a Nearer Have a look at Renting Through Selection

When the query of whether or not one will have to purchase or lease a house comes up, the standard solution is “Run the numbers.” A nice device for working the numbers is the Purchase-or-Hire Calculator from The New York Instances.

This calculator totally takes into consideration the cost of the house, how lengthy you’ll keep in the house, loan price, down fee, house charge expansion price, lease expansion price, funding go back, inflation, belongings tax, the tax price, ultimate prices, upkeep prices, insurance coverage, utilities, and HOA charges. It calculates a rent-equivalent quantity. If you’ll lease a identical house for not up to this quantity, then renting is healthier.

The Day-to-day podcast from The New York Instances put out this episode just lately: Will have to You Hire or Purchase? The New Math. The gist of it’s that the double-whammy of upper house costs and better loan charges has made renting extra favorable than purchasing. Right here’s a shorter interview with the similar creator on PBS NewsHour:

The general public pronouncing that renting is healthier than purchasing aren’t renters themselves. They just speak about renting within the summary after they don’t have real-world revel in in renting at the present time. I rented within the closing 4 years earlier than I turned into a home-owner once more closing month (I owned a house for 18 years earlier than renting). My revel in from 4 years of renting tells me {that a} buy-or-rent calculator will have to be the closing step you are taking while you discover whether or not you will have to purchase or lease, no longer step one. Best working the numbers misses a large a part of the image in purchasing as opposed to renting.

Listed below are 9 issues I discovered in genuine existence {that a} buy-or-rent calculator doesn’t inform you.

1. You’ve got fewer possible choices while you lease.

This was once the primary wonder once I attempted to hire. It can be other in the event you’re renting an condo however I will be able to best touch upon renting as opposed to purchasing single-family homes and townhouses as a result of I used to be best in that global. You don’t want a calculator to inform you that renting a one-bedroom condo prices not up to purchasing a three-bedroom space.

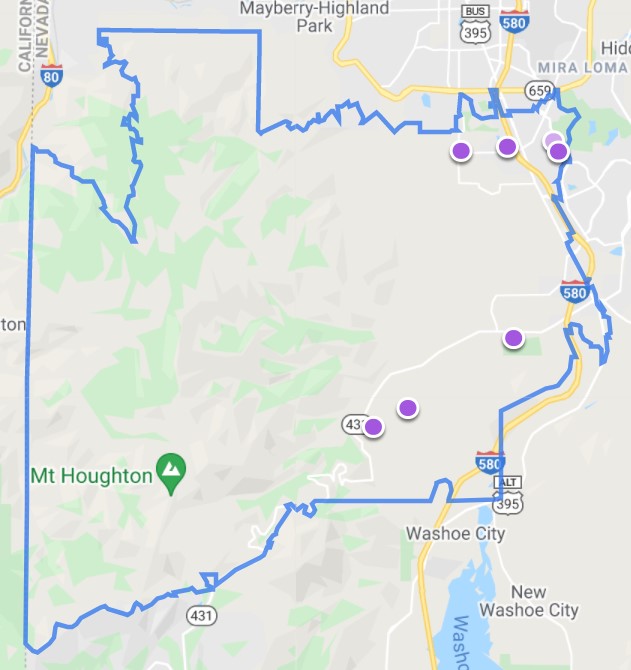

Those two maps from Zillow display houses indexed for lease (except residences) and houses indexed on the market in my earlier zip code in 2021:

