Alibaba Inventory Forecast for 2024 – BABA Technical Research

Alibaba Team Preserving Restricted (NYSE: BABA) stocks plummeted greater than 80% from October 2020 to October 2022 inclusive, shedding from 315 USD to 58 USD.

Their additional expansion didn’t instil self assurance in traders, and through mid-January 2024, the inventory retraced to the 2022 low.

Alternatively, two occasions adopted that can definitely have an effect on the Chinese language large’s inventory worth and revive investor hobby in its stocks. What’s all of it about? What do the mavens forecast? On 29 January 2024, we aimed to respond to those and different essential questions.

Creation to Alibaba Team

Alibaba Team Preserving Restricted is a Chinese language multi-industry conglomerate specialising in e-commerce, cloud computing, monetary products and services, virtual media, and generation. It was once based through Jack Ma in 1999. The corporate’s American depositary receipts (ADR) are indexed at the New York Inventory Change (NYSE). In October 2020, its marketplace capitalisation reached 780 billion USD, making it one of the vital global’s greatest public firms.

Primary trade spaces of Alibaba Team Preserving Restricted

- E-commerce. This essentially refers to platforms comparable to Alibaba, Taobao, and Tmall

- Cloud computing. Alibaba Cloud makes a speciality of cloud computing, AI applied sciences, Giant Knowledge, and IoT answers

- Virtual media and leisure. Initiatives comparable to Youku Tudou and Alibaba Photos are value bringing up on this section

- Monetary products and services. Ant Team, an organization affiliated with Alibaba Team Preserving Restricted, supplies virtual fee, lending, asset control, funding, and insurance coverage products and services

Causes for contemporary fluctuations in Alibaba’s inventory worth

In his public speech in October 2020, Jack Ma criticised China’s monetary gadget. That very same month, the Chinese language government scuttled Ant Team’s IPO, which will have been the sector’s greatest. It’s value noting that the subsidiary corporate deliberate to carry the preliminary public providing for 34 billion USD.

In December 2020, Chinese language regulators introduced an antitrust investigation into Alibaba Team Preserving Restricted, ensuing within the greatest high-quality in Chinese language historical past of two.8 billion USD being imposed at the large. As well as, the corporate was once obliged to switch the cooperation coverage with traders on its platforms and toughen its interior regulate gadget.

Amid those occasions, from 28 October 2020 to 24 October 2022, Alibaba Team Preserving Restricted inventory plummeted through 81.6% from 315 USD to 58 USD in line with unit.

