Use Pascal’s Bet When You are Now not Certain About Tax Regulations

Seventeenth-century French mathematician and thinker Blaise Pascal put ahead this reasoning on whether or not one will have to consider in God (paraphrasing):

You’re no longer certain whether or not God exists. When you consider in God and God doesn’t exist, you reside with some needless inconvenience. When you don’t consider in God and God does exist, you obtain endless struggling. The price of being fallacious is way upper within the latter case. Due to this fact you will have to consider in God whether or not God exists or no longer.

This is named Pascal’s guess. It’s a solution to reduce loss whilst you’re no longer certain.

We are facing many regulations and regulations in dealing with our budget. After we’re no longer certain how the regulations and regulations paintings, we will be able to:

A) Spend hours and hours researching the topic and seeking to perceive the terminologies and the way they have compatibility in combination. We would possibly nonetheless come to the fallacious conclusion regardless of our absolute best efforts.

B) In finding and rent knowledgeable and depend at the professional’s opinion. We would possibly not in finding the real professional and the professional can nonetheless be fallacious.

C) Use Pascal’s guess and weigh the price of being fallacious. Select the trail of the least pricey result if we’re fallacious.

Every now and then it isn’t value spending the time or cash to determine the real solution to a few difficult questions. The use of Pascal’s guess is a great way to reduce the wear in the event you’re fallacious. Let’s take a look at some real-life examples I got here throughout in recent years.

Required to Report a Tax Shape?

But even so the common source of revenue tax go back, there are some difficult to understand tax paperwork such because the reward tax go back, Shape 3520 for receiving overseas items, and Shape 5500-EZ for a solo 401(okay) plan. Regulations aren’t all the time transparent on whilst you’re required to record them and whilst you’re no longer.

When you’re required to record a tax shape however you suppose you don’t must record, you’ll face consequences for failing to record as required. When you’re no longer required to record a tax shape however you record one anyway, you waste a small period of time doing it. Pascal’s guess says you will have to record a tax shape anyway earlier than the closing date.

Submitting a tax go back whether or not required or no longer has different advantages too. Some other people had a more difficult time receiving stimulus bills from the federal government throughout the pandemic as a result of they didn’t record a tax go back in a prior 12 months when it wasn’t required. It will’ve been a lot more uncomplicated if that they had filed a tax go back anyway.

There’s no tax to pay if you happen to record a present tax go back, a Shape 3520, or a Shape 5500-EZ earlier than the closing date. Mistakenly pondering you’re no longer required to record when it’s in reality required incurs huge consequences. When it comes to Shape 5500-EZ, the penalty is $250 consistent with day!

When unsure, record the tax shape.

Take the RMD? In line with Whose Age?

The principles on Required Minimal Distributions (RMD) for an inherited IRA are rather advanced. It depends upon when the unique proprietor died, at what age, whether or not the IRA had a delegated beneficiary, whether or not the designated beneficiary was once an individual or a accept as true with, the connection between the unique proprietor and the beneficiary, the age distinction between the unique proprietor and the beneficiary, and so forth.

When you’re required to take the RMD from the inherited IRA, the following query is in response to whose age. Is it in response to the unique proprietor’s age or the beneficiary’s age?

The principles are so advanced that Leading edge stopped calculating the RMD for lots of inherited IRAs for worry of doing it fallacious. They punted that accountability again to the purchasers and requested them to seek the advice of a tax skilled.

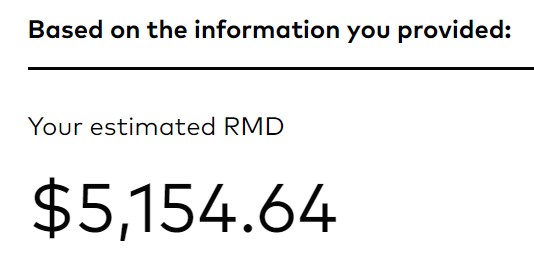

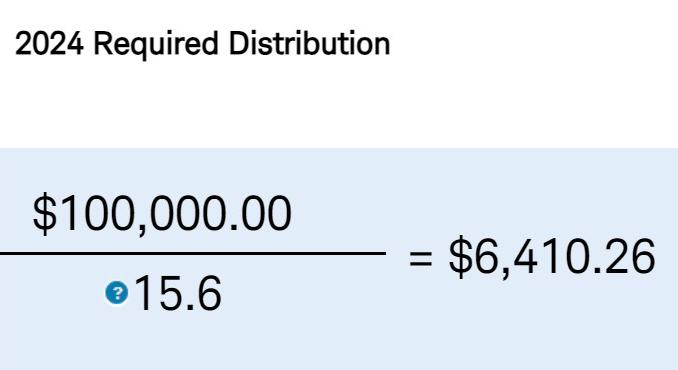

Leading edge nonetheless has an on-line RMD calculator for inherited IRAs. Charles Schwab has one too. The 2 calculators displayed other effects when a reader gave them similar inputs. I attempted either one of them with this hypothetical case:

