Lengthy Time period Monetary Function Examples

Lengthy-term monetary objectives are an very important a part of monetary making plans. They let you outline your aspirations and create a roadmap for reaching them.

Lengthy-term objectives aren’t simple to reach. However why?

May or not it’s that motivation wanes through the years? Possibly exterior cases trade. Perhaps it has to do with the feasibility of the objectives.

Many of us have bother sticking to one thing over the process a unmarried yr let on my own a number of years or a long time.

Possibly that’s why long-term objectives – like most monetary objectives – are so tough to reach.

How can we combat towards no matter it’s that holds us again from reaching those monetary objectives? Is it conceivable to win?

Sure. It’s.

Nowadays I’d love to percentage with you many ways you’ll reach your long-term monetary objectives. I received’t declare it’s going to be simple, however it’s going to be profitable.

So whether or not you wish to have to repay debt, construct an emergency fund, save on your youngsters’ school schooling, or make investments for retirement, listed below are many ways you’ll make it hap’n, cap’n.

Why Lengthy-Time period Monetary Objectives Are Necessary

Lengthy-term monetary objectives supply route and motivation on your monetary choices. By way of defining your long-term objectives, you are going to have a transparent image of what you wish to have to reach and what steps you wish to have to take to get there. Atmosphere long-term monetary objectives help you:

- Keep targeted for your priorities: Atmosphere long-term monetary objectives will let you prioritize your monetary choices and steer clear of getting distracted through temporary monetary wishes or impulses.

- Succeed in monetary balance: Lengthy-term monetary objectives help you create a security web, construct wealth, and get ready for sudden occasions comparable to clinical emergencies or task loss.

- Revel in some great benefits of compound pastime: Making an investment in long-term objectives, comparable to retirement or schooling, help you benefit from the ability of compound pastime and develop your wealth through the years.

1. Seize your long-term objectives on your to-do record.

Lengthy-term objectives of the monetary kind are generally extra like tasks than particular person duties.

For instance, if you wish to repay your debt, chances are high that that you simply don’t simply have one bank card to repay – you may have 3 bank cards, a automobile mortgage, and a pupil mortgage to triumph over (if now not extra).

“Repay debt” will be the challenge. “Repay Visa #1” will be the activity.

In fact that with out writing down your tasks and duties inside a job control method of a few kind, you’re a lot much less prone to accomplish your long-term objectives.

There’s simply one thing about seeing your long-term objectives on paper (or on a display) that makes them actual. The very act of writing them down is a kind of dedication.

Give it a whirl. Write down your long-term monetary objectives and overview them frequently.

2. Don’t bury your long-term objectives.

It’s now not sufficient to write down down your long-term monetary objectives. Moreover, you wish to have to cause them to readily to be had for your eye.

One concept that I’ve discovered works neatly is to write down down your objectives on a whiteboard the place you’ll’t lend a hand however see them. However that’s now not for everyone.

The purpose is that you wish to have to give you the chance to peer your long-term objectives within the context of your entire different objectives (specifically, your temporary objectives). If handiest your temporary, pressing objectives are displayed so that you can see, you’ll have a tendency to concentrate on the ones as an alternative of kicking butt for your long-term objectives.

Don’t bury your long-term objectives. They’re vital too!

3. Commit positive days of the week to long-term objectives.

One useful tip I derived from Strategic Trainer was once to devote positive days of the week to positive objectives. This has proved to be very useful in my very own lifestyles, and I consider it’s going to in yours, too.

For instance, you have to devote a undeniable day of the week to managing your price range and brainstorming tactics to give a boost to your monetary long term. Possibly you’ve a time off of labor that may paintings right for you.

Now, I will listen you announcing, “Oh Jeff, if I handiest had an afternoon for such duties – I’m method too busy with different stuff!” That’s truthful.

However right here’s the object, you don’t simply need to make at the moment about price range – you’ll make it about your different long-term objectives too. Upload in well being, circle of relatives, and different spaces of accountability. Imagine at the moment (or at the moment) of the week to be all about making improvements to your self and your lifestyles. Can’t you’re making time for that?