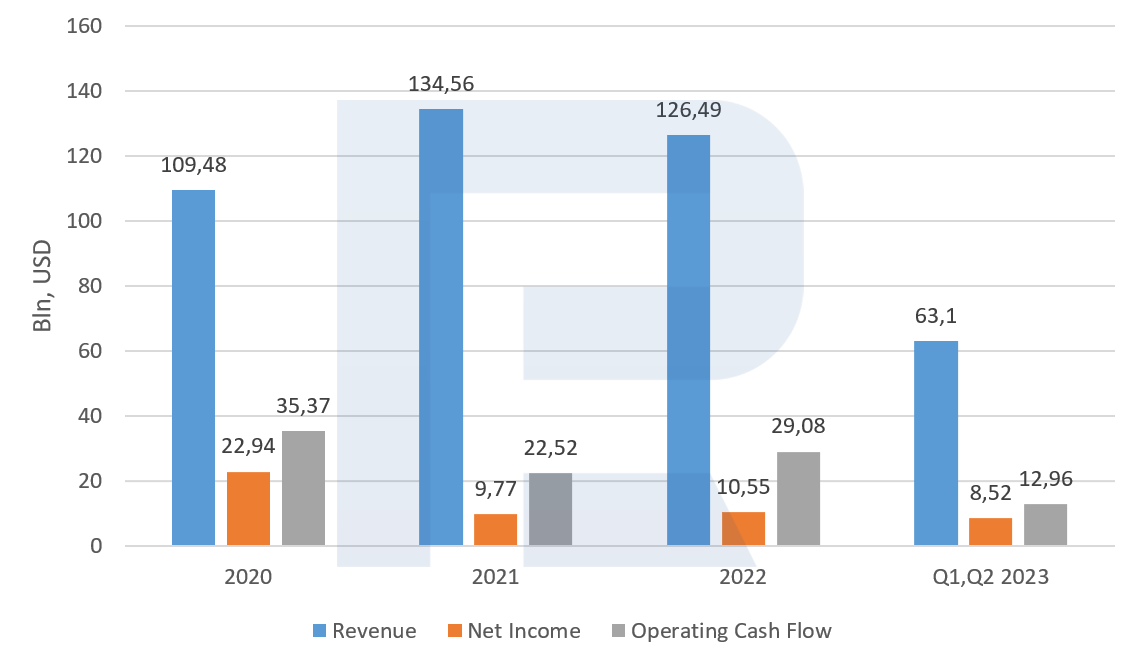

Monetary well being and function metrics of Alibaba Team Preserving

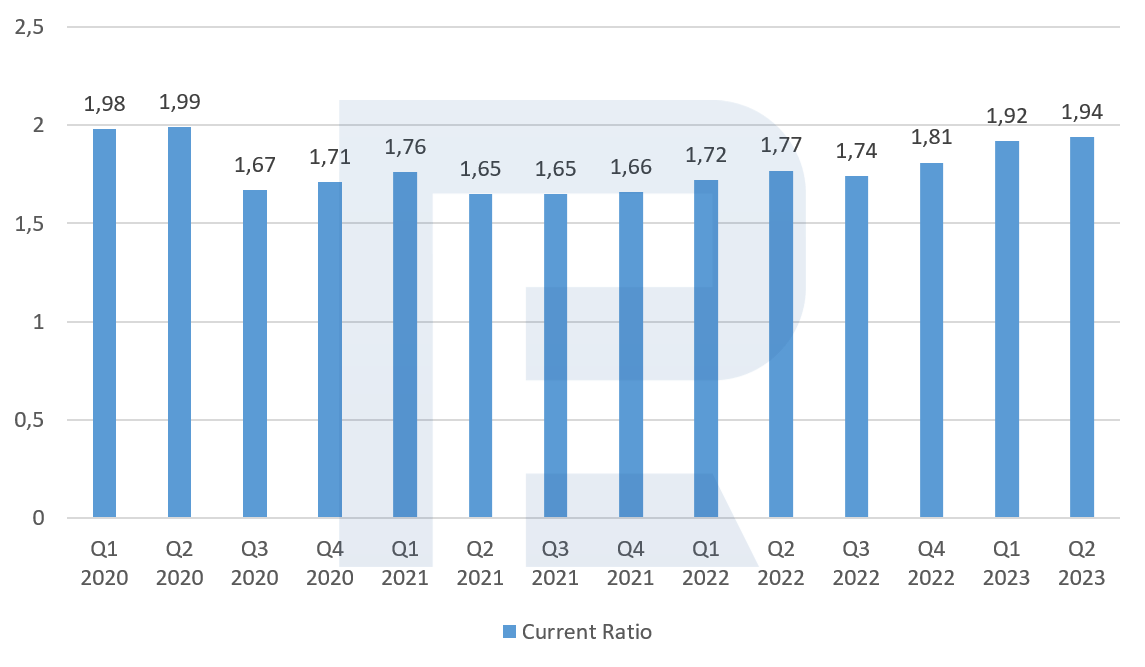

To achieve insights into Alibaba Team Preserving Restricted’s monetary place, we will be able to supply knowledge on some signs over the duration from Q1 2020 to Q2 2023:

- Income. Its expansion regularly signifies just right trade well being

- Internet Source of revenue. The corporate’s quantity of benefit, much less all bills and taxes, usually demonstrates the potency of price control

