargement through the variety worth to roughly 2,500 USD.

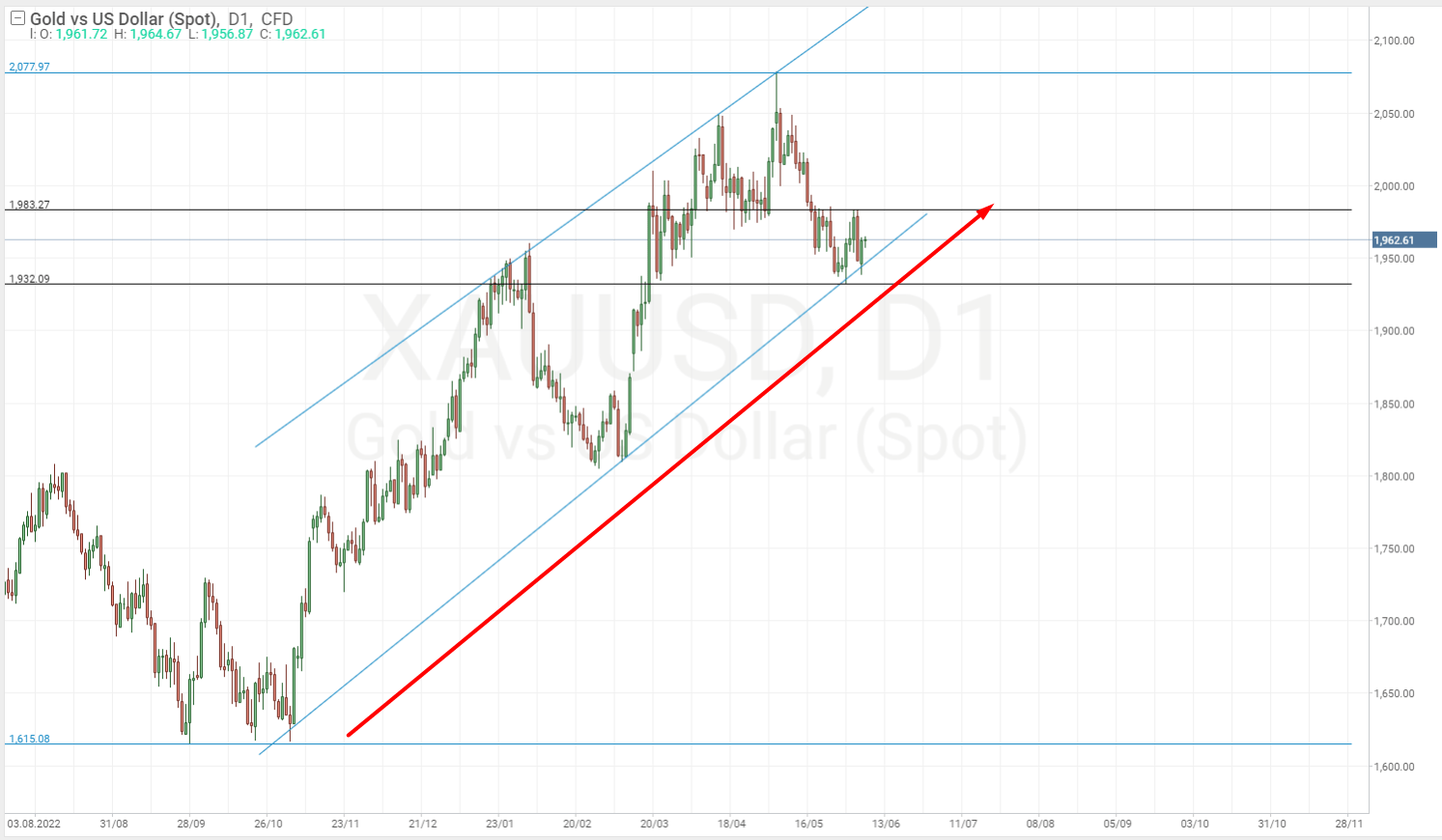

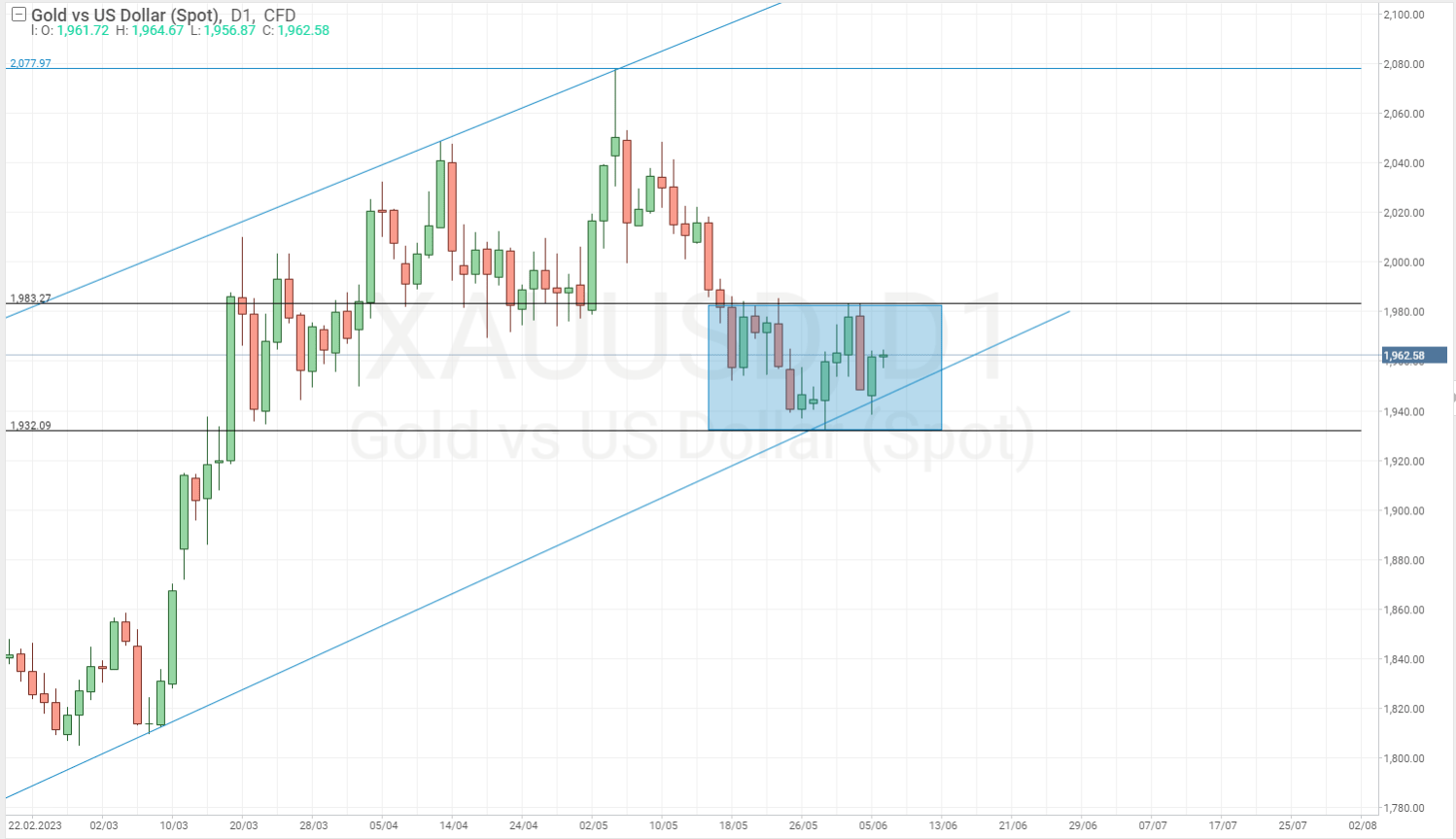

The day-to-day chart presentations that the gold quotes had been in an ascending worth channel since overdue 2022. Throughout this time, the fee has steadily greater from 1,615 USD to two,078 USD in step with troy ounce. In Would possibly this yr, it reached an all-time prime of two,078 USD.

