Exxon Mobil Plans to Pass Greener – R Weblog

Exxon Mobil Company (NYSE: XOM) CEO Darren Woods spoke at an investor assembly on 4 April 2023 in regards to the objectives of the corporate’s new option to transition its oil and fuel manufacturing to a greener industry. Woods foresees that, in ten years, the corporate’s inexperienced industry will surpass fuel and oil manufacturing and gross sales with regards to revenues.

These days, we take a better have a look at the company’s earnings construction, to find out what its environmental industry is all about and speak about the highlights of the introduced transition.

Exxon Mobil Company briefly

Exxon Mobil Company is likely one of the international’s greatest oil and fuel corporations. It produces, refines, and sells oil, fuel, and petroleum merchandise. The corporate was once created in 1999 via a merger between Exxon and Mobil and is headquartered in Irving, Texas.

Exxon Mobil Company may be engaged in analysis and construction within the oil and fuel {industry}. As an example, it funds analysis on tips on how to reinforce the potency of oil and fuel manufacturing, in addition to the advent of recent applied sciences to scale back the destructive affect of main business processes at the setting.

Exxon Mobil Company’s earnings construction

The company’s 2022 revenues reached USD 413.68 billion. Gross sales and different working actions accounted for 97% of this quantity, whilst the benefit of joint-stock corporations was once 2%, and different revenues accounted for 1%. Revenues from the environmental industry aren’t but printed as separate statistics by way of phase however are integrated in “Different revenues”.

The primary spaces of the oil and fuel industry:

- Downstream is all for oil refining, manufacturing, transportation, business, and gross sales of petroleum merchandise and lubricants. It accounted for 69% of overall revenues in 2022.

- Upstream – this industry space specialises within the prospecting, exploration, construction, and manufacturing of oil, herbal fuel, and condensate. It accounts for 25% of overall annual revenues.

- Chemical is chargeable for the manufacturing and sale of chemical merchandise to {industry} and customers. It accounts for six% of the corporate’s overall annual revenues.

Exxon Mobil Company’s environmental industry construction

Exxon Mobil Company’s ‘inexperienced’ industry is composed of a number of companies that purpose to scale back greenhouse fuel emissions and broaden a low-carbon economic system:

- Manufacturing and sale of biodiesel and hydrogen, in addition to carbon seize and garage. Those power assets have a smaller carbon footprint and will lend a hand scale back dependence on fossil fuels. The corporate plans to take a position USD 17 billion on this space by way of 2027.

- The improvement and use of emission relief applied sciences in mining, processing, and manufacturing. That is about power potency, procedure optimisation, methane leakage relief, use of different fuels, and renewable power. The Company is actively concerned within the construction of emission relief requirements for the {industry}.

- Growing leading edge answers to lend a hand different sectors within the transition to a low-carbon fashion. As an example, the corporate creates and sells lubricants for electrical cars, plastics from recycled waste, and jet gasoline from vegetable oil. Exxon Mobil Company works with governments, private and non-private analysis organisations, and the general public to search out new tactics to scale back damaging emissions.

Switching to inexperienced industry

Consistent with Exxon Mobil Company’s CEO, the plan to switch the course of the industry comprises 3 primary spaces – decarbonisation, carbon seize and garage, and hydrogen and biofuel manufacturing.

Decarbonisation

This procedure comes to lowering carbon emissions within the surroundings. Exxon Mobil Company expects to generate top and solid revenues from this phase via long-term contracts with huge shoppers searching for to scale back their carbon footprint.

Carbon seize and garage

This can be a procedure by which CO₂ is amassed at business and effort amenities, and transported to a garage website the place it’s saved for lengthy sessions of time. Exxon Mobil Company estimates that the blended doable of initiatives associated with this space, in addition to hydrogen and biofuel manufacturing, may just achieve USD 6.5 trillion by way of 2050.

Hydrogen and biofuel manufacturing

Hydrogen will also be constituted of methane, coal, water, biomass, garbage, and different uncooked fabrics via steam conversion, gasification, electrolysis, pyrolysis, or biotechnology. Exxon Mobil Company already produces about 1.3 million tonnes of hydrogen in keeping with 12 months. The corporate plans to construct a devoted plant in Beaumont, Texas, with a once a year manufacturing capability of a million tonnes of hydrogen gasoline. Additionally it is exploring the opportunity of generating blank hydrogen for an business complicated in Rotterdam and is collaborating in cross-industry tasks to broaden low-carbon hydrogen.

Biofuels are fuels constructed from plant or animal uncooked fabrics from the waste merchandise of organisms, or from natural business waste. Exxon Mobil Company objectives to offer round 40,000 barrels of low-carbon fuels in keeping with day by way of 2025 and to extend this to 200,000 barrels in keeping with day by way of 2030.

