Your Existence Expectancy Is dependent A great deal On Wealth And Location

The older you get, the extra you’ll price lifestyles as a result of you could have much less of it. If you wish to are living longer, you will have to intention to develop richer and are living in a extra hospitable position. As you’ll see on this article, the correlation with lifestyles expectancy, wealth, and site is robust.

Unfortunately, lifestyles expectancy at beginning fell in 2021 to its lowest stage since 1996 in keeping with the Facilities for Illness Keep watch over and Prevention. This virtually one-year decline in lifestyles expectancy in 2021 adopted a 1.8-year lifestyles expectancy decline from 2019 to 2020.

The CDC attributes more or less part of the lifestyles expectancy decline to COVID-19. As a result of the virus, more or less two decades of lifestyles expectancy development used to be burnt up.

Different causes for the dramatic lifestyles expectancy declines come with: Unintended accidents (16%), which come with drug overdoses, middle illness (4.1%), persistent liver illness and cirrhosis (3%), and suicide (2.1%).

Given the pandemic has waned, we will be able to be expecting lifestyles expectancy to stabilize and even rebound again to an upward development. On the other hand, as anyone who values lifestyles an excessive amount of to go away dwelling to probability, let’s discover direct answers to making improvements to our personal lifestyles expectancy.

Easy Tactics To Building up Existence Expectancy

In keeping with the above reasons for shorter lifestyles expectations, if we wish to are living longer, we will have to do the next:

- Give a boost to our psychological well being to cut back our probabilities of suicide

- Encompass your self with sure family and friends to fight loneliness

- Consume more healthy and workout extra to cut back our threat of middle illness

- Drink much less alcohol to cut back our threat of liver illness

- Forestall taking unlawful medicine and eat felony medicine moderately

- Force much less, power extra sparsely, take part in lower-risk actions

Lovely easy proper? The opposite transparent technique to expanding lifestyles expectancy is to get richer. You’ll achieve this via signing up for my weekly publication and studying my guide on development extra wealth.

Now let’s have a look at lifestyles expectancy differentials via state. The variations are stunning.