- Running Money Waft. The volume of price range the corporate receives from its core trade operations displays liquidity and its talent to generate price range

- Present Ratio. This ratio represents the connection between present belongings and present liabilities. A worth exceeding 1 signifies that the corporate has enough present belongings to satisfy its present responsibilities

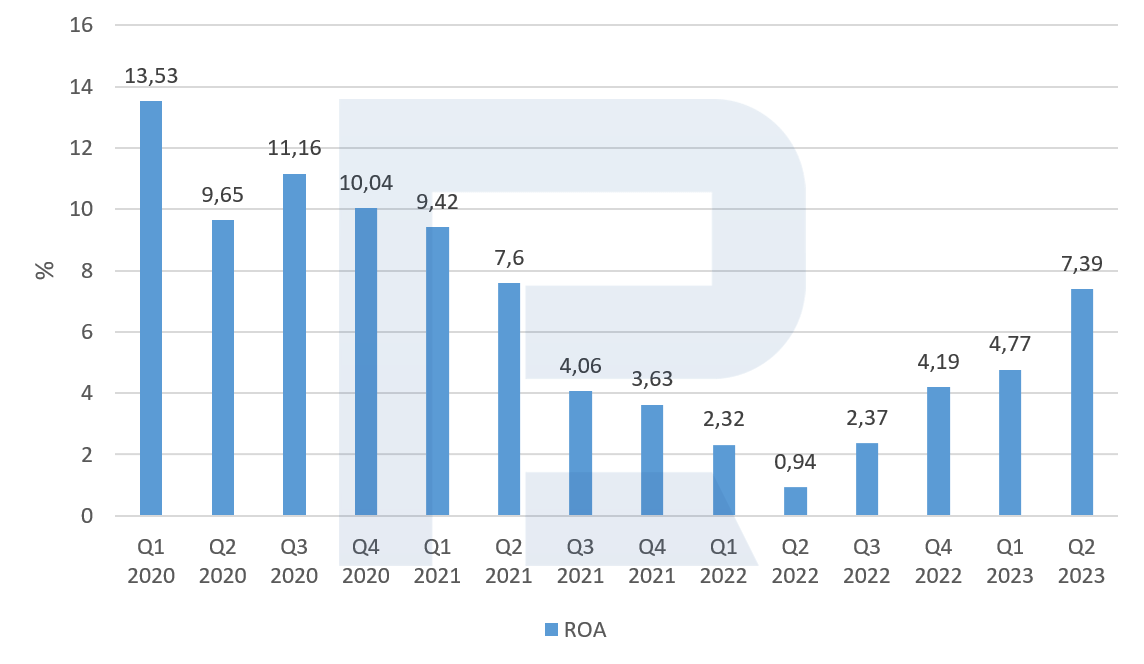

- Go back on Belongings (ROA). The ratio of internet source of revenue to general belongings signifies the potency with which the corporate utilises its belongings to generate benefit

The above statistics point out that 2021 and 2022 have been difficult years for the Chinese language large, whilst 2023 noticed certain dynamics. Given this, it may be assumed that the corporate’s monetary place would possibly proceed to toughen in 2024.

China allocates price range to improve the inventory marketplace

The Shanghai Shenzhen CSI 300 (SSE: 000300) inventory index, which displays the efficiency of the 300 greatest firms traded at the Shanghai and Shenzhen inventory exchanges, plummeted through 21.7% from 30 January 2023 to twenty-five January 2024. When put next, the S&P 500 received 21.1% all over this era. China’s govt plans to allocate price range to shop for stocks to improve the inventory marketplace.

In step with Bloomberg, the rustic’s government intend to ascertain a stabilisation fund for about 278 billion USD to buy stocks of Chinese language firms during the Hong Kong alternate gadget.