- IRA Stability on December 31: $100,000

- Proprietor’s Date of Beginning: Would possibly 15, 1955

- Proprietor’s Date of Dying: Would possibly 15, 2023

- (Non-Partner) Beneficiary’s Date of Beginning: Would possibly 15, 1950

The primary outcome was once from Leading edge’s calculator. The second one outcome was once from Schwab’s calculator. The consequences various through virtually 25%! Which one is right kind? In fact each calculators have disclaimers to mention they shouldn’t be depended on as prison or tax recommendation.

You’ll learn about the advanced regulations over and over again and get some extent in RMDs. Or you’ll be able to pay a CPA and ensure the CPA in reality understands this topic and also you’re no longer miscommunicating with the CPA. Or you’ll be able to see which trail will give you the least unhealthy result whilst you’re fallacious.

If you’re taking the RMD whilst you aren’t required to take it, the cash comes out of the IRA a bit quicker. The cash in the end has to come back out of the IRA anyway. Timing most effective makes a small distinction. When you don’t take the RMD if you find yourself in reality required to take it, you face a miles upper penalty.

In a similar way, when two calculators give two other RMD quantities and also you’re no longer certain which one is the real minimal, it’s completely OK to withdraw the next quantity for the reason that RMD is just a minimal. You’ll be in additional bother if you happen to withdraw lower than required. Even supposing I suppose the Leading edge calculator is right kind within the hypothetical case, I might take out the bigger quantity in case I’m fallacious.

When unsure, take the RMD. When unsure, withdraw a bigger quantity.

The Final Day to Purchase I Bonds

I Bonds credit score passion through the month. It doesn’t subject which precise day within the month you purchase I Bonds. You get passion for all the month so long as you grasp I Bonds at the final day of that month. Due to this fact it’s higher to shop for I Bonds on the subject of the tip of a month.

How shut despite the fact that? When is the final day to shop for I Bonds and nonetheless get the passion for that month? Is it the final trade day of the month? Or is it the 2nd final trade day of the month? Or the 3rd final trade day of the month?

When you suppose it’s the final trade day of the month however the closing date is in reality the 2nd final trade day of the month or if you happen to suppose the closing date is the second one final trade day of the month nevertheless it’s in reality the 3rd final trade day of the month, your acquire will leave out a complete month’s value of passion. When you suppose the closing date is quicker nevertheless it’s in reality later, you’re purchasing a bit too quickly and also you forego incomes passion for your financial savings account or cash marketplace fund for an afternoon or two. Now not incomes passion for an afternoon or two is much better than lacking a complete month’s value of passion.

I give it every week after I purchase I Bonds. The similar is going for paying taxes. I set the date of my cost to every week earlier than the due date. If the rest is going fallacious I nonetheless have time to mend it and check out once more.

When unsure, do it quicker.

Solo 401k Contribution Prohibit

I’ve a Solo 401k contribution prohibit calculator for part-time self-employment. A reader requested me about it as a result of his 3rd-Birthday celebration Administrator (TPA) gave him a decrease contribution prohibit. Even supposing I’m assured that my calculator is right kind, I mentioned he will have to pass with the decrease quantity from the TPA.

The calculated contribution prohibit is just a most. Nobody says you should give a contribution the utmost. It’s completely OK to give a contribution lower than the utmost. If the TPA is aware of one thing that I don’t, it’ll be a large number if the reader is going with the upper quantity from my calculator and exceeds the prison most.

When unsure, give a contribution much less.

***

You should still be fallacious after spending the time and/or cash to search out the real solutions to a few difficult questions. Chances are you’ll as neatly make it simple through comparing the effects whilst you’re fallacious. If the effects are lopsided between two possible choices, as they continuously are, use Pascal’s guess and select the trail that prices much less whilst you’re fallacious.

Say No To Control Charges

In case you are paying an consultant a proportion of your belongings, you might be paying 5-10x an excessive amount of. Learn to in finding an unbiased consultant, pay for recommendation, and most effective the recommendation.