Ford Motor Inventory Forecast for 2024 – F Technical Research

Ford Motor Corporate (NYSE: F) used to be anticipated to succeed in a earnings of 43 billion USD in line with the This autumn 2023 effects. Alternatively, the result exceeded expectancies by means of 7%. Moreover, america automaker introduced common and particular dividend payouts and shared an constructive outlook for 2024. As a result, its inventory surged.

On 12 February 2024, we tested the automobile massive’s monetary efficiency, performed a technical research of its inventory, and explored knowledgeable forecasts for its possibilities in 2024.

About Ford Motor Corporate

Ford Motor Corporate is an American corporate that designs, manufactures, and sells passenger and business cars, together with electrical and hybrid cars, underneath the Ford and Lincoln manufacturers. Henry Ford based it in 1903 in Detroit, Michigan.

Moreover, the corporate supplies monetary, infrastructure, and different services and products to its consumers. Nearly all of its earnings comes from car gross sales, particularly pickups and vehicles. Consistent with the document, in 2023, 1.08 million gadgets have been bought, which is 13.2% greater than the 2022 statistics. It additionally generates source of revenue from its subsidiaries and joint ventures in China, Europe, and different areas.

In 2023, the corporate bought 1.99 million cars, which is 7.1% greater than the entire in 2022. The most well liked fashions have been the Ford Explorer, the F-Sequence with the F-150 electrical model, and the Transit, together with the E-Transit electrical model.

About Ford Blue, Ford Fashion E, and Ford Professional

On 26 Would possibly 2021, Ford Motor Corporate unveiled Ford+, the corporate’s building plan for the electrical and hybrid car technology, which offered new distinct auto gadgets. At the similar day, it introduced Ford Professional, a carrier unit that gives a variety of services and products to business car house owners.

Ford Professional parts:

- Ford Professional Device – a collection of virtual equipment running in line with real-time car knowledge, improving potency and decreasing gasoline intake

- Ford Professional Charging – electrical car charging answers encompassing public charging stations, house and place of business chargers, and charging control and optimisation device

- Ford Professional Provider – car upkeep and service services and products, together with carrier centres, gross sales of spare portions and equipment, in addition to guaranty and insurance coverage services and products

- Ford Professional FinSimple – monetary answers for car acquire and rent, together with lending, particular provides and reductions

Consistent with Ford Motor Corporate’s 2023 document, Ford Professional earnings reached 58.1 billion USD, marking a 19% expansion in comparison to 2022 statistics.

The following level concerned setting up the companies for Ford Blue and Ford Fashion E. The previous specialises in growing and production inside combustion engine automobiles, whilst the latter makes a speciality of generating electrical cars, device building, and verbal exchange equipment. Ford Blue and Ford Fashion E revenues for 2023 amounted to 101.9 billion USD and 5.9 billion USD, respectively, reflecting an 8% and 12% building up in comparison to 2022 effects.

Analysing the monetary efficiency of Ford Motor Corporate

On 6 February 2024, Ford Motor Corporate launched the This autumn and full-year 2023 document, appearing that monetary efficiency has exceeded expectancies.

This autumn 2023 effects in comparison to This autumn 2022 statistics:

- Earnings: +4.55%, as much as 46 billion USD, forecasted at 43 billion USD

- Web loss: 0.53 million USD in comparison to a prior benefit of one.3 billion USD

- Adjusted loss consistent with percentage: 0.13 USD as opposed to the former EPS of 0.32 USD, with a forecast of 0.12 USD

- Working money drift: +111%, achieving 2.49 billion USD

Complete-year 2023 effects in comparison to 2022 statistics:

- Earnings: +11.47%, achieving 176.19 billion USD

- Web benefit: 4.35 billion USD in comparison to a prior web lack of 1.98 billion USD

- Adjusted EPS: 1.08 USD as opposed to a prior web lack of 0.49 USD

- Working money drift: +117.7%, achieving 14.9 billion USD

The manufacturing facility employees’ strike in This autumn negatively impacted the monetary statistics, which price the corporate 1.7 billion USD. We will be able to supply extra main points under.

