Drawback Correction After CPI-Led Rally

- Tough US client value knowledge renewed the potential of the Fed elevating rates of interest additional.

- The yen retreated towards the crucial 150 point, resulting in hypothesis about foreign money marketplace intervention.

- There was once a slight build up in Jap families’ value expectancies.

The greenback fell fairly following its most important day by day acquire since March the day prior to, making the USD/JPY value research fairly bearish. This decline got here as tough US client value knowledge renewed the potential of the Fed elevating rates of interest additional.

–Are you to be told extra about foreign exchange choices buying and selling? Test our detailed guide-

Particularly, the September client value index (CPI) confirmed a nil.4% build up. It maintained the once a year price at 3.7%, very similar to August. In the meantime, economists had predicted a nil.3% per thirty days acquire and a three.6% year-on-year build up in CPI. Nicholas Van Ness, a US economist at Credit score Agricole CIB, commented that this knowledge would stay the Federal Reserve on its ft.

Moreover, Van Ness famous, “The main state of affairs nonetheless comes to a longer pause into 2024. Nonetheless, the potential of a price hike in December (or later) stays. That is particularly if we see additional sure surprises in approaching CPI and employment reviews.”

Yesterday’s strengthening of america greenback precipitated the yen to retreat towards the crucial 150-level in brief touched the former week. Because of this, there was once larger hypothesis about foreign money marketplace intervention.

In different places, a quarterly central financial institution survey on Friday indicated a slight build up in Jap families’ value expectancies. This build up was once within the 3 months main as much as September. It underscores the monetary pressure families are experiencing because of the increased residing prices. The Financial institution of Japan (BOJ) will intently read about this survey when developing new inflation forecasts throughout its October 30-31 coverage overview.

USD/JPY key occasions lately

Neither america nor Japan will unencumber main financial reviews lately.

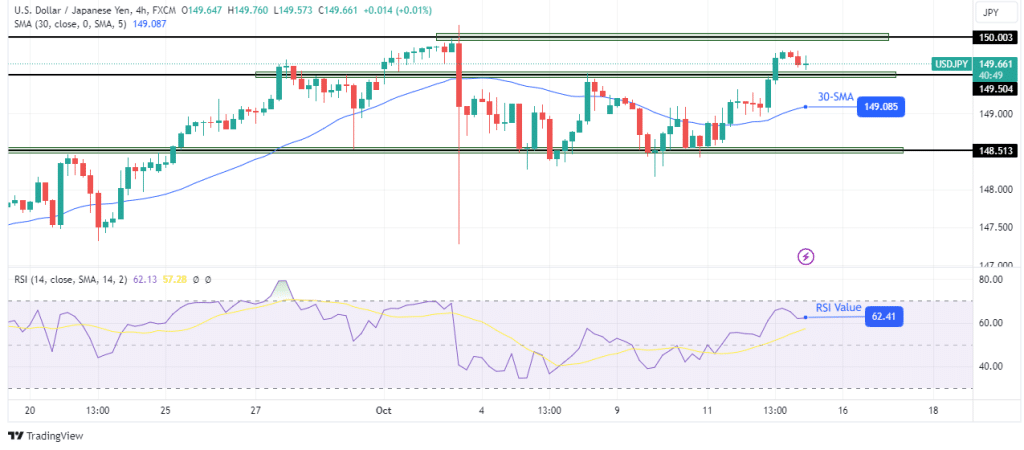

USD/JPY technical value research: Worth retreats after overcoming 149.50 resistance.

The USD/JPY value is chickening out after a contemporary surge that broke the associated fee above the 149.50 resistance point. However, bulls have a powerful cling in the marketplace as the associated fee trades neatly above the 30-SMA, appearing a steep transfer.

–Are you to be told about foreign exchange bonuses? Test our detailed guide-

Additionally, the damage above the 149.50 point made the associated fee upper, with the RSI buying and selling nearer to the overbought area. With one of these sturdy bullish bias, the retreat may most effective be transient prior to bulls retest the 150.00 key resistance point.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll be able to have enough money to take the top chance of shedding your cash.