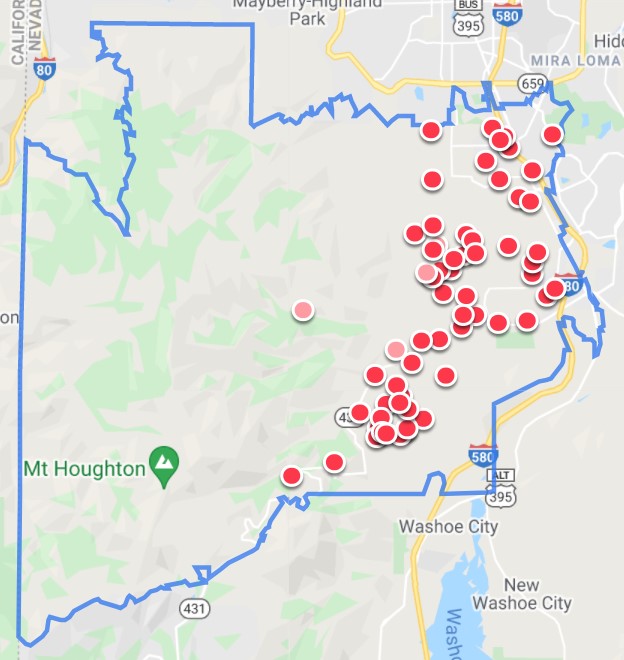

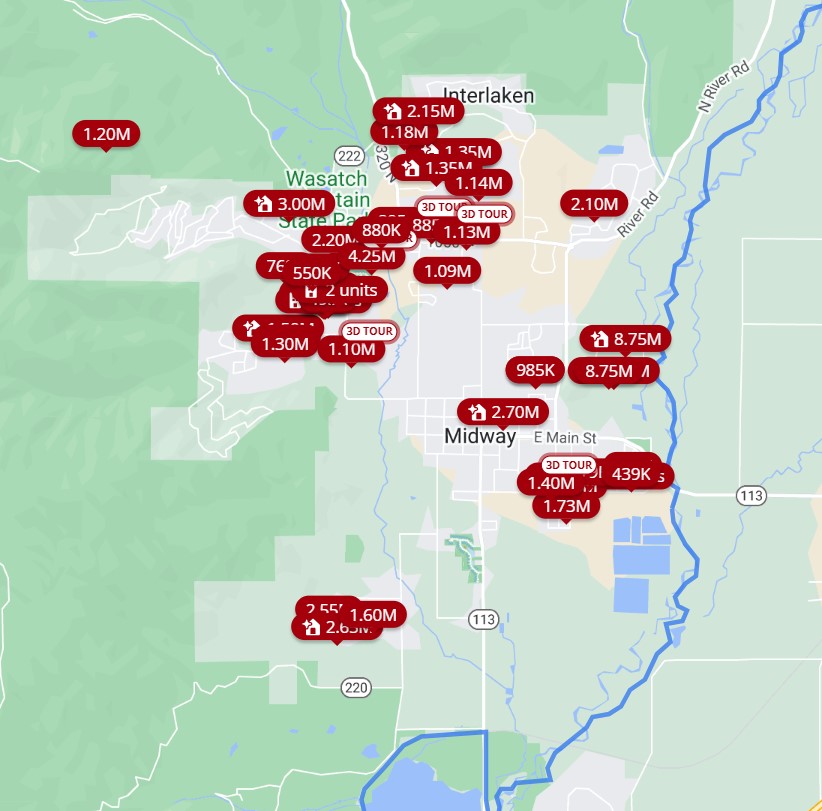

The 2 maps beneath display houses indexed for lease and houses indexed on the market in my present zip code in 2024:

Other instances, other puts, similar tale. Prior to taking into consideration costs, sizes, or desirability, you get started with fewer possible choices while you attempt to lease.

Have a look at the map from Zillow in each techniques on your space. Is it any other?

2. Simply since you see a list doesn’t imply you get to hire it.

Renting a house isn’t like purchasing one thing from a shop. Simply since you see a list and also you’re OK with the asking lease doesn’t imply you get to hire it. You’ll best practice to hire it. The landlord comes to a decision whether or not to hire it to you. Rightly or wrongly, the landlord can insert private personal tastes in choosing the tenant.

Homeowners aren’t intended to discriminate however so long as they don’t say it aloud, you’ll’t do anything else when an proprietor discriminates in opposition to you since you’re younger or outdated, male or feminine, unmarried or married, as a result of you might have youngsters or canines, or for a mess of different causes.

