Decide Out of Underpayment Penalty in TurboTax and H&R Block

While you do your taxes in tax device, the device infrequently calculates an underpayment penalty. It thinks you owe the penalty when your tax withholding plus any estimated tax bills have been under a definite threshold (the “protected harbor“):

- Inside $1,000 of your tax legal responsibility; or

- 90% of your present 12 months’s tax legal responsibility; or

- 100% of your earlier 12 months’s tax legal responsibility (110% in case your AGI within the earlier 12 months used to be $150,000 or extra)

In case your source of revenue used to be asymmetric right through the 12 months, you’ll attempt to get out of paying the underpayment penalty thru a sophisticated workout the usage of the “Annualized Source of revenue Installment Approach.” It mainly comes right down to doing all of your taxes 4 instances via setting apart your source of revenue and deductions into 4 sub-periods throughout the 12 months and calculating your taxes for each and every sub-period.

I don’t learn about you however I don’t have any urge for food for doing my taxes 4 instances.

There’s a a lot better manner. The tax device is most effective looking to be useful in calculating the underpayment penalty for you. You’ll be able to decline its lend a hand and let the IRS calculate the penalty and invoice you in the event that they come to a decision to evaluate a penalty.

The IRS in truth continuously doesn’t assess a penalty when the tax device thinks you owe a penalty. You don’t must volunteer the penalty now.

Right here’s the way to decide out of calculating the underpayment penalty in TurboTax and H&R Block device.

TurboTax

I’m the usage of TurboTax downloaded device. TurboTax downloaded device is each extra robust and more cost effective than TurboTax on-line device.

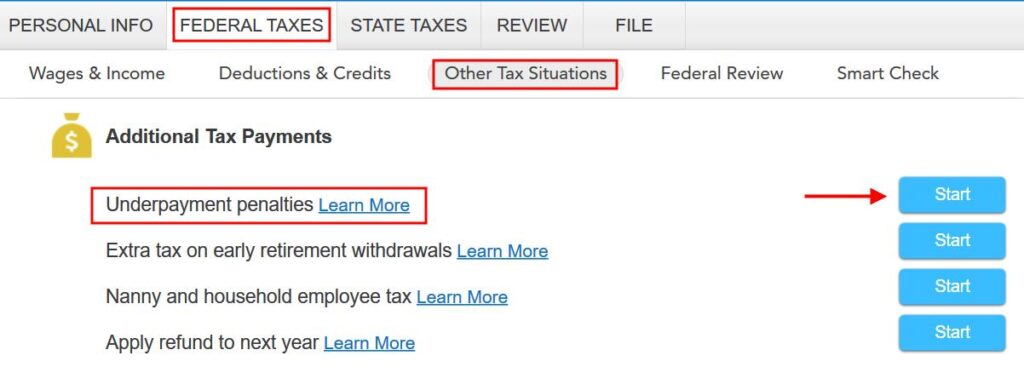

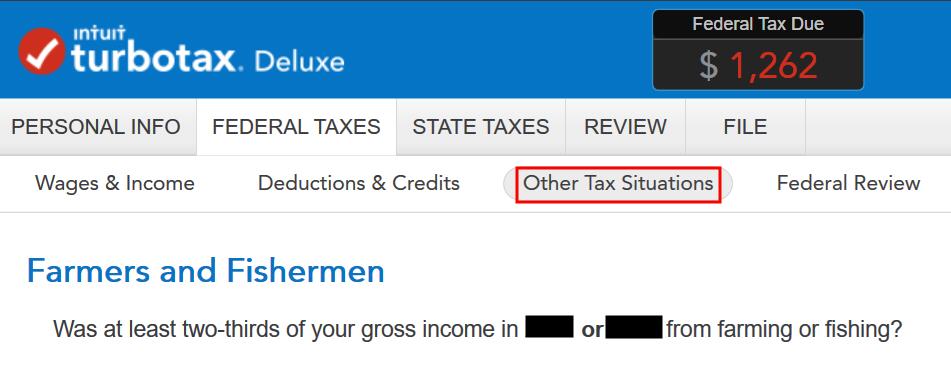

In finding “Underpayment consequences” beneath Federal Taxes -> Different Tax Eventualities. Click on on Get started.