Give a boost to Your Existence Expectancy Via Residing In The Proper State

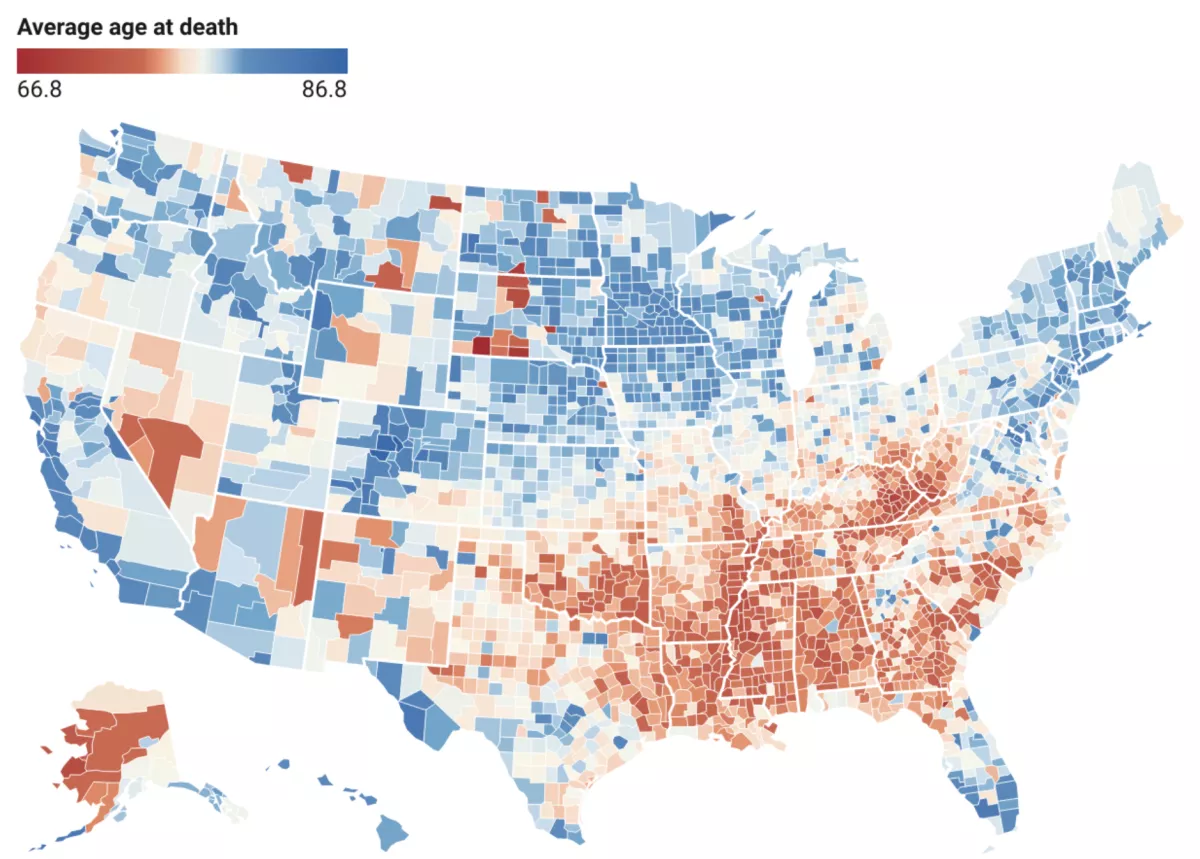

In line with this lifestyles expectancy chart via the World Well being Knowledge Alternate and Jeremy Ney, it’s transparent some citizens in sure states are living longer.

We’re speaking a couple of 20-year lifestyles expectancy hole between states with the shortest lifestyles expectations and states with the longest lifestyles expectations! Due to this fact, if you wish to build up your lifestyles expectancy, believe relocating to states with the absolute best moderate age at dying.

Positive, it can be costlier to are living in California than Mississippi, however how a lot is lifestyles value to you? The place you wish to have to are living is as much as you. This isn’t a piece of writing about the place you will have to are living. As a substitute, that is a piece of writing about the place it’s possible you’ll wish to are living to increase your lifestyles. Each state has its professionals and cons.

It can be too tricky to relocate all over your running years, until you’re ready to paintings remotely. On the other hand, relocating to a high-life-expectancy state for retirement is also extra possible. Whilst you’re older, you’ll most probably be extra motivated to increase your lifestyles as neatly.

States With The Best Existence Expectations

To are living longer, chances are you’ll wish to are living in Hawaii, California, Washington, Colorado, Minnesota, Southern Florida, and the Northeastern States. Citizens in Utah, Iowa, and Wisconsin even have slightly lengthy lifestyles expectations.

My favourite state is Hawaii. Once I step off the aircraft at Honolulu World Airport, my pressure stage drops via any other 3 issues out of ten. There’s one thing magical concerning the smell of plumeria flora and feeling the ocean breeze that makes dwelling in Hawaii so glorious.

As a resident of San Francisco, California since 2001, I’m satisfied dwelling right here as neatly. San Francisco is among the least expensive global towns on this planet with a torrent of fortune-making alternatives.

Even supposing each large town has its issues, I benefit from the nature, scenic good looks, range, actions, and delicacies of San Francisco. Having two babies has additionally greater my appreciation of dwelling in San Francisco given we don’t need to fly any place to have an excellent holiday.

States With The Lowest Existence Expectations

If you’re OK with dwelling a probably shorter lifestyles, chances are you’ll wish to are living in Alaska, Nevada, Northern Arizona, New Mexico, Northern and Japanese Texas, Oklahoma, Arkansas, Louisiana, Mississippi, Alabama, Georgia, Northern Florida, Tennessee, Kentucky, South Carolina, North Carolina, and West Virginia.