When I used to be searching for leases in every other town, any individual refused to turn me the house earlier than an area particular person noticed it first even supposing I used to be keen to pressure over to peer it. Possibly she was once burned through an out-of-town renter earlier than. I used to be responsible through affiliation.

There’s much less prejudice and discrimination while you check out to shop for a house as a result of purchasing is a one-time transaction. The vendor is long gone after you purchase it. Renting is an ongoing dating between the landlord and the tenant. The landlord cares deeply about what you do after you lease it. If the landlord suspects you’ll do one thing she or he doesn’t like since you’re younger or outdated, male or feminine, unmarried or married, you might have youngsters or canines, and so on., and so on., the landlord will make a selection to hire it to any individual else.

3. Simply because you might have pristine financials and an excellent credit score rating doesn’t imply you’ll get the condo.

Even though the landlord doesn’t discriminate, she or he best wishes a nice tenant. The landlord isn’t working a competition to peer who has the most powerful financials.

I as soon as carried out for a condo and the landlord didn’t even take a look at my software. He mentioned he won 30 packages in a couple of hours, discovered one appropriate after studying a number of, and discarded the remaining. Proceeding to check all 30 packages would’ve been a waste of his time.

After studying that lesson, I carried out for the following condo mins after Zillow despatched me the alert of a brand new record. I paid the $50 non-refundable software rate with entire documentation of my financials instantly. That was once how I were given the condo.

After I gave my realize to vacate this condo two years later, the valuables supervisor indexed it for lease on Zillow on a Saturday night time. Through the next Monday, they already coated up 8 showings for Tuesday afternoon. I won every other slew of texts on Tuesday morning pronouncing that they canceled 7 out of the 8 showings as a result of probably the most 8 signed the rent already with out seeing the condo.

The opposite 7 renters could have more potent financials than the one that signed however they nonetheless misplaced out as a result of they weren’t competitive sufficient.

The buy-or-rent calculator appearing that it’s higher to hire is beside the point in the event you don’t if truth be told get the chance to hire.

4. Properties for lease are normally of decrease high quality than houses on the market.

The most productive ROI in leases comes from renting reasonably-priced houses for not-as-cheap rents. Renters as a complete have decrease earning than patrons. Those elements make it uncommon to peer good-quality houses for lease. Just right-quality houses for lease also are taken away through the upward push of Airbnb and VRBO. Lots of the ultimate houses introduced as long-term leases don’t glance that groovy.

A house additionally deteriorates over the years after it turns into a condo. You’ve heard of the pronouncing that no one washes a condo automobile. The landlord doesn’t stick with it as a result of renters don’t have an incentive to take nice care of it. Some houses on the market particularly put it on the market that they have got by no means been a condo.

The landlord of my closing condo house didn’t do a lot upkeep once I rented it. When the dishwasher broke, the landlord changed it with a $300 dishwasher, which was once the most cost effective yow will discover at The House Depot. The dishwasher labored however I guess she wouldn’t have selected that one if the house weren’t a condo. Doing a lot past the naked minimal isn’t well worth the funding to the landlord, which is comprehensible however this contributes to the decrease high quality of leases.

5. It’s important to ask for permission in the way you are living.

You acted speedy and you were given the condo. You don’t thoughts its decrease high quality. You simply pay the lease and are living your existence, proper?

Understand that purchasing is a transaction and renting is a dating. The connection manner you want permission from the landlord in the way you are living while you lease.

Listed below are some phrases of the rent for my closing condo:

Occupancy through visitors ultimate over 3 consecutive days or greater than 5 days in any calendar quarter will probably be regarded as to be a contravention of this provision except prior written consent is given through Proprietor. Proprietor might limit any visitor for any or no explanation why.

Resident is needed to get acclaim for any significant other or provider animal PRIOR to the animal coming onto the Premises. Failure to procure prior approval is a vital violation of this settlement which shall permit for instant eviction.

Your sister is coming to talk over with you and he or she has a canine? She doesn’t have a canine however you need her to stick with you for 4 days? Ask for approval from the landlord, please.