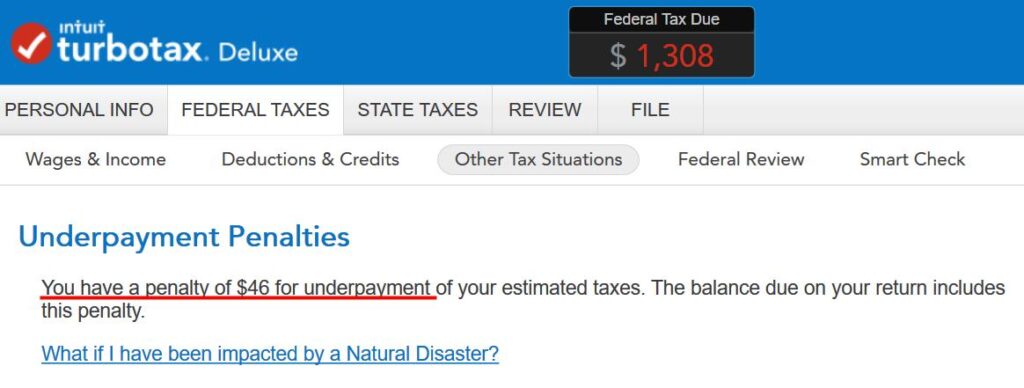

If TurboTax says you’ve gotten a penalty for underpayment. Click on on Proceed.

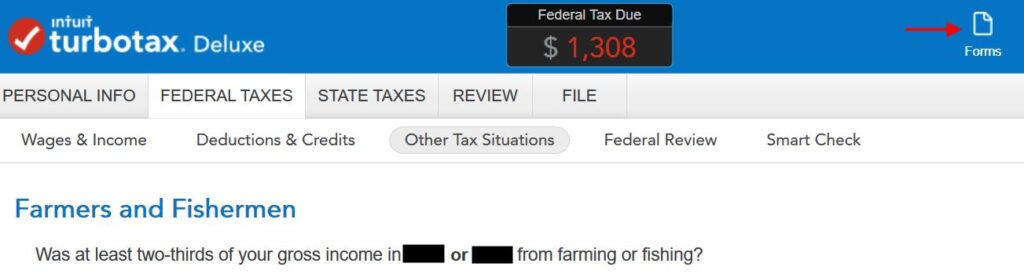

TurboTax asks you about farming or fishing, which doesn’t practice to most of the people.

You’ll be able to proceed the complicated interview with extra hoops to leap thru but it surely’s a lot sooner if you happen to transfer to the Paperwork mode now via clicking on Paperwork at the most sensible proper.

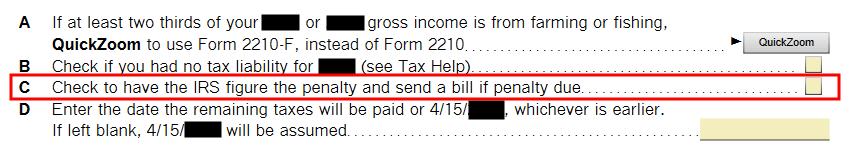

TurboTax opens a kind. Take a look at the field subsequent to merchandise C to have the IRS calculate the penalty and ship a invoice if essential. Chances are high that they received’t.

The underpayment penalty calculated via TurboTax is got rid of straight away after you test that field. Observe in our instance the tax owed meter dropped from $1,308 to $1,262 once we checked the field.

Click on on Step-by-Step to go back to the interview.

You’re again to the display about farming and fishing. Click on on “Different Tax Eventualities” within the sub-menu to go out this segment.

H&R Block

It’s a lot more simple within the H&R Block downloaded device. H&R Block obtain may be each extra robust and more cost effective than H&R Block on-line device.

