Construction Forged Possibility Control Methods for Buying and selling the Forex market

Possibility Control basics for effectively buying and selling foreign exchange

Possibility Control Buying and selling Methods – Face it, issues hardly ever ever cross in step with plan. This fact is much more so on the earth of buying and selling. For those who refuse to simply accept this fact and should you don’t paintings tirelessly on a forged buying and selling plan with an efficient motion plan that covers as many probabilities as you could run into whilst buying and selling, you don’t seem to be going to live on as a dealer.

A large a part of that survival comes from making plans and crafting a well-thought-out and intensive menace control buying and selling technique. Whilst you commerce, it’s crucial that you already know what dangers you’re keen to take and the way you’ll arrange if one thing is going unsuitable alongside the way in which. Possibility control methods let you determine and take on results that would possibly differently have led to catastrophic injury on your account.

Why is Possibility Control So Essential?

Buying and selling takes position in an intense paintings surroundings, surrounded through more than a few facets of uncertainty and loyal wonder. In our paintings as buyers, we can by no means have complete get entry to to all of the knowledge this is had to make an absolutely certain choice. Merely put, buying and selling is speculating, and the results of our movements are not in our arms as soon as now we have set a commerce into movement.

Coping with this nice unknown and out of control setting will also be intimidating and awaken many mental problems referring to how we maintain those eventualities.

This may increasingly motive us to react otherwise from state of affairs to state of affairs relying on how we’re emotionally brought about at a definite time.

To triumph over the un-controlled and stable loss of an important knowledge and regulate, we need to undertake a algorithm and insurance policies that give us a head get started in defeating those problematic variables.

Easy methods to Construct Possibility Control Buying and selling Methods

Now that the significance of menace control is obvious let’s cross throughout the gear now we have to be had to us in our combat towards uncertainty. We will by no means do away with it totally, however we will be able to publish a number of safeguards to verify the wear and tear is proscribed.

In buying and selling, all out of control components are regarded as dangers. Those are the standards that may all the time cross towards our commerce, although they had been unknown previous to access.

Alternatively, the managed components are the gear that lend a hand us restrain and cut back the hazards, rig (or cap) them right into a framework that permits us to take care of a wholesome buying and selling portfolio.

Here’s a useful desk appearing out of control and regulated components in buying and selling:

Now let’s dive into each and every of those components a little bit (Later within the article, there are answers on find out how to take care of each and every state of affairs).

Situation to Cause

We will by no means time when all of the proper prerequisites align to cause a commerce (or go out). This once in a while ends up in buyers doing such things as lacking the access and leaping past due on a commerce or in advance getting into a commerce. Getting into the marketplace in advance or past due might disclose you to larger drawdown with a deficient risk-reward ratio.

To be had Knowledge

As retail buyers, we’re all the time at the quick finish of receiving the related knowledge that may impact our commerce evaluation. Knowledge similar to expanding quantity shouldn’t be to be had for foreign currency trading. The order deal ebook could also be no longer clear, and main gamers’ task can’t be noticed. Since foreign exchange has no governing authority, establishments don’t seem to be reporting in line with their highest pursuits and will paintings with a prime stage of secrecy. Retail buyers like us are left most effective with get entry to to public knowledge, similar to chart studying and macroeconomic information. We merely don’t have a data edge.

Causes for Value Volatility

When the fee strikes in a robust approach, we will be able to most effective see it after it occurs. It’s nearly inconceivable to get a heads-up earlier than a significant transfer happens, and our place will all the time be uncovered to such tough occasions at any given time. After we are in a commerce, whilst the fee strikes, we can not truly do anything else because it occurs.

Sudden Information

The similar factor is going for surprising information occasions that impact our positions. We will by no means know after they’re about to erupt and by which path they’ll transfer the marketplace in.

Sudden Financial Knowledge Interpretation

There are never-ending examples of scheduled financial information releases that motive the marketplace to transport in a path reverse that not unusual sense. For instance, if the knowledge signifies strengthening a foreign money, the real marketplace response could be to devalue that very same foreign money. There’s little to no common sense to how the marketplace reacts to anticipated information.

