Development a Successful the Forex market Buying and selling Plan is More straightforward Than You Suppose

the Forex market Buying and selling Plan

The typical downside that the majority foreign exchange investors handle when first beginning out is the loss of a correct buying and selling plan.

Maximum investors don’t trouble with a buying and selling plan as a result of they suspect it will be difficult. On the other hand, this is the place they’re mistaken as it’s more straightforward than you suppose to construct a buying and selling plan!

Not anything in existence arrives simply, and foreign currency trading is similar. For those who don’t have a transparent buying and selling plan or technique, you are going to now not succeed in your required effects. As Benjamin Franklin said-

“Failing to devise is making plans to fail.”

The significance of a buying and selling plan

Granted that now not many of us consider in what Franklin acknowledged, but it surely does make sense, and skilled investors notice this. They know that in the event that they need to generate income from buying and selling in a Funded Investors Program, they’ll have to make a choice such a two possible choices:

- Methodically observe a written plan

- Fail at buying and selling

Buying and selling Plan as a Roadblock

The above might sound harsh, however it’s the fact – that may be the tip of the sport. Diving into foreign currency trading and not using a transparent buying and selling plan is like driving a bicycle with out coaching wheels. Few investors notice the significance of a well-defined technique. Some have a written funding or buying and selling plan. On the other hand, skilled foreign exchange trades who’re constantly being profitable will agree that having a buying and selling plan doesn’t ensure good fortune.

A buying and selling plan is supposed to behave as a roadblock. It assists in keeping you on the right track and from shedding all of your cash. Numerous folks suppose they’re higher investors than they’re, and this false sense of superiority in funded dealer techniques can end up to be deadly. In case your buying and selling plan lacks preparation or is according to mistaken tactics, you gained’t succeed in good fortune. On the other hand, what you are going to have is an in depth document that charts your disasters, and you’ll be able to use this to spot your errors and right kind them.

Documenting your development in foreign currency trading will can help you steer clear of repeating pricey errors and make stronger your strategic concepts. So, if you wish to in finding good fortune in foreign currency trading, a profitable buying and selling plan is the easiest way to move about it. All investors should have their plan, which must account for private buying and selling targets and types. You are going to now not in finding good fortune through the use of any person else’s buying and selling plan or technique as it doesn’t have any of your buying and selling traits.

Concepts to Imagine whilst you construct a buying and selling plan

Heading off Screw ups 101

Deal with your buying and selling as a sound industry. Admire it, deal with it correctly if you wish to succeed in good fortune.

To steer clear of failures and create a correct buying and selling plan, standard knowledge suggests:

That appears like a just right plan, however I’m right here to inform you that this can also be a recipe for crisis. It will not be the precise buying and selling plan that can convey you good fortune.

Investors must at all times do the next:

- Suppose out of doors the field.

- Account for marketplace fluctuations.

- Learn about the marketplace to gauge the possible to opposite or pause at all times.

- Act according to the ones ideas.

Sooner than you start buying and selling with a funded buying and selling program:

- Have a forged buying and selling plan.

- Account for a second look of the plan after the marketplace closes.

- The plan must be versatile and alter according to marketplace stipulations (You are going to make stronger at studying the marketplace).

- Adjusting your technique with revel in as your talent stage will increase.

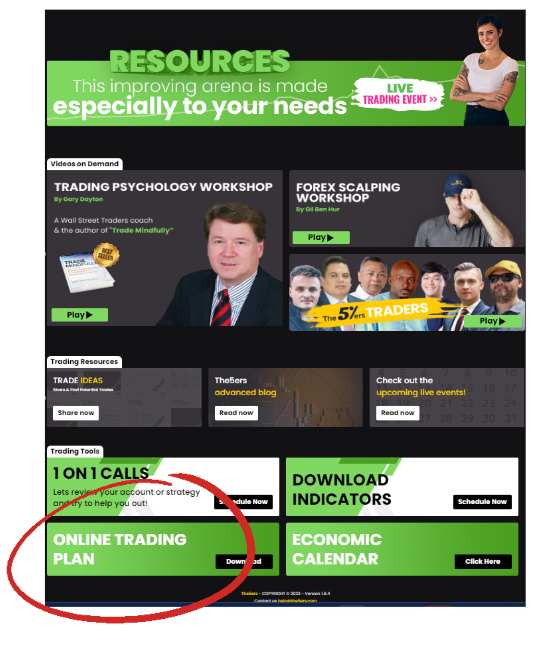

In case you are a 5ers dealer, you’ll be able to obtain a loose on-line buying and selling plan to your hub.

Development the Easiest the Forex market Buying and selling Plan

One of the best ways to construct a profitable buying and selling plan is to be sure that you might have the entire very important parts in position. Maximum investors do not know what to do or the way to start. Thankfully for you, that’s what you’re going to be informed nowadays.

1. Do Your Homework

Sooner than you start buying and selling –

- Start your homework sooner than the marketplace opens

- Be vigilant and extra knowledgeable about what’s going on in different markets all over the world.- are they up or down?

- Stay assessments on how the index futures are appearing, like Nasdaq, 100 Change-Traded Finances, or SP 500. (The important thing to gauging the temper of the marketplace sooner than it opens).

- Test on when the incomes or financial information is popping out and create an inventory. (Submit it someplace in entrance of you and make a decision if you wish to industry sooner than a essential document. I might advise minimizing possibility – wait till the whole document has been launched).

- Keep in mind – Execs position their trades on chances. They don’t gamble on their trades.

