Recharacterize & Convert to Roth IRA in TurboTax, Identical 12 months

You’ll have contributed to a Roth IRA after which learned later within the yr that you’d exceed the source of revenue prohibit. You recharacterized the Roth IRA contribution as a Conventional IRA contribution and transformed it to Roth once more prior to the top of the yr. Your IRA custodian despatched you two 1099-R bureaucracy, one for the recharacterization and one for the conversion. This publish displays you the way to put them into TurboTax.

In case you had carried out the recharacterizing and changing within the following yr, you would need to cut up the tax reporting into two years by means of following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st 12 months and Backdoor Roth in TurboTax: Recharacterize & Convert, second 12 months. Now since you stuck the issue quickly sufficient prior to the top of the yr, you’ll deal with it all in the similar yr by means of following this information.

Right here’s the instance situation we’ll use on this information:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You learned that your source of revenue can be too prime later in 2023. You recharacterized the Roth contribution for 2023 as a Conventional contribution. The IRA custodian moved $6,600 out of your Roth IRA in your Conventional IRA as a result of your unique $6,500 contribution had some profits. The price higher once more to $6,700 while you transformed it to Roth prior to December 31, 2023. You won two 1099-R bureaucracy, one for $6,600 and every other for $6,700.

In case you didn’t do any of those recharacterizing and changing, please observe our information for a “blank” backdoor Roth in How To Document Backdoor Roth In TurboTax (Up to date).

In case you’re married and each you and your partner did the similar factor, you must observe the stairs under as soon as for your self and as soon as once more in your partner.

Use TurboTax Obtain

The screenshots under are from TurboTax Deluxe downloaded device. The downloaded device is approach higher than on-line device. In case you haven’t paid in your TurboTax On-line submitting but, you’ll purchase TurboTax obtain from Amazon, Costco, Walmart, and lots of different puts and turn from TurboTax On-line to TurboTax obtain (see directions for the way to make the transfer from TurboTax).

1099-R for Recharacterization

We deal with the 1099-R shape for the recharacterization first. This 1099-R shape has a code “N” in Field 7.

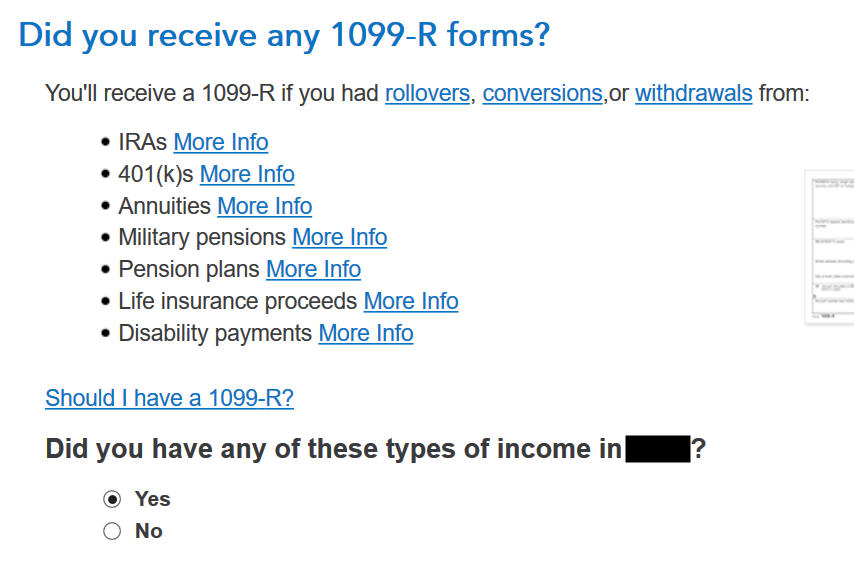

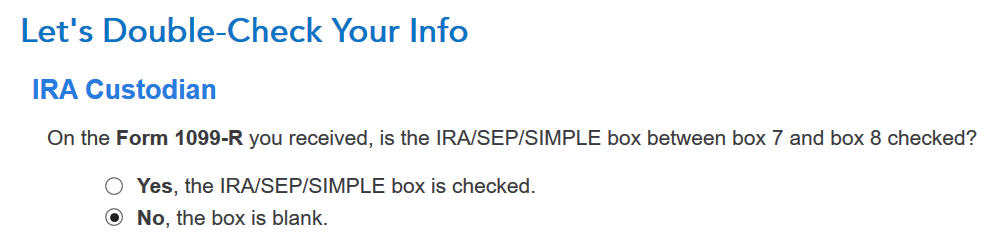

Cross to Federal Taxes -> Wages & Source of revenue -> IRA, 401(okay), Pension Plan Withdrawals (1099-R).

Verify that you’ve won a 1099-R shape. Import the 1099-R if you happen to’d like. I’m opting for to sort it myself.

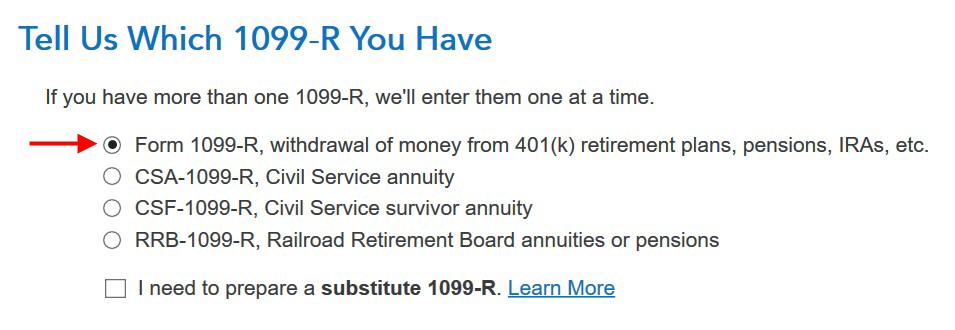

It’s an ordinary 1099-R.

