Which Treasury to Purchase Whilst Maintaining Your Taxes Easy

Many of us are taken with purchasing Treasuries however they hesitate as a result of they don’t wish to complicate their taxes. That’s a sound worry. How a lot purchasing Treasuries will complicate your taxes will depend on which Treasuries you purchase and the way you purchase them.

We pass from the most simple to probably the most sophisticated on this submit. It’s higher to learn to stroll earlier than you run whilst you aren’t aware of how taxes on Treasuries paintings.

No Worries in Tax-Advantaged Accounts

Purchasing Treasuries in a tax-advantaged account doesn’t impact your taxes. Those tax-advantaged accounts come with place of work retirement accounts comparable to 401k or 403b, Conventional IRA, Roth IRA, or HSA. You don’t pay tax whilst you purchase, grasp, or promote investments inside of a tax-advantaged account. Taxes on withdrawals from those accounts rely best at the account kind. It doesn’t subject what investments you purchase or how you purchase them in tax-advantaged accounts.

It makes no distinction relating to taxes whether or not you purchase Treasury Expenses, Notes, or Bonds, whether or not you purchase common Treasuries or TIPS, whether or not you purchase a brand new challenge thru an public sale otherwise you purchase an present bond at the secondary marketplace, or whether or not you grasp to adulthood otherwise you promote earlier than adulthood at the secondary marketplace. Purchase or promote on your center’s content material whilst you’re in a tax-advantaged account. See How To Purchase Treasury Expenses & Notes With out Rate at On-line Agents and How one can Purchase Treasury Expenses & Notes At the Secondary Marketplace.

Tax therapies are other best whilst you purchase Treasuries out of doors tax-advantaged accounts.

Dangle Treasury Expenses to Adulthood

Taxes out of doors tax-advantaged accounts also are simple if you happen to best purchase Treasury Expenses and grasp them to adulthood.

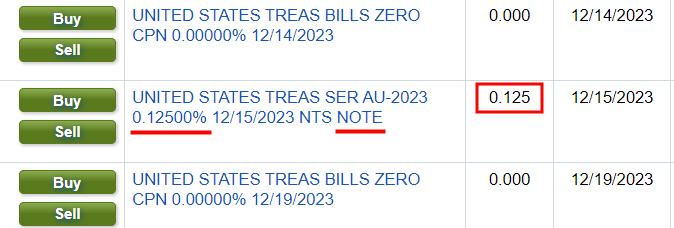

We’re speaking about strictly Treasury Expenses right here. A Treasury Invoice has no “coupon,” this means that it doesn’t pay any pastime when you grasp it. A Treasury observe with a discount that used to be issued a while in the past however now has not up to 365 days left to adulthood isn’t in point of fact a Treasury Invoice. The primary and the 3rd listings within the screenshot underneath are Treasury Expenses. The center one isn’t.

Treasury Expenses are bought at a cut price to the face price. The variation between the acquisition value and the face price you obtain at adulthood is your pastime. It doesn’t subject whether or not you purchase Treasury Expenses as a brand new challenge at a Treasury public sale or at the secondary marketplace so long as you grasp them to adulthood. Taxes are easy since the acquire value is the one variable.

Your dealer will come with the adaptation between the acquisition value and the face price as pastime on a 1099-INT shape. If you are going to buy at TreasuryDirect, you should definitely obtain the 1099-INT shape from TreasuryDirect. The precise box at the 1099-INT shape says it’s exempt from state and native taxes. Your tax device will calculate each federal and state taxes routinely after you input the 1099-INT shape.

Via a Mutual Fund or an ETF

Purchasing Treasuries thru a mutual fund or an ETF in an ordinary taxable brokerage account additionally doesn’t make your taxes too sophisticated. The dividends from the mutual fund or ETF shall be integrated on a 1099-DIV shape. Should you promote stocks in a mutual fund or an ETF for a capital achieve or loss, it’s going to be integrated on a 1099-B shape.