4. Prioritize your long-term objectives correctly.

On the subject of long-term monetary objectives, you wish to have to correctly prioritize them. There are some initial objectives that are supposed to handiest take you not up to a month, like putting in the cheap and chopping bills, however we’ll go away that for every other article.

What are some not unusual long-term monetary objectives and during which order will have to you entire them? Most often, I like to recommend you entire the next long-term monetary objectives within the order they’re displayed under:

Construct Your Emergency Fund

Recall to mind your emergency fund as the root of your monetary long term. With out some liquid cash, you’re going to be out of success when monetary crisis moves. Consider me, they occur.

Your automobile engine may explode. Your kneecap may explode (ouch). Your water heater may explode. There are such a large amount of issues that may explode . . . and it’s now not simple to only stroll clear of the ones explosions whilst protecting your cool. It’s tense!

However you understand what would make the ones scenarios rather less tense? You guessed it: an emergency fund child!

Wipe Out Your Debt

After getting your basis in position, it’s time to knock out that debt. This will take a number of years or a couple of months – it will depend on how a lot debt you’ve and the way temporarily you’ll shovel cash at it.

Write down your whole money owed and assault them separately. It’s more uncomplicated that method.

Get started Making an investment for Retirement

Now it’s time to start out making an investment on your latter years. Why? It’s conceivable that your incomes attainable can cross down while you’re bodily not able to paintings. Who is aware of, you may have a self-sustaining trade upon attaining retirement age, however don’t rely on it. Make investments for the long run!

Serving to folks retire neatly is what I do.

Get started Saving for Different Lengthy-Time period Objectives

This may come with saving on your youngsters’ school schooling, buying a brand new automobile, saving for a house renovation, or every other target that may take a while.

By way of prioritizing your long-term objectives in the correct method, you’ll make certain that are supposed to you revel in a hunch in source of revenue, you aren’t burnt up because of a loss of monetary making plans.

5. Uncover and concentrate on your motivations.

I’m satisfied that one of the most major causes folks don’t accomplish their long-term objectives is as a result of they truly haven’t came upon their motivations.

For instance, we all know it’s a good suggestion to repay debt. It’s a monetary target that’s been embedded in our minds through numerous monetary advisors. However until you find your motivation for paying off debt, chances are high that you’ll surrender prior to you reach your target.

In truth, if you’re paying off debt for the sake of paying off debt, it’s possible you’ll as neatly surrender now. You’re now not going to be motivated sufficient to get the task performed.

As an alternative, focal point on some not unusual motivations that may change into your motivations. Listed below are some nice the reason why folks wish to repay debt:

- Not to need to pay pastime on their purchases

- To disencumber cash for holidays

- To disencumber cash for making an investment for retirement

- Not to have to fret about the ones expenses

- To cut back the quantity of rigidity of their lives

- To disencumber the time it takes managing debt to concentrate on circle of relatives

Those are simply a number of the motivations of others. What’s your motivation?

Assign a motivation for each and every long-term target you’ve. In a different way, you’re simply seeking to accomplish your long-term objectives for the sake of attaining them – that’s now not an actual motivating issue should you question me!

Lengthy-Time period Function Examples

Lengthy-term monetary objectives can take many paperwork, relying for your values, aspirations, and time horizon. Listed below are some examples of long-term monetary objectives within the SMART framework:

Instance 1: Save for Retirement

Explicit: Save $1 million through age 65 for retirement.

Measurable: Save $500 per 30 days in a retirement account.

Achievable: In line with present source of revenue and bills, it’s possible to save lots of $500 per 30 days for retirement.

Related: Retirement is a long-term monetary target that aligns with non-public values and aspirations.

Time-bound: Do so target through age 65.

Instance 2: Repay Debt

Explicit: Repay $30,000 in bank card debt.

Measurable: Pay $500 per 30 days in opposition to bank card debt.

Achievable: In line with present source of revenue and bills, it’s possible to pay $500 per 30 days in opposition to bank card debt.

Related: Paying off debt is a long-term monetary target that aligns with non-public values and aspirations.

Time-bound: Do so target inside 5 years.

Instance 3: Spend money on Training

Explicit: Save $50,000 for a kid’s school schooling.

Measurable: Save $200 per 30 days in a 529 school financial savings plan.