My favourite states on this team are Alaska and Louisiana. Mountaineering and fishing in Alaska are superb stories. I extremely counsel visiting Mt. Denali Nationwide Park for the natural world. I’ll by no means fail to remember taking a ship aircraft to a couple far off lake and tenting with no person round for masses of miles.

I additionally love Louisiana as a result of New Orleans. The meals is improbable, the tradition is glorious, and so are the folks. I’m positive if I lived in New Orleans, I’d achieve a minimum of ten kilos and nonetheless be at liberty. Sugar-coated beignets full of jam or chocolate for the win!

In case you are living in a state with a low lifestyles expectancy, a minimum of get an reasonably priced time period lifestyles insurance plans to offer protection to your circle of relatives. It’s the accountable factor to do when you have dependents.

Why Are Existence Expectations So Other Via State?

In line with Robert H. Shmerling of Harvard Clinical Faculty, “American citizens with the shortest lifestyles expectations have a tendency to have essentially the most poverty, face essentially the most meals lack of confidence, and feature much less or no get entry to to healthcare. Moreover, teams with decrease lifestyles expectancy have a tendency to have higher-risk jobs that may’t be carried out nearly, are living in additional crowded settings, and feature much less get entry to to vaccination, which will increase the chance of changing into in poor health with or demise of COVID-19.”

No matter your perspectives on vaccinations are, there does obviously appear to be a correlation with increased vaccination charges and longer lifestyles expectations.

Coverage selections on the state stage subject.

Social Determinants Of Well being

The place you are living would possibly have an effect on what the CDC calls “the social determinants of well being” — “financial insurance policies and techniques, construction agendas, social norms, social insurance policies, racism, local weather exchange and political techniques.”

As an example, right here in San Francisco, virtually no person smokes. Due to this fact, there may be larger force on you not to smoke as neatly. In Los Angeles, there are super-fit folks in every single place given the consistent sunshine and leisure scene. Because of this, you’re feeling extra motivated to stick in form.

Given it is a private finance web page, what I’m maximum excited by is the correlation between wealth and lifestyles expectancy. I wish to know whether or not it’s value grinding exhausting to make and save as a lot cash as conceivable. Or whether or not the serious pursuit of cash will in the end result in a poorer way of life.

I consider within the easy speculation that the wealthier you might be, the longer your lifestyles expectancy because of larger schooling and higher clinical services and products. Let’s check out source of revenue and wealth via state and examine the information to lifestyles expectations via state.

Reasonable Family Source of revenue Via State

Underneath is a map of the common family source of revenue via state. As you’ll see beneath, there’s a excessive correlation between longer lifestyles expectations and better moderate family source of revenue. The common family source of revenue levels from $60,923 to $127,264 as of 2019. For 2023, we will be able to suppose 10% increased source of revenue levels.

The southeastern states all have the bottom moderate family earning in The united states. Montana could also be one of the most lowest family source of revenue states, alternatively its lifestyles expectancy is moderate. Therefore, just right on Montana for offering lifestyles extending insurance policies and social customs.

Virginia As Evidence Of Correlation Between Source of revenue And Existence Expectancy

The state that fascinates me essentially the most is Virginia, the state the place I went to school and faculty. I attended to McLean Prime Faculty in Northern Virginia and graduated from William & Mary in Williamsburg, southeastern Virginia.

Virginia has one of the most absolute best moderate family earning in The united states, but is a combined bag on the subject of lifestyles expectancy. Wealth is targeted in Northern Virginia, close to Washington D.C, the place lifestyles expectancy is excessive. On the other hand, the nearer you get to southwestern Virginia, the poorer its citizens and the decrease the lifestyles expectancy.

Therefore, I see Virginia as an excellent instance to show the sturdy correlation between lifestyles expectancy and source of revenue. I visited all corners of Virginia all over my highschool and faculty years, and may obviously see the variations in wealth and well being around the state.

The larger your source of revenue, the better it’s to have the funds for healthcare, are living in a pleasing area, consume more healthy meals, and pay for schooling.

