How {Couples} Can Undertake The Identical Monetary Targets And Win

In 2024, I’m transitioning from a spender to a saver mindset. I’m returning to frugal behavior paying homage to my way of life within the first 13 years after faculty. This alteration is triggered via the want to rebuild liquidity.

One space I am focused on to chop bills is meals. After a three-month experiment involving higher spending on foods, I grew bored with the surplus. Now, I am swinging the opposite direction—making plans to consume much less for weight reduction, choosing leftovers, and cooking extra to save cash.

The primary day of the brand new yr marked a favorable get started towards attaining my 2024 objectives. I rose early to edit and post a publish, adopted via a 1.5-hour pickleball consultation—a dedication tied to my New 12 months’s resolutions.

Alternatively, upon returning house at 11:35 am, my optimism took successful once I came upon an Uber Eats supply motive force blocking off my driveway. At a loss for words, I inquired concerning the cope with he was once looking for, handiest to are aware of it was once mine.

To my chagrin, my spouse had ordered $48 price of udon noodles for the children, whilst I had mentally ready to make cost-free grilled cheese sandwiches. Yum! Unbeknownst to me, they’d already eaten grilled cheese for breakfast.

Can Be Laborious To Get On The Identical Monetary Web page As a Couple

Normally, I am ok with spending cash on meals supply to avoid wasting time. My spouse was once being productive, modifying the general chapters of my new guide. Alternatively, with my answer to save cash within the new yr, I felt upset on the first actual day.

This is the object: at 12:35 pm, we have been heading to a chum’s New 12 months’s birthday celebration, which I attended with our son closing yr. They host an ideal birthday celebration with a ton of meals and drinks! So, stuffing ourselves previously and spending $48 on lunch felt like a double kick within the nuts.

We handiest argued for a minute after which moved on. But it surely were given me enthusiastic about how tough it may be for {couples} to get at the similar monetary web page, particularly when there’s a desired shift in spending behavior.

On the finish of the day, I didn’t do the next:

- Obviously keep in touch that I wish to spend much less cash on meals this yr.

- Tell my spouse there’s quite a lot of meals for each adults and youngsters to consume on the New 12 months’s lunch birthday celebration.

- Get ready meals for my children ahead of leaving to play pickleball for an hour.

How To Undertake The Identical Monetary Targets With Your Spouse

The reason for many arguments between {couples} ceaselessly stems from unstated expectancies. I had printed my 2024 objectives publish and expected we might get monetary savings on lunch via attending a chum’s lunch birthday celebration. The issue is, I did not proportion my expectancies with my spouse.

To me, I simply assumed this was once a logical conclusion. To her, she didn’t know what to anticipate from the birthday celebration and was once busy operating. She was once additionally ordering further to deal with dinner for all people and proceeding a Eastern custom of consuming noodles on New 12 months’s Day for lengthy existence.

In her thoughts, logically, it was once higher to feed our kids ahead of the lunch birthday celebration to steer clear of hangry meltdowns and stay them glad. For reference, our children in most cases consume lunch at 11:30 am, so having them wait to consume till 1 pm could be a recipe for possible meltdowns.

Getting at the similar monetary web page together with your spouse is the most important for a harmonious dating and will considerably reduce arguments. Listed here are 10 methods to succeed in monetary alignment.

1) Open Conversation

- Foster open and truthful conversation about cash issues. Identify a secure house for discussions, making sure each companions really feel heard and understood.

- Continuously test in for your monetary objectives and speak about any adjustments in source of revenue, bills, or priorities.

2) Set Shared Targets

- Outline temporary and long-term monetary objectives in combination. This would come with saving for a house, making plans for youngsters’s schooling, or getting ready for retirement.

- Make certain that your objectives align with each companions’ values and aspirations.

3) Funds In combination

- Create a joint price range that displays your shared monetary priorities. Be clear about your personal spending behavior and paintings in combination to discover a steadiness.

- Continuously overview and modify the price range as cases trade.