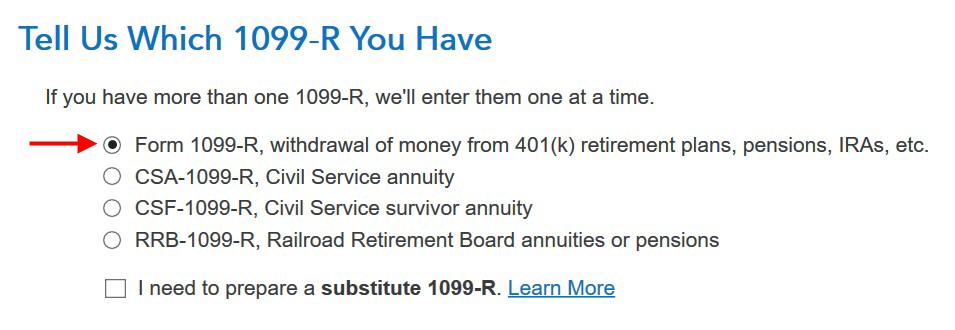

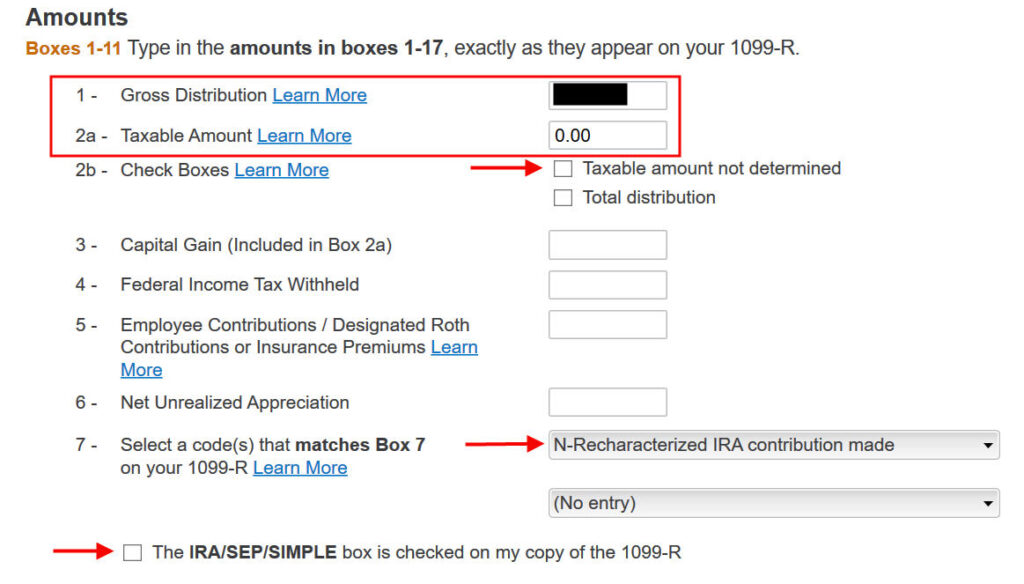

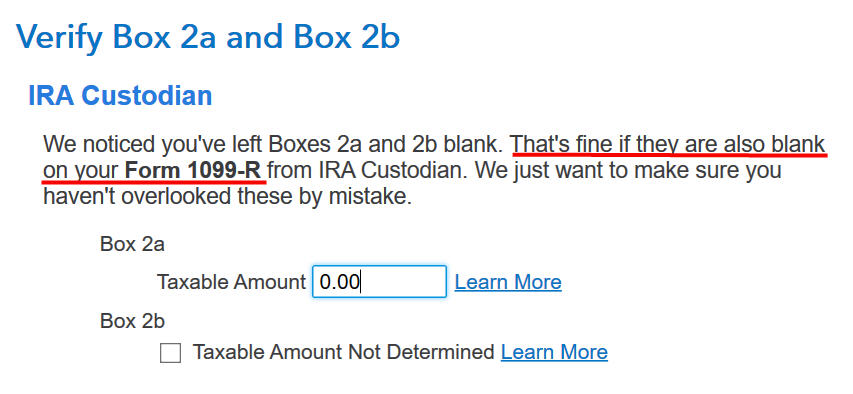

The 1099-R shape for the recharacterization displays the quantity moved from the Roth IRA to the Conventional IRA in Field 1. The taxable quantity is 0 in Field 2a and the “Taxable quantity no longer decided” field isn’t checked. The code in Field 7 is “N” and the “IRA/SEP/SIMPLE” field might or is probably not checked. It isn’t checked in our pattern shape.

That field is clean in our 1099-R, and that’s OK.

It’s commonplace to look 0 in Field 2a and clean in Field 2b in this 1099-R shape. TurboTax simply needs to double-check.

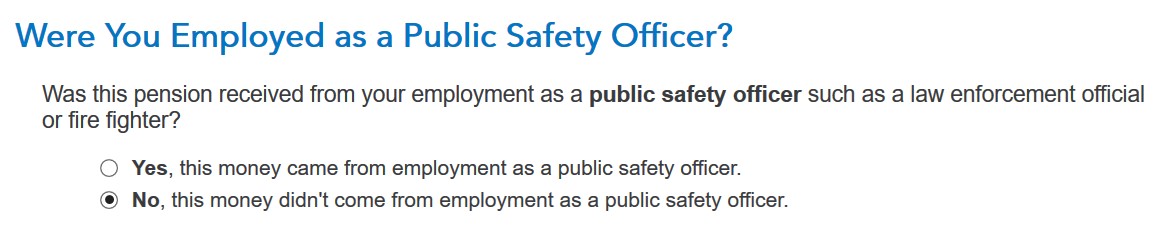

No longer a Public Protection Officer.

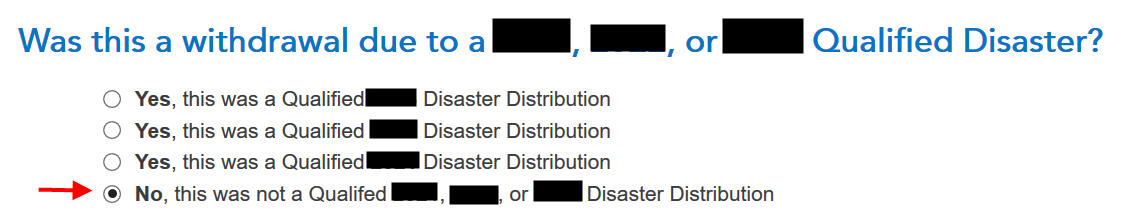

No longer because of a crisis.