Reject those phrases and negotiate? Fail to remember about it. See 1 thru 3.

6. Renting doesn’t imply maintenance-free.

Should you assume all upkeep is the landlord’s duty while you lease, assume once more. From my closing rent:

Resident will be accountable to care for the Premises together with the outside. It will be the particular duty of Resident to care for the sprinkling device and to take care of and care for the garden and landscaping. This shall come with however isn’t restricted to; weeding, watering, mowing, edging, fertilizing, and the rest vital to care for the landscaping. Within the tournament Resident fails to care for the garden and landscaping, Proprietor in its sole discretion might reason such to be maintained and will be entitled to repayment from Resident for the prices incurred in such upkeep. Tenant will be liable for commonplace day-to-day upkeep of the Premises and to stay the Premises blank and orderly. Different such upkeep is also assigned to Resident through Proprietor in the course of the Regulations and Laws or through different written settlement. All prices of such upkeep will be the duty of Citizens.

Sure, you’ll rent garden provider nevertheless it’s nonetheless your duty to care for the garden and landscaping.

7. You don’t essentially get to resume although you’re a nice tenant.

A normal rent time period is twelve months. If the buy-or-rent calculator continues to mention it’s higher to hire and also you’d love to proceed, you continue to don’t essentially get to resume the rent for every other 12 months.

Renting is a dating. The opposite birthday party within the dating has to comply with proceed the connection. The landlord might make a decision to promote, flip it right into a momentary condo, lease it to a family members member or a pal, or make it his or her number one or secondary house. It doesn’t subject how nice a tenant you’re.

The landlord of our first condo notified us in the course of the 12 months that he wouldn’t renew the rent as a result of he sought after to transport into it. He was once type sufficient to offer us realize six months earlier than the rent expiration and he waived the early termination price if we moved out quicker. Had he strictly long gone through the phrases of the rent, he best had to give us realize 30 days earlier than the tip of the rent time period and we’d’ve needed to scramble to discover a new position in 30 days.

A buy-or-rent calculator implicitly assumes that you’ll at all times renew or you’ll at all times in finding every other equal condo. The true global doesn’t paintings like that.

8. Your lease can build up so much on renewal.

The New York Instances buy-or-rent calculator has an enter for the lease expansion price. It defaults to two.5% in keeping with 12 months. If the landlord will give you to resume the rent, there’s no restrict to how a lot the lease can build up absent native lease keep an eye on rules.

The renewal I used to be introduced in the second one 12 months of my closing condo went up through 25%, no longer 2.5%. The landlord threw me a bone and decreased it to 23% once I begged for mercy. If I didn’t settle for the renewal, my best selection was once to search out every other position in 30 days.

Hiring movers would’ve eaten up a big a part of any financial savings assuming I used to be in a position to get a more cost effective condo in 30 days. That still doesn’t rely the effort of packing, unpacking, and disruptions to existence. I relented and renewed for a 23% build up.

Should you transfer each and every time you might have an unreasonable lease build up, you’ll be uninterested in it very quickly. The unreasonable lease build up will glance reasonably affordable when your family members asks you why you’re transferring once more. It’s rational for the landlord to price a top class for renewals since you get to steer clear of transferring while you renew.

When we vacated the condo, it was once indexed for lease at a miles decrease lease than we had been paying. New tenants don’t pay the renewal top class as a result of they’re transferring anyway.

9. Renting is much less versatile than you assume.

Flexibility is touted as a significant advantage of renting. If one thing comes up to your existence, you’ll simply depart. It’s true when it occurs as regards to the time of rent expiration however the proprietor isn’t obligated to will let you out of the rent at different instances. You don’t get to damage the rent for just one further month of lease.

From my closing rent once more:

If Resident vacates previous to the tip of the preliminary time period, all long term rents below this Settlement shall boost up and turn out to be instantly due.