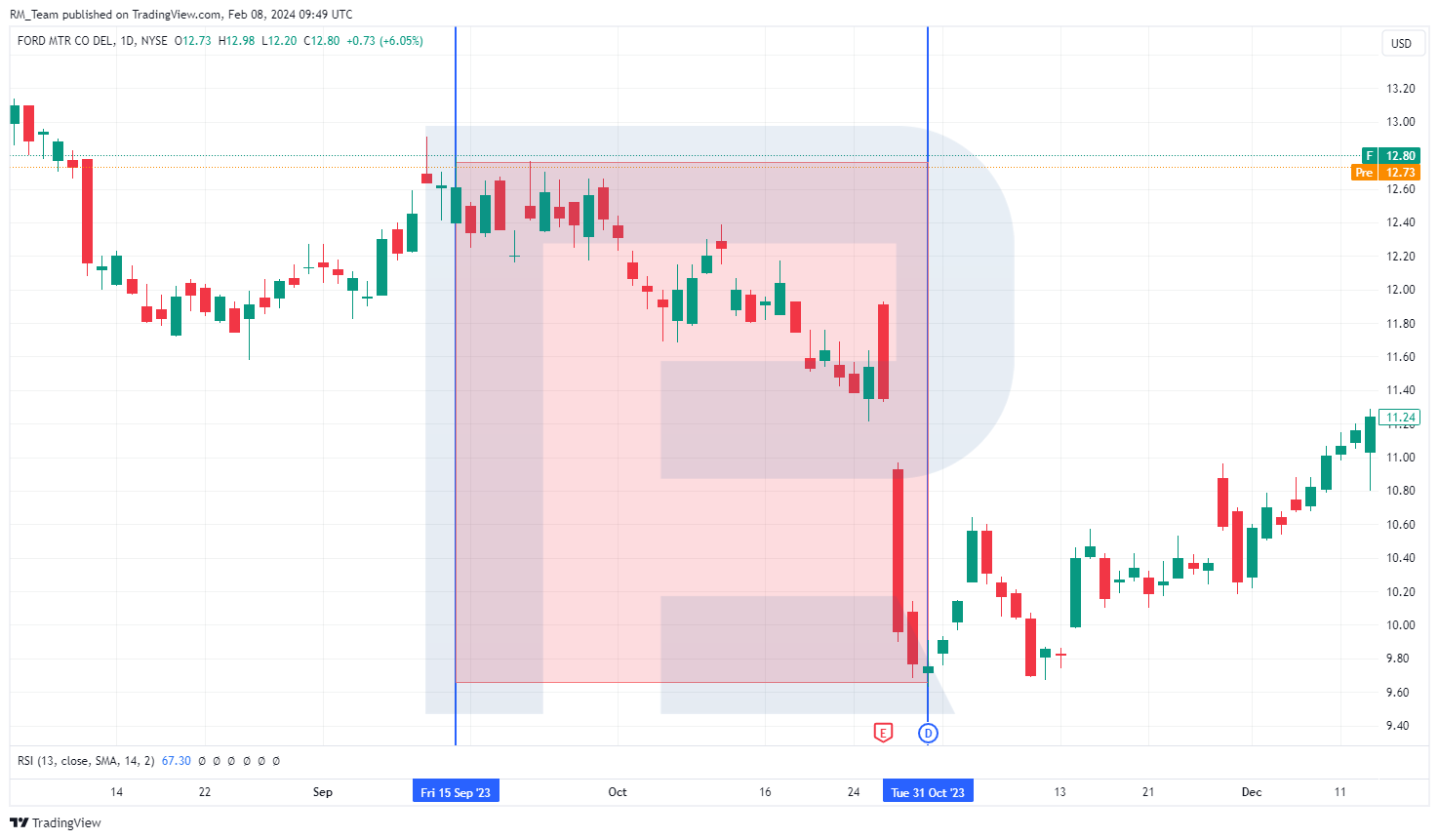

The day after the document’s unlock, Ford Motor Corporate’s inventory added 6.05% on the shut of the buying and selling consultation, emerging to twelve.80 USD.

Automobile gross sales statistics by means of section

On 4 January 2024, Ford Motor Corporate introduced car gross sales statistics for the ultimate quarter and the overall 12 months 2023.