The use of an excessive instance, some households I do know pay greater than $75,000 a 12 months for personal concierge well being carrier. Discuss an unaffordable luxurious for many households.

Reasonable Web Value Via State

Along with having a look at family source of revenue via state, let’s have a look at the common web value via state in keeping with Empower. I’ve used Empower’s (previously referred to as Private Capital) unfastened monetary gear to trace my web value since 2012 and used to be a shareholder.

As soon as once more, you’ll see a excessive correlation between lifestyles expectancy and web value. The states with increased moderate web worths have increased lifestyles expectations and vice versa.

On the finish of the day, you wish to have to construct as massive a web value as conceivable with a purpose to generate as a lot passive source of revenue as conceivable. As a result of sooner or later, we will be able to all tire or be not able to paintings. If you’re out of labor or not able to paintings, your lifestyles expectancy would possibly endure.

| Rank | State | Quantity |

| 1 | California | $884,003 |

| 2 | Connecticut | $873,746 |

| 3 | Washington | $865,309 |

| 4 | New Jersey | $810,106 |

| 5 | Massachusetts | $787,154 |

| 6 | New Hampshire | $735,968 |

| 7 | Vermont | $730,730 |

| 8 | Virginia | $716,643 |

| 9 | Colorado | $711,968 |

| 10 | Illinois | $690,464 |

| 11 | New York | $690,037 |

| 12 | Oregon | $666,247 |

| 13 | North Carolina | $653,513 |

| 14 | Alaska | $652,999 |

| 15 | Maryland | $650,616 |

| 16 | Minnesota | $648,178 |

| 17 | Pennsylvania | $636,880 |

| 18 | Nevada | $636,385 |

| 19 | Texas | $634,048 |

| 20 | Idaho | $626,599 |

| 21 | Florida | $619,275 |

| 22 | South Dakota | $614,059 |

| 23 | Washington, D.C. | $611,898 |

| 24 | Arizona | $605,953 |

| 25 | Iowa | $600,063 |

| 26 | South Carolina | $587,075 |

| 27 | Georgia | $568,001 |

| 28 | New Mexico | $553,107 |

| 29 | Wisconsin | $553,086 |

| 30 | Michigan | $550,298 |

| 31 | Ohio | $545,090 |

| 32 | Kentucky | $544,334 |

| 33 | Delaware | $542,743 |

| 34 | Tennessee | $530,092 |

| 35 | Kansas | $523,916 |

| 36 | Rhode Island | $523,710 |

| 37 | Hawaii | $518,417 |

| 38 | Wyoming | $516,292 |

| 39 | Nebraska | $504,347 |

| 40 | Missouri | $504,319 |

| 41 | Indiana | $497,440 |

| 42 | Maine | $494,845 |

| 43 | Montana | $490,433 |

| 44 | Alabama | $481,228 |

| 45 | Utah | $474,093 |

| 46 | Louisiana | $459,770 |

| 47 | Oklahoma | $448,494 |

| 48 | Arkansas | $439,790 |

| 49 | Mississippi | $407,691 |

| 50 | West Virginia | $376,690 |

| 51 | North Dakota | $339,955 |

Outlier States With Susceptible Correlation With Web Value And Existence Expectancy

North Carolina, Alaska, Nevada, Texas Underperforming

The most important outliers above are North Carolina (#13 rank, $653,513 web value), Alaska (#14 rank, $652,999 web value), Nevada (#18 rank, $636,385 web value), and Texas (#19 rank, $634,048 web value). Regardless of slightly excessive moderate web worths, the lifestyles expectations in those states are beneath moderate.

We will be able to make the idea that once a definite stage of web value, cash doesn’t subject as a lot if state insurance policies and social influences aren’t conducive to more healthy life.

As an example, of the 20 states with the worst lifestyles expectations, 8 are a number of the 12 states that experience no longer carried out Medicaid growth below the Inexpensive Care Act.