Achievable: In line with present source of revenue and bills, it’s possible to save lots of $200 per 30 days for varsity schooling.

Related: Making an investment in schooling is a long-term monetary target that aligns with non-public values and aspirations.

Time-bound: Do so target in 18 years.

Instance 4: Purchase a Area

Explicit: Save $100,000 for a down fee on a space.

Measurable: Save $1,000 per 30 days in a high-yield financial savings account.

Achievable: In line with present source of revenue and bills, it’s possible to save lots of $1,000 per 30 days for a down fee.

Related: Purchasing a home is a long-term monetary target that aligns with non-public values and aspirations.

Time-bound: Do so target in 5 years.

Instance 5: Get started a Trade

Explicit: Release a winning trade within the subsequent 5 years.

Measurable: Expand a marketing strategy and safe investment throughout the subsequent 365 days.

Achievable: In line with present abilities and revel in, it’s possible to broaden a marketing strategy and safe investment throughout the subsequent 365 days.

Related: Beginning a trade is a long-term monetary target that aligns with non-public values and aspirations.

Time-bound: Release the trade throughout the subsequent 5 years.

| Lengthy-Time period Function | Explicit | Measurable | Achievable | Related | Time-bound |

|---|---|---|---|---|---|

| Save for Retirement | Save $1 million through age 65 for retirement. | Save $500 per 30 days in a retirement account. | In line with present source of revenue and bills, it’s possible to save lots of $500 per 30 days for retirement. | Retirement is a long-term monetary target that aligns with non-public values and aspirations. | Do so target through age 65. |

| Repay Debt | Repay $30,000 in bank card debt. | Pay $500 per 30 days in opposition to bank card debt. | In line with present source of revenue and bills, it’s possible to pay $500 per 30 days in opposition to bank card debt. | Paying off debt is a long-term monetary target that aligns with non-public values and aspirations. | Do so target inside 5 years. |

| Spend money on Training | Save $50,000 for a kid’s school schooling. | Save $200 per 30 days in a 529 school financial savings plan. | In line with present source of revenue and bills, it’s possible to save lots of $200 per 30 days for varsity schooling. | Making an investment in schooling is a long-term monetary target that aligns with non-public values and aspirations. | Do so target in 18 years. |

| Purchase a Area | Save $100,000 for a down fee on a space. | Save $1,000 per 30 days in a high-yield financial savings account. | In line with present source of revenue and bills, it’s possible to save lots of $1,000 per 30 days for a down fee. | Purchasing a home is a long-term monetary target that aligns with non-public values and aspirations. | Do so target in 5 years. |

| Get started a Trade | Release a winning trade within the subsequent 5 years. | Expand a marketing strategy and safe investment throughout the subsequent 365 days. | In line with present abilities and revel in, it’s possible to broaden a marketing strategy and safe investment throughout the subsequent 365 days. | Beginning a trade is a long-term monetary target that aligns with non-public values and aspirations. | Release the trade throughout the subsequent 5 years. |

Want Extra Lengthy-Time period Function Examples?

