GBP/USD Weekly Forecast: US-UK Economies Show Resilience

- Buyers driven again bets for fee cuts in the United Kingdom and the United States.

- US GDP figures got here in upper than anticipated, indicating sturdy financial efficiency.

- Marketplace individuals be expecting the BoE to handle charges subsequent week.

The GBP/USD weekly forecast is impartial because the resilience of each the United States and UK economies creates a degree enjoying box for the foreign money.

–Are you curious about studying extra about ETF agents? Take a look at our detailed guide-

Ups and downs of GBP/USD

The pound ended the week flat, with the United Kingdom and the United States economies appearing resilience. Industry process within the production and services and products sectors for each nations rose. Consequently, buyers driven again bets for fee cuts in the United Kingdom and the United States.

Extra information from the United States supported the view that Fed fee cuts won’t get started in March. GDP figures got here in upper than anticipated, indicating sturdy financial efficiency. In the meantime, the Fed’s most well-liked inflation measure got here consistent with expectancies.

Subsequent week’s key occasions for GBP/USD

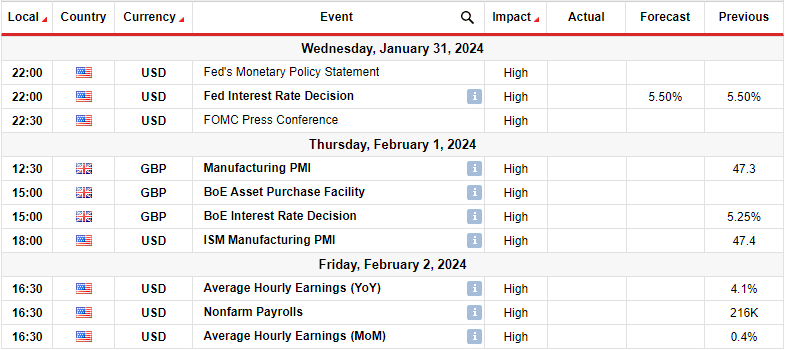

Subsequent week, primary studies from the United States will come with the FOMC assembly mins, the ISM production PMI, and the employment file. In the meantime, buyers can pay shut consideration to the Financial institution of England coverage assembly in the United Kingdom. On February 1, the BoE will most probably handle rates of interest at 5.25%. On the similar time, buyers will carefully track any indications in regards to the timing of attainable fee cuts.

In the meantime, there might be clues on conceivable Fed fee cuts within the FOMC assembly mins and the NFP file. Some other upbeat employment file may additional scale back rate-cut bets, resulting in a decline within the pair. The other could also be true.

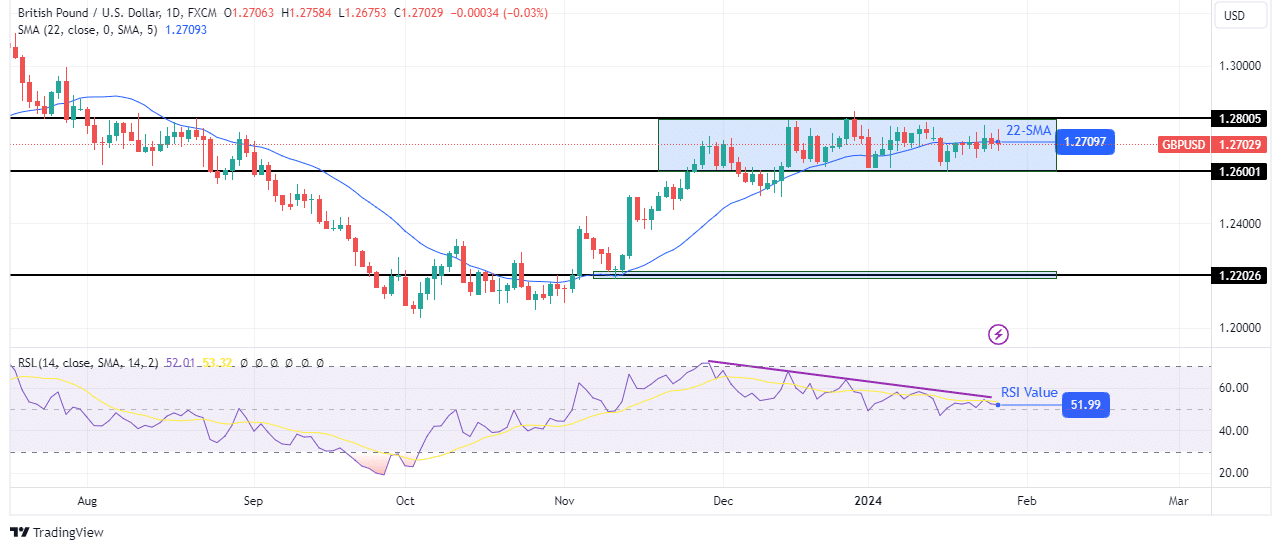

GBP/USD weekly technical forecast: Bullish momentum weakens close to 1.2800

The pound is consolidating in a good vary with fortify at 1.2600 and resistance at 1.2800. The bullish development slowly weakened when the fee neared 1.2800. The fee began sticking with regards to the 22-SMA till it began reducing throughout the line. This means a shift from a trending to a ranging marketplace.

–Are you curious about studying extra about Canada foreign exchange agents? Take a look at our detailed guide-

If it is a pause within the bullish development, the fee will sooner or later damage above the variety resistance to proceed upper. On the other hand, there are indications that bears would possibly take over. The RSI has made a bearish divergence with the fee, appearing weaker bullish momentum. Due to this fact, if bulls fail to regain momentum, bears would possibly damage underneath the variety fortify to start out a brand new downtrend.

Having a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll find the money for to take the prime possibility of dropping your cash