This autumn 2023 gross sales as opposed to This autumn 2022:

- Electrical cars: +27.5%, achieving 25,937 gadgets

- Hybrid cars: +55.5%, achieving 37,229 gadgets

- ICE cars: −3.4%, achieving 424,674 gadgets

2023 gross sales as opposed to 2022 statistics:

- Electrical cars: +17.9%, achieving 72,608 gadgets

- Hybrid cars: +25.3%, achieving 133,743 gadgets

- ICE cars: +5.5%, achieving 1,789,561 gadgets

Ford Motor Corporate monetary forecast for 2024

- Adjusted EBIT: 10-12 billion USD

- EBIT Ford Professional: 8-9 billion USD

- EBIT Ford Blue: 7-7.5 billion USD

- EBIT Ford Fashion E: from −5 to −5.5 billion USD

- Dividends: Common dividends of 0.15 USD consistent with percentage and supplemental dividends of 0.18 USD consistent with percentage are payable on 1 March 2024.

Have an effect on of the commercial motion on Ford Motor Corporate’s inventory

The latest strike, as of the preparation of this subject matter, involving the UAW (United Auto Staff), indicates a significant warfare between the business union representing car business employees striving for higher operating prerequisites and the 3 car giants, specifically, Ford Motor Corporate, Common Motors Corporate (NYSE: GM), and Stellantis NV (NYSE: STLA). The strike lasted from 15 September to 31 October 2023, leading to a compromise between the events.

Consistent with Ford Motor Corporate’s control, the strike price the producer 1.7 billion USD. Moreover, employees’ new contracts until 2028 will building up manufacturing prices by means of 900 USD consistent with car. The corporate plans to extend labour productiveness and scale back manufacturing prices to offset those losses. The automaker’s inventory fell 23.7% all the way through the strike, from 12.70 to 9.70 USD.

Ford Motor Corporate inventory research for 2024

Since 19 September 2022, Ford Motor Corporate stocks have traded between 11.20 and 14.60 USD consistent with unit. Amid the UAW strike, the quotes broke under its decrease boundary, achieving a low of 9.63 USD. After the events to the warfare reached an settlement, the inventory costs retraced to the buying and selling vary and hovered at 12.68 USD on the time of writing.

A retracement of the inventory costs to the variability would possibly point out a prime chance of additional expansion in opposition to its higher boundary at 14.60 USD. The formation of an inverse Head and Shoulders development at the chart may function an extra sign confirming a possible inventory upward push.

If Ford Motor Corporate’s stocks surpass the resistance stage of 14.60 USD, they’ll most probably climb to the following resistance stage of 16.50 USD.

Technical research of Ford Motor Corporate*

Professional forecasts for Ford inventory for 2024

- Consistent with Barchart, 5 out of 17 analysts rated Ford Motor Corporate inventory as Sturdy Purchase, two as Average Purchase, seven as Grasp, and 3 as Sturdy Promote, with a mean worth goal of 13.52 USD

- In accordance with the ideas from MarketBeat, 4 out of 14 professionals assigned a Purchase score to the stocks, 9 gave a Grasp advice, and one designated a Promote score, with a mean worth goal of 13.66 USD

- As TipRanks experiences, six out of 15 experts designated a Purchase score for the automaker’s inventory, six rated it as Grasp, and 3 gave a Promote score, with a mean worth goal of 13.74 USD

- Consistent with Inventory Research, two out of 13 analysts rated the stocks as Sturdy Purchase, 3 as Purchase, six as Grasp, one as Promote, and one as Sturdy Promote, with the typical 12-month inventory worth forecast of 13.78 USD

Conclusion

CEO of Ford Motor Corporate, Jim Farley, notices that america govt’s infrastructure bills, as consistent with Joe Biden’s plan, undoubtedly have an effect on the corporate’s profits as call for for Ford vehicles is rising. As well as, in 2024, the corporate plans to fabricate electrical cars in keeping with call for. It’ll be poised to ramp up its manufacturing if the shopper center of attention shifts from hybrid cars to electrical ones.

The Ford Fashion E industry is projected to peer the next loss this 12 months, however an building up in hybrid car gross sales can offset this loss. It’s price noting that gross sales of this kind of shipping rose by means of greater than 25% in 2023. Moreover, the particular dividend payout could make the automobile massive’s inventory extra interesting to buyers whilst undoubtedly affecting its price.

Given the ideas supplied within the textual content, it may be assumed that the constructive forecast of Ford Motor Corporate control would possibly end up true, only if america financial system continues to develop in 2024. On this case, the inventory will most probably have the danger to achieve the degrees projected by means of professionals.

