Source of revenue Required To Come up with the money for A Conventional House Via Town In 2024

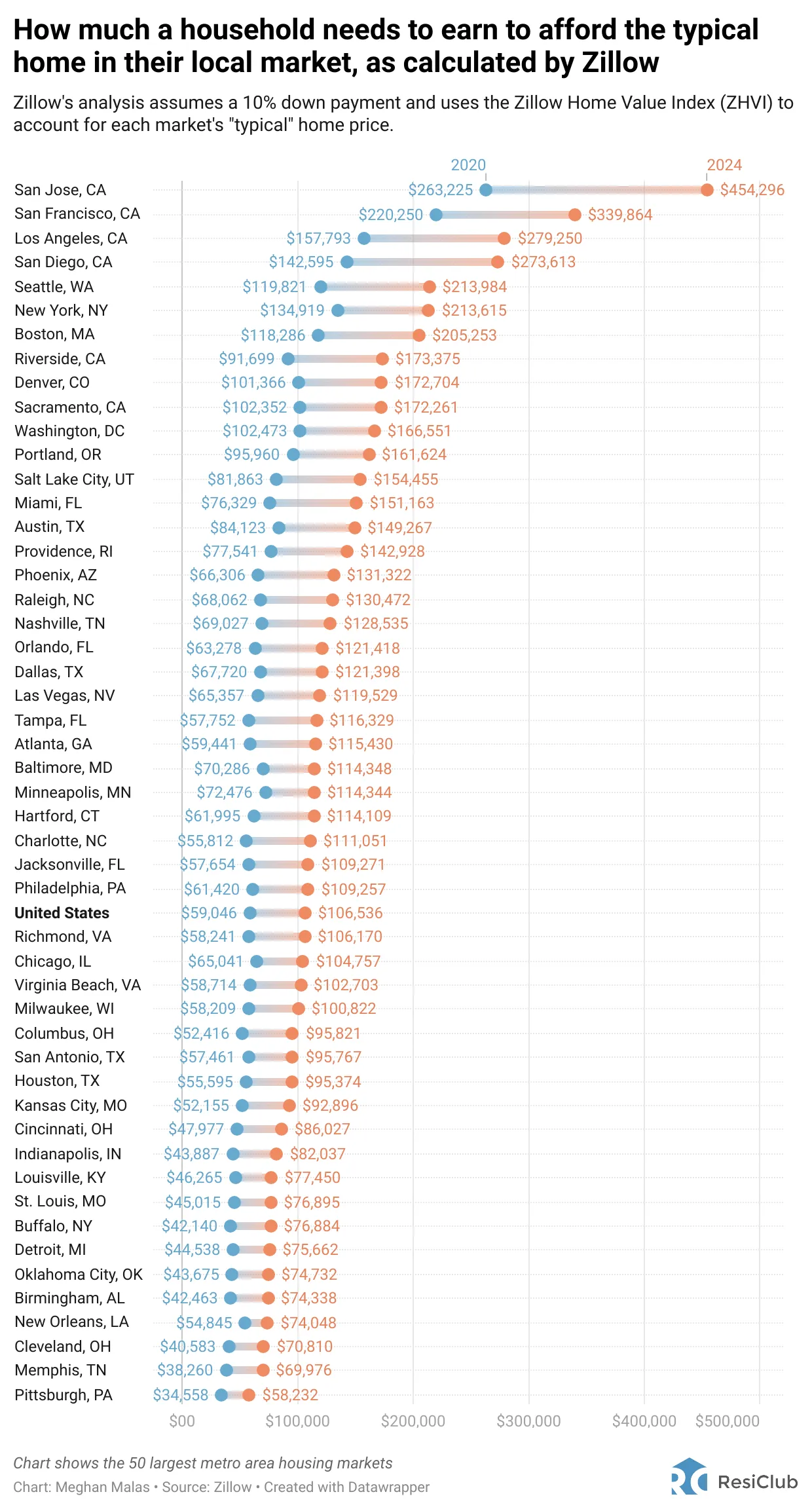

Zillow just lately launched an intriguing learn about that outlines the revenue had to have the funds for a “conventional house” in several towns. The learn about considers a ten% down fee and makes use of the Zillow House Worth Index to decide the median house value in each and every town.

A ten% down fee is 10% not up to I’d suggest, however it is Zillow’s workout. Let’s evaluate the revenue required to buy the median house in each and every town between 2020 and 2024. Those are the highest 50 town metros in The usa.

San Jose instructions the best possible revenue requirement to have the funds for a mean house at $454,296, whilst Pittsburg boasts the bottom revenue wanted at simply $58,232. If homeownership is a concern and funds constraints are a priority, possibly a transfer to Pittsburgh, Pennsylvania, is price taking into account!

As a San Francisco resident, I in finding it reassuring that the price of residing here’s most effective $339,864. This represents a considerable $114,432 relief within the required annual revenue, or 25%, in comparison to the revenue wanted for homeownership in San Jose.

Moreover, with regards to way of life concerns, San Francisco provides a extra picturesque, full of life, and stress-free atmosphere in comparison to San Jose. It isn’t San Jose that pulls international vacationers to the U.S., however somewhat the attract of San Francisco!

Pricey Towns May In truth Be The Least expensive Towns To Reside In

You’ve got learn my submit titled “Why Families Want To Earn $300,000 A 12 months To Reside A Heart-Magnificence Way of life As of late.” Whilst you’ll have strongly disagreed with my research relating to households living in pricey coastal towns, it is reassuring to seek out exterior validation from Zillow supporting it.

The US is huge, with various cost-of-living ranges around the nation. Thankfully, all of us possess the liberty to make a choice the place we wish to reside. If the price of residing turns into too burdensome for our revenue, we now have the method to relocate, trim bills, or search further paintings, as we’re all rational decision-makers.

Regardless of towns reminiscent of Boston, New York, Seattle, San Diego, Los Angeles, San Francisco, and San Jose necessitating over $200,000 in family revenue to have the funds for an ordinary house, I argue that those towns are extra inexpensive than often perceived.

Listed below are two explanation why.

1) Pricey towns are less expensive to have amusing and reside more healthy

As I wrote in my submit about non-public sports activities golf equipment, I pay $180 a month to be part of a community of golf equipment within the Bay Space. I feel $180 a month is superb worth, which is why I am unwilling to chop the expense regardless of now not being financially impartial.

Then Nate, a reader from Pittsburgh, PA chimed in and wrote,

“Very bizarre a personal sports activities membership with indoor pickleball and tennis would most effective charge $180/m. Clearly you wouldn’t cancel this. There is not any such factor as non-public indoor sports activities membership for $180/month in Pittsburgh. Simplest nation golf equipment with out of doors tennis or pickleball and golfing for $1,500/m and up. Different possibility is public park for tennis or pickleball which comes to ready/no reservations/no availability.”

Holy moly! $1,500 a month and up so that you can play tennis and pickleball indoors? No thanks! Who can have the funds for that?

$18,000 a yr for sports activities membership club dues whilst it most effective takes $58,232 in revenue to have the funds for an ordinary home is an absurd ratio.

Nicer Climate Issues For High quality Of Existence

Right here in San Francisco, the elements stays average right through the yr, offering plentiful unfastened public courts for tennis and pickleball. On this instance, non-public sports activities membership memberships are no less than 88% extra inexpensive.

For the ones looking for cost-effective out of doors enjoyment nearly year-round, towns like San Jose, San Francisco, Los Angeles, and San Diego be offering favorable stipulations. Then again, in spaces the place the specified revenue is lower than the entire U.S. revenue of $106,536 to have the funds for a house, keeping up a year-round out of doors way of life is tougher.

Progressed climate sticks out as probably the most an important explanation why residing at the West Coast surpasses residing at the East Coast. Having skilled each coasts for over a decade each and every, I will attest to the considerably increased high quality of existence.

Existence is already transient, and enduring 3 to 4 months of maximum wintry weather stipulations yearly is suboptimal for plenty of American citizens. As a result, a considerable selection of American citizens decide to relocate out west or south.

For the ones prioritizing favorable climate and homeownership, towns like New York Town ($213,615) and Boston ($205,253) will not be the most productive possible choices.

Given their high-income necessities for housing and difficult climate stipulations, a strategic transfer may just contain geoarbitrage to extra inexpensive and hotter towns like Miami ($151,163), Raleigh ($130,472), Baltimore ($114,348), and even Pittsburgh, PA ($58,232).

2) Pricey towns are more straightforward to make more cash and thereby building up affordability

I have been considering a transfer to Honolulu, Hawaii since 2014.

After retiring in 2012, I assumed, “Why now not relocate to my favourite state in The usa?” The glorious climate, scrumptious meals, and laid-back vibe all looked like elements that might give a contribution to an extended and extra pleasurable existence. With sufficient passive revenue to maintain a easy way of life and the chance to generate supplemental retirement revenue via writing on Monetary Samurai, the theory appeared interesting.

Again then, without a children, retiring to Hawaii looked to be an easy resolution. Then again, my pastime for actual property made me really feel that if I had been to transport, I had to personal a house in Honolulu.

Simply as shorting the S&P 500 long-term is regarded as a suboptimal resolution, I thought that renting long-term and now not proudly owning actual property in Honolulu may also be lower than perfect.

For 3 years, I diligently attended open properties in Honolulu all through each and every consult with to look my folks. Regardless of leaving each and every time eager about the possibility of relocating, I could not shake the concern that I would possibly now not conveniently have the funds for to reside in Honolulu.

Honolulu Housing Is ~30% Less expensive Than San Francisco Housing

It would appear abnormal to precise fear about retiring in Honolulu, the place similar housing is set 30% less expensive than in San Francisco. Or is it?

My concern stemmed from the concern that if I bought a house in Honolulu and encountered surprising monetary difficulties, I’d in finding myself in a good spot. In 2014, my passive revenue used to be round $110,000, which used to be already inadequate to qualify for a standard loan for a median-priced house in SF or Honolulu.

Given my loss of W2 revenue, I’d want to get a hold of a down fee of fifty% or extra to shop for a house priced between $700,000 and $1 million. For context, the median house value in Honolulu is roughly $780,000, in line with Zillow, however $1,075,000 in line with Places Hawaii, which turns out extra correct.

Pay Is A lot Much less In Honolulu Too

Upon exploring the activity marketplace in Honolulu, I found out that the pay used to be 40% – 60% lower than what I may just earn in San Francisco. Additionally, I wasn’t conscious about any horny part-time consulting jobs in Honolulu.

Against this, San Francisco boasted a plethora of consulting and full-time jobs paying $100,000 or extra. As of late, even 23-year-old faculty graduates operating in tech, consulting, or finance can get started incomes $150,000 or extra yearly.

In keeping with Numbeo, you possibly can want round $7,701 in Honolulu, HI to care for the similar same old of existence that you’ll be able to have with $8,900 in San Francisco, CA (assuming you hire in each towns). This calculation makes use of their Value of Dwelling Plus Hire Index to match the price of residing and suppose after revenue tax.

Purchasing Actual Property In San Francisco Felt More secure Due To Upper Source of revenue

Even if San Francisco house costs are roughly 42% increased than Honolulu house costs, I felt extra comfortable buying a fixer-upper in San Francisco for $1,230,000 than purchasing a space in Honolulu for $700,000 – $1.1 million. I controlled to shop for the fixer in 2014 as a result of a few huge CDs matured, and my spouse used to be in her ultimate yr of labor.

I used to be assured that if I confronted monetary difficulties after purchasing the fixer in San Francisco, I may just all the time safe a six-figure activity as a specialist or full-time worker. San Francisco boasts an enormous tech ecosystem, in conjunction with biotech, clinical, aerospace, and tourism industries.

Against this, Honolulu closely is dependent upon tourism as its major supply of revenue. Subsequently, financial demanding situations in Japan and China may just adversely impact Honolulu. Earning money in Hawaii is solely more difficult than creating wealth in San Francisco.

Purchasing a house in San Francisco felt extra safe because of the range of industries and the supply of higher-paying jobs. The continued synthetic intelligence increase may additionally improve the returns of my mission capital price range.

Moreover, if I did not reside in San Francisco, I most certainly would not have had get right of entry to to a few those non-public price range.

Just right factor nowadays is that everyone who has $10 to take a position can spend money on the Fundrise Innovation Fund, an open-ended fund that invests in non-public expansion firms within the AI house and extra. I wish to make investments nowadays so my children don’t question me why I didn’t twenty years from now.

Extra Examples Of How Prices Are Upper In Less expensive Towns

Value of Vehicles: The cost of a Honda Accord stays constant irrespective of location. For example, buying a $34,000 Honda Accord Recreation would account for 58% of an $58,000 wage however most effective 23% of a job-equivalent wage of $150,000.

Value of Fabrics for House Rework: Lumber, sheetrock, wiring, and fixtures usually charge the similar around the nation. Whether or not you might be transforming a $500,000 space or a $1,200,000 space, the prices would possibly vary (10% as opposed to 5.8% of the house worth, respectively). Then again, the higher-priced house yields a better go back at the transform, taking into account the 120% increased value in keeping with sq. foot.

Value of Faculty: Faculty tuition costs are constant national. Then again, the affordability of school has turn out to be difficult for middle-class households, specifically in less expensive towns, the place most effective the wealthy or the deficient can conveniently have the funds for increased training.

Believe any product that maintains a constant value irrespective of your location, and you can perceive why residing in a extra inexpensive town with a decrease revenue may also be extra pricey.

Dwelling In An Pricey Town Is Like Taking part in Offense

To your adventure to monetary independence, you’ve got the method to play offense, striving to maximise your revenue, or play protection, aiming to save lots of as a lot cash as imaginable. Most people pursuing FIRE (Monetary Independence, Retire Early) undertake a mixture of each methods.

Individually, I desire taking part in offense in wealth-building, pushed by way of the limitless possible for revenue and funding returns. Since 2009, I’ve selected to live in New York Town and San Francisco, spotting the considerable alternatives for increased profits. This way is comparable to making an investment in expansion shares within the first part of your existence.

No longer most effective used to be I ready to make more cash residing in NYC and SF, I used to be additionally ready to construct connections that granted me non-public funding alternatives, a few of that have became out smartly.

Whilst the price of residing in those towns is surely excessive, it is a mirrored image of the alternatives they provide. Proudly owning actual property in such high-opportunity towns, as soon as accomplished, makes constructing extra wealth a lot more straightforward.

Relocate As soon as You’ve got Made Your Fortune

After amassing enough wealth, one can ponder relocating to a extra budget-friendly town that aligns higher with way of life objectives and revenue ranges. It is more straightforward to transport from New York Town to New Orleans as opposed to the wrong way round.

The revenue possible in a pricey town may also be so considerable that the perceived drawbacks, basically the excessive charge of residing, turn out to be much less important.

If you happen to reside in an inexpensive town, the entire extra reason why to capitalize on on-line revenue and work at home alternatives. Thankfully, more and more jobs now be offering similar wages irrespective of your location. Subsequently, you could as smartly take merit!

Reader Questions And Ideas

Resides in a pricey town in point of fact cheaper? Are folks overlooking the truth that those towns are pricey as a result of the revenue alternatives they provide? Which towns do you assume strike the most productive steadiness between affordability and revenue possible?

I plan to proceed making an investment within the heartland of The usa, the place the price of residing is decrease and apartment yields are increased. Technological developments will pressure extra American citizens to relocate to extra inexpensive towns over the following a number of many years.

If you happen to percentage this long-term demographic trade point of view, check out Fundrise. Managing over $3.5 billion in property, Fundrise basically invests in residential and business houses within the Sunbelt area. If you select to stay in a pricey town, the entire extra reason why to diversify throughout more cost effective portions of the rustic.

Fundrise is a long-time sponsor of Monetary Samurai and Monetary Samurai is an investor in Fundrise price range. Since 2016, I have invested $954,000 in plenty of non-public actual property price range and person offers to diversify clear of my pricey San Francisco holdings and earn extra passive revenue.