The XAU/USD then made a pointy reversal downwards, adopted through a correctional downward motion, which despatched the quotes right down to the 1,932 USD stage the place there used to be the enhance of the ascending channel. That is the place they rebounded upwards however didn’t display explosive enlargement. The pair reversed downwards once more and examined the channel enhance over again.

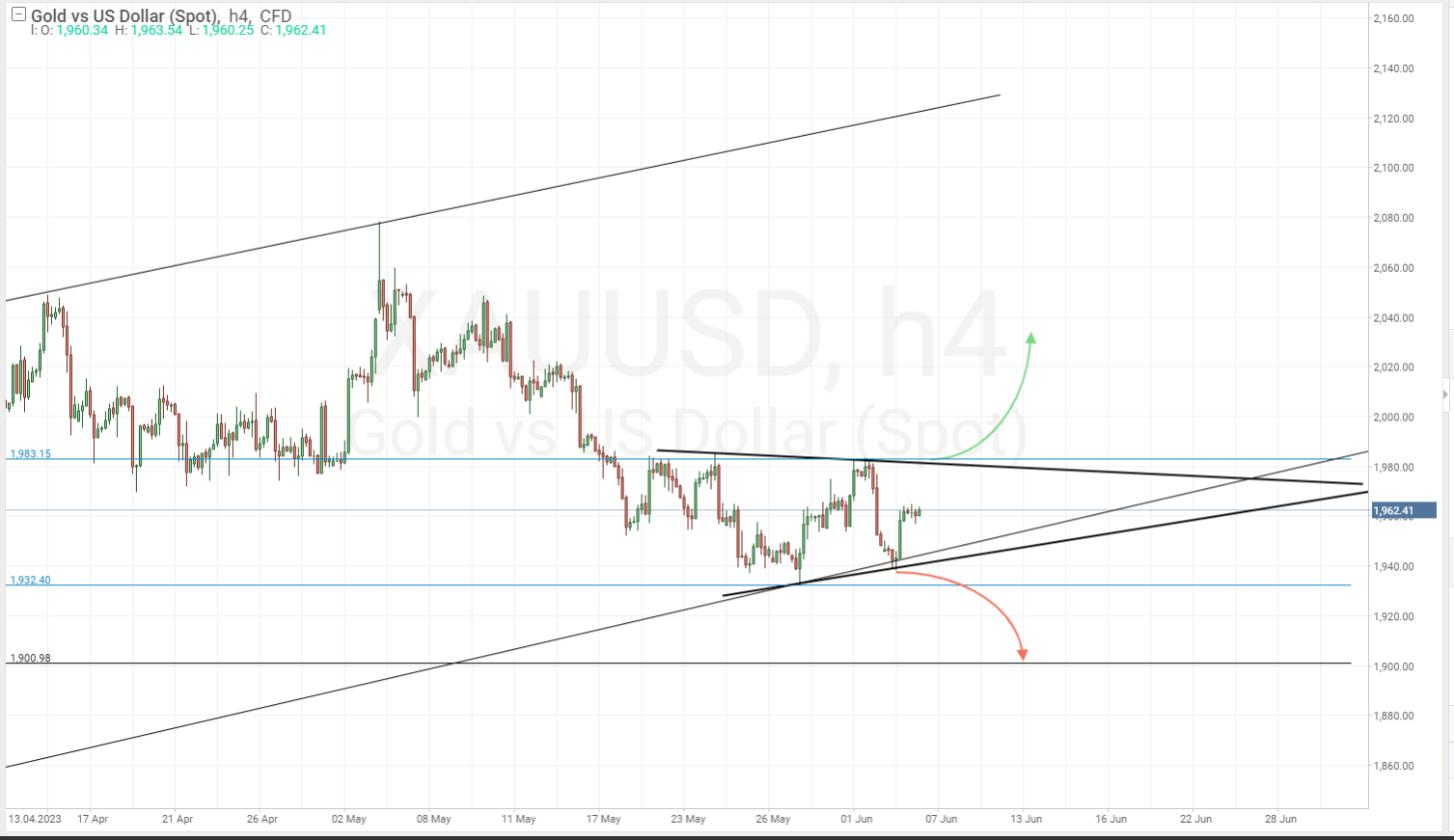

A “Triangle” development is now forming close to the decrease boundary of the fee channel at the H4 time frame. An go out from this development might resolve in what course the asset quotes will transfer within the close to long term. If the last costs fall under the decrease boundary of the development and the low of one,932 USD, a downward correction is more likely to proceed, and the quotes will drop to one,900 USD and under. If the bulls snatch the initiative, and the quotes protected above the higher boundary of the development and the 1,983 USD stage, enlargement is more likely to proceed and the highs close to the two,070-2,078 USD stage will likely be examined once more.