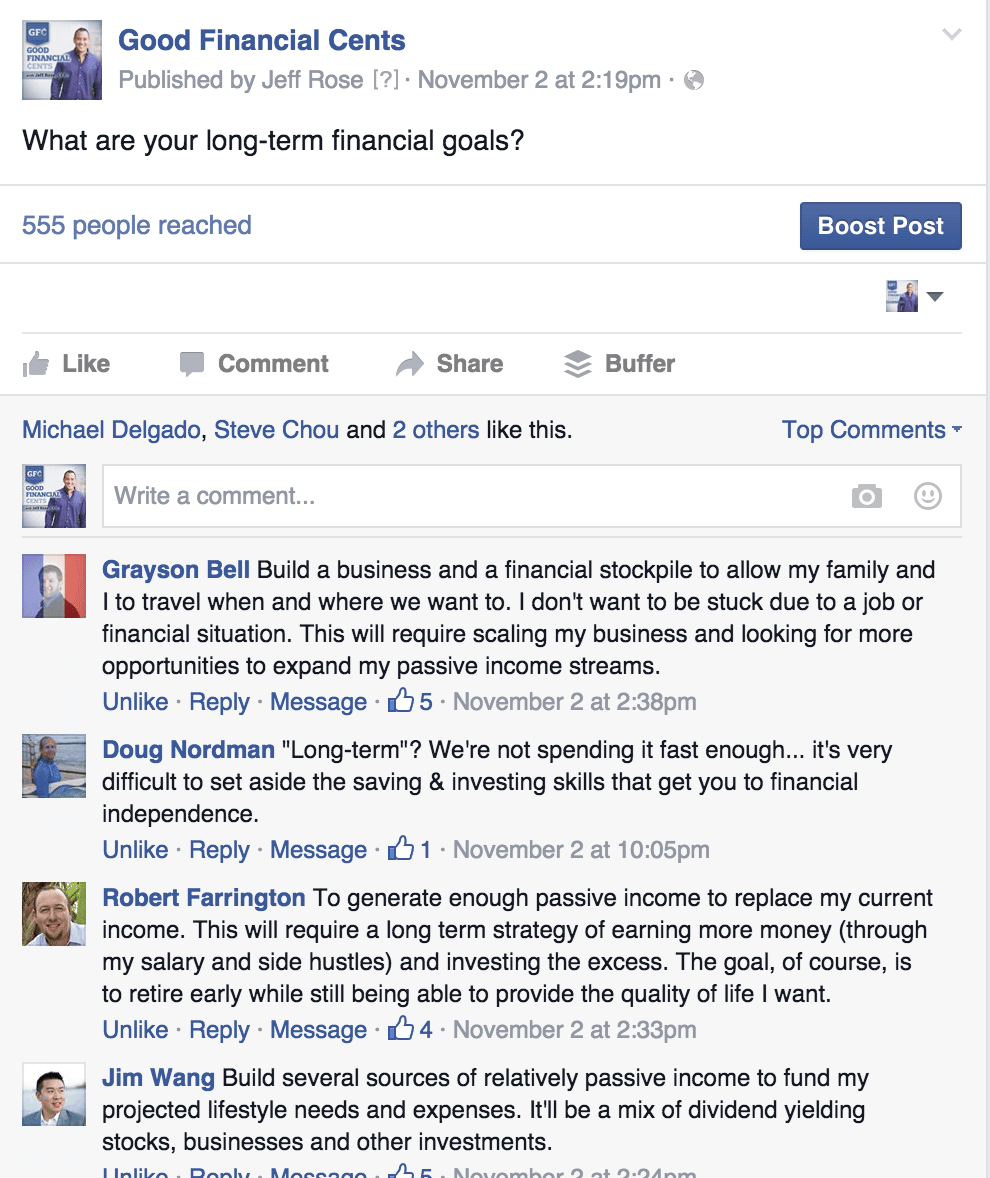

Realizing I’m now not the one goal-setting freak that exists on this global, I requested lovers from the Excellent Monetary Cents Fb web page what their long-term objectives (giant shout to the Fincon group for contributing, too!).

Fincon Group Lengthy-Time period Objectives

Right here’s a perfect record of examples of long-term objectives:

Bob Lotich at SeedTime.com says:

[I want] to offer a comfy lifestyles for my circle of relatives, to have sufficient money to care for a versatile way of life, and to make use of the entirety else to financially make stronger charities and organizations which are making an enormous affect at the global.

Ryan Guina at TheMilitaryWallet.com says:

[I want] to change into financially impartial. What this implies to me: to don’t have any client or loan debt and feature sufficient sources in financial savings and investments to hide my on a regular basis dwelling bills with out depending upon source of revenue from my task. This will likely supply extra freedom in pursuing actions in response to achievement vs. the wish to generate earnings.

Larry Ludwig at InvestorJunkie.com says:

[I want] to be financially unfastened. I outline it in particular as to acquire $10,000,000 in funding property that may generate at minimal 4% in step with yr of source of revenue.

Teresa Mears at LivingOnTheCheap.com says:

[I want] to make stronger myself, each now and in retirement, and revel in lifestyles. What else is there?

Steve Chou at MyWifeQuitHerJob.com says:

[I want] to generate sufficient source of revenue in order that I will spend extra time with my circle of relatives and be there for the youngsters. Rising up, my folks labored their butts off so I may just cross to a excellent college however I didn’t see them very continuously throughout the week. With my youngsters, I’m going to ship them to a excellent school and all the time be provide.

