BOC Anticipated to Ship a 25bps Hike

- America Federal Reserve unanimously determined to stay rates of interest unchanged in June.

- America added fewer jobs than anticipated ultimate month.

- Maximum economists expect the Financial institution of Canada will build up rates of interest via 0.25%.

The USD/CAD weekly forecast is somewhat bearish as buyers be expecting a hike from the Financial institution of Canada subsequent week. Alternatively, it’s essential to look at the tone of the financial institution.

Ups and downs of USD/CAD

The start of ultimate week used to be marked via vacations in the USA and Canada, leading to skinny buying and selling. Alternatively, the marketplace later picked up on Wednesday when the USA launched the FOMC assembly mins.

-If you have an interest in agents with Nasdaq, take a look at our detailed guide-

Of their June assembly, the USA Federal Reserve determined to stay rates of interest unchanged. This resolution permits policymakers to guage the need of long term charge hikes.

Alternatively, the largest transfer got here on Friday when the nonfarm payroll record got here out. Particularly, the USA added fewer jobs than anticipated which noticed USD/CAD pull again sharply from its weekly highs.

Subsequent week’s key occasions for USD/CAD

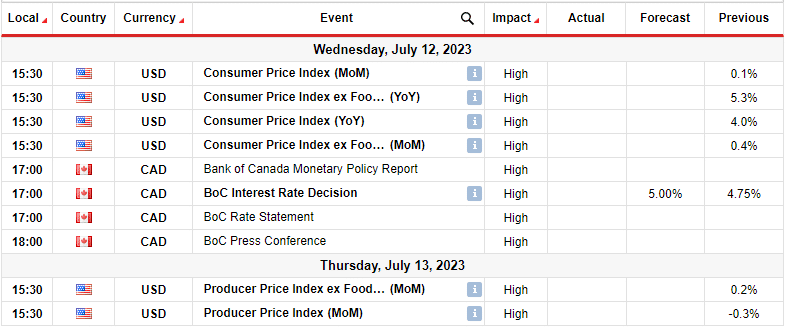

Subsequent week will probably be essential for USD/CAD as there will probably be a number of key financial releases from the USA and Canada. America will unencumber inflation knowledge that may have an effect on the outlook for Fed rates of interest. Alternatively, the Financial institution of Canada will hang its coverage assembly the place it could hike rates of interest.

In step with a Reuters ballot, maximum economists expect the Financial institution of Canada will build up rates of interest via 0.25% in its upcoming assembly on July 12. This could mark the second one consecutive assembly with a charge hike, bringing the velocity to five.00%. Additionally, economists be expecting the financial institution to take care of this charge all over 2024.

USD/CAD weekly technical forecast: Bulls face robust opposition at 1.3350.

At the day by day chart, USD/CAD driven above the 30-SMA in a surprising shift in sentiment. Alternatively, the cost may just no longer cross above the 1.3350 resistance stage as bears returned with a powerful bearish candle. However, the cost continues to be above the 30-SMA, an indication that bulls may nonetheless have a possibility to take over.

If the 30-SMA acts as toughen within the coming week, the cost will soar upper and most probably take out the 1.3350 resistance stage. This could transparent the trail for bulls to climb to the following resistance at 1.3600. Alternatively, if bears destroy underneath the 30-SMA, we may see a destroy underneath the 1.3201 and a go back of the former bearish transfer.

Having a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll have enough money to take the top chance of dropping your cash.