EUR/USD Worth Research: Euro Reveals Respite on Higher PMI

- Knowledge on Tuesday published a large bounce within the Eurozone’s products and services sector.

- ECB’s Luis de Guindos showed the June fee reduce.

- Any coverage divergence between the Fed and the ECB may weaken the euro.

The EUR/USD value research leans bullish because the euro beneficial properties floor on upbeat PMI knowledge. In spite of this certain momentum, investor focal point stays at the chance of the Ecu Central Financial institution imposing its first fee reduce in June.

–Are you curious about studying extra about STP agents? Test our detailed guide-

Knowledge on Tuesday published a large bounce within the Eurozone’s products and services sector, which made up for a decline in production process. Subsequently, the composite PMI jumped, indicating a go back to expansion within the Euro house. In spite of the restoration within the financial system, markets nonetheless be expecting the ECB to start out imposing fee cuts forward of the Fed in June.

Particularly, ECB Vice President Luis de Guindos showed on Tuesday that the ECB will decrease charges in June. Then again, he additionally mentioned the central financial institution must workout warning after June and look forward to alerts from the Federal Reserve. Obviously, policymakers are nervous a few conceivable coverage divergence with the Fed. Marketplace individuals have considerably driven again expectancies for fee cuts in the USA after fresh upbeat inflation knowledge.

Additionally, policymakers have shifted their tone from dovish to bullish, pronouncing they could lengthen upper rates of interest. Subsequently, markets be expecting fewer cuts, which may get started within the fourth quarter. That is smartly after the ECB’s June reduce. Any divergence with the Fed may motive a vital decline within the euro, which may undo one of the most ECB’s paintings. A weaker euro would build up import prices and force inflation. As such, the ECB will probably be affected person after the primary reduce to look what the Fed will do.

EUR/USD key occasions these days

- US flash production PMI

- US flash products and services PMI

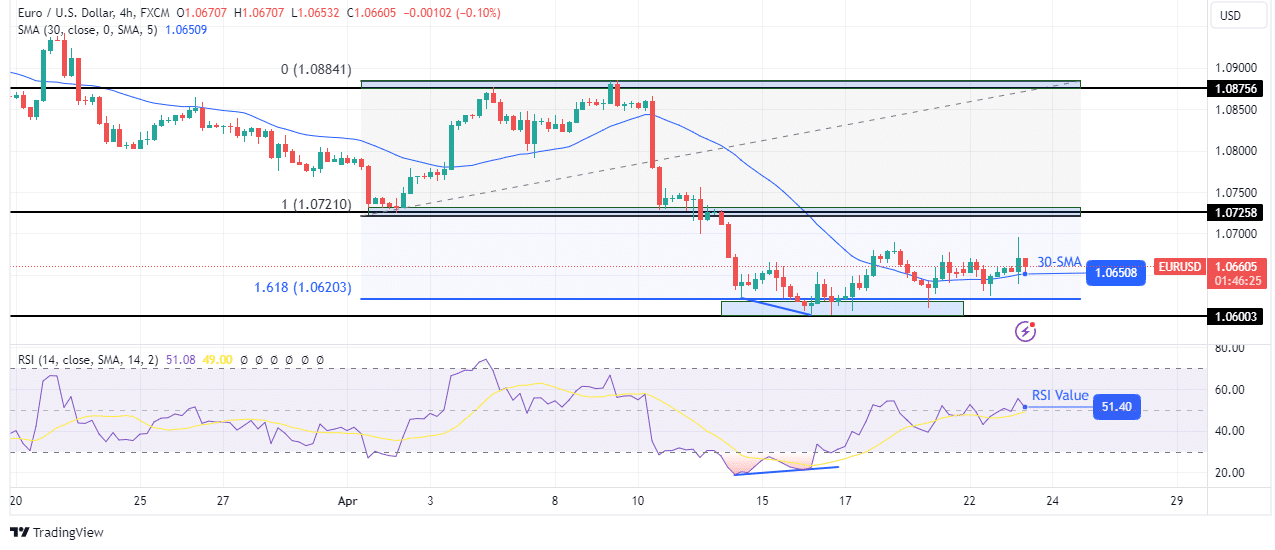

EUR/USD technical value research: Weaker push above 30-SMA

At the technical aspect, the EUR/USD value has began buying and selling above the 30-SMA, appearing bulls have taken over. This comes after a pause on the 1.618 Fib extension degree and a bullish divergence within the RSI.

-Are you in search of automatic buying and selling? Test our detailed guide-

Then again, the brand new transfer is susceptible for the reason that value is sticking with regards to the SMA. On the similar time, it’s making small-bodied candles, appearing susceptible momentum. If bulls to find their footing above the SMA, they’ll retest the 1.0725 key degree. In a different way, the downtrend will proceed beneath 1.0600.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must imagine whether or not you’ll have the funds for to take the top possibility of shedding your cash