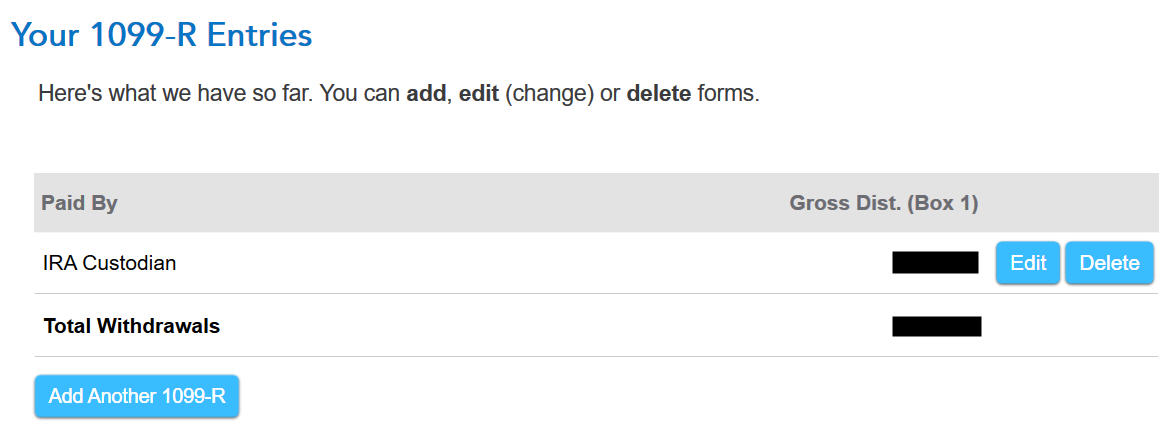

You’re carried out with the 1099-R shape for the recharacterization. Click on on “Upload Some other 1099-R” so as to add the only for the conversion if you happen to don’t have each 1099-R bureaucracy imported already.

1099-R for Conversion

This 1099-R shape may be an ordinary 1099-R.

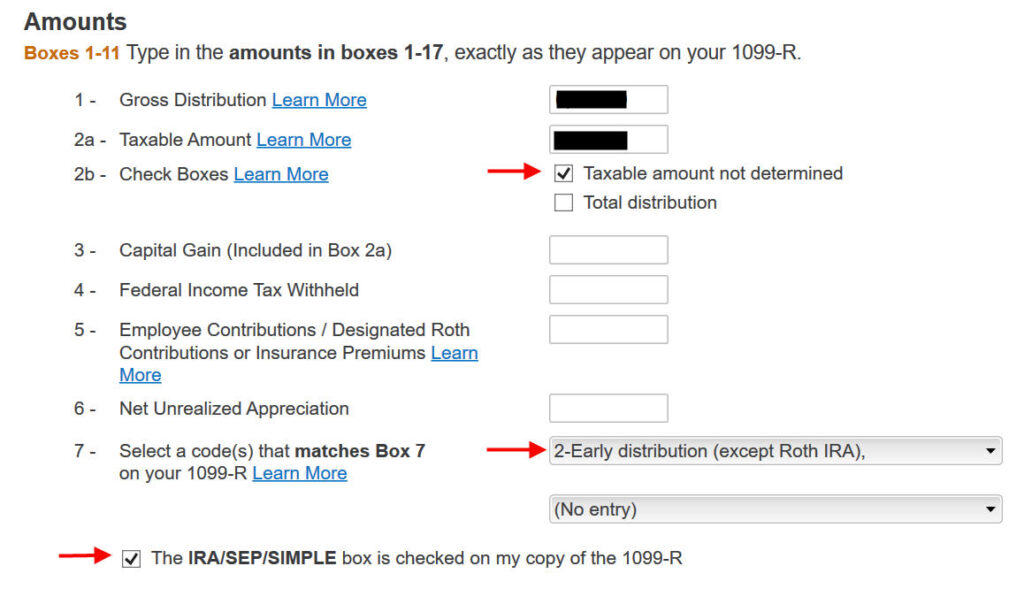

It’s commonplace to look the conversion reported in Field 2a because the taxable quantity when Field 2b is checked to mention “Taxable quantity no longer decided.” The code in Field 7 is ‘2‘ while you’re underneath 59-1/2 or ‘7‘ while you’re over 59-1/2. The “IRA/SEP/SIMPLE” field is checked in this 1099-R shape for the conversion.

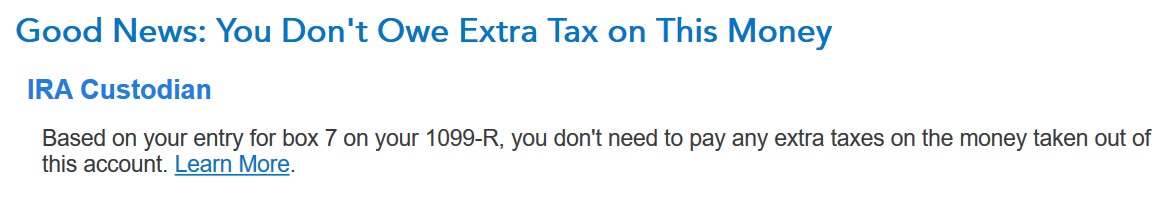

It says that you just don’t owe further tax in this cash however your refund meter drops. Don’t panic. It’s commonplace and simplest brief.

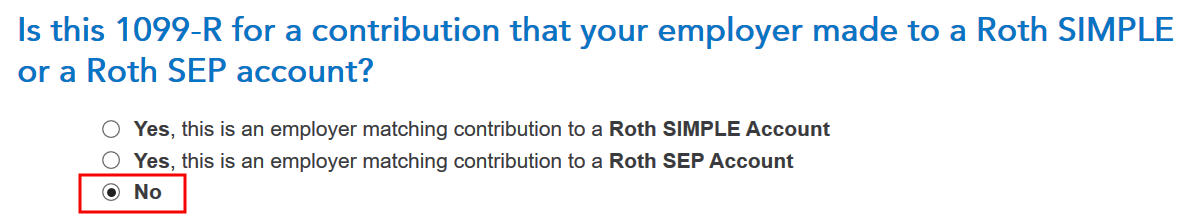

It’s no longer a Roth SIMPLE or a Roth SEP.

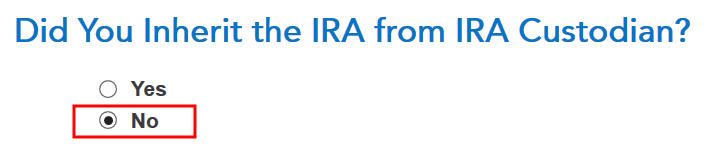

Didn’t inherit it.

Transformed to Roth

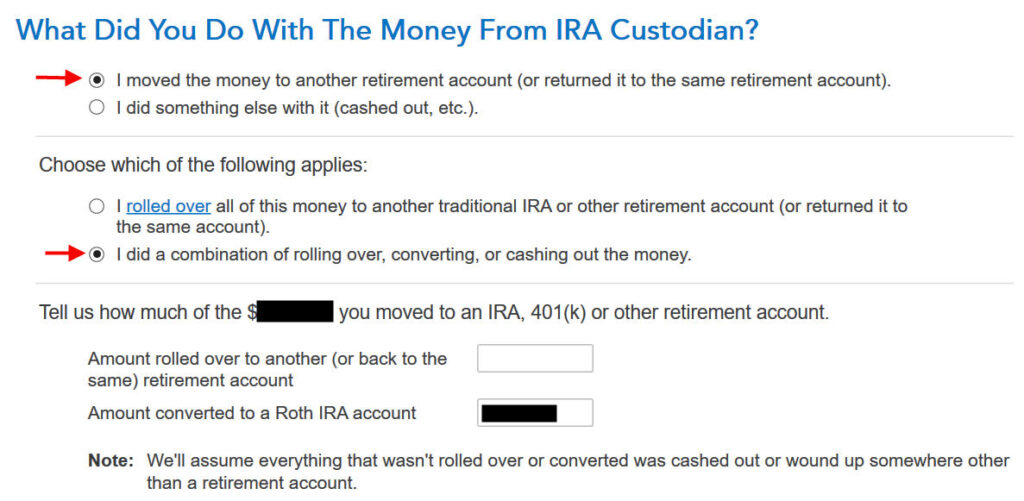

First click on on “I moved …” then click on on “I did a mixture …” Input the quantity you transformed to Roth within the field. It’s $6,700 in our instance. Don’t make a selection the “I rolled over …” possibility. A rollover method Conventional-to-Conventional. Changing to Roth isn’t a rollover.

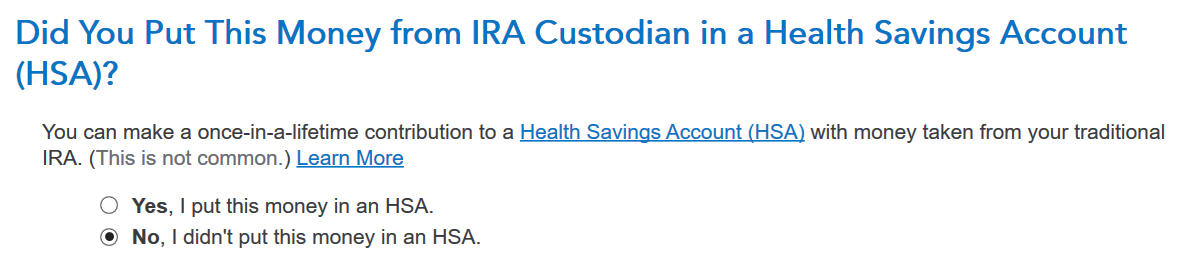

Didn’t put it in an HSA.

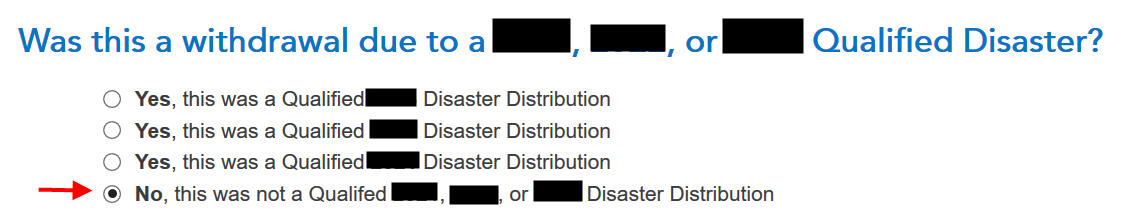

No longer because of a crisis.

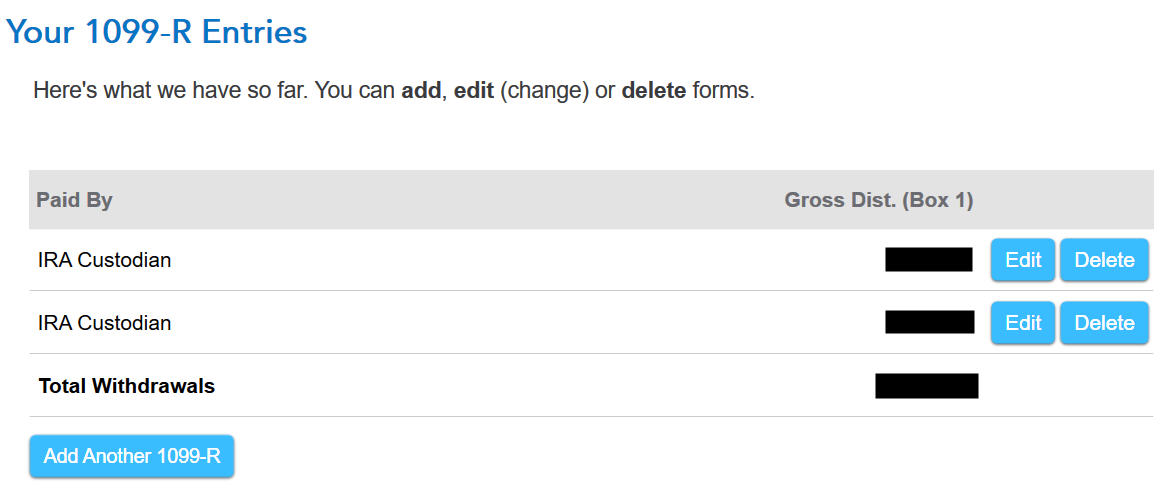

Now the 1099-R abstract contains each 1099-R bureaucracy. Stay going by means of clicking on “Proceed.”

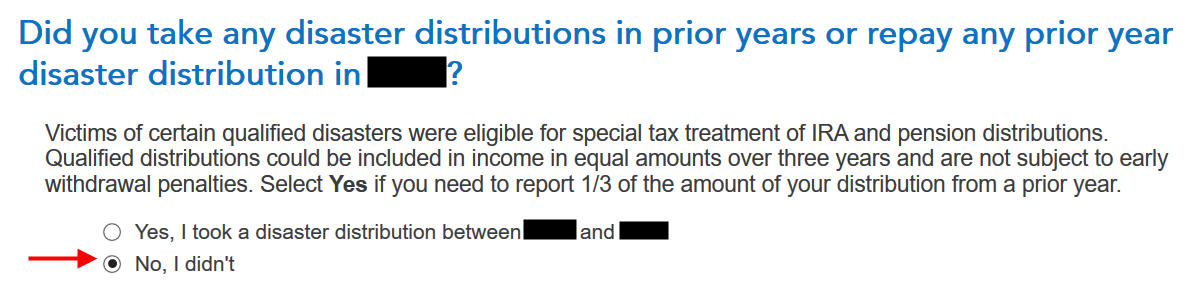

No crisis distributions.

Foundation

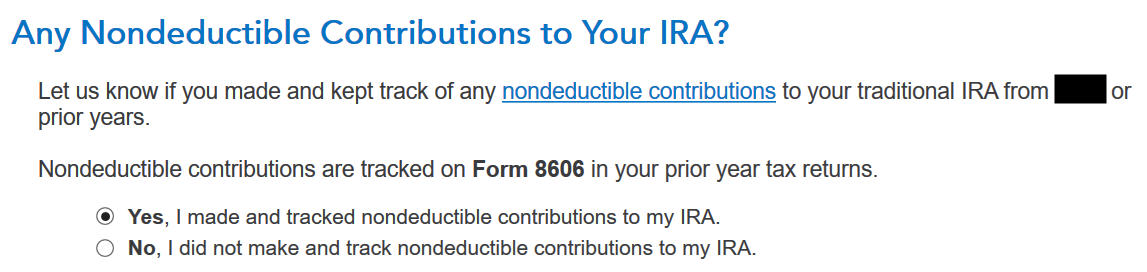

You’ll solution “No” right here however answering “Sure” with a zero has the similar impact and it permits you to proper earlier improper entries.

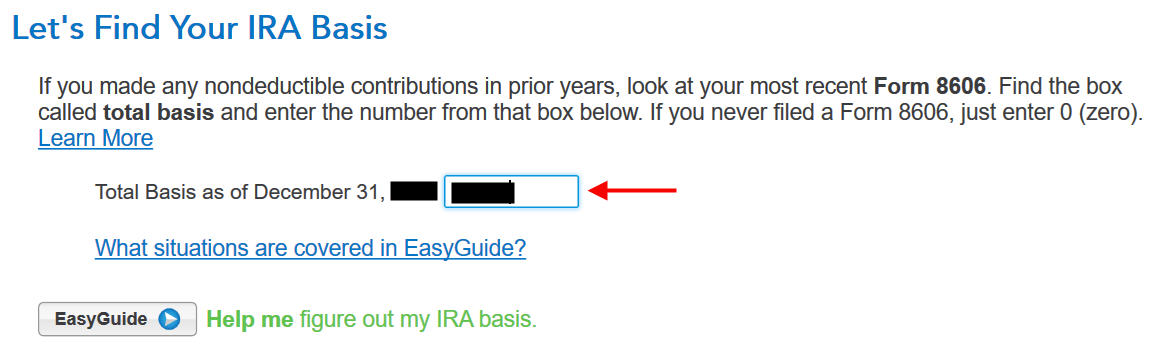

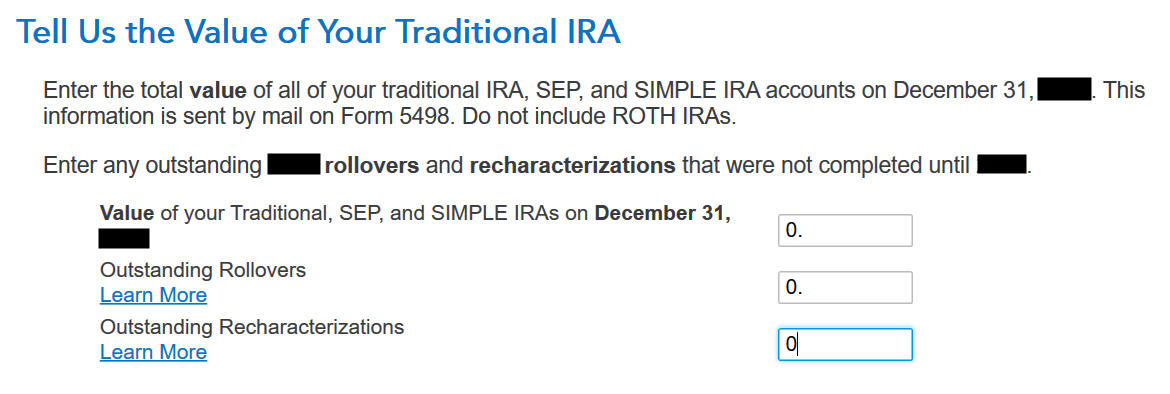

This must be 0 if you happen to hadn’t made any nondeductible contribution to a Conventional IRA prior to. In case you had, get the worth out of your remaining yr’s Shape 8606 Line 14.

Those are generally all 0 if you happen to transformed the whole lot. In case you had a couple of greenbacks left within the account from profits posted after you transformed, input the worth out of your year-end commentary within the first field.

The refund meter continues to be quickly depressed. It’ll come again simplest after we input the recharacterized Roth IRA contribution.

Recharacterized Contribution

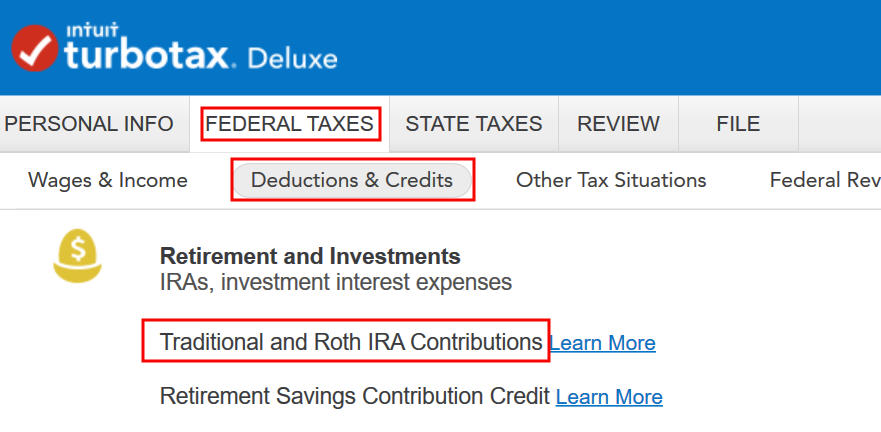

Cross to Federal Taxes -> Deductions & Credit -> Conventional and Roth IRA Contributions.

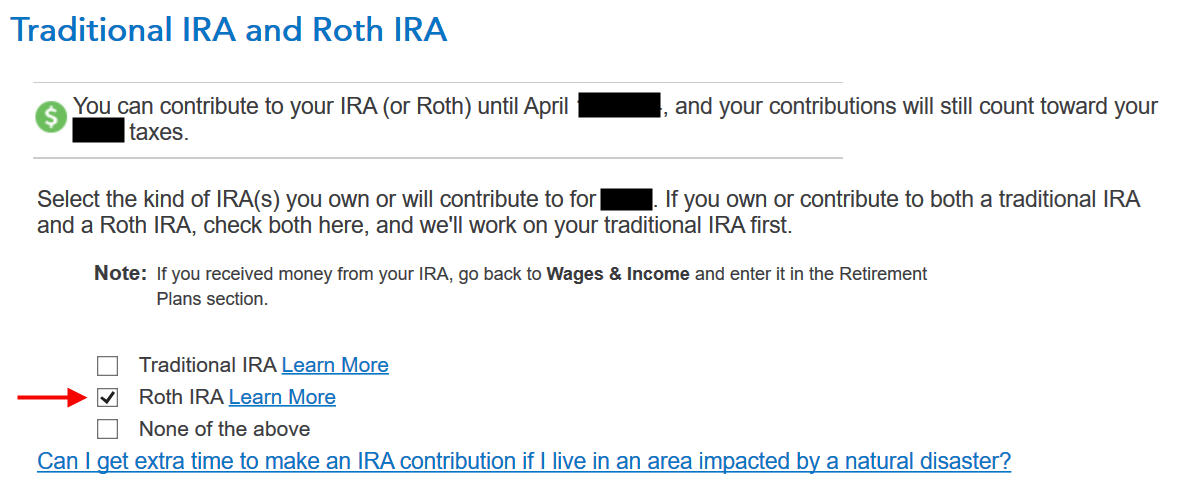

Take a look at the field for Roth IRA since you in the beginning contributed to a Roth IRA.

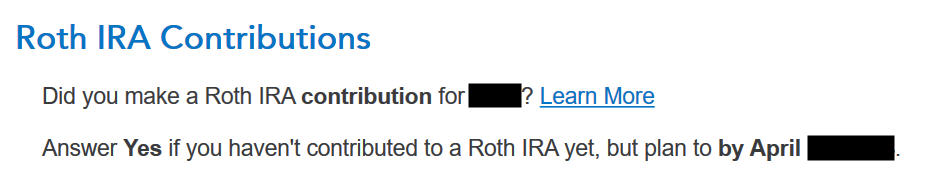

We already checked the field for Roth IRA however TurboTax simply needs to ensure.

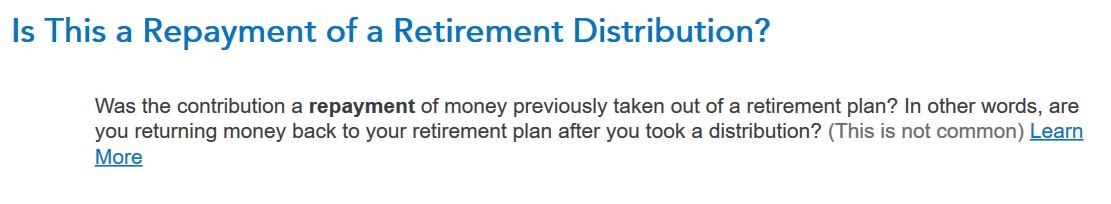

It used to be no longer a compensation of a retirement distribution.

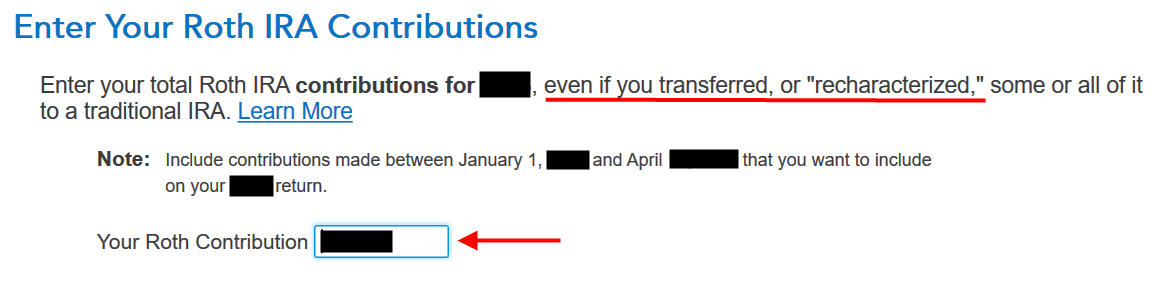

Input the quantity of your unique Roth contribution. It used to be $6,500 in our instance.

Recharacterized

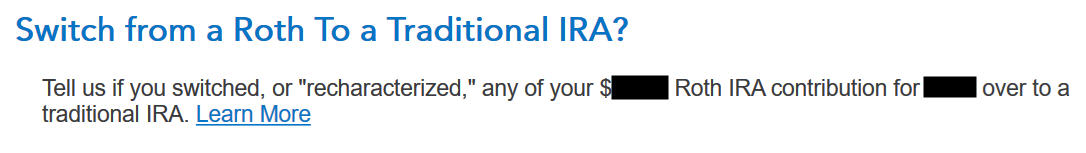

Now we confess that we recharacterized the contribution as a Conventional IRA contribution. Resolution Sure right here.

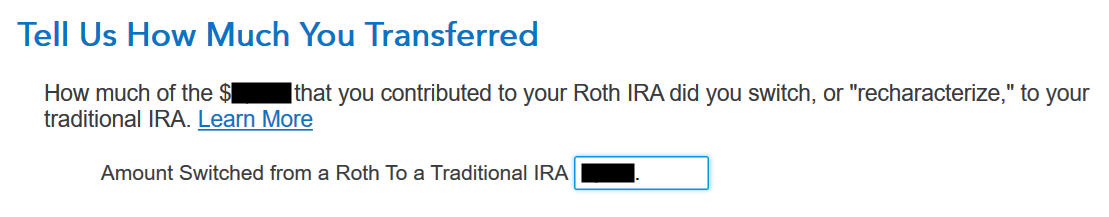

The quantity this is relative to the unique contribution quantity. In case you recharacterized the entire thing, input $6,500 in our instance, no longer $6,600 which used to be the quantity with profits that the IRA custodian moved into the Conventional IRA.

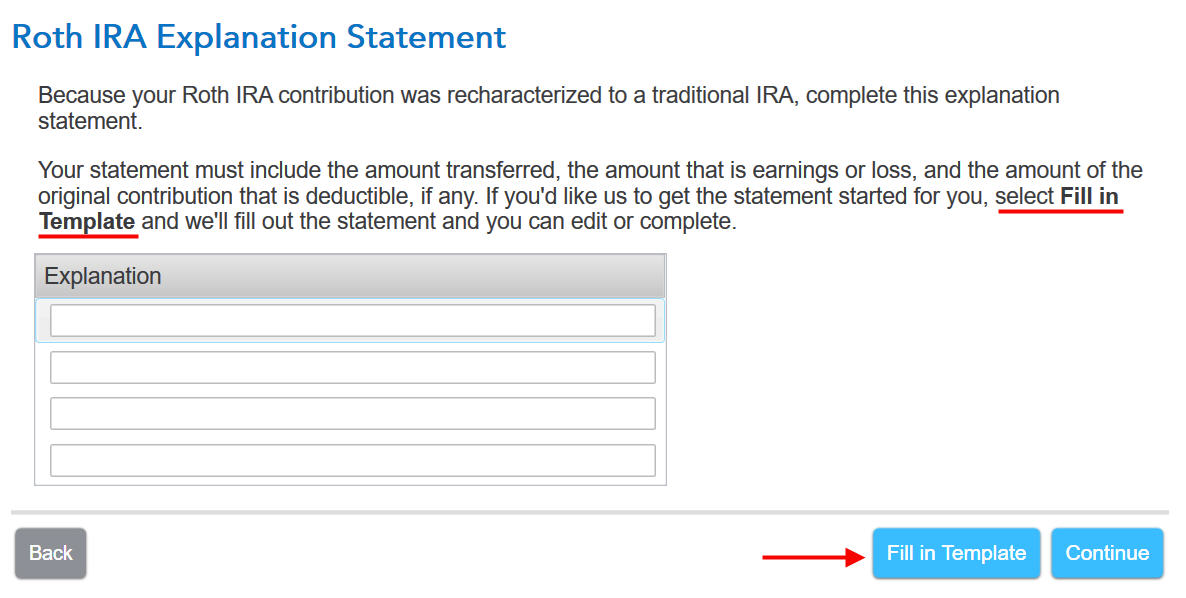

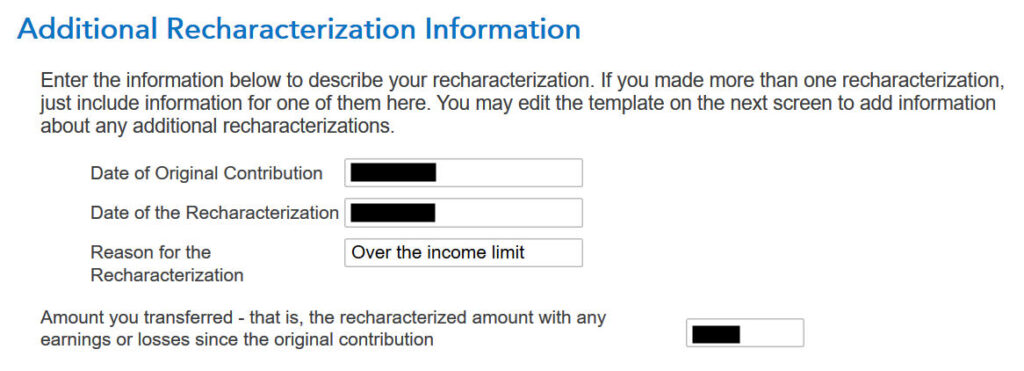

The IRS needs a commentary to give an explanation for the recharacterization. Click on on “Fill in Template.”

Fill within the dates of your unique contribution and your recharacterization. The quantity within the remaining field contains profits. It’s $6,600 in our instance.

Roth Foundation

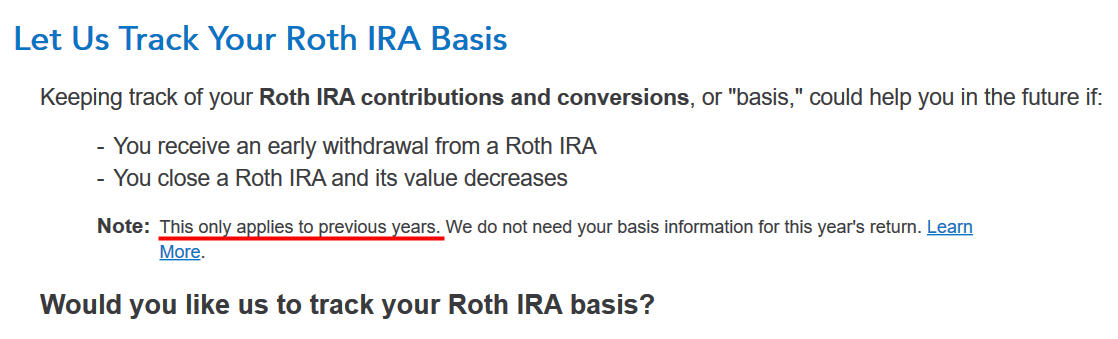

If you are taking up this be offering from TurboTax to trace your Roth IRA foundation, it’s going to invite you questions on earlier years, which is extra hassle than it’s price to me. I replied No.

You don’t wish to observe your Roth IRA foundation if you happen to’re making plans to withdraw out of your Roth account simplest after age 59-1/2 and after you’ve had your first Roth IRA for 5 years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No extra contributions.

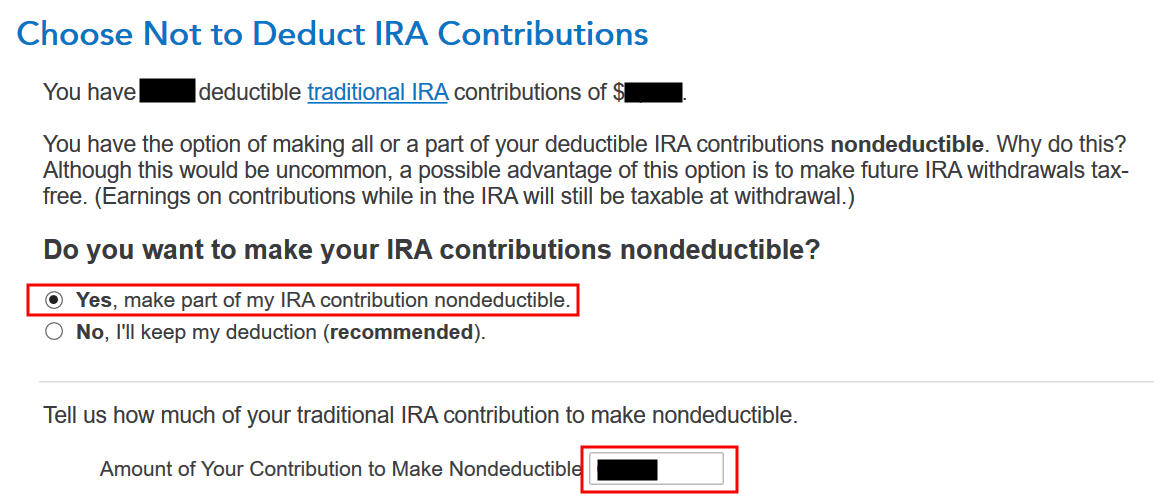

Make It Nondeductible

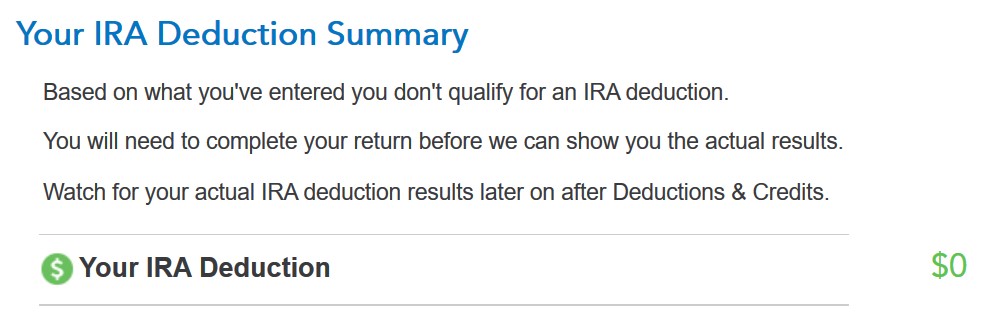

TurboTax displays this simplest when it sees your source of revenue qualifies for a deduction. You have got the technique to take the deduction or decline the deduction. Taking the deduction will make your conversion taxable, which may be OK as it creates a wash. It’s more practical if you are making your complete contribution nondeductible after which your Roth conversion isn’t taxable. Input the quantity of your to be had deductible contribution within the remaining field. It’s $6,500 in our instance.

Your Conventional IRA deduction is 0, which is OK as it makes your Roth conversion no longer taxable.

Taxable Source of revenue

Let’s take a look at how these kind of display up for your tax go back. Click on on “Paperwork” at the most sensible proper.

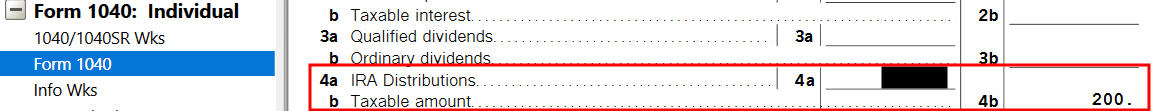

In finding Shape 1040 within the left navigation panel. Scroll up or down at the proper to seek out traces 4a and 4b. Line 4a displays the sum of your two 1099-R bureaucracy. It’s $13,300 in our instance. That is commonplace. Line 4b displays that simplest $200 is taxable. That’s the profits between the time you contributed in your Conventional IRA and the time you transformed it to Roth.

While you’re carried out inspecting the shape, click on on Step-by-Step at the most sensible proper to return to the interview.

Transfer to Blank Backdoor Roth

You have shyed away from having to separate your IRA contribution and Roth conversion in two other tax returns by means of recharacterizing in the similar yr and changing prior to December 31. Nonetheless, you needed to do the additional paintings along with your IRA custodian and observe these kind of steps on this information while you do your taxes.

It’s a lot better to head with a “blank” backdoor Roth from the get-go. If there’s any chance that your source of revenue can be over the prohibit once more, merely give a contribution to a Conventional IRA for 2024 in 2024 and convert it to Roth in 2024. You’re allowed to do a blank backdoor Roth although your source of revenue finally ends up under the source of revenue prohibit for a right away contribution to a Roth IRA. It’s a lot more practical than the complicated recharacterize-and-convert maneuver. You then simplest wish to observe our information for a blank backdoor Roth in How To Document Backdoor Roth In TurboTax.

Say No To Control Charges

If you’re paying an guide a share of your belongings, you’re paying 5-10x an excessive amount of. Discover ways to to find an impartial guide, pay for recommendation, and simplest the recommendation.