Those tax paperwork aren’t new. You’ll have them whilst you purchase or promote different mutual finances or ETFs as smartly. Your tax device will routinely deal with the federal taxes with none further steps.

Additional Step for State Taxes

The additional wrinkle is in state taxes. You’ll wish to get a file from the fund supervisor on what share of the fund’s source of revenue got here from Treasuries. That portion is exempt from state and native taxes. It takes an additional step however it’s now not that tough. Please learn how to try this in State Tax-Exempt Treasury Hobby from Mutual Budget and ETFs.

Adulthood Alternatives

Purchasing thru a mutual fund or an ETF doesn’t imply that you simply’re purchasing long-term Treasuries. You will have many alternatives in finances that spend money on other maturities. Make a choice a fund that best invests in momentary Treasuries if you happen to best need brief maturities. Make a choice a fund that best invests in TIPS if you happen to best need TIPS. The expense ratio may be very low in lots of finances and ETFs.

With such a lot of alternatives in finances and ETFs at an excessively low value, you in point of fact don’t wish to get into person Treasury notes and bonds until you will have to withdraw in a brief length on a preset agenda otherwise you simply desire the mental convenience. See Two Varieties of Bond Ladder: When to Exchange a Bond Fund or ETF.

Dangle New-Factor Treasury Notes and Bonds to Adulthood

New-issue Treasury Notes and Bonds purchased at a Treasury public sale and held to adulthood are somewhat extra sophisticated however they’re nonetheless now not too dangerous relating to tax complexity.

Purchasing at a Treasury public sale doesn’t imply you will have to use TreasuryDirect. You’ll purchase new problems at a Treasury public sale for your brokerage account thru Constancy, Charles Schwab, Leading edge, or E*Business with out a charge in any respect. See How To Purchase Treasury Notes With out Rate at On-line Agents.

Steer clear of Reopenings

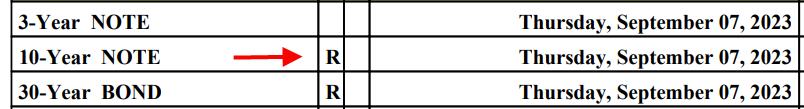

No longer all Treasury Notes and Bonds bought at an public sale are true new problems even though. Some Treasury auctions are reopenings. A reopening occurs when the federal government is promoting further amounts of a bond that used to be already issued a while in the past. The tax remedy of shopping for a reopening is equal to purchasing at the secondary marketplace, which is extra sophisticated than the tax remedy of shopping for a real new challenge.

Reopenings are marked with the letter “R” in Treasury’s public sale agenda. Steer clear of reopenings if you happen to’d love to stay your taxes easy.

The cost of a real new challenge from a Treasury public sale shall be at a slight cut price to the face price. You’ll deal with this small cut price when the bond matures. Treasury Notes and Bonds pay pastime each six months. Your dealer will file those pastime bills in the best position on a 1099-INT shape. Your tax device will routinely calculate each federal and state taxes.

Amassed Hobby

Typically there’s 0 collected pastime on a real new challenge. If there may be any, it’s very small. The small collected pastime doesn’t display up at the 1099 shape. It’s best within the 1099 complement. You’re allowed so as to add a damaging access for the collected pastime to offset the coupon bills however as it’s small, it’s now not a large deal even supposing you don’t know the way to do it otherwise you merely overlook.

Dangle New-Factor TIPS to Adulthood

TIPS provides somewhat extra complexity than common Treasury Notes and Bonds as a result of TIPS receives each pastime bills and inflation changes. It’s nonetheless now not too dangerous if you happen to stick with true new problems (keep away from reopenings) and also you grasp them to adulthood.

Along with the 1099-INT shape, the inflation adjustment shall be on a 1099-OID shape. It’s one additional shape however your tax device is aware of methods to deal with it.

Very similar to common Treasuries, the cost of a real new challenge TIPS from a Treasury public sale shall be at a slight cut price to the face price. You’ll deal with this small cut price when the bond matures.

