Debt Ceiling Optimism Spice up Buck

- US retail gross sales rose whilst jobless claims fell, indicating nonetheless chronic inflation.

- The buck additionally rose amid optimism over america debt ceiling negotiations.

- Japan’s economic system recovered and grew at a faster-than-expected fee in Q1.

The USD/JPY weekly forecast is bullish as buck energy will most probably proceed amid hopes of a debt ceiling answer.

Ups and downs of USD/JPY

USD/JPY had a bullish week because the buck bolstered, pushing the pair to better highs. The week used to be stuffed with releases from america and Japan that moved the pair. Necessary knowledge from america integrated retail gross sales and preliminary jobless claims, whilst Japan launched GDP knowledge.

–Are you to be informed extra about foreign exchange bonuses? Test our detailed guide-

US retail gross sales rose whilst jobless claims fell, indicating nonetheless chronic inflation. This revelation had traders scaling again their rate-cut bets, which boosted the buck. The buck additionally rose amid optimism over america debt ceiling negotiations.

Japan’s economic system recovered and grew at a faster-than-expected fee in Q1. Then again, there’s nonetheless uncertainty about how quickly the BOJ can scale back its stimulus.

Subsequent week’s key occasions for USD/JPY

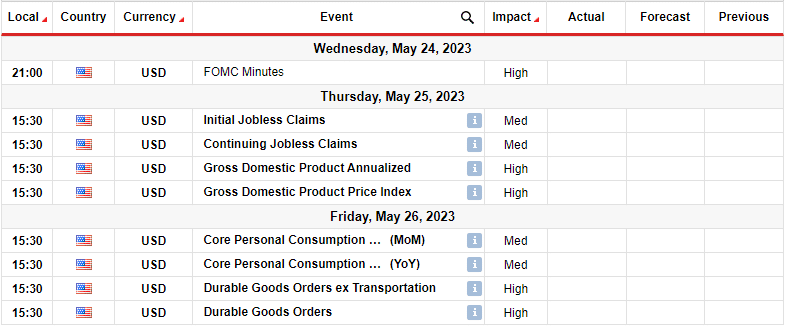

Traders will focal point on US releases subsequent week as there received’t be any key ones from Japan. The USA will unlock many experiences, however investor focal point will likely be at the Fed assembly mins, jobless claims, and the core PCE worth index.

The FOMC mins will display what went into the velocity resolution at the newest Fed assembly. It would give extra clues on the way forward for the Fed’s financial coverage. Then again, the jobless claims will display the state of america exertions marketplace.

After all, the core PCE worth index, the Fed’s major inflation indicator, will pop out on Friday. This may affect the marketplace’s rate of interest outlook.

USD/JPY weekly technical forecast: 139.00 breakout looms as bullish development strengthens

The bullish bias within the day-to-day chart for USD/JPY is powerful for the reason that worth trades a ways above the 22-SMA. Moreover, the RSI trades nearer to the overbought area, indicating forged bullish momentum.

–Are you to be informed extra about foreign currency trading apps? Test our detailed guide-

Moreover, the fee broke above the 137.75 resistance stage to make the next prime, strengthening the bullish bias.

The associated fee is retesting the not too long ago damaged 137.75 stage. Lets see it jump upper within the coming week to take out the 139.00 resistance stage. On the identical time, there could also be a deeper pullback underneath 137.75 prior to the bullish development continues.

Having a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll be able to have the funds for to take the prime possibility of shedding your cash.