AUD/USD Weekly Forecast: Buck Vulnerable, Focal point on US CPI

- The RBA used to be no longer as hawkish as maximum had anticipated.

- Australia just lately reported higher-than-expected figures for Q1 inflation and employment.

- The greenback used to be susceptible after unemployment claims jumped.

The AUD/USD weekly forecast stays bullish. The greenback weak point may proceed subsequent week with a focal point on the United States inflation record.

Ups and downs of AUD/USD

The AUD/USD pair had a reasonably bearish week as markets absorbed the end result of the RBA coverage assembly. On Tuesday, the Reserve Financial institution of Australia held charges as anticipated. Alternatively, the central financial institution used to be no longer as hawkish as maximum had anticipated.

–Are you interested by finding out extra about crypto robots? Test our detailed guide-

Australia just lately reported higher-than-expected figures for Q1 inflation and employment. Consequently, economists had anticipated that the RBA would sign a conceivable fee hike. When they didn’t, the Aussie fell. In the meantime, the greenback used to be additionally susceptible after unemployment claims jumped, confirming easing exertions marketplace prerequisites.

Subsequent week’s key occasions for AUD/USD

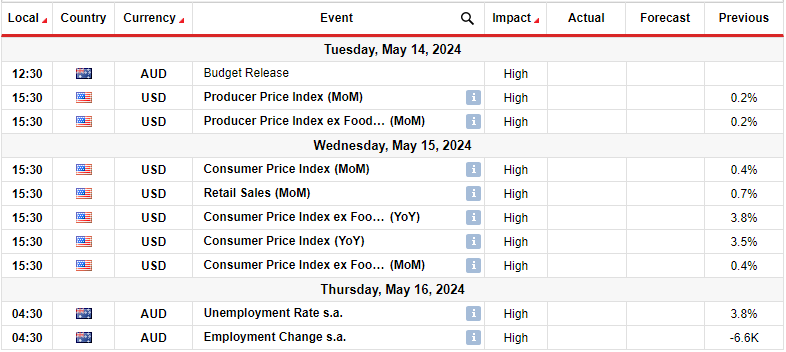

Primary stories from the United States subsequent week will come with inflation and retail gross sales. On the similar time, buyers will center of attention on Australia’s employment figures. The United States PPI and CPI figures will instruction manual the Federal Reserve on your next step to take referring to financial coverage. Upper-than-expected figures would imply additional delays in fee cuts. Then again, lower-than-expected figures would build up the danger of a fee reduce in September.

In the meantime, Australia’s employment figures will display the state of its exertions marketplace which has remained resilient.

AUD/USD weekly technical forecast: Bulls pause underneath the 0.6650 forged barrier

At the day by day chart, the prejudice for the AUD/USD worth is bullish as it sits above the 22-SMA, and the RSI is above 50. Alternatively, on a bigger scale, the fee has remained in a sideways transfer for a while now. It has most commonly traded between the 0.6475 beef up and the 0.6650 resistance degree.

–Are you interested by finding out extra about purchasing Dogecoin? Test our detailed guide-

Bears as soon as attempted to wreck out of this vary house however failed, creating a false breakout. Now, the fee is again to the resistance degree. The extent is robust as it lies between the 0.5 and zero.618 key Fib ranges. Subsequently, bulls face a forged barrier that would result in some other jump decrease.

Within the coming week, bulls will desire a vital catalyst to wreck previous this resistance zone. This is able to transparent the trail to the 0.6850 resistance degree. Alternatively, if the resistance holds company, the fee will most probably fall to retest the 0.6475 beef up.

Having a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll be able to manage to pay for to take the top possibility of shedding your cash