4) Perceive Each and every Different’s Cash Mindset

- Acknowledge that folks ceaselessly have other attitudes and ideology about cash. Perceive your spouse’s cash mindset, bearing in mind components like upbringing and previous reports. There is a giant distinction between having a shortage mindset and an abundance mindset.

- Be affected person and empathetic, operating against discovering not unusual flooring.

5) Designate Monetary Roles

- Obviously outline each and every spouse’s duties relating to price range. This would contain one particular person dealing with invoice bills, whilst the opposite manages investments, for instance.

- Continuously speak about and assess whether or not those roles want changes.

6) Emergency Fund and Insurance coverage

- Prioritize development an emergency fund price no less than six months of residing bills to create a buffer for surprising bills.

- Safe suitable insurance plans as nicely. The quantity of psychological reduction my spouse and I skilled after you have two matching 20-year time period existence insurance coverage insurance policies with PoilcyGenius just lately was once massive. The psychological reduction by myself is price the price of the premiums.

7) Monetary Dates

- Time table common “monetary dates” to speak about cash issues. Make it an stress-free task via combining it with a meal or a stroll, developing a favorable affiliation with monetary discussions.

8) Compromise

- Acknowledge that compromise is essential. You would possibly not at all times agree on each monetary resolution, however discovering center flooring guarantees that each companions are happy with the decisions being made.

9) Monetary Schooling

- Make investments time in monetary schooling in combination. Attend workshops, learn books like Purchase This No longer That, pay attention to podcasts that speak about couple’s problems, or take classes that beef up your figuring out of private finance.

- Studying in combination will toughen your monetary literacy and supply a shared basis for decision-making.

10) Search Skilled Steerage

- If wanted, seek the advice of a monetary guide or marriage counselor. A impartial 3rd birthday celebration can give steerage, particularly all the way through primary monetary choices or if there are power disagreements.

Going From Spender To Saver Can Be Laborious

After years of rather unfastened spending, transitioning from a spender’s mindset to a frugal one can also be difficult. Because the supervisor of our circle of relatives’s price range, I think the force to verify our monetary safety, and the extra we’ve, the more secure I think.

I am keen to make excessive sacrifices like eating handiest ramen noodles and water day by day if it method replenishing our checking account. I am additionally keen to paintings 60-80 hours every week for so long as important to reach monetary freedom faster. I do know this as a result of it is the method I took to retire at 34 in 2012!

Alternatively, I acknowledge that my point of view could be thought to be excessive. My concern of poverty stems from rising up in creating international locations surrounded via it. In consequence, embracing frugality makes me really feel extra safe.

Fasting all morning to experience unfastened meals at a chum’s lunch birthday celebration brings me pleasure. Dressed in the similar garments since 2002 seems like a badge of honor. I even put on my socks till they’ve now not one, however two holes in them!

Some may say I’ve a frugality illness. Regardless of efforts to be much less frugal since leaving my day process in 2012, the truth is that dropping a solid source of revenue supply does not make spending cash any more uncomplicated. And neither does having youngsters.

If I am not cautious, my frugality might result in way of life deflation and useless conflicts with my spouse. On the similar time, if we spend excessively, monetary rigidity will develop. For the well-being of our circle of relatives, we will have to come to a compromise.

Highest Technique To Change into Extra Frugal

If you’re feeling like you have got been spending an excessive amount of and wish to undertake a extra frugal way of life, one efficient method is to imagine the struggling of others.

Surely, developing the cheap, chopping up your bank cards, and heading off useless purchases are treasured steps. Alternatively, probably the most impactful strategy to shift from being a spender to a saver is to recognize the level of poverty on this planet.