2. Ability Evaluation

Have a good suggestion of your buying and selling talents.

- Are you in a position to check your self out there?

- What’s your buying and selling revel in?

- Do you are feeling assured to your figuring out of the marketplace?

- Can you make selections with out hesitating?

Be mindful that even execs in finding it difficult to learn the marketplace as it should be. In case you are buying and selling within the markets, you should be in a position to present and take. Skilled foreign exchange portfolio managers are at all times ready. They take income from others who don’t have a transparent set plan and throw their cash away as a result of pricey errors.

3. Set Chance Degree

- Determine and determine a possibility stage that you’re pleased with to steer clear of dear mistakes. (Resolve this thru your possibility tolerance and buying and selling taste. It may be part of 1% – 5% of your portfolio on any buying and selling day.)

- Have the self-discipline to transport out and keep out of the marketplace.

- Stay buying and selling if issues aren’t going your method as a result of it’s higher to name it an afternoon and get started contemporary.

- Don’t be cussed.

4. Psychological Preparation

Be mentally ready to handle the entire demanding situations that buying and selling brings you.

- Have a just right night time’s sleep – to be psychologically and emotionally ready.

- For psychological exhaustion -take the break day to steer clear of shedding cash. (You shouldn’t industry whilst you’re now not in the fitting headspace. Anger, distraction, or preoccupation does now not convey just right effects).

- Some skilled investors create rituals to apply and to go into the marketplace with a favorable headspace.

- Be sure that there aren’t any distractions with reference to the place you take a seat and industry.

5. Buying and selling Arrangements

Label those obviously sooner than you start to industry:

- Minor and primary strengthen

- Resistance ranges.

- Go out indicators

- Indicators for access

6. Set Objectives

Your buying and selling plan targets must be:

- Sensible possibility/praise ratios and benefit goals.

- Transparent – Some investors gained’t industry with you till the possible benefit is 3 times greater than the chance.

- Atmosphere annual, per thirty days, and weekly benefit targets.

- Re-assess them ceaselessly to be ready.

7. Stay Very good Data

All foreign exchange portfolio managers are nicely arranged and stay very good information of all trades they make – profitable and shedding ones. It supplies a reference level for long run trades. In order that they know precisely what they did proper and what errors they made.

You must write down necessary main points like:

- Goals

- Access and go out of each and every industry

- The time

- Provide and insist ranges

- Day-to-day opening vary

- Marketplace open and shut for the day

- File: feedback about why you sought after to make the industry and what courses you realized from the trades.

- Often overview buying and selling information to investigate the benefit or loss for a device, moderate time in line with industry, drawdowns, and more than a few different elements. (Evaluate them someday).

8. Set Go out Laws

Numerous foreign exchange investors make the mistake of now not taking note of once they must go out the marketplace. They’re busy focusing2 on purchasing indicators as a result of they don’t need to promote if they’re down, which might imply taking a loss.

- You should discover ways to recover from it, or you are going to now not in finding good fortune.

- Take feelings out of the sport.

- Don’t take losses in my opinion.

- Everybody has just right and unhealthy days, or even the most productive execs lose extra trades than they win. (The important thing to their good fortune is proscribing their losses and managing cash cleverly).

9. Set Access Laws

Atmosphere go out regulations for the marketplace is all nicely and just right, however you should additionally create regulations for getting into the marketplace. Some investors don’t do that and suppose that exits are extra necessary than entries. However even investors should know the most productive time to go into the marketplace. All of it will depend on your buying and selling taste. Investors must set stipulations for getting into the marketplace and make sure getting into when the marketplace is true.

A part of the rationale computer systems are higher at buying and selling than folks is they don’t let feelings get of their method when buying and selling. They have a look at the stipulations, and if the marketplace stipulations are met, they’ll input. Investors don’t do it like this, which complicates their buying and selling and forestalls them from profitable.

The most efficient factor to do:

- Set transparent regulations for getting into the marketplace.

- Don’t get indignant on the marketplace when you lose or really feel invincible from profitable a few trades.

- Base all of your buying and selling selections on chances.

10. Carry out a Submit-Mortem

After each and every buying and selling day:

- Upload up your benefit and losses.

- Determine what came about to your trades.

- Write down your conclusions in a magazine and test upon them.

the Forex market Buying and selling Plan – The Backside Line

A profitable buying and selling plan doesn’t at all times ensure good fortune. You might have a fortunate segment additionally however take a look at to not let that get for your head through sticking to simply what you suppose works for you.

The important thing to changing into a hit in foreign currency trading is being assured but in addition re-evaluating each and every industry! Sooner or later, you are going to broaden sufficient talents that you just don’t must doubt your selections or 2nd bet if you end up buying and selling.

You’ll be able to’t make sure that a industry will earn a living as a result of your possibilities of good fortune hinge for your device of profitable, shedding, and your talent. You will need to needless to say profitable doesn’t come with out shedding, {and professional} investors handiest input a industry when the chances are of their want. The important thing to discovering good fortune as a dealer is to chop your losses brief and let your income trip. You could lose a large number of trades, however when you don’t divert out of your buying and selling plan, you are going to in finding good fortune as nicely.

Don’t surrender!

👉 If you wish to obtain a call for participation to our reside webinars, buying and selling concepts, buying and selling technique, and high quality foreign exchange articles, signal up for our Publication.

👉 Click on right here to test our investment techniques.

👉 Don’t omit our the Forex market Buying and selling Concepts.

Apply us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView