Easy methods to Industry the “Base 150” Technique – R Weblog

On this overview article, we will be able to communicate concerning the medium-term indicator technique “Base 150”. We will be able to provide an explanation for the way it works, easy methods to set the indications, and the way the tactic can be utilized in buying and selling.

How the “Base 150” technique works

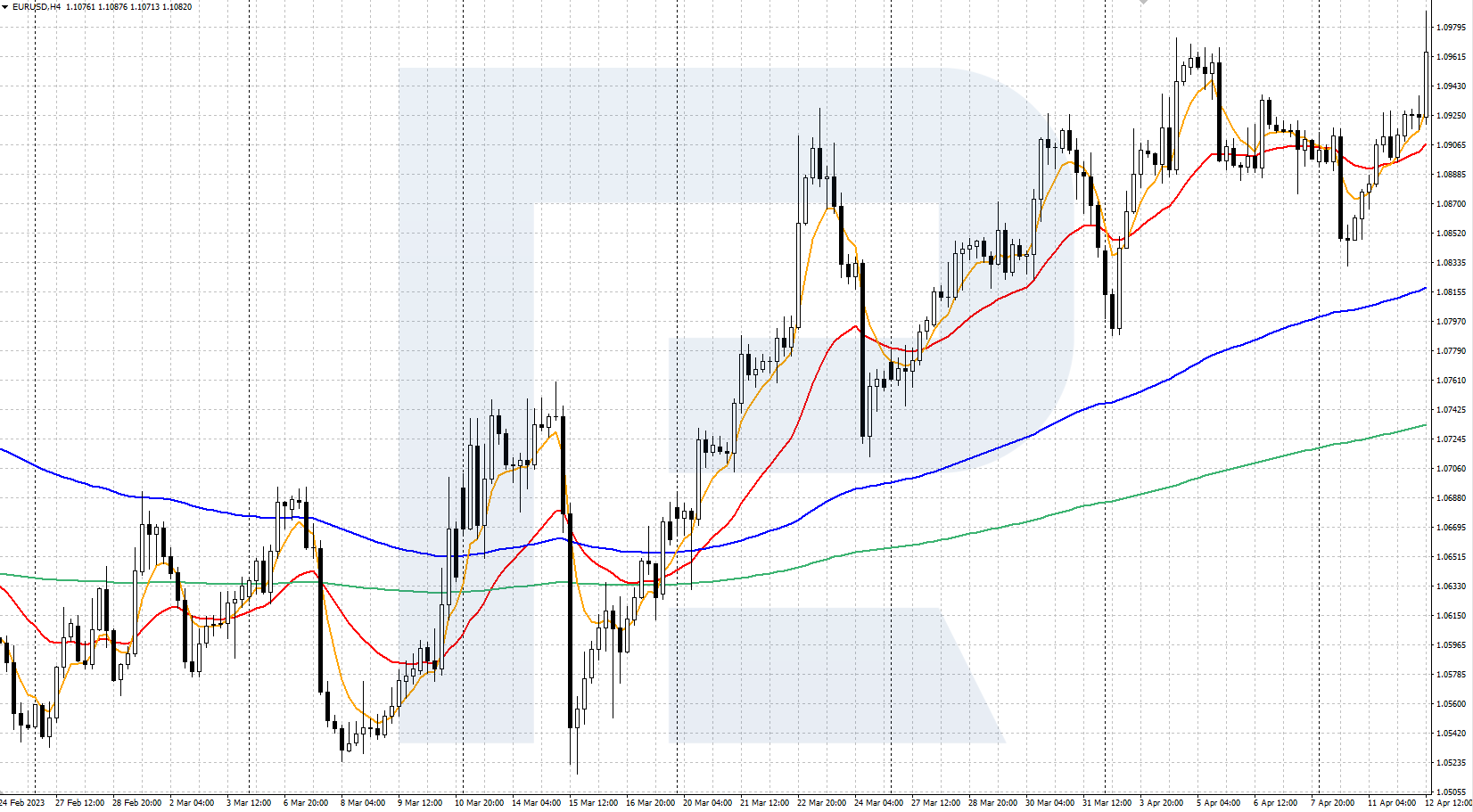

This indicator technique makes use of 4 exponential transferring averages (Shifting Moderate, MA) – EMA (6), EMA (25), EMA (150), and EMA (365) – to substantiate the buying and selling route and seek for buying and selling indicators. This indicator has lengthy been regarded as a easy and efficient tech research instrument, which is helping decide development actions and give a boost to or resistance spaces at the worth chart.