This plan targets to halt the marketplace decline and repair investor self assurance amidst a number of demanding situations within the Chinese language financial system. Those come with an actual property marketplace disaster, dwindling shopper sentiment, declining overseas investments, and lowering self assurance amongst native companies. Government also are making an allowance for different supportive measures, which may well be introduced later.

Despite the fact that the improve plan has no longer been licensed but, the CSI 300 already received 4.1% on rumours from 23 to twenty-five January. Alibaba Team Preserving Restricted’s inventory replied with a 9.6% build up. Alternatively, it’s value noting that the stocks had another reason to upward push: the co-founders purchased an important selection of corporate stocks.

Jack Ma and Joseph Tsai’s funding strikes

On 23 January 2023, it was once introduced that Jack Ma and Joseph Tsai bought 200 million USD value of stocks in Alibaba Team Preserving Restricted. Blue Pool, owned through Tsai, received stocks value 150 million USD, and Jack Ma bought inventory value 50 million USD.

The purchases have been made in This fall 2023, when the inventory worth of the Chinese language corporate averaged 78.40 USD. The New York Occasions suggests that those purchases may sign the co-founders’ trust within the undervaluation of Alibaba’s trade following an over 80% decline within the inventory worth.

Alibaba inventory research

Alibaba Team Preserving Restricted’s inventory has been buying and selling between 80 to 120 USD since March 2022. Breaking beneath its decrease boundary on 19 September 2022, the quotes reached a low of 58 USD. Surpassing the 80 USD stage on 28 November 2022, they retraced to the former buying and selling vary and persevered to transport inside of it till 12 November 2023.

Every other breakout of the decrease boundary happened on 13 November. However information of presidency incentives and Jack Ma and Joseph Tsai’s purchases within the Chinese language conglomerate halted a decline in inventory worth, propelling it from 67 USD to 74 USD.

It can be assumed that if the quotes damage above the resistance stage of 80 USD once more, they could succeed in the higher vary boundary at 120 USD, pushed through certain information. Another way, we will be able to most probably see a take a look at of the low at 58 USD once more.

Alibaba Team Preserving Restricted inventory research*

Knowledgeable and analyst forecasts for Alibaba inventory worth for 2024

- In step with Barchart, 14 out of 12 analysts rated Alibaba Team Preserving Restricted stocks as Robust Purchase and two as Dangle, with a mean worth goal of 117.75 USD

- According to the guidelines from MarketBeat, 13 out of 15 mavens assigned a Purchase ranking to the inventory, whilst two gave a Dangle ranking, with a mean worth goal of 119.80 USD

- In step with TipRanks, 18 out of 20 consultants designated a Purchase ranking for the Chinese language large’s inventory, whilst 2 gave a Dangle advice, with a mean worth goal of 118.60 USD

- As Inventory Research reviews, 12 out of 23 analysts rated the stocks as Robust Purchase, 4 as Purchase, two as Dangle, 3 as Promote, and two as Robust Promote. The typical 12-month worth forecast for the corporate’s inventory is 128.39 USD

Investor methods according to Alibaba inventory predictions

In regards to the Chinese language inventory marketplace and Alibaba Team Preserving Restricted stocks, a number of funding concepts for 2024 will also be regarded as:

- Rate of interest aid. Not like america, the place the Federal Reserve has raised the rate of interest since 2022, the Other people’s Financial institution of China is pursuing a comfortable financial coverage. The rate of interest has been diminished from 3.85% in January 2022 to three.45% in January 2023. According to the December 2023 effects, China is experiencing deflation of −0.7%, prompting the regulator to not tighten financial coverage

- Financial stimulus. Deflation in China will pressure the federal government to introduce stimulus measures to restore the financial system, which may definitely impact the rustic’s inventory marketplace and probably the most outstanding native public firms, together with Alibaba Team Preserving Restricted

- World financial expansion. America, EU, UK, Canada, and Australia regulators evaded elevating rates of interest at their remaining conferences. Marketplace contributors be expecting financial insurance policies to be eased in those international locations, probably definitely impacting the nationwide economies. For the reason that China is among the key industry companions of every of those international locations, it can be assumed that certain dynamics of their economies could have a really helpful impact on China’s financial system, probably growing beneficial stipulations for an build up in imports of products and products and services from China

Conclusion: Synthesising Alibaba inventory predictions

For Alibaba Team Preserving Restricted’s shares in 2024, there are certain elements that can give a contribution to the expansion in their worth. Those come with incentives from the Chinese language govt and demanding securities purchases through the corporate’s founders.