Sturdy profits force Exxon Mobil Company shares upper

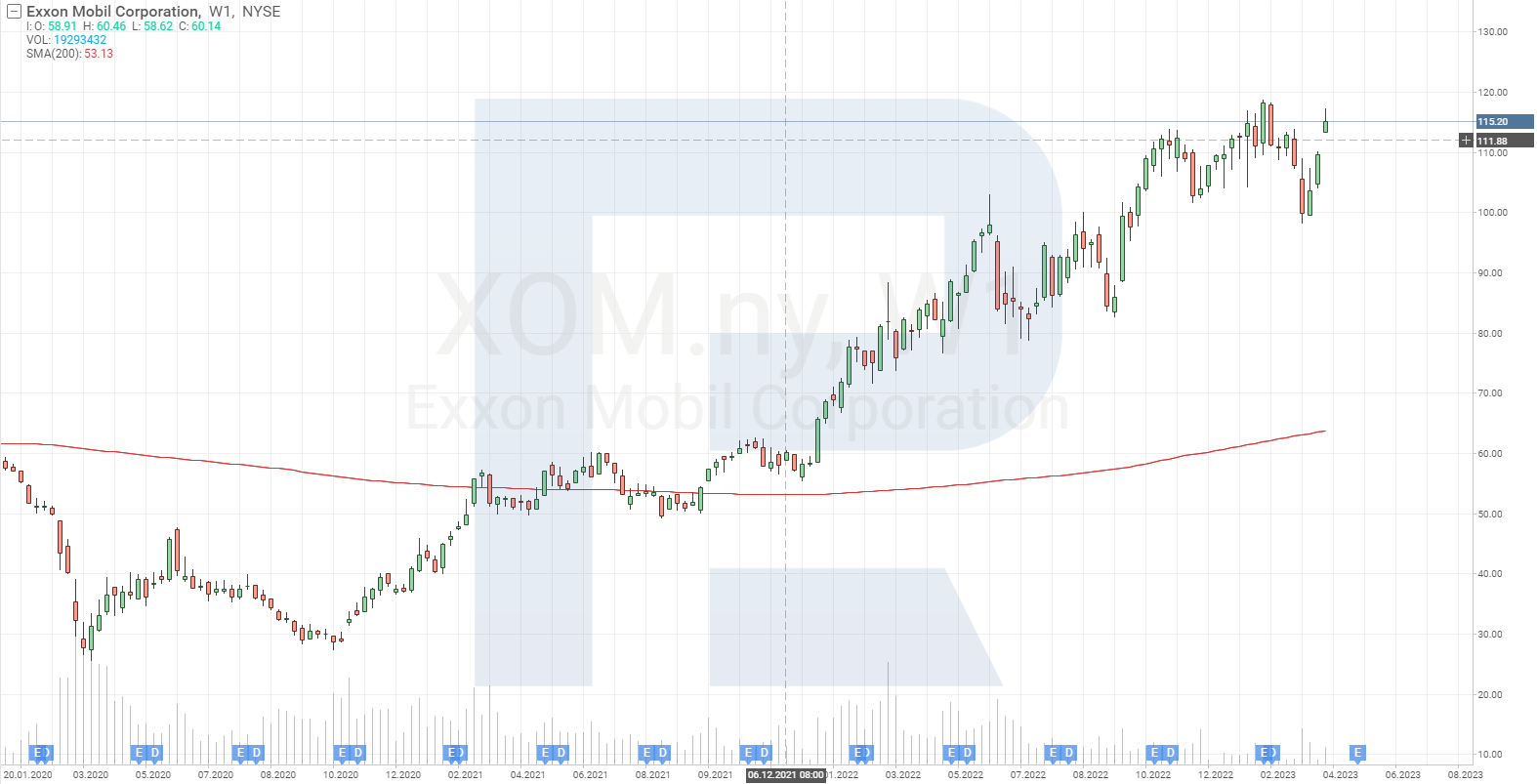

Because the oil and fuel industry is Exxon Mobil Company’s primary earnings generator, top hydrocarbon costs observed since 2021 had a favorable affect on its annual profits. During the last two years, the determine has risen from USD 181.5 billion to USD 413.6 billion. The upper revenues allowed the corporate to extend its dividend payout from USD 3.03 in keeping with inventory on the finish of 2020 to USD 3.54 in February 2023 and to allocate the price range to inventory buybacks.

A brand new inventory buyback programme was once introduced in December 2022, expanding the quantity from USD 30 billion to USD 50 billion. The programme is because of be finished by way of 2024. In consequence, the price of the company’s shares has skyrocketed 180% to 119 USD in keeping with unit for the reason that starting of 2021.

Conclusion

Exxon Mobil Company plans over the following decade to shift its center of attention from oil and fuel manufacturing and gross sales to selection power construction. On the other hand, in case of an international recession and a drop in hydrocarbon costs, the company’s plans may exchange, and the introduced closing date is also prolonged. On the similar time, the ongoing upward push in oil costs won’t simplest have a favorable affect at the corporate’s revenues but in addition accelerate the implementation of its plans.

As well as, for its power transition, aside from a stimulating call for for low-carbon applied sciences, Exxon Mobil Company wishes strengthen from regulators and policymakers on carbon pricing.

Put money into American shares with RoboForex on favorable phrases! Actual stocks will also be traded at the R StocksTrader platform from $ 0.0045 in keeping with percentage, with a minimal buying and selling charge of $ 0.5. You’ll be able to additionally take a look at your buying and selling talents within the R StocksTrader platform on a demo account, simply sign up on RoboForex and open a buying and selling account