Buyers Flock to Buck Forward of Powell

- Powell’s speech may supply insights into the course of rates of interest.

- The Financial institution of Japan may start decreasing its really extensive financial easing in a yr.

- Japan wishes steady salary expansion to reach inflation pushed by way of financial enlargement.

Nowadays’s USD/JPY outlook is bullish. The United States greenback bolstered, achieving a greater than two-month top. Additionally, it’s on course for its 6th consecutive week of positive factors. Significantly, traders are in quest of protection within the greenback as they watch for a speech from Federal Reserve Chair Jerome Powell. The speech will most likely supply insights into the course of rates of interest.

–Are you to be told about foreign exchange bonuses? Take a look at our detailed guide-

The Jackson Hollow Financial Coverage Symposium will host Powell’s cope with on financial coverage at 10:05 a.m. ET. Moreover, the speech will most likely resolve whether or not the Fed has concluded its charge hikes and the projected length of increased rates of interest.

In the meantime, maximum economists surveyed by way of Reuters expect that the BOJ will start decreasing its really extensive financial easing in a yr. Additionally, hypothesis about long term coverage adjustments has lessened since a marvel adjustment to the yield regulate final month.

All over the July 27-28 assembly, the BOJ altered its yield curve regulate technique. Because of this, this change lets in extra versatile will increase in rates of interest. The markets interpret this as a step in opposition to regularly taking out many years of stimulus.

In the meantime, Takumi Tsunoda from the Shinkin Central Financial institution Analysis Institute means that the BOJ may handle the present way till subsequent summer season. This way aligns with the uncertainty surrounding Japan’s salary developments for fiscal yr 2024, which is able to handiest transform obvious after spring.

Eastern policymakers emphasize the need of constant salary expansion to reach inflation pushed by way of financial enlargement.

USD/JPY key occasions as of late

Buyers eagerly wait for a speech from Fed chair Powell on the Jackson Hollow symposium. This speech will almost definitely have clues at the Fed’s rate of interest trail.

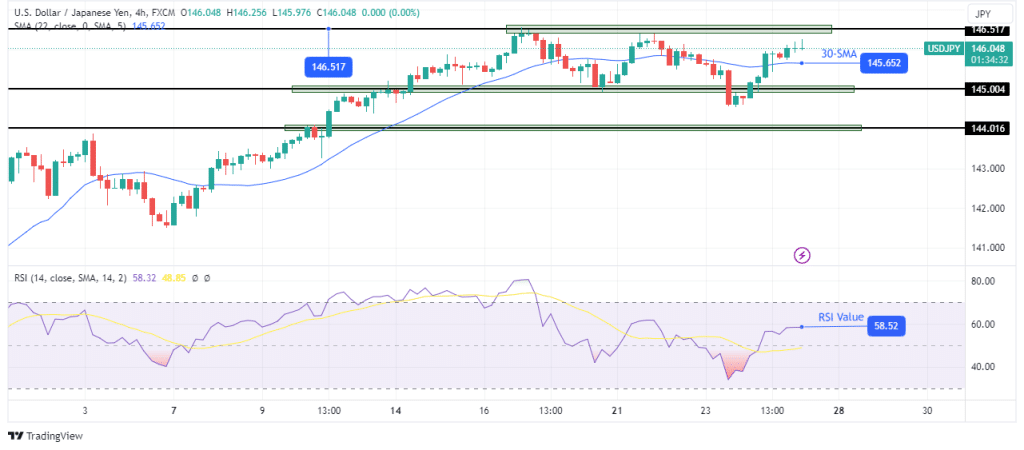

USD/JPY technical outlook: Bulls to problem 146.51 resistance.

At the charts, USD/JPY is reducing throughout the 30-SMA, appearing a loss of course. On the identical time, the cost oscillates in a variety with give a boost to at 145.00 and resistance at 146.51. This consolidation comes after a bullish development and may, due to this fact, be a pause sooner than the uptrend continues.

–Are you to be told extra about foreign exchange choices buying and selling? Take a look at our detailed guide-

Inside the vary, the cost trades above the 30-SMA, with the RSI in bullish territory above 50. Due to this fact, bulls may quickly retest the 146.51 vary resistance. A ruin above this stage would sign a continuation of the former bullish development.

Taking a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll have the funds for to take the top chance of dropping your cash.