The identify “Base 150” comes from the primary model of the tactic, which used just one slow-moving moderate EMA (150). This buying and selling manner used to be later progressed to incorporate yet one more transferring moderate EMA (365), however the identify remained unchanged. On this technique, the Shifting Averages no longer best function development signs but in addition as dynamic give a boost to/resistance ranges, that are used to behavior trades.

How the “Base 150” technique works:

- To seek out purchase indicators for a monetary tool, the quotes will have to upward push above the sluggish EMA (150) and EMA (365), thereby confirming the uptrend. Subsequent, the dealer must stay up for a downward correction till the cost first touches one of the crucial 4 transferring averages, adopted by way of an uptrend reversal – this can be a sign to shop for

- To seek out promote indicators for a monetary tool, the quotes will have to settle underneath the sluggish EMA (150) and EMA (365), thus confirming the downtrend. Then the dealer must stay up for an upward correction till the cost first touches one of the crucial 4 transferring averages, adopted by way of a downward reversal – this can be a sign to promote

The “Base 150” technique is essentially geared toward buying and selling the EUR/USD, GBP/USD, USD/CHF, and USD/JPY forex pairs. Then again, it’s flexible sufficient and can be utilized to business different monetary tools. The advisable timeframes at the chart are H1, H4, and D1. Trades are made within the route of the rage after the cost rebounds from the Shifting Averages. Possibility control for this technique signifies that imaginable losses in step with business will have to no longer exceed 1% of the deposit.