A real new challenge TIPS has just a small quantity of collected pastime. You’ll to find it within the 1099 complement and upload a damaging access to your tax go back to offset the pastime. It’s now not a large deal if you’ll be able to’t work out methods to do it otherwise you merely overlook.

Purchasing a TIPS reopening at a Treasury public sale is equal to purchasing at the secondary marketplace relating to taxes. It’s extra sophisticated than purchasing a real new challenge.

Promote Treasury Expenses Earlier than Adulthood

Promoting Treasury Expenses earlier than adulthood provides one variable to the another way easy tax remedy of conserving them to adulthood. Now you’ll be able to have each pastime and a capital achieve. Please observe we’re nonetheless best speaking about Treasury Expenses that don’t have a discount. It’s extra sophisticated if you happen to promote a Treasury observe, bond, or TIPS that has a discount.

The concept that is going like this. Should you purchased $10,000 value of a 13-week Treasury Invoice for $9,865, you had been intended to earn $135 in pastime in 91 days through conserving it to adulthood. Think you bought it for $9,957 after conserving it for 60 days, you do a linear proration to calculate the prorated pastime:

( $10,000 – $9,865 ) / 91 * 60 = $89

The variation between the volume you paid and the volume you gained used to be:

$9,957 – $9,865 = $92

As a result of that is greater than the prorated pastime, the surplus quantity is a capital achieve.

$92 – $89 = $3

If the adaptation used to be not up to the prorated pastime, then all of the quantity is pastime source of revenue.

You’ll must calculate this cut up between pastime and capital achieve your self in case your dealer doesn’t do it for you. In case your dealer stories the adaptation between your acquire quantity and your sale quantity as 100% pastime or 100% capital achieve at the 1099 shape, you’ll must proper it to your tax go back.

You will have this complexity from promoting earlier than adulthood. You’ll keep away from it if you happen to grasp your Treasury Expenses to adulthood. Should you will have to promote one thing earlier than adulthood even though, promote Treasury Expenses. It’s nonetheless more practical than promoting bonds with a discount earlier than adulthood.

Purchase or Promote at the Secondary Marketplace

The extra sophisticated tax remedy comes from purchasing or promoting Treasury notes or bonds with a discount at the secondary marketplace (together with purchasing a reopening thru an public sale).

The present marketplace fee will also be rather other from the coupon fee of an present bond. This ends up in a big cut price or top class in the fee. The massive cut price or top class makes taxes extra sophisticated. Purchasing or promoting at the secondary marketplace ceaselessly comes to paying or receiving a significant quantity of collected pastime, which you will have to additionally deal with at the tax go back.

How one can deal with those complexities is past the scope of this already lengthy submit. If you’ll be able to lend a hand it, for the sake of preserving your taxes easy in a taxable account, don’t purchase Treasury notes or bonds with a discount at the secondary marketplace, don’t purchase them in a reopening, and don’t promote them at the secondary marketplace. Use the secondary marketplace just for Treasury Expenses. Should you will have to do the ones issues, do them in a tax-advantaged account.

***

Taxes on Treasuries get steadily extra sophisticated as you progress down the record. Discover ways to stroll earlier than you run.

1. Do the entirety in tax-advantaged accounts. No tax worries there.

2. Purchase some Treasury Expenses and grasp them to adulthood. That’s simple too.

3. Use a fund or an ETF. No longer too dangerous there.

4. If you wish to have longer maturities in person Treasuries (together with TIPS) in an ordinary taxable account, best purchase true new problems in an public sale, keep away from reopenings, and grasp them to adulthood.

5. In any case, if you happen to will have to promote one thing earlier than adulthood in an ordinary taxable account, best promote Treasury Expenses.

That’s so far as I might pass. Any longer headaches aren’t value it to me.

Say No To Control Charges

If you’re paying an consultant a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to to find an impartial consultant, pay for recommendation, and best the recommendation.