Should you will have to transfer two months right into a one-year rent, paying lease for every other 10 months isn’t a lot not up to paying the transaction value of promoting a house. You don’t have the correct to sub-lease while you lease.

Some rentals robotically turn out to be monthly after twelve months. That’s no longer at all times the case. If the landlord best needs 12-month renewals, transferring is your best selection even supposing you realize you’ll have to transport once more in two months.

***

Purchasing as opposed to renting is a lot more about the fee however a buy-or-rent calculator best tells you about the fee. Imagine those different elements earlier than you soar into the buy-or-rent calculator.

Did I simply have unhealthy success and run into unreasonable leases? I doubt it. Fundamental economics says that lower-priced merchandise see the next call for. The upper call for creeps into non-price elements akin to low availability, discrimination through some house owners as a result of they are able to, numerous renters chasing after a small choice of leases, decrease high quality, and laborious rent phrases.

A buy-or-rent calculator implicitly assumes a fable global wherein leases of equivalent high quality to houses on the market are abundantly to be had, you get to hire a house of your selection so long as your financials qualify, you’ll renew for so long as you need for an inexpensive build up in lease, and the rent phrases are versatile and accommodating to you. If that’s the case to your space, nice, run the numbers the usage of the buy-or-rent calculator. Differently, no longer so speedy.

Renting through selection appears to be like nice on paper nevertheless it will get messy in genuine existence. Renting isn’t like purchasing irrespective of the fee. Purchasing is a transaction. Renting is a dating. I’m glad to be a home-owner once more and out of my renting dating.

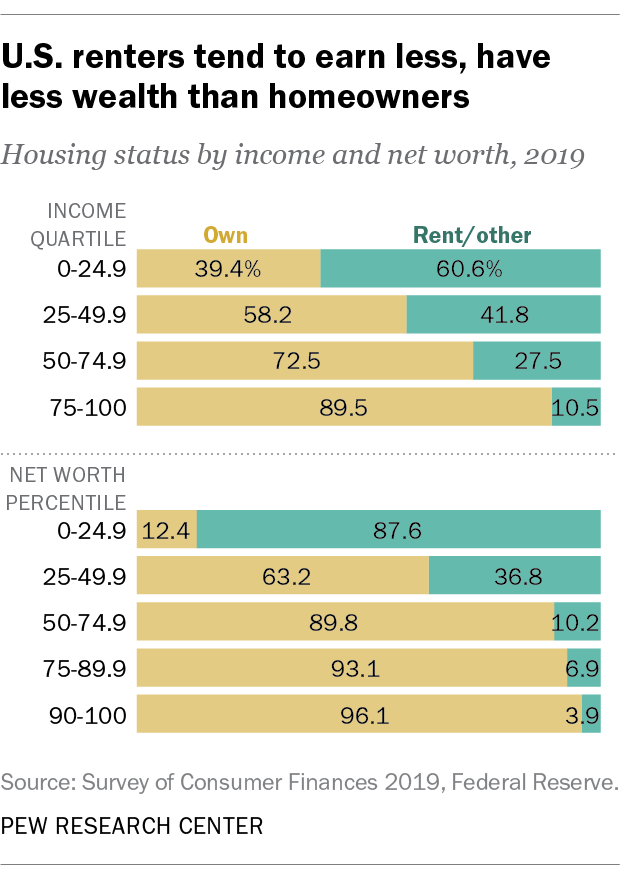

Purchasing is also costlier (or it is probably not) however charge isn’t the whole thing. In step with a file through Pew Analysis Heart, 90% of folks within the most sensible source of revenue quartile and 90% of folks within the most sensible part in web price personal their houses. As regards to 40% of all houses within the U.S. don’t have a loan. Individuals who personal their houses free-and-clear don’t promote their houses to turn out to be renters when the buy-or-rent calculator says it’s higher to hire as a result of they know to appear past the numbers.

Say No To Control Charges

If you’re paying an guide a share of your belongings, you’re paying 5-10x an excessive amount of. Learn to in finding an unbiased guide, pay for recommendation, and best the recommendation.