Easy methods to arrange the Shifting Moderate signs

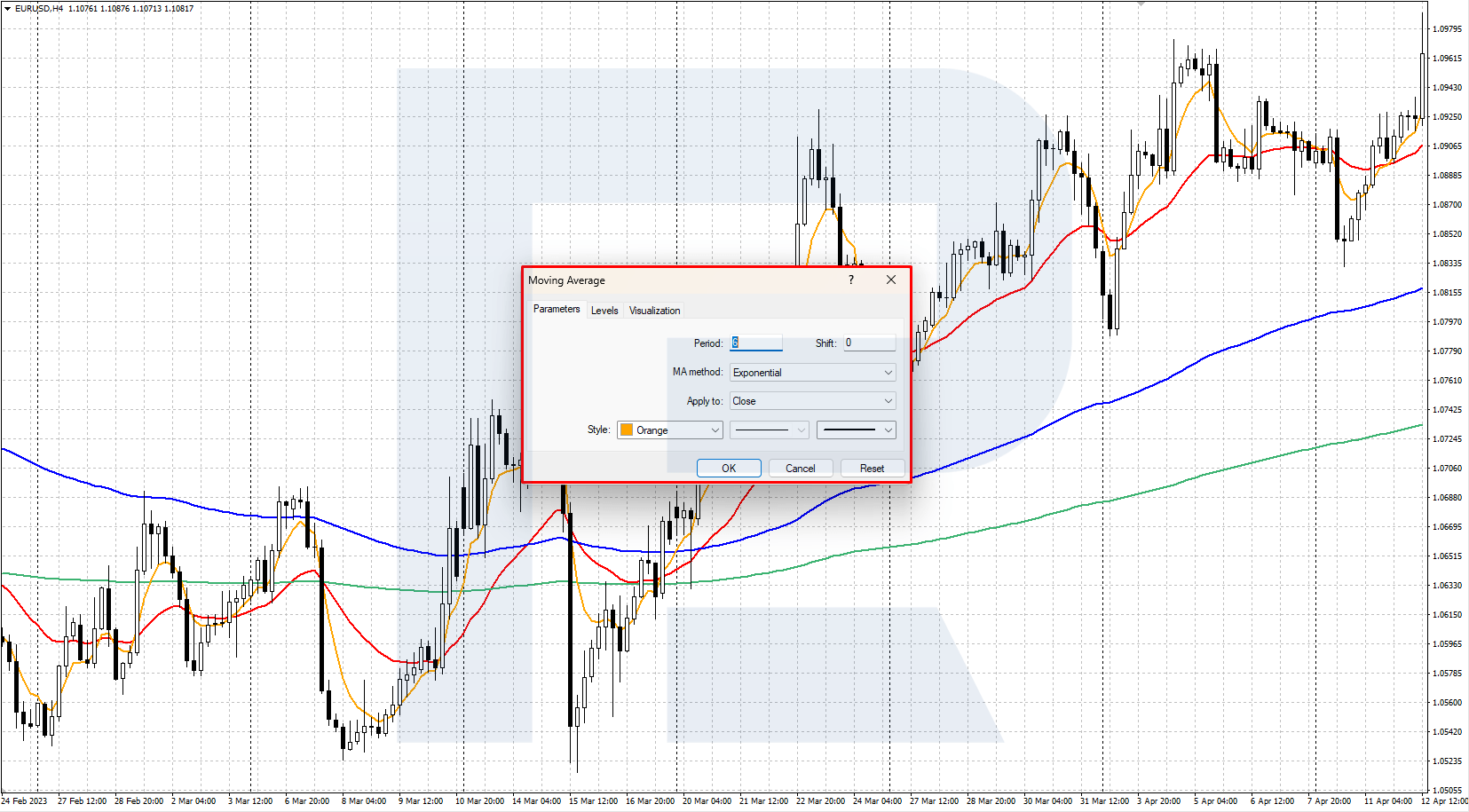

To arrange the indications on the preferred buying and selling platforms МetaTrader 4 and МetaTrader 5, practice those steps:

- Open the terminal and log in in your account.

- Make a selection the chart of your required tool.

- From the Major Menu, cross to – Insert – Signs – Pattern, after which click on on Shifting Moderate.

- Within the settings window that looks, make a selection length 6, the color and width of the road, MA manner – Exponential. Click on OK to use the parameters and shut the settings window.

- Repeat the movements above for the opposite 3 transferring averages. Within the settings window that looks, make a selection the sessions 25, 150, and 365, the color and width of the road, MA manner – Exponential. Click on OK to use the parameters and shut the settings window.

Consequently, the chart will display 4 Shifting Averages – EMA (6), EMA (25), EMA (150), and EMA (365).