Breaching Ultimate Goal

Environment commerce goals does no longer ensure costs will achieve it earlier than they achieve your forestall loss. We don’t have any regulate over what trail the marketplace takes. For those who’re aiming for a particular RRR, it’s no longer assured you’ll get it as anticipated.

Unaware / Now not Skilled

At all times recognize that there are extra facets that you simply’re no longer acutely aware of that may impact your buying and selling and disclose your place to menace. Sooner or later, it is possible for you to to identify new blindspots as they start to shape, however you could lack the correct coaching to maintain them. On this case, simply recognize that those occasions can come out of the blue and wonder you.

Mental State

Your mental readiness for the day, the week, or for particular occasions can hit you through wonder. Finally, we’re human, and as such, we’re emotional creatures.

External interferences

Buying and selling in most cases calls for a prime stage of focal point, recurrently known as being within the zone. However there’s a international available in the market that assists in keeping turning irrespective of whether or not we’re in it or no longer. Children, folks, spouses, buddies, neighbors, bosses, climate, visitors, and so forth., anything else can all of sudden have interaction with you and distract you from buying and selling.

Existence Cases

Perhaps you’re dealing with a difficult duration to your lifestyles, but it’s a must to be buying and selling professionally and putting in place the wanted time, effort, and focal point to make it be just right for you. Existence instances won’t all the time be optimum to improve your challenging process of buying and selling.

The Managed Components in Buying and selling

Thankfully, there are some things that we do get to have regulate over once we’re buying and selling. Considered one of our major targets will have to be to make use of those gear in the most productive solution to give ourselves an actual edge with a view to take care of a wholesome industry.

Timing The Access / Go out

In the end, we get to make the verdict for the place and when to behave available in the market and at what value to position our positions, goals, and forestalls. We additionally get to make a choice when to go into and the way we set the tolerance stage for our standards to take any motion available in the market.

Research

We regulate how thorough and reasoned our research is. If we make investments the correct time and information into it, we’ll be capable to come away with a well-educated research and evaluation.

Plan Possibility-Praise

It’s our choice to clear out trades that don’t seem to be deemed to offer a enough risk-reward ratio. We will act upon bettering the risk-reward ratio through ready a little bit longer and taking the commerce at a deeper value which can give much less menace vary. Via that, we will be able to building up the risk-to-reward ratio much more.

Place Sizing

We make a decision how a lot we dimension a place. It’s at our discretion to set the margin for error and drawdown. There are tactics that can be utilized with place sizing, similar to steadily scaling in as soon as the commerce is on benefit or the use of other sizing upon the chance magnificence, e.g., for the extra dangerous magnificence will take part or 1 / 4 of the common sizing.

Recognized Financial Information Liberating time

We will time how we safe our uncovered place right through main financial releases. The time table of those occasions are pre-planned and printed forward of time, so now we have a lot of time to stick out, development stops and goals, cut back publicity or some other imply of coverage from the impending prime volatility.

Growing & Following your individual Buying and selling Plan

We will paintings diligently mapping marketplace eventualities, prerequisites, and or motion plans in reaction. That is so we will be able to all the time be ready with right kind and examined movements for no matter situation would possibly get up. It’s by no means sufficient to emphasise the significance of this and the way necessary it’s to a buying and selling plan.

Coaching Your Mental State

Being ready for the psychological facets of buying and selling is necessary as nicely. Realizing your psychological strengths and what you’ll be able to put to make use of by which eventualities is vital. This additionally approach being acutely aware of the psychological weak spot you want to paintings on and how you’ll be able to cross about doing so. Mapping and figuring out those components and their implications is a handy gizmo to stick on most sensible of your psychological sport.

Environment Stops

Capping your menace could also be one thing that’s indubitably executed through your choice. So are transferring and securing income with stops and environment forestall loss and goals (take benefit) in practical places relative to the marketplace prerequisites. It’s necessary to be sure to’re environment stops and transferring them most effective within the path this is confirmed to be recommended for long-run menace control.

The Time You Industry

You’ll make a decision when, the place, how lengthy, and beneath what settings you need to commerce in. You’ll and will have to make a choice to commerce on the instances which are maximum welcoming in your buying and selling technique, targets, and availability.