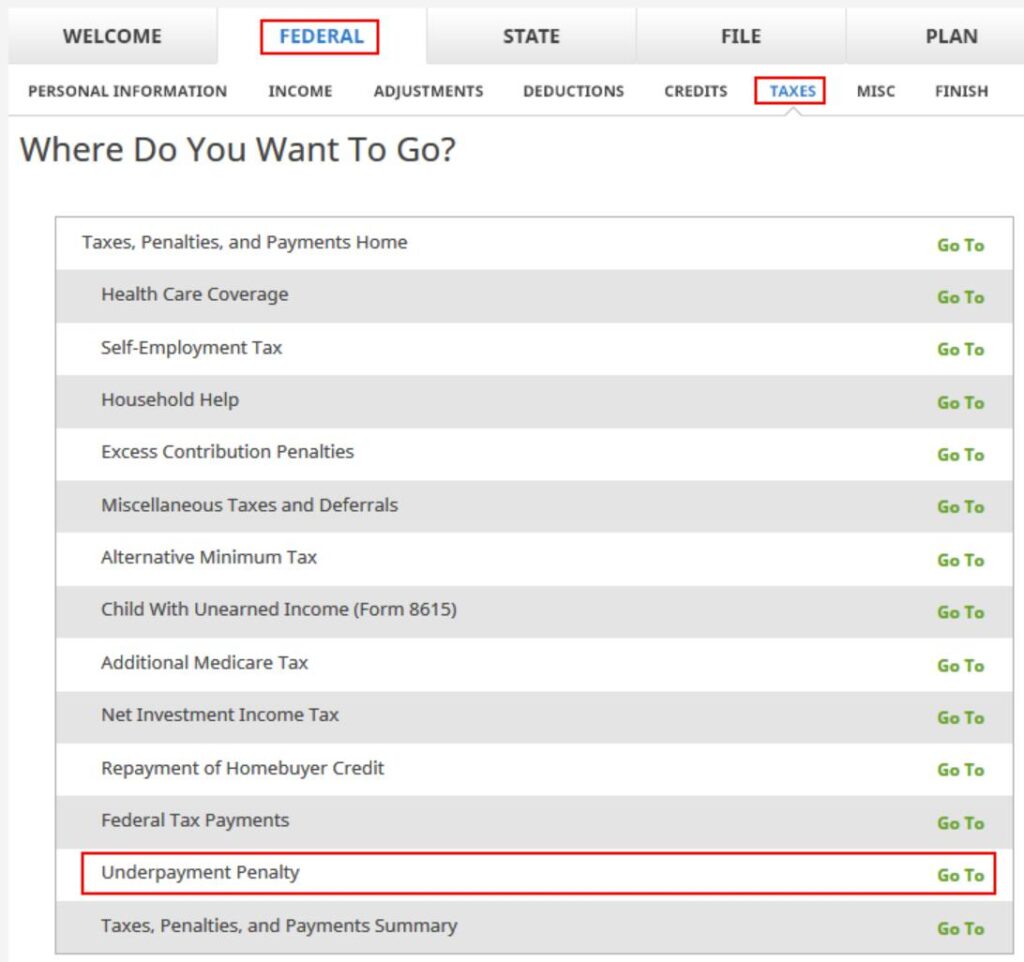

In finding “Underpayment Penalty” beneath Federal -> Taxes. Click on on Pass To.

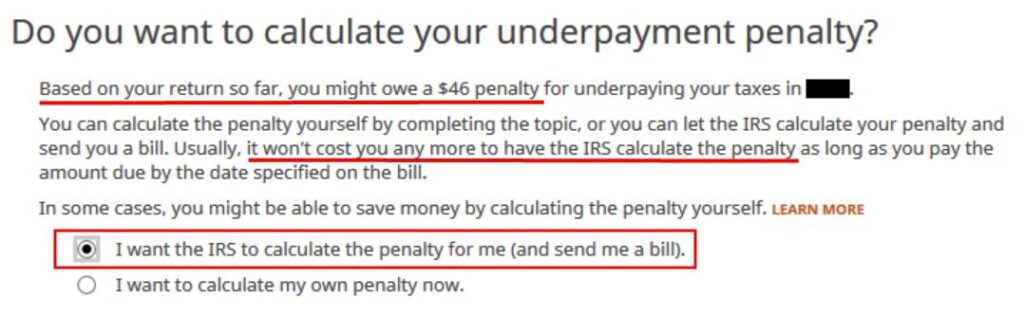

H&R Block gives the solution to let the IRS calculate the penalty immediately. The choice is chosen via default.

H&R Block explains that it received’t price you to any extent further to have the IRS calculate the penalty. It in truth will price you much less when the IRS doesn’t assess a penalty.

Say No To Control Charges

In case you are paying an consultant a share of your property, you’re paying 5-10x an excessive amount of. Discover ways to in finding an impartial consultant, pay for recommendation, and most effective the recommendation.