Grayson Bell at DebtRoundup.com says:

[I want to] construct a trade and a monetary stockpile to permit my circle of relatives and I to commute when and the place we wish to. I don’t wish to be caught because of a role or monetary scenario. This will likely require scaling my trade and in search of extra alternatives to enlarge my passive source of revenue streams.

Robert Farrington at TheCollegeInvestor.com says:

[I want] to generate sufficient passive source of revenue to interchange my present source of revenue. This will likely require a long-term means of incomes extra money (via my wage and aspect hustles) and making an investment the surplus. The target, in fact, is to retire early whilst nonetheless having the ability to give you the high quality of lifestyles I need.

My Lifetime Objectives

Lengthy-term objectives can also be tough to articulate however should be written down. I in the past shared my lifetime objectives on this put up. Taking a look them over I acknowledge I might make a couple of tweaks, however; for essentially the most phase, they’re nonetheless align with what I wish to reach in lifestyles. Right here’s a glance:

1. Religious chief of my family. I need my youngsters to peer me first as a God-loving father who places his religion first prior to good fortune. I wish to frequently love and make stronger my spouse, and accomplish that in an Godly way.

2. Are living a protracted and filling lifestyles with my spouse and circle of relatives. Elevate my youngsters with the philosophies of: operating arduous, however now not sacrificing “paintings” for what you like; love first; and deal with folks with appreciate (Golden Rule)

3. Have a number of multiple-system pushed companies that produce >$100,000 a month of passive source of revenue.

4. Are living in a number of nations (5+) for a longer time period (minimal 3 weeks) with complete circle of relatives

5. Encourage over a million folks to put money into themselves. This can also be via conventional making an investment (Roth IRA, 401k), acquiring a better stage or certification, or making an investment in a small trade.

6. Be a a success entrepreneur and best-selling writer of a large number of works. I wish to be identified as as a difficult employee who put his circle of relatives and religion first.

The Backside Line – Lengthy-Time period Monetary Objectives

Atmosphere long-term monetary objectives is crucial step in opposition to reaching monetary balance and development wealth. By way of defining your values, aspirations, and time horizon, you’ll create a roadmap that aligns along with your priorities and guides your monetary choices.

Take into accout to watch your development, keep motivated, and search skilled recommendation when wanted. With self-discipline and perseverance, you’ll reach your long-term monetary objectives and safe your monetary long term.

Right here’s your homework

I need you to enforce no less than such a methods for attaining your long-term objectives over the following yr. When the yr is over, write me. Inform me how neatly the method labored out for you. I need you to position your middle and soul into a number of of those methods.

Why? I need you to peer good fortune.

Make it hap’n, cap’n!

FAQs – Lengthy-Time period Monetary Objectives

It’s vital to strike a steadiness between saving on your long-term monetary objectives and assembly your temporary wishes. You’ll do so through developing the cheap that allocates a few of your source of revenue in opposition to each temporary and long-term objectives.

This fashion, you’ll deal with your speedy monetary wishes whilst additionally making development in opposition to your long-term objectives.

Staying motivated to reach your long-term monetary objectives can also be difficult, particularly in case your objectives are a number of years away.

One technique to keep motivated is to wreck your long-term objectives into smaller, manageable milestones. Rejoice each and every milestone as you achieve it, and use the development you’ve made as motivation to stay going.

Incessantly tracking your development in opposition to your long-term monetary objectives is very important to staying on the right track.

You’ll use monetary making plans gear and tool to trace your development and modify your plan as wanted. You’ll additionally paintings with a monetary guide or planner to guage your development and make any important changes for your plan.

Sure, it’s vital to be versatile and modify your long-term monetary objectives as your scenario adjustments. Lifestyles is unpredictable, and sudden occasions can affect your monetary scenario. Evaluate your monetary plan ceaselessly and modify it as had to make sure that it aligns along with your present scenario and objectives.

Want some extra long-term objectives? Take a look at The Most sensible 10 Excellent Monetary Objectives That Everybody Must Have. When you’re a toddler boomer, take a look at 5 Monetary Objectives for Child Boomers.