Opting for an Asset to Industry

Opting for which asset corresponds along with your buying and selling coverage, your buying and selling plan, and menace control is the very last thing on our record of controllable components. You’ll make a choice to commerce most effective certified belongings that gives you the most productive chance of rewarding your efforts.

Working out Controllable and Uncontrollable Components

As soon as what’s and isn’t beneath your regulate, you’ll be able to start to craft a menace control buying and selling technique that makes use of the controllable components whilst minimizing the prospective results of the uncontrollable components. Remember the fact that loss is part of buying and selling, and you’ll by no means be capable to totally rid your self of unplanned occasions. The objective of a super menace control plan will have to be to account for those unknowns and arrange the wear and tear they may motive.

The Significance of Environment a Real looking Objective

As soon as what’s and isn’t beneath your regulate, you’ll be able to start to map a practical objective in your buying and selling. Assessing your targets and figuring out which can be achievable and which don’t seem to be will set you in the fitting path towards sustained good fortune. Figuring out actual targets is the cornerstone for development your menace control technique.

It can be useful to damage down your targets into milestones. Small accomplishments that at last hit greater targets are an effective way to keep away from frustration and evenly and effectively reach what you’re after. Real looking targets can all the time be met, and it simply would possibly take you a distinct, extra incremental path to get there.

Alternatively, in case your targets don’t seem to be practical, it is going to lead you to take useless dangers to your buying and selling. Those dangers would possibly come with overexposing, over-trading, and avoidance of taking income or neglecting your individual forestall loss.

Environment a practical objective will have to reduce your rigidity and help you recuperate and maintain the surprising will have to issues no longer cross in step with plan.

Possibility Control Buying and selling Methods

There are a couple of necessary tips to practice with a view to construct a complete menace control technique.

At all times take into account that menace control methods are person and subjective resolutions. They depend by yourself persona, strengths, weaknesses, account dimension, and targets.

Be fair with your self whilst you start striking a method in combination. If you need your plan to steer you on an extended and wealthy buying and selling trail, it should be practical, achievable, and adaptable.

Listed here are one of the crucial main phrases you should unravel for your self:

Know your Present Objectives (vs. the longer term)

What are your expectancies from buying and selling in the case of your account dimension? It’s evident you’ll be able to’t be expecting to make a 5K per 30 days source of revenue from a 10K account, proper? For those who take a look at to take action, you’ll crush your self, over-trade, and push your self to intense frustration.

Your present objective will have to be one thing that lets you develop your portfolio to the purpose the place you’ll be able to reach your larger objective, which is to withdraw 5K each month. Set a present objective this is practical and does no longer drive you in the case of place sizing, display time, and enlargement tempo. Make this paintings whilst additionally permitting you to develop for my part and experience a typical lifestyles.

Set Real looking Goals and know your barriers

Goals will have to be set inside of a couple of time parameters. This implies mapping the path for unmarried, day-to-day, weekly, per 30 days, and annual trades.

The goals that you simply set in those parameters will have to even be set for the shedding facet. Ask your self at what stage you will have to halt buying and selling and for a way lengthy. Additionally, know what you want to switch earlier than you permit your self again within the sport.

Place Measurement

Set place dimension in step with the chance of good fortune in your commerce. The upper the chance of good fortune, the upper the leverage you might use. Conversely, the bottom chance trades will have to use decrease leverage.

Remember the fact that no matter sizing (leverage) you utilize, be sure to go away enough space for managing catastrophic value motion towards you.

You’ll know your sizing is correct when you’re feeling comfy maintaining it, and there’s no anxiousness whilst you’re to your menace zone. You’ll additionally know since you’re no longer taking low pips to depend on benefit for the reason that worth is prime sufficient.

Finally, for place dimension, by no means use it to catch up on previous losses.

Compounding

It’s possible you’ll use one of the crucial take advantage of your previous trades to scale as much as your subsequent commerce place. Alternatively, this will have to be constrained to the chance stage of the following commerce. Don’t compound income beneath any circumstance. Endurance is vital in buying and selling, so by no means rush the method. Take most effective what the marketplace provides and don’t attempt to artificially make stronger what it provides.

