Which Schwab Cash Marketplace Fund Is the Perfect at Your Tax Charges

After studying my earlier posts Which Leading edge Cash Marketplace Fund Is the Perfect at Your Tax Charges and Which Constancy Cash Marketplace Fund Is the Perfect at Your Tax Charges, a reader requested me to do the similar for Charles Schwab. Many of us have a brokerage account with Schwab or TD Ameritrade. It’s extra handy to stay money and different investments in a single position. Even though Leading edge fees the bottom charges on its cash marketplace budget, a Schwab cash marketplace fund continues to be fairly just right sufficient in case you don’t want the absolute best yield.

As I wrote in No FDIC Insurance coverage – Why a Brokerage Account Is Protected, while you stay your money in a cash marketplace fund at a dealer, the protection of your cash doesn’t rely at the monetary well being of the dealer. The security comes at once from the protection of the holdings within the cash marketplace fund. Your cash marketplace fund is protected when the fund’s underlying holdings are protected.

Why Cash Marketplace Fund

The rationale to stay your money in a cash marketplace fund, versus a top yield financial savings account, is that you just’re no longer relying on any financial institution to set their price competitively. You robotically get the marketplace yield minus the fund supervisor’s minimize, not more, no much less, type of like while you put money into an index fund. You’re no longer transferring to some other financial institution as it’s providing a promotional price. You’re no longer transferring once more when that financial institution makes a decision to lag in the back of. See my Information to Cash Marketplace Finances & Top Yield Financial savings Accounts.

Schwab gives 8 cash marketplace budget of various sorts. Those budget also are to be had in a TD Ameritrade account. Every fund has an Investor Stocks magnificence and an Extremely Stocks magnificence. Extremely Stocks pay extra however they require a $one million minimal. Investor Stocks require no minimal. I will be able to best discuss Investor Stocks on this submit.

Those 8 cash marketplace budget range of their underlying holdings and tax remedy at each the federal and the state ranges. Which one is moderately higher for you than some other will depend on your desire for comfort and your federal and state tax brackets.

Taxable Cash Marketplace Finances

4 of the 8 Schwab cash marketplace budget are taxable cash marketplace budget. You pay federal source of revenue tax at the source of revenue earned from those budget. A portion of the source of revenue earned in some budget is exempt from state source of revenue tax in maximum states.

The quoted yield on any cash marketplace fund is at all times a web yield after the expense ratio is already deducted. You don’t wish to deduct it once more.

Not like Leading edge and Constancy, Charles Schwab doesn’t sweep uninvested money to a cash marketplace fund (with the exception of in some legacy accounts). The default “money sweep” can pay a lot not up to a cash marketplace fund. It’s important to purchase a cash marketplace fund your self if you wish to earn extra for your money. Charles Schwab doesn’t robotically liquidate from a cash marketplace fund to hide trades or transfers both. It’s important to promote a cash marketplace fund manually.

Top Cash Marketplace Finances

Schwab Price Merit Cash Fund (SWVXX) is a top cash marketplace fund. It invests in repurchase agreements, CDs, time deposits, and industrial paper. Top cash marketplace budget pay extra however they have got a moderately upper possibility.

The source of revenue earned from a major cash fund is totally taxable on the federal stage. A small share of the source of revenue could also be exempt from state source of revenue tax. That share varies from 12 months to 12 months. It used to be 0% in 2022.

Executive Cash Marketplace Finances

Schwab Executive Cash Fund (SNVXX), Schwab Treasury Tasks Cash Fund (SNOXX), and Schwab U.S. Treasury Cash Fund (SNSXX) are executive cash marketplace budget. They just put money into executive securities and repurchase agreements which might be collateralized via money or executive securities.

Call to mind repurchase agreements (“repo”) as a handle a pawn store. Entities give collaterals to the cash marketplace fund for non permanent money. They’ll come again later to shop for again (“repurchase”) their collaterals at the next worth. In the event that they don’t satisfy the repurchase settlement, the cash marketplace fund will promote the ones collaterals. Repurchase agreements aren’t assured via the federal government. Their protection comes from the collaterals.

A central authority cash marketplace fund is more secure than a major cash marketplace fund. Schwab U.S. Treasury Cash Fund (SNSXX) is the most secure of the 3 as it invests best in Treasuries. It can pay rather less despite the fact that.