Analysis of the indicator alerts

- 200-day Transferring Reasonable. On the time of writing, the golf green line of SMA (200) is on the 1,836.3 USD stage, and the asset quotes are significantly upper, close to 1,960 USD. This means a present long-term uptrend. A large margin between the quotes and the Transferring Reasonable, on the other hand, implies dangers of growing a downward correction

- Alligator. The Williams development indicator presentations a downward motion at the day-to-day chart. The quotes are under all 3 strains of the indicator, with the strains reversing and taking place, which confirms a present bearish state of affairs. The indicator strains are actually at 1,983 USD. If the fee crosses them upwards, the bearish state of affairs will likely be cancelled

- RSI (14). The preferred oscillator has secured under the extent of fifty at the day-to-day chart, which confirms a momentary downward state of affairs. If the indicator line reaches a space above 50, it’ll sign the cancellation of this state of affairs

- Ichimoku Kinko Hyo. The preferred development indicator from Goichi Hosoda confirms a downtrend. The gold quotes are actually within the cloud. The Tenkan-Sen line crossed the Kijun-Sen line downwards, giving a sign to promote. The Chinkou Span line fell under the fee chart, confirming a descending impulse. The most important sign now would be the course of a value go out from the indicator’s cloud. If it is going up, a bullish state of affairs is possible but when it is going down, a bearish state of affairs will proceed

- Fibonacci retracement ranges. Fibonacci retracement ranges in keeping with the remaining enlargement impulse of the asset worth from 1,615 USD to two,078 USD point out that the quotes are a little less than the correction stage of 23.6. If a downward correction persists, the degrees of 38.2 (close to 1,900 USD), 50.0 (close to 1,850 USD), and 61.8 (close to 1,800 USD) will likely be possible issues for a reversal upwards

Elementary elements research

Throughout financial and geopolitical downturns, the cost of gold has a tendency to upward thrust as self assurance in currencies diminishes. In such prerequisites, the dear steel acts as a secure haven asset.