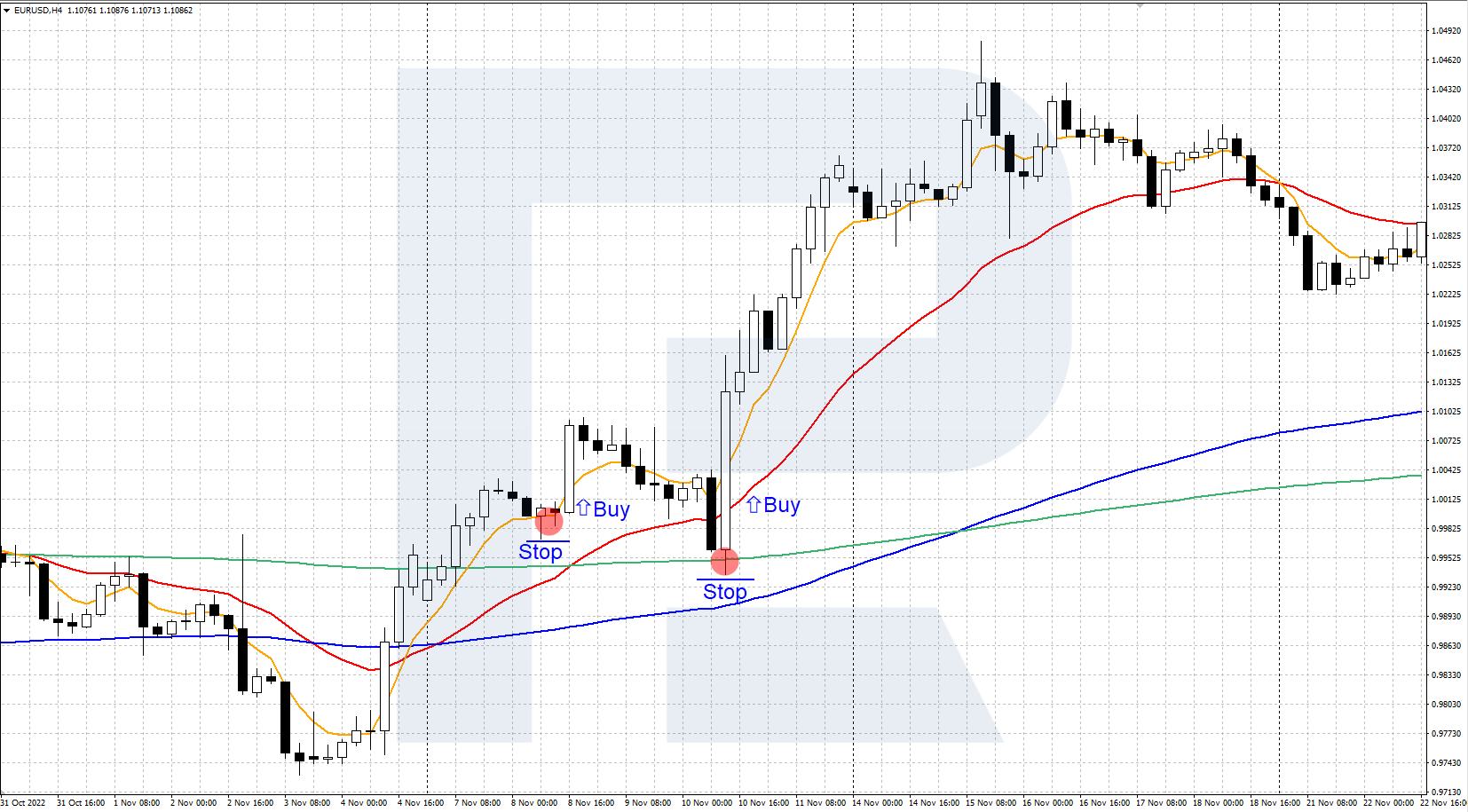

How to shop for with the “Base 150” technique

- The marketplace is in an uptrend, with the quotes and fast-moving averages EMA (6) and EMA (25) emerging above the slow-moving averages EMA (150) and EMA (365)

- The dealer waits for a downward correction till the cost first touches any of those transferring averages, adopted by way of an upward worth reversal. Additional touches will have to be omitted because the business is to be opened best after the first actual contact

- For a extra correct access when the cost touches the transferring moderate, a decrease time-frame (e.g. H1 for H4 or H4 for D1) can be utilized to track how quotes opposite upwards

- In case of an upward reversal, a purchase place is opened. If there’s no reversal, the sign is omitted, and the dealer waits for different transferring averages to be touched

- Forestall Loss is ready slightly below the native low shaped by way of the correction. The predicted Take Benefit will have to be two times the Forestall Loss quantity

Instance of a purchase the usage of the “Base 150” technique

- The H4 chart of the EUR/USD forex pair confirmed an uptrend, with the quotes and fast-moving averages EMA (6) and EMA (25) emerging above the slow-moving averages EMA (150) and EMA (365)

- On 8 November 2022, following a downward correction, the quotes touched the orange EMA (6) for the primary time

- At the decrease H1 time-frame, the dealer waited for an uptrend reversal and opened a purchase place

- The purchase place used to be opened at the cost of 1.00100, Forestall Loss used to be set at 0.99700, underneath the low of the correction, and Take Benefit used to be set at 1.00900

- Later, there used to be yet one more upside rebound, however from the golf green EMA (365)