The conglomerate’s monetary situation research displays bettering statistics, with earnings regularly returning to the 2020 ranges. Moreover, mavens from the discussed platforms expect an build up within the costs of those shares.

Making an allowance for these kind of elements, a good information background is almost definitely forming across the Chinese language corporate in 2024, which can most probably have an effect on the price of its securities definitely.

FAQ

Making an investment in Alibaba, like all inventory, carries each attainable rewards and dangers. The corporate’s powerful place in e-commerce and generation, specifically within the Asian marketplace, gives expansion attainable. Alternatively, traders must believe elements comparable to regulatory dangers in China, marketplace volatility, and international financial stipulations. Carrying out private analysis or consulting with a monetary consultant to decide if Alibaba aligns together with your funding targets and chance tolerance is very important.

To put money into Alibaba inventory, you’ll be able to apply those basic steps:

1. Open a buying and selling account: select a brokerage account that fits your buying and selling wishes. As an example, RoboForex gives a number of account varieties for various platforms.

2. Make a deposit: fund your account with the minimal required deposit. For RoboForex, the minimal first deposit begins from 10 USD, relying for your account kind.

3. Choose Alibaba inventory: analysis and select Alibaba (BABA) as your required funding.

4. Come to a decision on funding quantity: decide the volume of Alibaba inventory you wish to have to shop for according to your funds and funding technique.

5. Execute the industry: log into your buying and selling platform, make a selection Alibaba inventory, and position your purchase order. You’ll make a choice from other order varieties like marketplace, prohibit, or forestall orders.

6. Track your funding: stay observe of your Alibaba inventory place, analyse efficiency, and make changes as wanted.

For more info, consult with the RoboForex site right here.

Quite a lot of mavens and analysts ‘ forecasts for Alibaba’s inventory worth in 2024 point out a in most cases certain outlook. Maximum analysts from Barchart, MarketBeat, TipRanks, and Inventory Research have given the inventory scores starting from “Robust Purchase” to “Dangle.” In step with Inventory Research, the typical worth objectives from those resources range, with the easiest being 128.39 USD. General, whilst a definitive build up in Alibaba’s inventory worth can’t be assured, the analyst consensus leans against a good outlook for 2024. Take into accout, inventory marketplace predictions are inherently unsure, and carrying out thorough analysis or consulting with a monetary consultant is very important.

You’ll discover a reside worth chart of Alibaba (BABA) at the R StocksTrader platform. To get right of entry to this, merely cross to the platform and use the quest box to kind “Alibaba.” This provides you with Alibaba’s present and ancient inventory worth knowledge.

As of 2023, Alibaba had a dividend yield of one.38% and paid 1.00 USD in line with proportion in dividends. The dividends are distributed every year, with the remaining ex-dividend date being 20 December 2023. Buyers must be aware that dividend insurance policies can alternate, so staying up to date with the corporate’s newest monetary reviews and bulletins is recommended for probably the most present data.

* – The TradingView platform provides the charts on this article, providing a flexible set of equipment for examining monetary markets. Serving as a state-of-the-art on-line marketplace knowledge charting provider, TradingView permits customers to have interaction in technical research, discover monetary knowledge, and connect to different investors and traders. Moreover, it supplies precious steerage on how you can learn foreign exchange financial calendar successfully and gives insights into different monetary belongings.