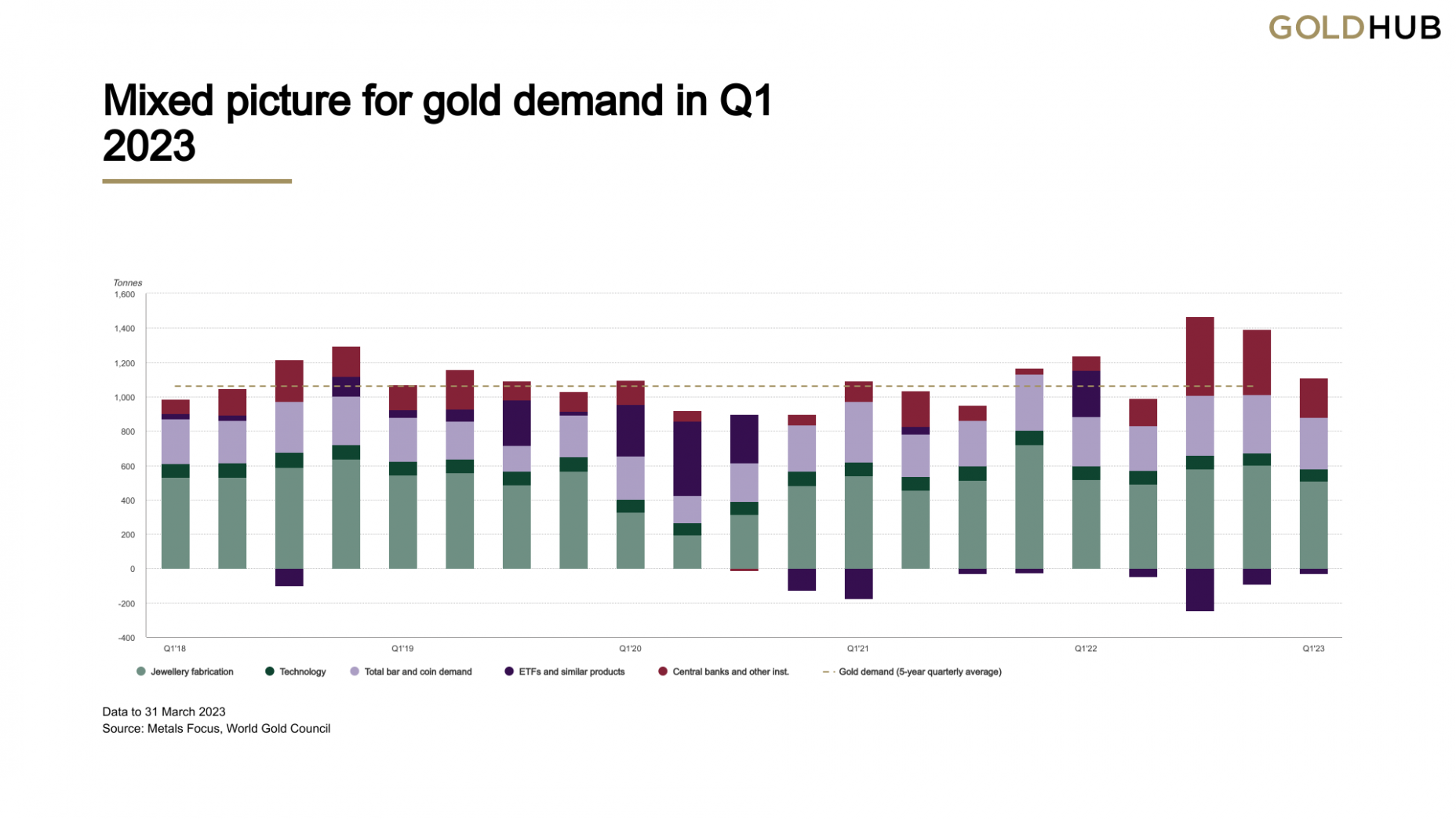

The International Gold Council, which incorporates the arena’s greatest gold mining firms, reviews a rising call for for the asset within the first quarter of 2023 from central banks of quite a lot of nations and customers in China.

In step with its knowledge, 24% of central banks intend to extend their gold reserves through the top of 2023. As well as, perspectives of central banks at the long term function of america buck have been extra pessimistic than in earlier surveys. On the identical time, perspectives of the long run function of gold have develop into extra positive, with 62% of central financial institution respondents announcing that the proportion of the dear steel in overall reserves would exceed remaining yr’s signs.

Army movements in Ukraine and the surge of worldwide inflation contributed to the expansion of the XAU/USD quotes. Since November 2022, they’ve been emerging abruptly, achieving an all-time prime of two,078 USD in Would possibly 2023.

However on the time of writing, the asset is beneath momentary drive, losing under the psychologically vital stage of two,000 USD. This is going on amid the native strengthening of america buck towards the arena’s main currencies and rising optimism on the inventory exchanges, which is attributed to the expectancy of the top of america Federal Reserve financial coverage tightening cycle. Price range are moving from safe-haven property to extra successful tools, similar to shares.

Abstract

Technical research equipment and alerts of decided on signs display that on the time of writing, there’s a downward correction at the gold worth chart, which has stopped on the enhance line of the day-to-day ascending channel. The important thing house at the chart is the only at 1,932-1,983 USD, the place the “Triangle” development has shaped. If the quotes smash this house upwards, this may increasingly sign the start of the following enlargement impulse of the asset. An go out downwards will sign the continuation of the downward correction.

As for the analysis of basic elements, in the long run, the worth of the dear steel will likely be supported through geopolitical stress, disaster trends within the world economic system, and extending call for from central banks and customers. Quick-term elements of drive on gold quotes are the strengthening of america buck and emerging inventory markets.