We wrote a super article about how compounding paintings.

Possibility Praise Ratio

A elementary rule of thumb is to set a minimal risk-reward ratio this is achievable and is aligned along with your technique win fee.

As a thumb rule, know that should you wait too lengthy for a deeper access, you could fail to notice some trades, but when they’re brought about, the outcome will likely be a significantly better risk-reward ratio, with the next good fortune fee.

Excellent risk-reward ratio self-discipline will lead you to commerce with upper potency, the next good fortune fee, much less rigidity, and quicker conviction referring to whether or not your commerce succeeded or no longer.

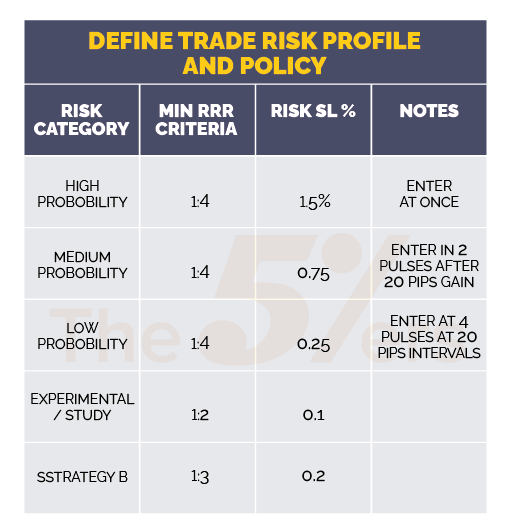

Outline Industry Possibility Profile and Coverage

Each and every commerce you propose will have to fall right into a menace profile definition class. Every class has its personal parameters for a way a lot menace will have to be taken.

For example, you’ll be able to set menace classes like this:

Admire your buying and selling plan

Respecting your buying and selling plan is a menace control necessity. Self-discipline when following your plan is vital for consistency as a result of, with out patience, you can not measure your effects. With out measured effects, it’s inconceivable to accomplish an effective forensic research that would let you enhance your decline and attach your menace control plan.

Cherry Pick out your trades. Much less is extra

Build up your buying and selling potency through deciding on most effective the most productive of your trades. Let overlooked indicators run with out you and keep away from being dragged into lengthy and uneven markets since you had entered in advance.

That is any other key component to in the end getting your buying and selling to be extra environment friendly and no more hectic.

Whilst within the commerce

While you’re within the commerce, Stay inspecting your chart and repeatedly assess the chance of your commerce.

Take a look at the clock and all the time Pay attention to the consultation hours. Additionally, regulate the industrial unlock calendar and the way and whilst you would possibly in all probability be uncovered to surprising fluctuation.

After you determine the days by which it’s essential to be at risk of those occasions, know precisely what you’ll do should you’re uncovered. It’s an important to have a plan for each and every other situation as your commerce evolves.

Put up commerce and publish consultation

As soon as a commerce has run its path, take an extended glance again and carry out an in-depth forensic evaluation of your efficiency. It’s necessary to all the time be on most sensible of your efficiency so you’ll be able to acknowledge any spaces of weak spot which can wish to be labored on.

In trades that went nicely and carried out in step with plan, there’ll nonetheless be puts the place you’ll be able to be informed from the a success revel in. In finding tactics to gift your self for a role nicely executed and all the time be pleased with your accomplishments.

Possibility Control Buying and selling Methods – The Backside Line

Be affected person and considerate, and paintings against developing a valid and dependable buying and selling plan. With it, you’ll all the time have a information thru your buying and selling occupation. A excellent menace control technique will also be your lifeline in instances of bother and a gentle hand in smoother markets. Paintings on it, consider it, and enhance it for an extended and extra productive buying and selling occupation.

👉 If you wish to obtain a call for participation to our reside webinars, buying and selling concepts, buying and selling technique, and top of the range foreign exchange articles, signal up for our E-newsletter.

👉 Click on right here to test our investment techniques.

👉 Don’t omit our the Forex market Buying and selling Concepts.

Practice us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView