EUR/USD Value Pauses Drawback Amid Oversold Stipulations

- A brand new decrease low in EUR/USD worth may turn on extra declines.

- False breakdowns may sign a brand new leg upper.

- 07 mental degree stands as a possible goal.

The EUR/USD worth slumped after america Non-Farm Payrolls, Moderate Hourly Profits, Unemployment Charge, and Revised UoM Shopper Sentiment got here in higher than anticipated on Friday.

–Are you interested by studying extra about ETF agents? Test our detailed guide-

The associated fee is buying and selling at 1.0736 on the time of writing, above the day gone by’s low of one.0723. The DXY’s sturdy rally boosted the dollar. Nonetheless, we can not exclude the chance of an upside retracement.

The disadvantage power stays top as america ISM Products and services PMI got here in at 53.4 issues, above the 52.0 issues anticipated the day gone by.

However, the German Business Steadiness and German Ultimate Products and services PMI got here in higher than anticipated, whilst the Eurozone PPI and Ultimate Products and services PMI matched expectancies.

Nowadays, the Eurozone Retail Gross sales reported a 1.1% drop as opposed to the 0.9% drop anticipated, whilst the German Manufacturing unit Orders rose by way of 8.9% even supposing the investors anticipated a zero.1% drop.

Nowadays, the FOMC Member Mester Speaks and the BOC Gov Macklem remarks may transfer the markets.

EUR/USD Value Technical Research: Oversold

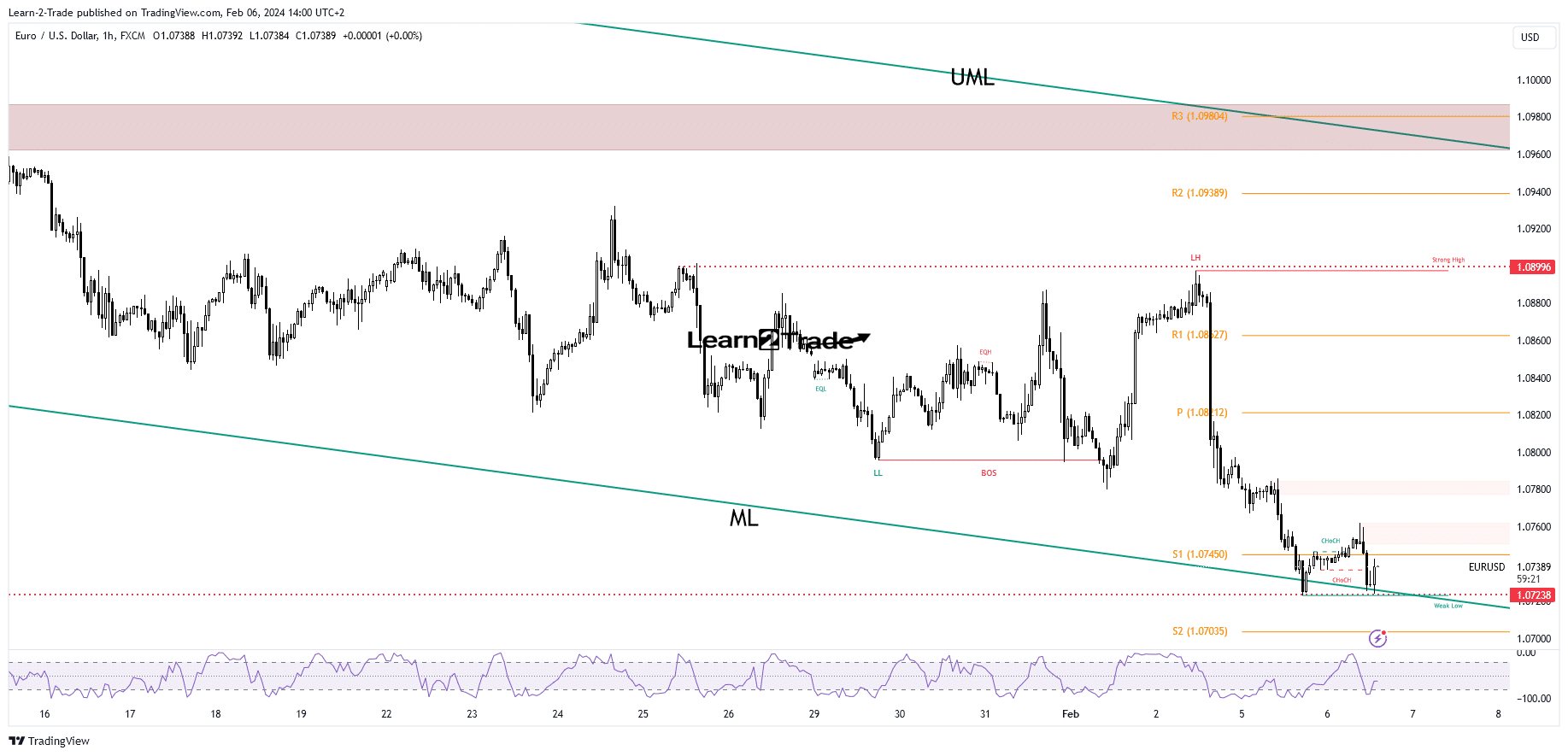

From the technical perspective, the unfairness stays bearish regardless of brief rebounds. The sell-off used to be paused by way of the most important descending pitchfork’s median line (ML) and by way of the 1.0723 degree.

–Are you interested by studying extra about Canada foreign exchange agents? Test our detailed guide-

Best false breakdowns would possibly announce exhausted dealers and may sign a bigger rebound. A brand new upper top, leaping and shutting above these days’s top of one.0762, confirms extra positive factors.

To the contrary, staying close to the disadvantage hindrances would possibly announce an coming near near breakdown. A brand new decrease low and making a sound breakdown underneath the median line turns on extra declines. If the associated fee drops, the S2 (1.0703) and the 1.07 mental degree are doable problem goals.

Taking a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll have enough money to take the top chance of shedding your cash