The source of revenue earned from those 3 budget is totally taxable on the federal stage. A share of the source of revenue is exempt from state source of revenue tax. That share varies from 12 months to 12 months.

The expense ratio is identical throughout all 4 taxable cash marketplace budget. If you need the next yield and also you’re no longer involved in regards to the moderately upper possibility, you’ll move with the top cash marketplace fund (SWVXX). If you need probably the most cast peace of thoughts at the price of a moderately decrease yield, you’ll select the U.S. Treasury fund (SNSXX) for additonal protection and further state source of revenue tax financial savings.

The opposite two budget — Schwab Executive Cash Fund (SNVXX) and Schwab Treasury Tasks Cash Fund (SNOXX) — are just right center floor with more secure holdings than the top fund and also you’re no longer giving up an excessive amount of yield. Schwab Treasury Tasks Cash Fund (SNOXX) limits the repurchase agreements to being subsidized via Treasuries best. Schwab Executive Cash Fund (SNVXX) comprises repurchase agreements subsidized via each Treasuries and executive company money owed.

Have in mind to assert the state tax exemption while you do your taxes. See learn how to do it in State Tax-Exempt Treasury Passion from Mutual Finances and ETFs.

Unmarried State Tax-Exempt Cash Marketplace Finances

Schwab gives tax-exempt cash marketplace budget particularly for traders in upper tax brackets in California and New York. Schwab California Municipal Cash Fund (SWKXX) and Schwab New York Municipal Cash Fund (SWYXX) put money into high quality, non permanent municipal securities issued via entities inside the state. Source of revenue from those budget is tax-exempt from each the federal source of revenue tax and the state source of revenue tax. They’re often referred to as “double tax-free” budget.

The yield on those unmarried state tax-exempt cash marketplace budget is less than the yield at the 4 taxable cash marketplace budget however the federal and state tax exemption makes up for it while you’re in a top tax bracket.

Have in mind to assert the state tax exemption while you do your taxes. See learn how to do it in State Tax-Exempt Muni Bond Passion from Mutual Finances and ETFs.

Nationwide Tax-Exempt Cash Marketplace Fund

Schwab gives two tax-exempt cash marketplace budget for traders in upper tax brackets out of doors of California and New York. Schwab Municipal Cash Fund (SWTXX) and Schwab AMT Tax-Loose Cash Fund (SWWXX) are extra diverse than the 2 single-state budget as a result of they put money into non permanent, high quality municipal securities from many states. The 2 budget are identical. AMT tax-free or no longer makes a distinction while you’re matter to the Choice Minimal Tax however so much fewer individuals are suffering from it now than earlier than.

Source of revenue from those two nationwide tax-exempt cash marketplace budget is tax-exempt from the federal source of revenue tax however just a small share is exempt from state source of revenue tax. The yield is less than the yield at the 4 taxable cash marketplace budget however the federal source of revenue tax exemption makes up for it while you’re in a top tax bracket. In case you reside in California or New York, you’ll nonetheless put money into those nationwide budget in case you don’t thoughts paying extra in state source of revenue tax.

Have in mind to assert the small state tax exemption while you do your taxes. See learn how to do it in State Tax-Exempt Muni Bond Passion from Mutual Finances and ETFs.

Taxable or Tax-Exempt?

A tax-exempt cash marketplace fund gives tax financial savings nevertheless it can pay much less. Make a choice a tax-exempt fund in case you’re in a top tax bracket. Make a choice a taxable fund in case you’re in a low tax bracket. In case you’re no longer certain whether or not your federal and state tax brackets are thought to be top or low, you’ll use a calculator to peer which fund gives a greater yield after taxes.

Yield Swings

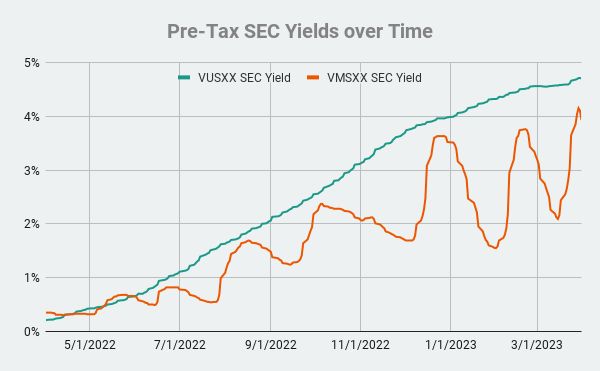

A wrinkle in evaluating taxable and tax-exempt cash marketplace budget is that the yield on tax-exempt cash marketplace budget swings wildly all the way through the 12 months. This chart displays the yield on a taxable cash marketplace fund and the yield on a tax-exempt cash marketplace fund over a 12-month duration:

Whilst the yield at the taxable fund (inexperienced line) rose incessantly through the years because the Fed raised rates of interest, the yield at the tax-exempt fund (orange line) swung wildly up and down. In case you occur to match the after-tax yields when the yield at the tax-exempt fund is close to a most sensible, it could display that the tax-exempt fund is best even in a low tax bracket. In case you occur to match them when the yield at the tax-exempt fund is close to a backside, it could display that the taxable fund is best even in a top tax bracket.

MM Optimizer

So you’ll’t simply regulate for taxes best in keeping with the yields at this second. You want to appear over an extended duration to take note the wild swings within the yield on tax-exempt budget.

Person retiringwhen at the Bogleheads discussion board created a Google Sheet that does this. It’s referred to as MM Optimizer. Even though this instrument best backtests Leading edge cash marketplace budget, it’s additionally informative while you use a Schwab cash marketplace fund. If the instrument displays {that a} Leading edge taxable cash marketplace fund is best than a Leading edge tax-exempt fund at your tax charges, it’s extremely most probably {that a} Schwab taxable cash marketplace fund could also be higher than a Schwab tax-exempt fund for you on the similar tax charges.

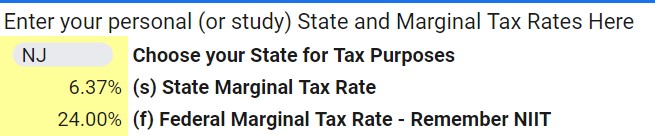

Your Tax Charges

MM Optimizer is a shared as View Simplest. After you are making a replica of it for your Google account, you convert the tax charges at the My Parameters tab for your tax charges.

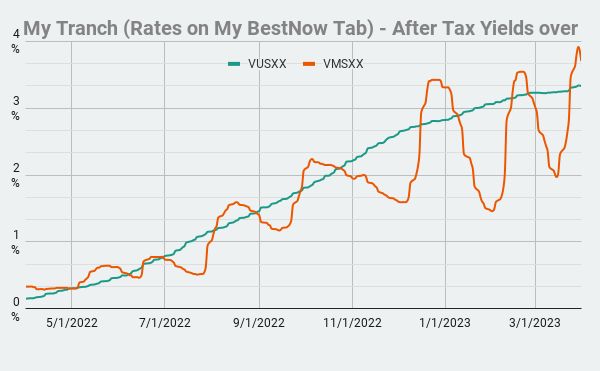

Examine After-Tax Yield

The My Charts tab displays the after-tax yield of various budget during the last one year. You’ll watch the yields and turn from side to side between a taxable fund and a tax-exempt fund however I wouldn’t trouble. The chart displays how repeatedly you could’ve needed to transfer to catch the transient swings and the way short-lived each and every transfer used to be.

I might check out this chart and spot which line is on most sensible more often than not. Make a choice a Schwab taxable cash marketplace fund and stick with it if the chart displays that the smoother line is on most sensible more often than not. Make a choice a Schwab tax-exempt cash marketplace fund if the chart displays that the bouncy line is on most sensible more often than not.

After I performed with MM Optimizer, it confirmed {that a} taxable cash marketplace fund used to be nonetheless higher for any person in a 35.8% federal source of revenue tax bracket (32% plus 3.8% Internet Funding Source of revenue Tax) and a 9% state source of revenue tax bracket. The tax brackets should be upper than the ones ranges for a tax-exempt cash marketplace fund to win.

MM Optimizer has much more options however you don’t need to get into the ones. It’s easy to make use of in case you best have a look at the puts I’m appearing right here. The writer continues to be including new options. You’ll in finding the hyperlink to the newest model in this submit at the Bogleheads discussion board.

Say No To Control Charges

In case you are paying an guide a share of your property, you’re paying 5-10x an excessive amount of. Learn to in finding an impartial guide, pay for recommendation, and best the recommendation.