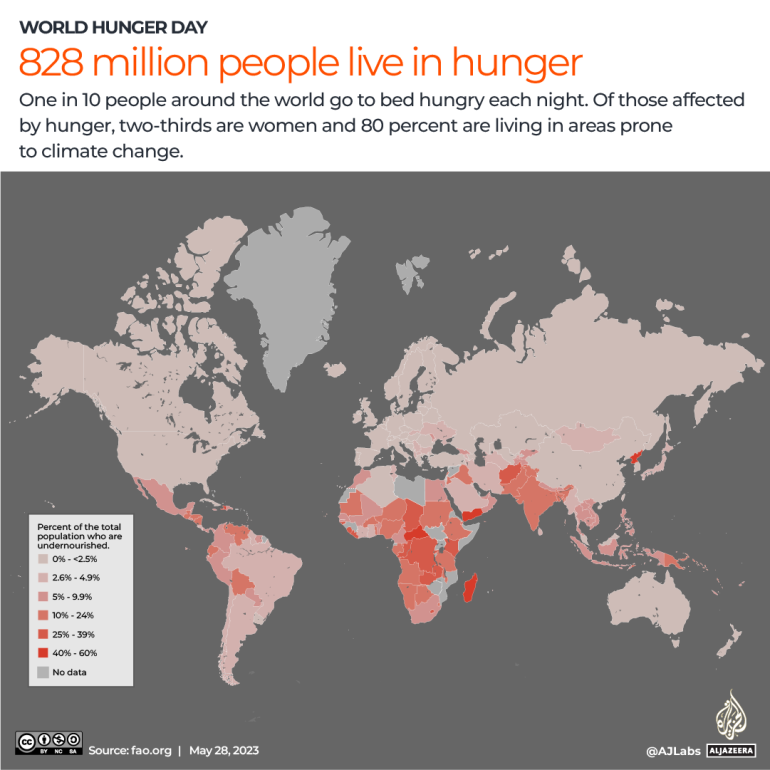

Roughly 828 million folks, or 10% of the worldwide inhabitants, move to mattress hungry each night time. While you grow to be conscious about this and witness the faces of those that are ravenous, you’re much more likely to steer clear of overeating and gaining useless weight. How are you able to delight in every other slice of key lime pie when there is a kid available in the market who has handiest had one bowl of rice and pickles to consume all day?

Round 650 million folks reside in poverty. Experiencing or witnessing poverty is more likely to make you much less extravagant and extra conscious of your spending behavior. Believe staring at movies on-line or taking a commute to a much less prosperous nation. I guarantee you that such reports will make you extra conscientious about your spending.

The Want To Be in contact Higher

My spouse isn’t a large spender in any respect. She bought her wedding ceremony get dressed at Goal for $80 in 2008, and to these days, her favourite retailer stays Goal, the place we move possibly as soon as 1 / 4. She does not personal fancy sneakers or clothier garments. Maximum just lately, she was once completely content material with us proceeding to reside in our previous space till I satisfied her another way because of my actual property FOMO.

Bettering our conversation about monetary expectancies is very important. I will’t suppose she is aware of what I need, and in addition, she cannot suppose what I need. Steady assumptions will handiest result in ongoing arguments.

Due to this fact, I am including every other objective for 2024: to keep in touch higher. Regardless of writing and podcasting for a few years, I notice I am not the communicator I aspire to be. I want to be extra specific when explaining issues to my spouse to attenuate miscommunication.

On the finish of the day, spending $48 on lunch ahead of a lunch birthday celebration is not going to wreck us. Ordering became out to be a smart move since the meals on the birthday celebration was once too highly spiced for the children. This is to higher discussion!

Questions And Ideas

Readers, have you ever discovered it tough to get at the similar monetary web page together with your vital different? How do you to find answers to undertake an identical monetary objectives? Have you ever ever long past from being a unfastened spender to all of sudden an ultra-frugal particular person? If this is the case, how lengthy did you stick with it and what have been you methods?

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I plan to talk to my spouse about many monetary subjects going ahead.

For extra nuanced private finance content material, sign up for 60,000+ others and join the unfastened Monetary Samurai publication. Monetary Samurai is without doubt one of the biggest independently-owned private finance websites that began in 2009.