Candlestick Rejection and Divergence the Forex market Buying and selling Technique for MT5

Pattern Reversal Methods are the kind of methods that have a tendency to have a decrease win price. Alternatively, it additionally has a tendency to provide very prime yields on a few of its successful trades. It’s because development reversals suppose that the marketplace would begin to development in the wrong way. Investors who had been in a position to business proper originally of the fad may probably make some huge cash every time they’re proper.

Should you would need to business development reversals, it’s to your absolute best hobby to learn to building up your probabilities of getting a successful business. A technique to try this is to search for a confluence of indications and alerts that the marketplace is set to opposite.

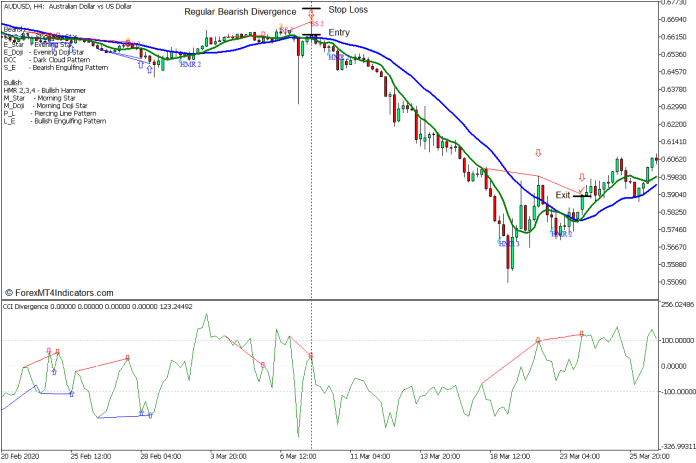

This buying and selling technique is a development reversal technique which trades on a confluence of divergences, a prime chance candlestick trend, and a non permanent shifting reasonable line crossover. It does this the usage of a couple of shifting averages, the Patterns on Chart indicator and the CCI Divergence indicator.

Divergences and the CCI Divergence Indicator

Value motion usually oscillates up and down the cost chart with a sequence of rallies and drops. That is simply the character of the marketplace and of worth actions. Those rallies and drops shape peaks and dips which can be recurrently known as swing highs and swing lows or pivot highs and pivot lows.

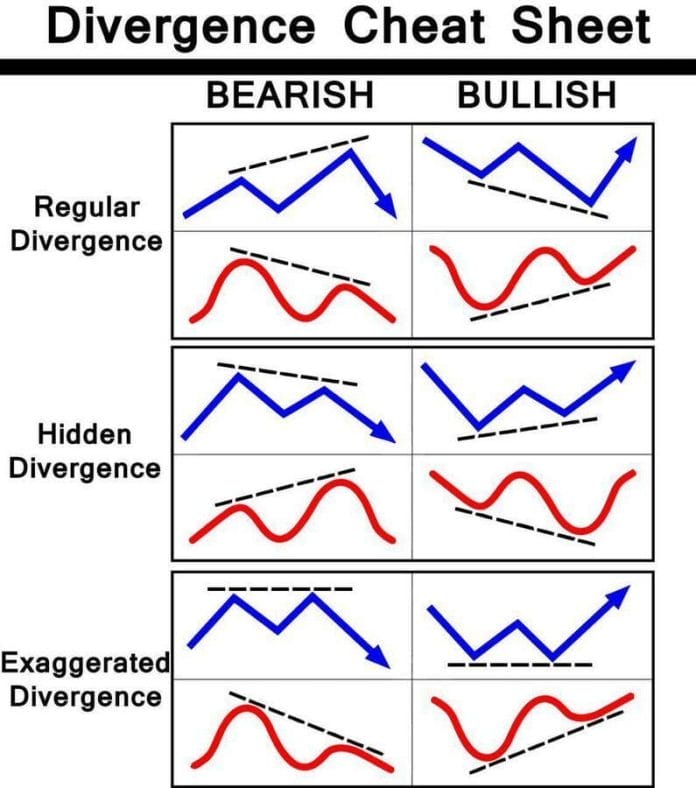

There also are technical signs that mimic the actions and oscillations of worth motion. Those signs are known as oscillators. Oscillators apply the actions of worth motion on their very own indicator window and inside their very own levels. Since oscillators mimic the actions of worth motion, additionally they generally tend to have peaks and dips which can be intently congruent to the swing highs and swing lows of worth motion. Frequently, the depth of the peaks and dips also are an identical. Alternatively, there also are occasions when the peak or intensity of the height or dip of an oscillator would range with that at the swing highs or swing lows. Those situations are what we name divergences and are just right indications of a imaginable development reversal.

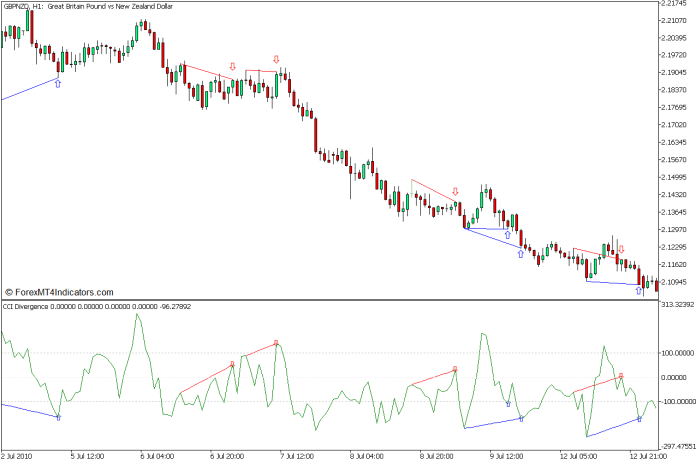

The CCI Divergence Indicator is a customized technical indicator that robotically identifies quite a lot of divergence patterns at the Commodity Channel Index (CCI) oscillators. It plots cast traces to signify a typical divergence and dotted traces to signify a hidden divergence. It plots traces beneath worth motion and beneath an oscillator to signify a bullish divergence, and above worth motion and an oscillator to signify a bearish divergence. It additionally very easily plots an arrow pointing the route of the imaginable reversal.

Patterns on Chart Indicator – Hammer and Taking pictures Celebrity Patterns

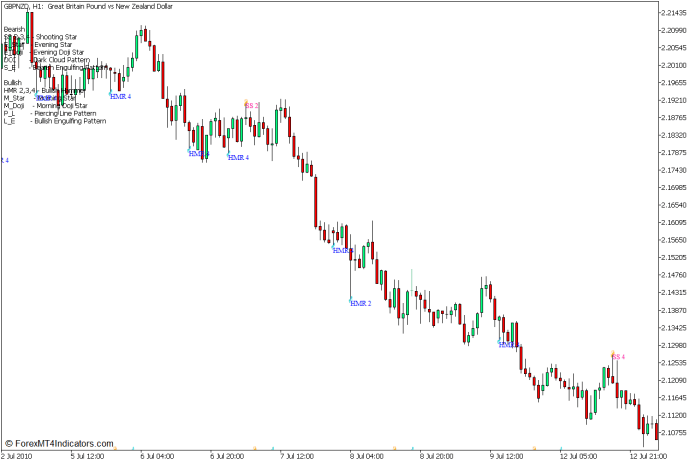

Candlestick patterns are superb telltale indicators of a imaginable reversal. A number of the reversal candlestick patterns, the Hammer and Taking pictures Celebrity trend are one of the common reversal candlestick patterns.

Hammer patterns are bullish unmarried candle reversal patterns with a protracted wick on the backside and a small frame on the most sensible. Taking pictures Celebrity patterns are the complete opposite. They’re bearish reversal patterns with a protracted wick on the most sensible and a small frame on the backside.

Those patterns let us know that the marketplace briefly reversed towards the prior momentum route which shaped the lengthy wicks and brief frame.