FAQ

On the time of writing, the inventory worth of Ford Motor Corporate stands at 12.68 USD, with a 52-week prime of 15.42 USD and a low of 9.63 USD.

To buy Ford Motor Corporate inventory, you’ll apply those common steps:

1. Open a buying and selling account. Make a choice a brokerage account that fits your buying and selling wishes. For instance, RoboForex provides accounts of a number of sorts for quite a lot of platforms.

2. Make a deposit. For instance, for RoboForex, the minimal first deposit begins from 10 USD, relying in your account sort.

3. Make a choice Ford Motor Corporate inventory.

Decide the funding quantity, maintaining your finances and funding technique in thoughts.

4. Shut the business. Log in on your buying and selling platform, choose Ford Motor Corporate inventory, and position a purchase order.

5. Track your funding. Stay observe of your inventory positions, analyse efficiency, and alter as wanted.

The dividend yield of Ford Motor Corporate stocks is 4.73% on the time of writing. Alternatively, a different dividend of 0.18 USD consistent with percentage payable on 1 March 2024 will have to be added to the yield.

Ford Motor Corporate delivered sure effects on the year-end 2023 amid intense festival and the massive UAW strike, surpassing the 2022 figures. Annual earnings rose by means of 12% to 176.2 billion USD. Web benefit reached 4.4 billion USD; a 12 months in the past, the corporate posted a lack of just about 2 billion USD. The stocks received 10% over 2023, mountain climbing from 11 to twelve USD.

A couple of Web sources supply Ford Motor Corporate inventory research and forecasts, similar to Weblog Roboforex, Yahoo Finance, MarketBeat, WallStreetZen, and StockScan.

Making an investment in Ford Motor stocks comes to the next dangers:

1. Cyclical industry operations. The corporate’s gross sales and profits in large part rely at the financial cycle. When the financial system is vulnerable or risky, shoppers would possibly put off or minimize their auto spending, probably impairing the automobile maker’s profits and benefit

2. Disadvantages of price shares. Ford Motor Corporate stocks are thought to be price inventory, buying and selling at a low worth relative to their profits, property, and expansion attainable. Whilst price securities would possibly usher in interesting income in the longer term, they might also come upon demanding situations similar to low investor hobby, detrimental marketplace sentiments, or sluggish expansion

3. Debt burden. The corporate has a prime debt stage of 129.29 billion USD as of 31 December 2023. The debt-to-equity ratio is 3.02, significantly upper than 1. The debt will increase the automaker’s hobby bills and boundaries its monetary flexibility and talent to spend money on expansion alternatives. The corporate might also face issues of refinancing its debt or satisfying its responsibilities in case of a industry decline or a credit standing downgrade

Ford Motor Corporate information assets:

1. The principle supply is the corporate’s reputable website online

2. Yahoo Finance information aggregator provides whole, treasured, and up-to-date knowledge at the corporate, together with the most recent information, analysts’ rankings, forecasts, worth goals, knowledge on monetary profits experiences, dividends, and plenty of extra

3. Information sources similar to The Motley Idiot, MarketWatch, CNBC, and so on.

As discussed above, monetary profits experiences and whole necessary knowledge on Ford Motor Corporate are revealed on its reputable website online underneath the Record & Fillings Segment.

It’s price noting that Ford Motor Corporate supplied an constructive annual outlook and raised dividend payouts. Moreover, the automaker makes a speciality of manufacturing optimisation and a extra balanced way to electrical car manufacturing, finding out call for on this section to release essentially the most sought-after fashions. These kind of elements will have to be thought to be when assessing the automaker’s inventory possibilities. Consistent with the above respected assets, 2024 worth goals for the corporate’s stocks vary from 13.52 USD to 13.78 USD.

* – The charts introduced on this article are sourced from the TradingView platform, widely known for its complete suite of equipment adapted for monetary marketplace research. Serving as each a user-friendly and complex on-line marketplace knowledge charting carrier, TradingView empowers customers to behavior technical research, delve into monetary knowledge, and interact with fellow investors and buyers. Additionally, it furnishes treasured steering on adeptly comprehending the best way to learn foreign exchange financial calendar, whilst additionally providing insights into numerous different monetary property.