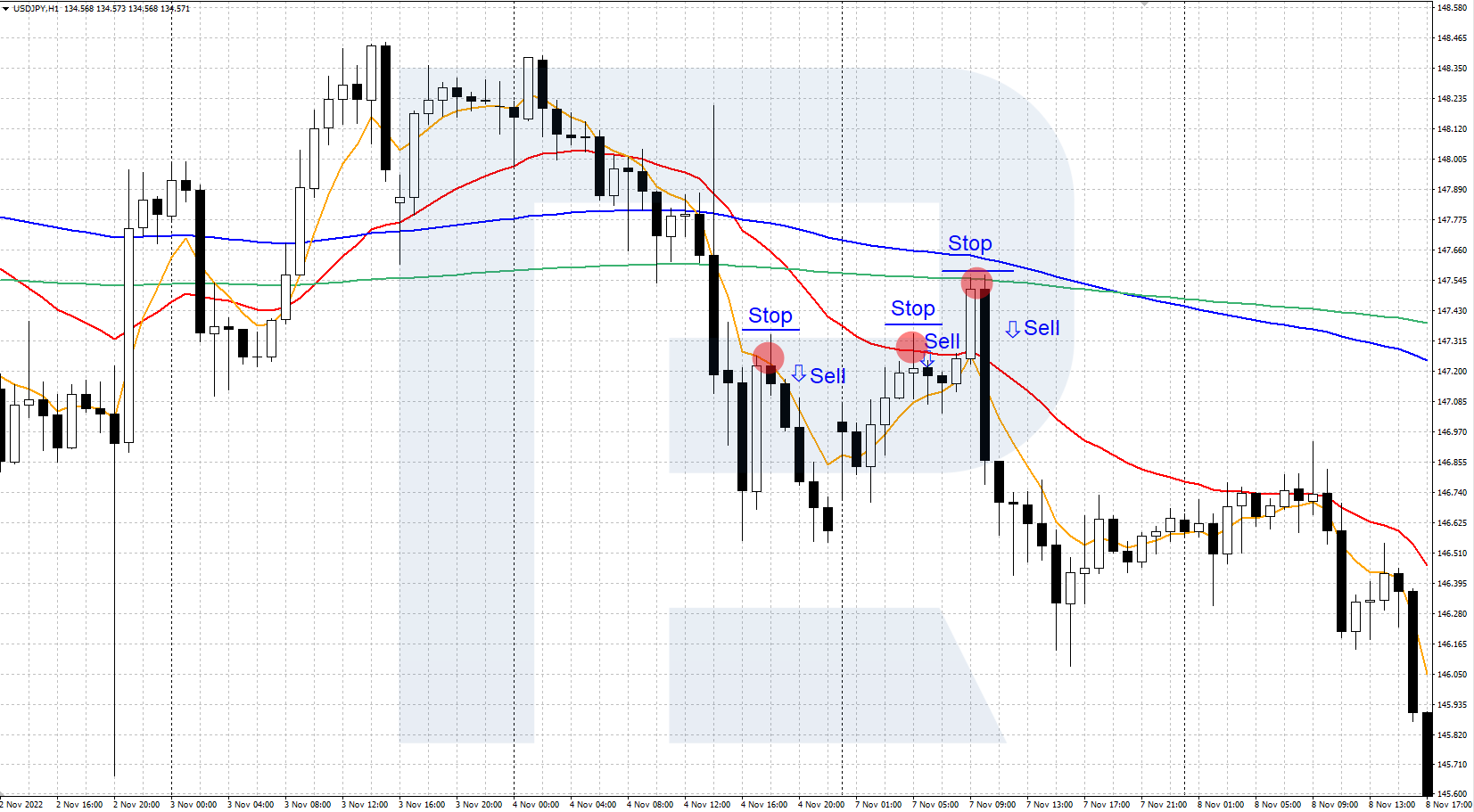

Easy methods to promote with the “Base 150” technique

- The marketplace is in a downtrend, with the quotes and fast-moving averages EMA (6) and EMA (25) falling underneath the slow-moving averages EMA (150) and EMA (365)

- The dealer waits for an upward correction till the cost first touches any of those transferring averages, adopted by way of a worth reversal downwards

- For a extra correct access when the cost touches the MA, a decrease time-frame (e.g. M15 for H1 or H1 for H4) can be utilized to track how quotes opposite downwards

- In case of a downward reversal, a promote place is opened. If there’s no reversal, the sign is omitted, and the dealer waits for the primary contact of alternative MAs

- Forestall Loss is ready simply above the native low shaped by way of the correction. The predicted Take Benefit will have to be two times up to the Forestall Loss quantity

Instance of a promote the usage of the “Base 150” technique

- The H1 chart of the USD/JPY forex pair confirmed a downtrend, with the quotes and fast-moving averages EMA (6) and EMA (25) falling underneath the slow-moving averages EMA (150) and EMA (365)

- On 4 November 2022, following an upward correction, the quotes touched the orange EMA (6) for the primary time

- At the decrease M15 time-frame, the dealer waited for a downtrend reversal and opened a promote place

- The promote place used to be opened at the cost of 147.100, Forestall Loss used to be set at 147.350, above the top of the correction, and Take Benefit used to be set at 146.600

- Later, there have been two extra downward rebounds from the crimson EMA (25) and the golf green EMA (365)

Abstract

The “Base 150” technique is a straightforward indicator buying and selling gadget in keeping with the indicators of 4 Exponential Shifting Averages with quite a lot of sessions. The gadget works effectively throughout a development on native corrections, however it’s best to not use it throughout a flat marketplace. For extra reliability, we advise the usage of the tactic together with classical technical research equipment. You’ll want to check the tactic on a demo account sooner than the usage of it.