EUR/USD Value Appearing Exhaustion Indicators Beneath 1.0800

- Removing the downtrend line turns on higher enlargement.

- The Canadian inflation information will have to have an have an effect on day after today.

- The prejudice stays bearish so long as it remains underneath the downtrend line.

The EUR/USD worth rebounded within the quick time period as america greenback entered a corrective segment. The pair is buying and selling at 1.0771 on the time of writing.

The prejudice stays bearish in spite of the present leg upper. The pair moved down after a rally amid profit-taking. On Friday, the PPI rose through 0.3%, beating the 0.1% enlargement anticipated, Core PPI reported a nil.5% enlargement, exceeding the 0.1% enlargement forecasted, and the Prelim UoM Shopper Sentiment got here in at 79.6 issues in comparison to 80.0 issues estimated.

–Are you to be told extra about computerized foreign currency trading? Take a look at our detailed guide-

As of late, the Canadian IPPI got here in keeping with expectancies whilst the RMPI rose through 1.2%, extra in comparison to the 0.7% enlargement estimated.

The next day to come, the Canadian inflation information will have to have a large have an effect on at the USD. The CPI is anticipated to document 0.4% enlargement. However, the Eurozone Present Account may just drop from 24.6B to twenty.3 B.

Moreover, the FOMC Assembly Mins may just alternate the sentiment on Wednesday, whilst the producing and products and services figures will have to transfer the fee on Thursday.

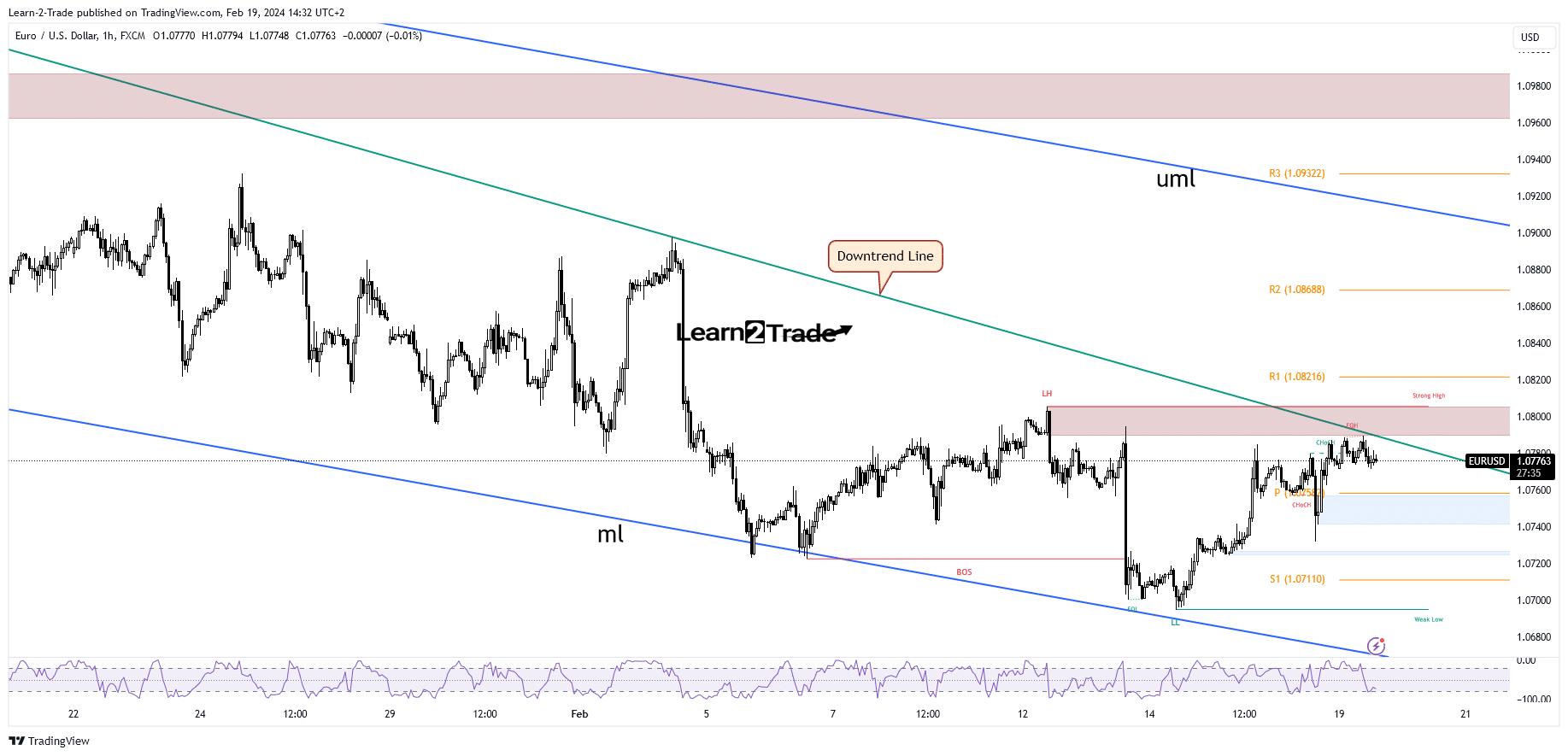

EUR/USD Value Technical Research: Downtrend Intact

Technically, the EUR/USD worth advanced a brand new leg upper after failing to retest the median line (ml), and now it used to be virtually achieving the downtrend line.

–Are you to be told extra about foreign exchange indicators? Take a look at our detailed guide-

So long as the pair remains underneath it, the unfairness stays bearish. Checking out it or registering false breakouts might announce a brand new drawback motion. Additionally, failing to achieve this dynamic resistance signifies exhausted patrons.

The weekly pivot level of one.0758 stands as a static beef up. Removing the downtrend line validates a bigger swing upper. The 1.08 mental stage represents a key upside impediment as smartly.

Having a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll come up with the money for to take the prime chance of shedding your cash.