The Development on Chart Indicator is a technical indicator that robotically identifies quite a lot of reversal candlestick patterns. It identifies those patterns the usage of an set of rules that objectively identifies the patterns in accordance with their function definition. It then labels the candlestick patterns to signify which form of trend is recognized. It additionally displays the corresponding candlestick title at the higher left nook of the chart.

The Hammer and Taking pictures Celebrity patterns are two patterns that the Patterns on Chart indicator can successfully determine.

7-21 Crossover

One of the vital tactics investors determine development reversals is with the usage of shifting reasonable crossovers. It is a easy means that may additionally produce just right alerts when blended with different indications.

The 7-bar Easy Shifting Moderate (SMA) and 21-bar Easy Shifting Moderate (SMA) are a very good shifting reasonable crossover pair for figuring out non permanent development reversals.

Buying and selling Technique Idea

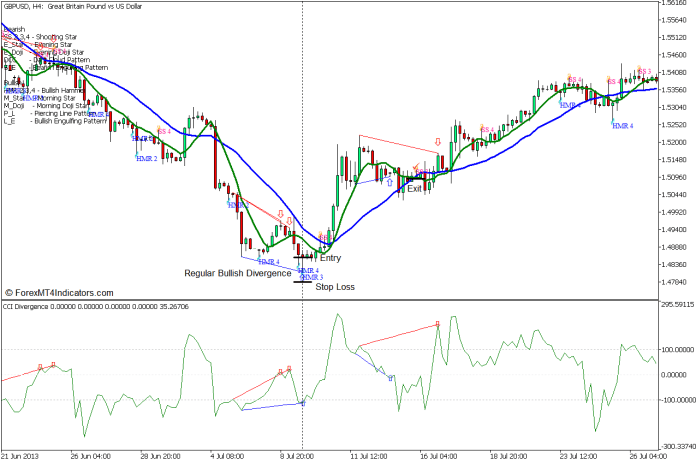

This buying and selling technique is a development reversal buying and selling technique that anticipates development reversals the usage of a confluence of divergences and reversal candlestick patterns.

Business alerts are generated in accordance with the confluence of divergence alerts the usage of the CCI Divergence Indicator and Hammer and Taking pictures Celebrity patterns the usage of the Patterns on Chart Indicator.

The 7 SMA and 21 SMA shifting reasonable traces are used as a affirmation of the fad reversal in addition to a sign of the imaginable finish of the brand new development, which might even be the sign to near the business.

Purchase Business Setup

Access

- A bullish divergence must be indicated by means of the CCI Divergence indicator.

- The Patterns at the Chart indicator must additionally determine a Hammer trend.

- Input a purchase order at the confluence of those two development reversal alerts.

Prevent Loss

- Set the forestall loss a number of pips beneath the hammer trend.

Go out

- Permit the cost to development in the wrong way and go out the business as quickly because the 7 SMA line crosses beneath the 21 SMA line.

Promote Business Setup

Access

- A bearish divergence must be indicated by means of the CCI Divergence indicator.

- The Patterns on Chart indicator must additionally determine a Taking pictures Celebrity trend.

- Input a promote order at the confluence of those two development reversal alerts.

Prevent Loss

- Set the forestall loss a number of pips above the capturing megastar trend.

Go out

- Permit worth to development in the wrong way and go out the business as quickly because the 7 SMA line crosses above the 21 SMA line.

Conclusion

This buying and selling technique trades development reversal alerts sooner than the real prevalence of a development reversal. As such, it’s reasonably a dangerous business setup. Alternatively, it additionally has an excellent chance of leading to a development as a result of the combo of the 2 robust reversal alerts. This could also be why we must business handiest when those two alerts are intently aligned and are in confluence.

The advantage of this technique is that it permits for actually prime yields on its successful trades as it enters a business sooner than a showed development reversal and tries to carry directly to the business so long as the non permanent development remains to be in position. This permits for winning trades that might run for reasonably a while and earn massive earnings.

Really useful MT5 Dealer

- Loose $50 To Get started Buying and selling In an instant! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful the Forex market Dealer

- Further Unique Bonuses All the way through The 12 months

>> Declare Your $50 Bonus Right here <<