Comparable: The Unhappiest Towns In The united states Based totally On A Wealth Realty Ratio

Hawaii and North Dakota Outperforming

At the turn aspect, the common web value in Hawaii is handiest $518,417 (#17 rank), alternatively, Hawaii citizens are living the longest. One may argue the slower way of life, higher year-around climate, state insurance policies, and more healthy social influences are the explanations for the lifestyles expectancy outperformance.

Throughout the pandemic, for instance, Hawaii barred vacationers and different non-essential vacationers from coming to their islands. No different state took such drastic measures to offer protection to its voters from the virus.

North Dakota ($339,955 web value) could also be outperforming at the lifestyles expectancy entrance. Regardless of being the state with the bottom web value within the nation, its general lifestyles expectancy is ready moderate.

In the end, one of the most biggest determinants of a better web value is proudly owning your number one place of abode. It’s no twist of fate the states with the absolute best web worths even have the absolute best median house costs. Therefore, if you wish to construct extra wealth, personal actual property.

How A lot Would You Pay To Are living Longer?

The lifestyles expectancy unfold between states with the absolute best and lowest lifestyles expectations is between 10 to two decades. You’ve were given to invite your self how a lot you’d be prepared to pay to have 10 to two decades extra of lifestyles?

At age 45, I’d be prepared to surrender 70% of my web value for 10 extra years of lifestyles and 90% of my web value for 20 extra years of lifestyles. I’ve thought to be giving up all my web value to are living an additional 20 wholesome years, alternatively, then I wouldn’t be capable to maintain my circle of relatives.

If lifestyles is beneficial, paying extra to are living in a dear town and state is worthwhile. For many who can not have the funds for to are living in the most costly towns and states, just right factor there’s a plethora of lower-cost choices comparable to Colorado, Minnesota, Iowa, and Southern Florida.

Underneath is a tragic chart that presentations the US spending essentially the most consistent with capita on well being whilst having the bottom lifestyles expectancy among international locations with an identical GDP consistent with capita.

Make investments In Low Value, Prime Existence Expectancy States

As the common age of American citizens will get older because of declining beginning charges, the investor in me thinks there will probably be a better waft of capital to states with increased lifestyles expectations. Because of this, chances are you’ll wish to put money into actual property and firms primarily based in states with the absolute best lifestyles expectations.

Particularly, you wish to have to concentrate on making an investment in lower-cost states with excessive lifestyles expectations. Those states are: Colorado, Nebraska, Minnesota, Wisconsin, Iowa, and Michigan.

Upper lifestyles expectations additionally create the will for extra service-related companies that cater to the aged. Therefore, investments in retirement houses, group dwelling houses, minimal impact wearing amenities, wellness facilities, and leisure will have to increase.

Residing Longer In Hawaii Is My Purpose

We plan to retire to Hawaii the place part my circle of relatives is from.

The issue is making the transfer since we’ve grown roots in California since 2001. Our window of alternative is also in 2025, when our daughter is eligible for kindergarten. If 2025 doesn’t paintings, we will be able to believe 2031, when our son is eligible for highschool.

Given the sturdy correlation between wealth and lifestyles expectancy, I now have an extra motivation to write extra books and articles about easy methods to construct extra wealth. Longer lifestyles expectations result in larger happiness and extra contributions to society.

Now those are issues value dwelling for!

Reader Questions and Tips

Do you consider there’s a sturdy correlation with wealth, location, social influences and lifestyles expectancy? What do you suppose are the largest causes for such massive lifestyles expectancy discrepancies amongst states? What are a few things you intend to do to extend your lifestyles expectancy?

Examine lifestyles insurance coverage quotes in a single position at PolicyGenius. Each my spouse and I were given new 20-year time period insurance policies with PolicyGenius all over the pandemic and we really feel extra at peace. Regardless of the place you are living or how wealthy you might be, lifestyles isn’t assured.

For extra nuanced private finance content material, sign up for 60,000+ others and join the unfastened Monetary Samurai publication and posts by way of email. Monetary Samurai is among the biggest independently-owned private finance websites that began in 2009.